The Aave Dao has reached a consensus. Based on the CEO of Aave Labs, the DAO is at the moment not on the lookout for tokens aside from Aave.

The unanimous resolution got here by a consensus amongst members of the DAO. A decentralized autonomous group (DAO) runs on “decentralized” authority, in order that choices are often by no means made by one individual.

Extra particulars in regards to the consensus

Stani Kulechov, the CEO of a laboratories, introduced that the consensus can be revered, as a result of a DAO doesn’t have a DAO not alone in identify. Based on Stani, because of this the group shouldn’t be making an attempt to push a special agenda than the choice of the DAO.

Stani Kulechov, CEO of a laboratories, shares a message with the Aave Dao after they’ve reached a consensus about token funding. Supply: Stani Kulechov (X/Twitter)

Relating to the promise to take RWA exploration extra critically, Stanis’ Put up ensures that it’s going to proceed, however solely after they discover the precise strategy.

“There may be solely $ aave,” he wrote as he ended his place.

The choice of the DAO to return and return to the Whiteboard with regard to RWA exploration shouldn’t be solely a wise, but in addition proof of the strategic (or cautious) curiosity of a DAO within the budding crypto sector.

Simply specializing in Aave implies that the Aave Dao doesn’t should handle the dangers related to portfolio diversification.

Underneath the commentary a part of Stani’s Put up through which the consensus and the group of the group to honor it introduced, events weighed their opinion.

Though many praised the choice of the DAO to focus on Aave alone, there was just a little extra vital feedback. One in every of them puzzled why the RWA exploration was positioned on a again burner and likewise identified that including worth to the AaVee -token shouldn’t be one thing they only agree on.

One other consumer acknowledged that it made no sense to make one other token and implied that “extracting worth from Aave” can be the last word efficiency.

Usually, the neighborhood agrees with the consensus and it’s comfortable that RWA exploration continues to be on the desk, even when it isn’t a precedence now.

The information comes shortly after Aave Labs has introduced the Horizon launch

One motive why many could also be stunned that RWA exploration is at the moment not the precedence of the DAO is that Aave Labs has launched a brand new initiative with the identify Horizon, and the goal is to enhance the combination of Institutional Actual-World Belongings (RWAS) in Defi.

Aave made the announcement on 13 March, and in keeping with stories, the undertaking goals to bridge the open monetary ecosystem of Defi with the structured wants of institutional energy bills, creating infrastructure that encourages a broader participation in financing to the chain.

Challenge Horizon can be in accordance with institutional compliance necessities and can stay true to the effectivity and transparency of Defi. It primarily introduces a structured route for establishments and tokenization platforms to make use of decentralized financing with out concern.

One of many core traits of Horizon is that establishments will be capable to use tokenized cash market funds (MMFs) as collateral when borrowing stablecoins. It additionally has future plans to increase to different types of RWAs and to enhance the institutional entry to Defi -Liquidity.

The CEO of Aave Labs, Stani Kulechov, has identified prior to now that Defi lacks the mandatory infrastructure to deal with massive -scale institutional participation, though that’s the endgame.

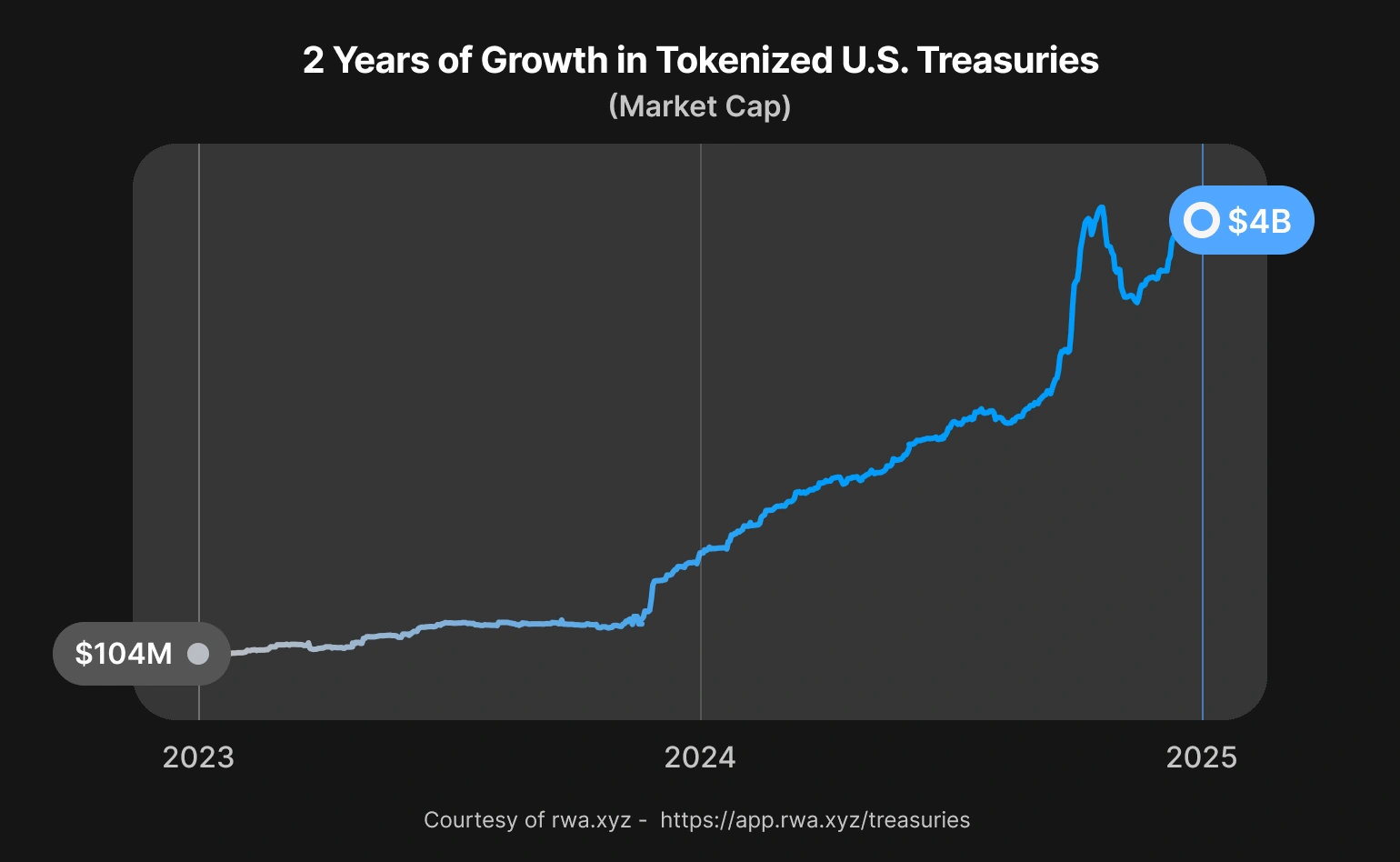

Two -year graph of Tokenized American treasury. Supply: rwa.xyz

Based on him, Challenge Horizon, sensible from classes from an Aave -Boog, is ready to enhance institutional entry to permissionless Stablecoin -Liquidity.

To assist the initiative, Aave has proposed to launch a acknowledged copy of the Aave protocol by way of the Aave Dao and will probably be the idea for all tasks underneath the Horizon initiative.

The RWA answer from Horizon begins as an operation underneath a V3 as a acknowledged copy, however will ultimately swap to a customized Aave V4 implementation if out there.

Horizon can even implement a revenue -sharing mechanism for lengthy -term sustainability, so that fifty% of its first -year gross sales are assigned to the Aave Dao. Extra incentives can even be launched to encourage a wider acceptance of ecosystem.

The curiosity of RWAS laboratories takes place within the midst of appreciable development within the sector. Based on RWA.XYZ, the full worth of RWAS on-chain has risen by greater than 17% prior to now month and reached as much as $ 18.13 billion.

The variety of distinctive energy holders has additionally risen by 5percentand exceeds 89,818. A vital growth space is on-chain treasuries, which at the moment are good for a TVL of $ 4.22 billion, because of a rise of 400% on an annual foundation.

Regardless of all that development, specialists nonetheless see numerous potential in Rwas. Many predict that the RWA sector can scale as much as $ 16 trillion over the following decade, which emphasizes the rising presence in international funds. The pattern has been seen by massive establishments similar to BlackRock, which have already printed appreciable tokenized property by its buid -product.

Different establishments similar to BlackRock which have proven numerous curiosity within the RWA sector are JPMorgan, Citigroup, UBS, Franklin Templeton and Goldman Sachs.

These organizations do it for their very own respective causes. JPMorgan, for instance, has a pioneer in RWA-Tokenization by his Onyx platform and has processed greater than $ 900 billion in tokenized property, whereas Franklin Templeton embraces RWAS by launching tokenized cash market funds and exploring blockchain-based property administration.