Yearn Finance’s YFI token fell over 40% within the final 24 hours, leading to a major liquidation of round $5 million. The sudden value drop led to hypothesis about whether or not something suspicious was occurring to the protocol.

Information from BeInCrypto exhibits that Yearn Finance’s value fell sharply from $14,519 to $8,915 inside a couple of hours. However YFI has recovered to over $9,000 as of this writing.

YFI’s market capitalization is falling

The sudden sell-off resulted in Yearn Finance’s market capitalization dropping by about $200 million, from $482 million to $296 million.

In the meantime, information from Coinglass signifies that crypto merchants who held positions in YFI have been liquidated roughly $5 million throughout this era, with $3.5 million coming from lengthy positions and $1.42 million from brief positions.

Yearn Finance (YFI) value efficiency. Supply: BeInCrypto

Moreover, the DeFi token noticed a 26% enhance in its derivatives buying and selling quantity to roughly $2 billion and a rise in open curiosity to roughly $162.54 million. Main exchanges specifically, together with Binance, have seen a major decline in YFI image open curiosity positions along with the liquidations.

Learn extra: Determine and discover dangers on DeFi lending protocols

The sell-off additionally resulted within the complete worth of property tied up within the venture dropping by about $6 million to $329.5 million, in keeping with DeFiLlama information.

Why did Yearn Finance crash?

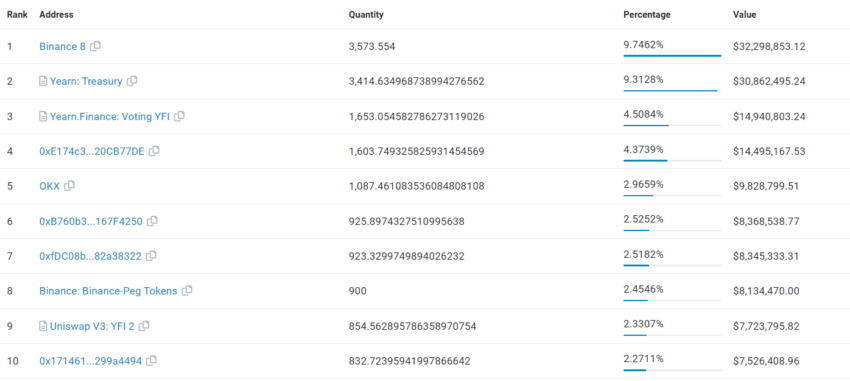

Observers have advised that venture insiders have pushed the promoting stress, as virtually half of YFI’s provide is in ten wallets.

Crypto dealer Skew described the YFI value transfer as a “fairly deliberate tapestry.”

“Earlier than the carpet, there was a reasonably apparent spot in value promoting, in addition to a major brief place. Most of that brief OI closed right here, halting the ~$8500 promoting,” the dealer mentioned.

Learn extra: Evaluating Cryptocurrencies with On-Chain and Elementary Evaluation

Yearn Finance YFI holders. Supply: Etherscan

Moreover, on-chain analyst LookOnchain reported a major whale switch involving a pockets, “0x48f9,” shifting 446 YFI value roughly $5.8 million, most of which was deposited on exchanges. Regardless of this pullback, LookOnchain famous {that a} whale profited from the trades earlier than the crash.

This subject follows the venture’s area registrar points in September. On the time, customers of the DeFi protocol couldn’t entry the protocol by means of the Yearn.fi URL. Nonetheless, the issue was later corrected.

Yearn Finance is without doubt one of the largest DeFi protocols within the ecosystem. At its peak in 2021, the protocol had a TVL of over $7 billion.