Decentralized exchanges (DEX) are growing their relevance within the cryptocurrency buying and selling panorama, approaching centralized platforms (CEX) in quantity. On this context, Finbold chosen three DEX tasks to focus on 2025.

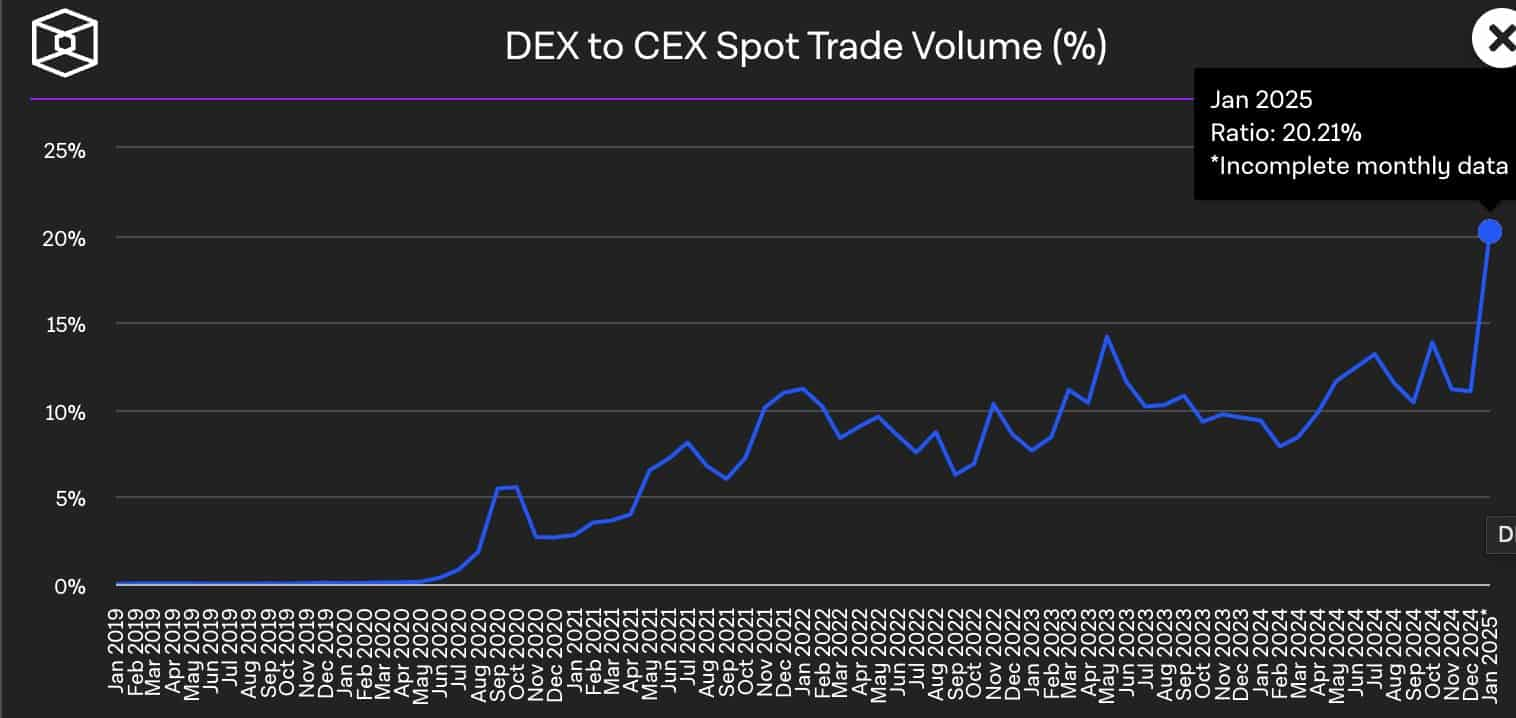

On January 7, the DEX/CEX quantity ratio reached an all-time excessive, with greater than 20% of all crypto buying and selling going down on decentralized exchanges. This information comes from InTheBlokshared on X by Hayden Adams, inventor of the Uniswap protocol, a number one decentralized alternate.

Uniswap (UNI) because the main DEX for the EVM ecosystem

Among the many prime tasks to observe for 2025, Uniswap (UNI) stands out because the main decentralized alternate for the Ethereum Digital Machine (EVM) ecosystem.

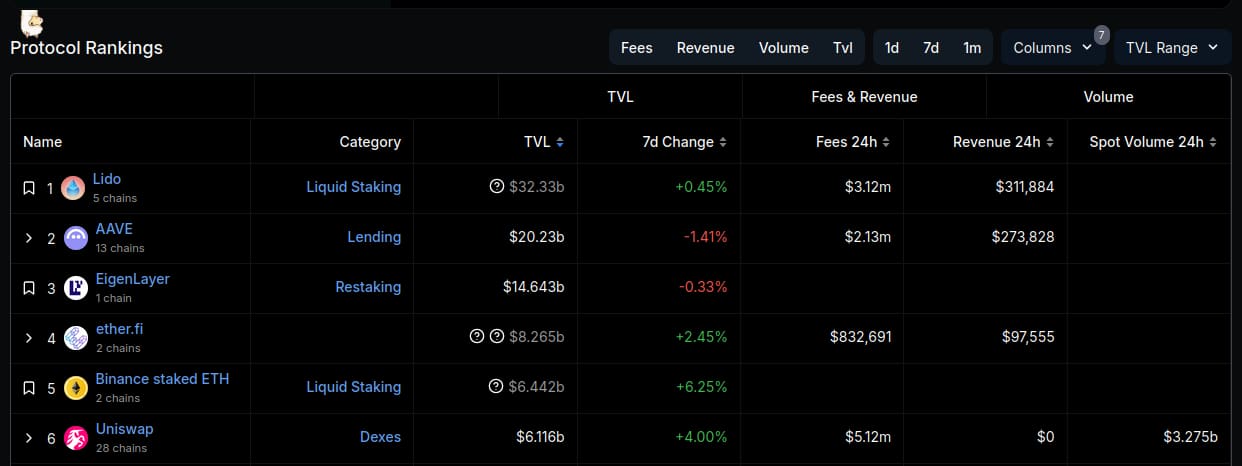

In line with DefiLlamaUniswap can also be the biggest DEX in Whole Worth Locked (TVL) of all ecosystems, with $6.11 billion. The TVL is up 4% over the previous seven days regardless of the current market crash, indicating a wholesome ecosystem.

Within the final 24 hours, Uniswap has seen a buying and selling quantity of $3.275 billion and picked up over $5 million in charges.

Raydium as a buying and selling coronary heart on Solana

Secondly, there’s Raydium (RAY), the buying and selling coronary heart that offers life to the Solana (SOL) decentralized finance ecosystem, particularly memecoins. Solana has been within the highlight in recent times due to the rise of memecoins, which created demand and capital.

Raydium is probably the most used decentralized alternate by Solana merchants who alternate between the ecosystem’s numerous utility tokens, but in addition speculate on the lively memecoin market, successful and shedding enormous sums of cash.

That leaves Solana’s main DEX with $2.29 billion in TVL, up 8.66% over the previous seven days. Raydium generated over $2.79 billion in quantity and $7.4 million in charges within the final 24 hours.

UNI and RAY worth evaluation

On the time of writing, UNI is buying and selling at $12.59 and RAY at $4.87, each experiencing losses. Within the final seven days, UNI fell 6.16% and RAY fell 1.74%, with the most important losses occurring within the final 24 hours.

Whereas some merchants see the market crash as a risk, shedding greater than $630 million in liquidations, others imagine it is a chance.

With strong use instances and a rising DEX/CEX quantity ratio, these decentralized exchanges might have robust long-term fundamentals, permitting them to shine in 2025 if demand continues to develop.

Nonetheless, the cryptocurrency business is a dynamic atmosphere, continually altering and innovating. Uniswap and Raydium must proceed to enhance to fulfill the competitors, which is able to solely get higher with time and form the way forward for the market.

Featured picture from Shutterstock