Natalya Bosyak/iStock through Getty Photos

We keep our buy-rating on ZScaler (NASDAQ:ZS) post-1Q24 incomes outcomes. We predict the 1Q24 outcomes underscore the corporate’s distinctive cloud safety structure and development trajectory for FY24. We’re not too nervous in regards to the extra conservative billings outlook of ~4% of billings development upside, and neither is the market; the inventory erased all of its pre-market losses and was hovering on the flat line on Tuesday. We predict administration is setting a “prudent bar” or giving itself room to be weak to macro uncertainty with the present steering. We predict this can be a basic purchase the rumor, promote the information motion play; in our opinion, it really works in Zscaler’s favor to have a extra conservative billings outlook and outperform their steering.

The inventory outperformed the S&P 500 by 18% since our final be aware from mid-September; our bullish sentiment was because of our perception that Zscaler is extra resilient because of its distinctive place to profit from the industry-wide shift in direction of new structure within the zero-trust market. We predict we’re seeing our constructive thesis play out into 2024 with investor confidence within the firm’s merchandise reaching new highs. We perceive that cybersecurity shares are extra resilient than the remainder of the software program sector, however we do not suppose they’re totally proof against macro downturns; we noticed this play out earlier this 12 months with Fortinet (FTNT). Fortinet inventory dropped +14% after decreasing its FY gross sales outlook because of macro headwinds amid reporting 2Q23 incomes outcomes, and the cybersecurity peer group traded decrease in response. We’re updating our ideas on Zscaler in gentle of incomes outcomes and outlook; our analysis leads us to consider Zscaler will see a extra constructive development narrative taking part in out via 2024

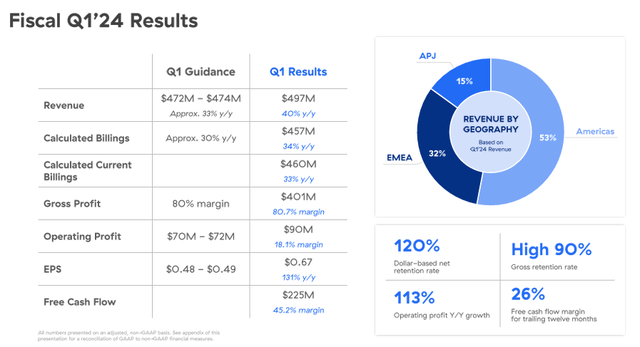

Zscaler reported 1Q24 incomes outcomes late final month, on November twenty seventh. For the quarter, Zscaler reported income up 40% Y/Y to $497M. The corporate’s calculated billings grew by 34% Y/Y to $457M, and deferred income was $1,399M, representing a 39% Y/Y development. We count on the corporate to proceed to report excessive double-digit top-line development via 2024 as enterprise spending improves and cybersecurity stays a high IT spending precedence.

We additionally suppose Zscaler is uniquely positioned to increase its market share, with its product portfolio on the intersection of AI and Zero-Belief. We consider the Zero-Belief market remains to be in its early innings and see room for Zscaler to cleared the path via its Zero-Belief structure and defending cloud workloads.

The under determine summarizes ZS’s 1Q24 outcomes.

1Q24 incomes outcomes

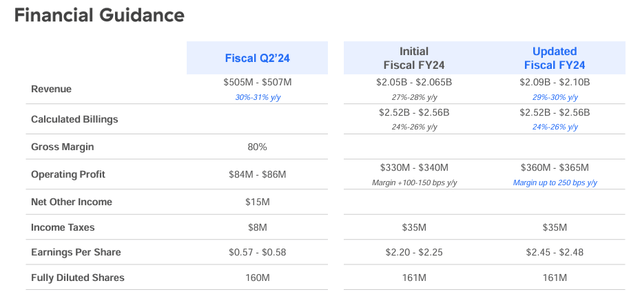

Moreover, Zscaler administration positively revised the fiscal 12 months 2024 outlook; the corporate now forecasts FY revenues from $2.09-$2.10B, up from the earlier estimate of $2.050-$2.065B. We consider this adjustment signifies confidence in continued top-line development; we expect Zscaler is best positioned now to outpace the {industry} common development charge. For the upcoming 2Q24, Zscaler initiatives revenues between $505M and $507M. We predict it is solely prudent that ZS administration is extra conservative in its outlook contemplating the present macro actuality. We predict the corporate ought to be capable to beat its steering for subsequent quarter or be in-line with the mid-point of steering; we expect the extra conservative outlook is because of fears of slower deal cycles with macro uncertainty. Nonetheless, we expect the brand new steering is lifelike and ought to be properly inside attain. The next outlines Zscaler’s monetary steering for FY24 and the following quarter.

1Q24 incomes outcomes

Because the {industry} workloads transfer to the cloud, the corporate’s potential to safe rising cybersecurity spending might be a testomony to its strong product choices and market relevance. We count on Zscaler to proceed to achieve cybersecurity spend pockets share as extra prospects’ workloads transfer to the cloud. We count on massive offers that had been beforehand on maintain to renew in 1H24.

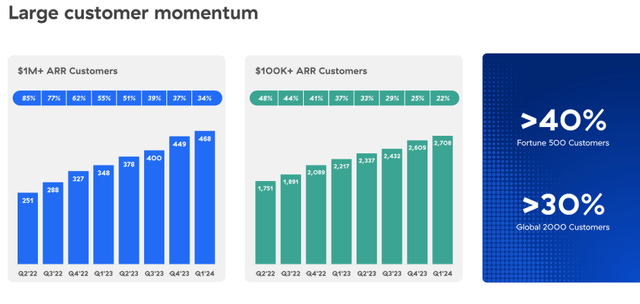

Beneath is a slide for the ZS earnings deck showcasing massive buyer momentum:

1Q24 incomes outcomes

The core of Zscaler’s aggressive benefit lies in its early funding in AI and ML applied sciences, positioning itself as a frontrunner within the increasing cloud safety panorama. Moreover, we expect the market alternative in AI and Zero-Belief is sufficiently big to embody a number of gamers within the SSE market, together with Microsoft (MSFT) and others. The Zero-Belief safety market would develop at a 16.9% CAGR between 2023-2028. We predict the corporate has a large sufficient buyer base to assist its share growth, together with greater than 40% of the Fortune 500 and 30% of the International 2000 prospects.

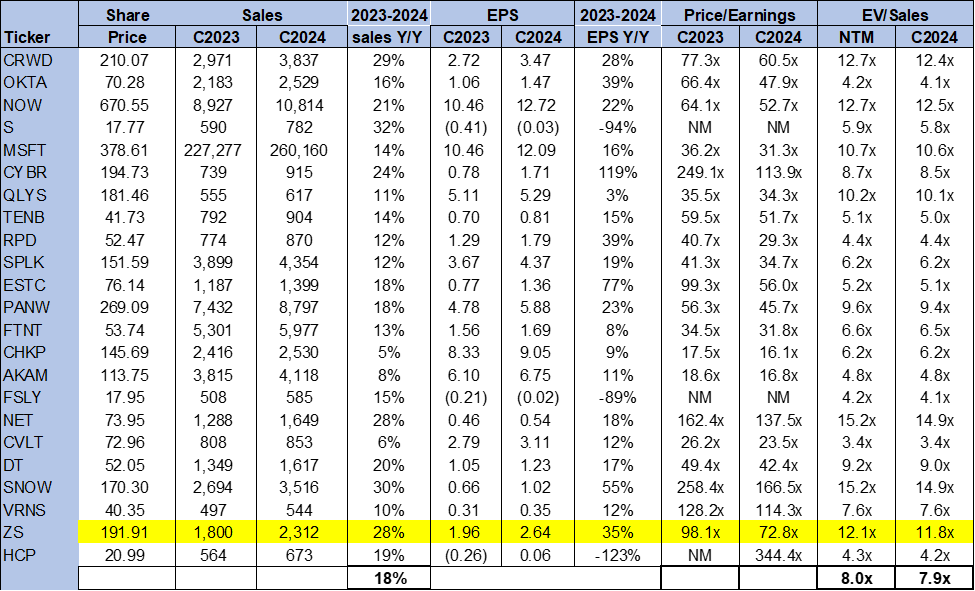

Valuation

Zscaler is buying and selling above the peer group common; the inventory is a excessive development inventory, in our opinion. The inventory is pricey, however we expect the expansion charge for 2024 because the SSE alternative expands justifies the upper a number of; we expect there’s truthful worth within the a number of because the market is pricing in future earnings that we count on in 2024. We consider Zscaler ought to be seen on an Enterprise to Worth ratio; for CY24, the inventory is buying and selling at 11.8x EV/C2024 Gross sales in comparison with the {industry} common of seven.9x. On a Value-to-earnings ratio, Zscaler is buying and selling for CY24 at 72.8x with an EPS of $2.64 versus the peer group common of 81x. We consider ZS is on the forefront of a big secular development alternative as structure strikes to the cloud within the SSE setting.

The under determine was made utilizing Refinitiv information and descriptions ZS’s valuation.

TSP

Phrase on Wall Road

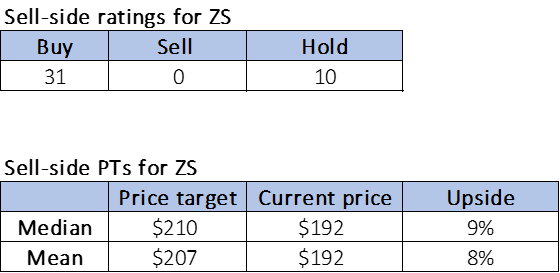

Wall Road shares our bullish sentiment on the inventory. Of 43 analysts masking the inventory, 31 are buy-rated, and the remaining are hold-rated. Utilizing the median of the Wall Road value goal of $210 and the imply value goal of $207, we are able to calculate a possible upside of 8-9%.

The under outlines ZS sell-side scores and price-targets.

TSP

What to do with the inventory

We stay buy-rated on Zscaler; we count on the inventory to outperform the S&P 500 and peer group via 2024. The inventory is up 23% since our final be aware in mid-September, outperforming the S&P 500 by 21%. We count on Zscaler to proceed to achieve cybersecurity spend pockets share as extra prospects’ workloads transfer to the cloud. We predict the market is slowly waking as much as Zscaler’s potential, particularly after its bounce again post-earnings final month. We predict a novel window exists to purchase the inventory forward of 2024. We proceed to advocate traders purchase the inventory opportunistically.