Authored by Nick Giambruno via InternationalMan.com,

Given the traits of gold and Bitcoin, which is finest fitted to sending worth via time and area?

Under, I’ll analyze the ten most decisive financial attributes and see whether or not gold or Bitcoin has a bonus.

Financial Attribute #1: Shortage

The World Gold Council estimates there are 6.8 billion ounces of mined gold globally, and annual manufacturing averages round 118 million ounces.

That a lot is what is understood. Nevertheless, we don’t understand how a lot gold shall be found and mined sooner or later.

For instance, what number of mined ounces of gold shall be obtainable on June 1, 2031?

We will most likely make a reasonably correct projection, however no person can know.

What is going to the Bitcoin provide be on June 1, 2031?

It is going to be round 20,589,121 Bitcoins.

With Bitcoin, the present and future provide is finite and recognized to all.

There’ll by no means be greater than 21 million Bitcoins, and there’s nothing anybody can do to vary that.

At present, the Bitcoin provide is about 19.6 million, that means the overwhelming majority—over 93%—of the overall Bitcoin provide has already been created.

The remaining 1.4 million BTC will come onto the market at a preset, ever-decreasing fee till the final Bitcoin is created 116 years from now, in 2140.

In different phrases, Bitcoin’s provide will solely develop about 7% within the subsequent 116 years.

The availability of Bitcoin received’t develop a lot in any respect from right here.

By 2030, over 98% of all Bitcoins can have already been created.

Bitcoin_apex, a German Bitcoin advocate, describes Bitcoin’s shortage like this:

8 billion individuals, 21 million Bitcoin.

That’s proportionally as if:

80,000 individuals needed to share $210.

8,000 individuals unfold out on a bus with 21 seats.

800 individuals would share 2.1kg of bread.

80 individuals sharing 0.21 liters of water.

8 individuals must dwell in an condominium with 0.021 sq. meters.

Right here’s one other method to think about it.

Proudly owning 1 BTC is like proudly owning 324 ounces of the worldwide gold provide; every would offer you possession over about 0.00000476% of the general provide.

Proudly owning 1.236 BTC is like proudly owning a 400-ounce Good Supply gold bullion bar; every would offer you possession over about 0.0000059% of the general provide.

Right here’s the underside line.

Gold is scarce, however solely Bitcoin is completely scarce.

Verdict: Bitcoin Wins

Financial Attribute #2: Hardness

For my part, hardness is an important financial attribute.

Hardness doesn’t imply one thing that’s essentially tangible or bodily exhausting, like metallic. As a substitute, it means “exhausting to provide.” Against this, “simple cash” is straightforward to provide.

One of the simplest ways to think about hardness is “resistance to debasement,” which helps make it a very good retailer of worth—a necessary operate of cash.

All different financial traits are meaningless if the cash is straightforward for somebody to provide.

What’s fascinating in a very good cash is one thing that another person can not make simply.

For instance, think about the worth of copper going 5x or 10x.

You possibly can ensure that would spur elevated manufacturing, ultimately increasing the copper provide. After all, the identical is true of some other commodity.

That’s why there’s a well-known saying in mining: “The treatment for prime costs is excessive costs.”

The dynamic of upper costs incentivizing extra manufacturing and in the end extra provide, bringing costs down, exists with each bodily commodity. Nevertheless, gold is probably the most immune to this course of.

That offer response is why most commodity costs are likely to revert round the price of manufacturing over time.

This dynamic is much more profound with cash.

When an asset obtains financial properties, the pure response is for individuals to make extra of it—much more of it.

This is named the simple cash lure.

Traditionally, gold was all the time the toughest asset, the one most immune to the simple cash lure… till Bitcoin.

Bitcoin is the primary—and solely—financial asset with a provide solely unaffected by elevated demand.

That’s an astonishing and game-changing attribute.

Meaning the one method Bitcoin can reply to a rise in demand is for the worth to go up. Not like gold and each different commodity, growing the availability in response to elevated demand is just not an choice.

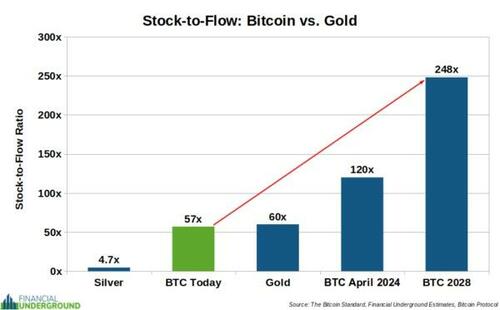

The stock-to-flow (S2F) ratio measures an asset’s hardness.

S2F Ratio = Inventory / Stream

The “inventory” half refers back to the quantity of one thing obtainable, like present stockpiles. It’s the availability already mined. It’s obtainable immediately.

The “movement” half refers back to the new provide added from manufacturing and different sources annually.

A excessive S2F ratio implies that annual provide progress is small relative to the prevailing provide, which signifies a tough asset immune to debasement.

A low S2F ratio signifies the other. Because of this new annual manufacturing can simply affect the general provide and costs, which isn’t fascinating for one thing that capabilities as a retailer of worth.

Earlier than I transfer on, it’s essential to make clear that hardness is just not the identical as shortage. They’re associated ideas however not the identical factor.

For instance, platinum and palladium are scarcer than gold however not exhausting belongings. Present manufacturing is excessive relative to present stockpiles.

Not like gold, stockpiles of platinum and palladium haven’t constructed up over hundreds of years. It’s the first purpose why new provide can simply rock the market.

Due to their low S2F ratios, platinum (0.4x) and palladium (1.1x) aren’t appropriate as cash. Their low S2F ratios point out they’re primarily industrial metals, akin to how individuals use them immediately. Nearly no person makes use of platinum and palladium as cash.

Gold has an S2F ratio of 60x. Meaning it could take about 60 years of the present manufacturing fee to equal the prevailing gold provide.

At present, Bitcoin’s S2F ratio is about 57x, barely beneath gold’s.

Based on its mounted protocol, we all know exactly how Bitcoin’s provide will develop sooner or later.

A key function is that the brand new provide will get minimize in half each 4 years, which causes Bitcoin’s hardness to double each 4 years. This course of is named the “halving.”

The subsequent time Bitcoin’s provide progress shall be minimize in half shall be in April 2024.

However this coming halving shall be very totally different…

That’s as a result of Bitcoin’s hardness shall be nearly twice that of gold’s when that occurs.

That’s how Bitcoin will quickly grow to be the toughest cash the world has ever recognized. And it’ll hold getting more durable as its S2F ratio approaches infinity.

For hundreds of years, gold has all the time been mankind’s hardest cash. That’s all set to vary in a couple of weeks, and most of the people do not know.

Verdict: Bitcoin Wins

Financial Attribute #3: Liquidity

Having a big international pool of patrons and sellers—liquidity—is critically essential for any critical cash.

With a market cap of round $14.6 trillion, gold has a big pool of worldwide liquidity.

At round $1.3 trillion, Bitcoin has a a lot smaller pool of worldwide liquidity.

Nevertheless, it’s rising shortly.

If the Bitcoin value goes up 10x—which it has performed many instances in its historical past, and I anticipate it would do once more quickly—Bitcoin’s pool of worldwide liquidity shall be inside spitting distance of gold’s.

If Bitcoin’s market cap and pool of liquidity proceed to develop sooner than gold’s, it would erode gold’s benefit. However for now, gold wins.

Verdict: Gold Wins

Financial Attribute #4: Portability

In the event you ship $1 billion value of bodily gold from New York to Beijing, sophisticated and costly logistics are required.

$1 billion of gold weighs about 14,300 kilograms (or about 31,500 kilos). Transporting that a lot gold would seemingly contain a number of cargo flights after which armored vehicles transferring it from the vacation spot airport to the vacation spot vault.

It might additionally require insurance coverage, navigating rules, paying import or export taxes, clearing customs, and thorough verification of the gold’s purity, amongst different issues.

It might additionally take appreciable time; It wouldn’t occur in a single day.

Transporting smaller quantities of gold can be problematic. For instance, going via airport safety with gold cash and bars will seemingly generate undesirable consideration.

These are among the points with gold’s portability.

Bodily gold is weak to seizure partly due to the issues with transporting it.

Bitcoin, then again, is probably the most transportable asset on the planet.

It’s a digital bearer asset that may obtain ultimate worldwide settlement in 10 minutes for pennies.

You possibly can ship $1 billion value of Bitcoin from New York to Beijing for lower than $10 in charges. It should arrive in round 10 minutes.

The transaction has no credit score danger and no counterparty danger. You don’t must get anybody’s permission or want to make use of—or belief—any third celebration in anyway. And there’s nothing anyone can do to dam, freeze, reverse, or censor the transaction.

The recipient can immediately confirm the Bitcoin’s authenticity for free of charge.

Going via airports and crossing borders with Bitcoin can be rather more sensible than different types of wealth.

In the event you maintain Bitcoin in your telephone, laptop computer, or flash drive, it may be accessible to frame brokers in the event that they search you and also you reveal your password. Nevertheless, these issues are a lot much less conspicuous than bodily gold.

Additional, many widespread Bitcoin wallets use a 12-word phrase to recuperate your funds. In the event you can memorize the 12-word phrase, you’ll be able to probably retailer billions of {dollars} value of worth simply in your head with nothing else.

On the subject of portability, Bitcoin isn’t simply barely higher. It’s an improve orders of magnitude higher than gold.

It’s an much more profound improve than when mankind moved from utilizing horse carriages for journey to utilizing Boeing 747 airliners. It’s extra like going from horse carriages to futuristic teleportation machines that may immediately beam you from one location to a different.

Verdict: Bitcoin Wins

Financial Attribute #5: Verifiability

Do you actually know that the gold you personal is genuine?

It may look one thing like this on the within.

Likelihood is the gold you personal is certainly genuine… however you’ll be able to by no means know for positive until you check it your self with specialised tools. In any other case, you’ll must belief a third-party auditor and appraiser.

If you need 100% certainty, you’ll most likely must soften the gold down and recast it.

Regardless of the way you do it, verifying gold’s authenticity is rare, gradual, people-intensive, pricey, and probably unreliable. It additionally doesn’t scale.

With Bitcoin, counterfeiting is virtually not possible. Easy arithmetic can immediately confirm a Bitcoin transaction’s authenticity for free of charge.

In the event you doubt it, attempt to ship some pretend Bitcoin and see what occurs.

I don’t see any purpose to consider Bitcoin’s resistance to counterfeiting can be eroded.

Additional, think about if the typical particular person may immediately audit and confirm the complete international gold provide’s authenticity—with out counting on any third celebration. That’s what anybody can do with Bitcoin.

Briefly, Bitcoin customers have a degree of certainty that has by no means beforehand existed for some other financial asset.

Verdict: Bitcoin Wins

Financial Attribute #6: Fungibility and Privateness

Anybody can go to a web site with particulars of the general public Bitcoin blockchain to investigate and think about the complete transaction historical past.

The data on Bitcoin’s blockchain doesn’t explicitly present your title, handle, and different private data. Nevertheless, suppose it turned recognized {that a} specific Bitcoin handle was related to you. In that case, outsiders may monitor your stability and each transaction you make.

Specific Bitcoins may additionally grow to be “tainted” via transactions that governments don’t like. For instance, suppose you obtained a Bitcoin with a transaction historical past linking it to somebody in North Korea, Iran, or one other sanctioned entity. It’d trigger issues.

All of this raises a elementary query.

How do you receive privateness on Bitcoin’s public blockchain?

It’s a very good query that confuses many individuals.

The reply entails hiding in crowds.

Acquiring privateness on Bitcoin has been likened to the scene within the film V for Vendetta through which hundreds of masked individuals marched on the street. They had been all engaged in a public act, however their identities had been hid as a result of all of them wore the identical masks, permitting them to cover in a crowd.

Privateness in Bitcoin works equally.

A number of wonderful privateness instruments can be found to anybody proper now on Bitcoin, and they’re getting higher daily.

For instance, yow will discover a typical JoinMarket transaction, a particular Bitcoin transaction optimized for privateness, on the hyperlink beneath.

Are you able to inform who the sender and receiver are?

https://mempool.space/tx/a56d23da7df68eb49d3665452bf7085c07a79be62f29f19e588240f02eb94c76

Alternatively, bodily gold doesn’t retain a transaction historical past for anybody to view at any time. Additional, you’ll be able to all the time soften down a gold bar or coin and recast it to destroy any earlier associations.

I anticipate developments within the subsequent few years to considerably enhance Bitcoin’s fungibility and privateness for all customers.

Within the meantime, gold has a bonus.

Verdict: Gold Wins

Financial Attribute #7: Sturdiness

Gold is indestructible. It doesn’t decay or corrode. That’s why many of the gold individuals produced even hundreds of years in the past continues to be round immediately.

With Bitcoin, all elements are genuinely decentralized and sturdy.

Even when the US and Russia engaged in an all-out nuclear conflict, destroying many of the Northern Hemisphere, Bitcoin wouldn’t miss a beat within the Southern Hemisphere.

Barring an inescapable, international return to the Stone Age that lasts into eternity, Bitcoin is sturdy… however not as sturdy as bodily gold.

Verdict: Gold Wins

Financial Attribute #8: Divisibility

Bodily gold is mostly inconvenient and impractical to make use of for small transactions.

A one-gram bar—across the dimension of a pushpin—is concerning the smallest sensible dimension. As of writing, one gram of gold is value about $65. Transactions value something lower than that shall be problematic.

Every of the 21 million Bitcoins might be divided into 100,000,000 models known as satoshis (or sats). Every sat is value 0.00000001 of 1 Bitcoin.

As of writing, it takes about 1,500 sats to make a greenback, which implies a penny is value 15 sats, and every sat is value 1/15 of a penny.

Briefly, Bitcoin’s excessive divisibility permits for transactions of any dimension—from fractions of a penny to billions.

Verdict: Bitcoin Wins

Financial Attribute #9: Scalability

If gold or Bitcoin turns into the world’s dominant cash, how can or not it’s scaled to billions of individuals?

That’s a key query.

With gold, settling all transactions in bodily funds—particularly small ones—is just not sensible.

Trusted third events, like mints, vaults, banks, transportation firms, and others, are crucial for gold to operate as a sensible medium of alternate at scale. These entities should comply with all legal guidelines and rules, or governments will shortly shut them down.

Briefly, trusted third events are centralized vulnerabilities. Governments can seize and coerce them.

That is precisely how governments used the gold customary to bootstrap the fiat forex system into existence.

First, individuals used bodily gold as cash. Then, to scale, they essentially turned to 3rd events, like banks, that saved gold and issued gold IOUs to facilitate commerce. Governments captured these third events and regularly eliminated the gold backing from the IOUs till they had been nothing greater than confetti. Briefly, that’s how the fiat forex system was born.

Right here’s the underside line.

Gold’s largest flaw as cash is that for it to operate at scale, it requires IOUs and third events beholden to governments.

With Bitcoin, anybody can ship and obtain worth—from fractions of a penny to billions—worldwide with out counting on any third celebration and obtain ultimate worldwide settlement inside minutes, 24/7/365.

Nevertheless, the bottom layer of the Bitcoin community can solely course of about 576,000 transactions a day.

Every single day, there are over 2,000,000,000 shopper transactions around the globe. Meaning Bitcoin can solely course of about 0.029% of them. That’s why recording each Starbucks or McDonald’s transaction on the Bitcoin blockchain was by no means attainable.

It was additionally by no means fascinating.

If Bitcoin wanted to file each shopper transaction on its blockchain—or perhaps a fraction of them—it could require an industrial-scale operation with costly knowledge facilities. The typical laptop would not be capable of run the Bitcoin software program.

On this state of affairs, Bitcoin may as effectively be one other PayPal, Visa, or one other centralized monetary service the place you must ask for permission to do something.

Keep in mind, Bitcoin’s complete worth proposition is dependent upon it being impartial, censorship-resistant, accessible to everybody, and managed by no person.

To have these properties, it’s important that the typical particular person can run the Bitcoin software program. That’s why Bitcoin has a tough restrict on the transactions it may deal with every day. It must be this manner in order that the typical laptop—and shortly the typical smartphone—can simply deal with operating Bitcoin. That makes Bitcoin genuinely decentralized and incorruptible, giving it distinctive financial properties.

It’s essential to emphasise that Bitcoin, with out decentralization, can be nugatory.

Scaling Bitcoin by compromising its decentralization would defeat its complete goal.

Does that imply Bitcoin won’t ever be capable of scale and obtain widespread adoption?

Completely not.

Quite a few scaling options for Bitcoin will inevitably emerge. Nevertheless, the Lightning Community is probably the most dominant one.

The Lightning Community is an open, peer-to-peer community constructed on prime of Bitcoin.

Anybody can use the Lightning Community, and no person might be prevented from utilizing it.

On the Lightning Community, individuals can carry out a vast variety of transactions without having so as to add them to the Bitcoin blockchain. Delegating custody of funds to a 3rd celebration is pointless—you’ll be able to all the time stay in management.

The Lightning Community can ultimately permit Bitcoin to scale up and deal with each shopper transaction on the planet.

Verdict: Bitcoin Wins

Financial Attribute #10: Recognition

Whereas gold is a longtime cash, Bitcoin is an rising one.

Gold has over 5,000 years of historical past as cash. You possibly can take gold to any nation on the planet, and most will immediately acknowledge it.

Bitcoin doesn’t have this established historical past and recognition. It’s solely been round since 2009.

It took gold centuries to attain monetization. Bitcoin has a very good probability of present process monetization in a a lot shorter interval—and it’s already effectively on its method.

Within the meantime, gold has the benefit.

Verdict: Gold Wins

* * *

Traditionally, Bitcoin’s largest strikes to the upside occur in a short time… and the subsequent huge transfer may occur imminently. That’s why I’ve simply launched an urgent PDF report revealing three essential Bitcoin methods to make sure you keep away from the most typical—generally deadly—errors. Test it out as quickly as attainable as a result of it may quickly be too late to take motion. Click here to get it now.

Loading…