The decentralized finance (DeFi) ecosystem is witnessing a strong resurgence, with complete worth seize (TVL) catapulting to a staggering $60 billion for the primary time in 18 months.

This milestone underlines the growing curiosity within the DeFi sector, with protocols like Lido Finance and the renewal story main this shift.

DeFi TVL will increase by 68% in 4 months

The entire worth of the DeFi ecosystem elevated by 68%, from $36 billion in October 2023 to $60.55 billion. This improve is especially as a result of rally within the crypto market and sector improvements, particularly within the space of liquid asset buying and selling and withdrawals.

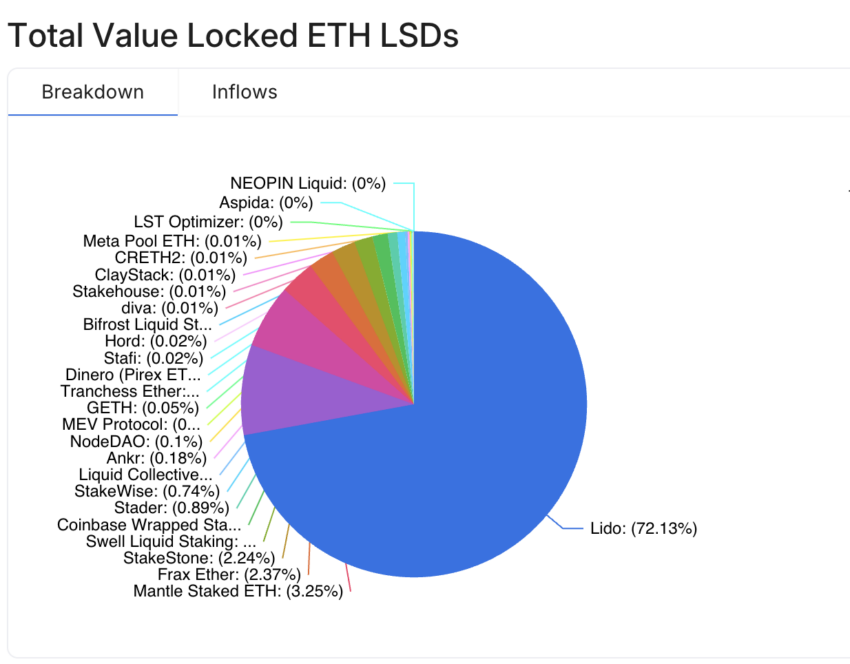

Lido Finance, a pacesetter in liquid staking, now has a 37% market share. The TVL stands at $22.65 billion, with a progress of 4.50% over the previous seven days. The protocol is approaching a significant milestone of 10 million ETH, which represents 72.13% of all Ethereum liquid belongings invested.

It’s price noting that Ethereum’s complete liquid stakes within the DeFi sector additionally elevated to 13.20 million ETH, price $31.17 billion.

Learn extra: 11 Greatest DeFi Platforms to Earn with Lido’s Staked ETH (stETH)

Whole ETH locked by way of DeFi protocols. Supply: DefiLlama

The resumption of Ethereum, a brand new DeFi story, may even be a significant pattern in 2024. It permits customers to make use of the identical ETH throughout a number of protocols, strengthening safety on these platforms. This mannequin has been instrumental in bettering the robustness of smaller and rising blockchains by leveraging Ethereum’s established safety infrastructure.

On the coronary heart of the story is EigenLayer, a middleware platform that was launched on Mainnet in June 2023. Even with out its native token, EigenLayer has carved out a distinct segment within the DeFi sector with a TVL of $4.07 billion, witnessing a outstanding 161% progress within the sector. just one month.

“Restaking is at the moment the quickest rising crypto sector. There’s a huge wave of protocol launches utilizing EigenLayer coming our approach,” says Ignas, a pseudonymous DeFi researcher.

Nonetheless, the resuming story additionally has its critics. Analysts like Miles Deutscher have raised issues and drawn parallels between the revocation mannequin and the DeFi Ponzi schemes that marred the sector in 2021 and 2022. Deutscher’s skepticism stems from the inherent dangers and pursuit of returns that characterised earlier DeFi manias, urging stakeholders to proceed with warning.

“I see re-stakes as the following model of the DeFi Ponzis… The re-stakes story, in my view, could be very paying homage to the 2021 DeFi Ponzi protocols. When folks tackle extra threat, they search for returns, they starvation them for on-chain alternatives, and that is what actually noticed the DeFi Ponzi Mania of 2021[and] 2022,” Deutscher stated.

Disclaimer

In accordance with the Belief Challenge tips, BeInCrypto is dedicated to neutral, clear reporting. This information article is meant to supply correct, well timed info. Nonetheless, readers are suggested to independently confirm the information and seek the advice of knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage and Disclaimers have been up to date.