- XRP tumbled as Ripple moved 50 million tokens, inflicting a market stir.

- The general market sentiment for XRP is blended, with neither the bulls nor the bears in management.

Ripple’s [XRP] current value surge hit a wall, leaving traders questioning what’s stalling its momentum. The cryptocurrency noticed a promising 6% rise yesterday however has decreased by 2% at this time.

What precisely is dragging XRP down?

Why is XRP down at this time?

Current data from the blockchain tracker Whale Alert revealed a large switch of fifty million XRP tokens from Ripple Labs Inc. to an unknown pockets valued at roughly $25.7 million.

This huge-scale motion follows one other large transaction final week, by which over 100 million XRP had been despatched to an exterior pockets.

Sometimes, these Ripple dumps are likely to shake XRP’s value negatively. It is because they enhance the availability of XRP out there, which may result in downward strain on the value if demand stays fixed.

And it has — XRP crossed the $0.55 threshold lower than 24 hours in the past, however the token is value $0.53 at press time.

What does the market inform us?

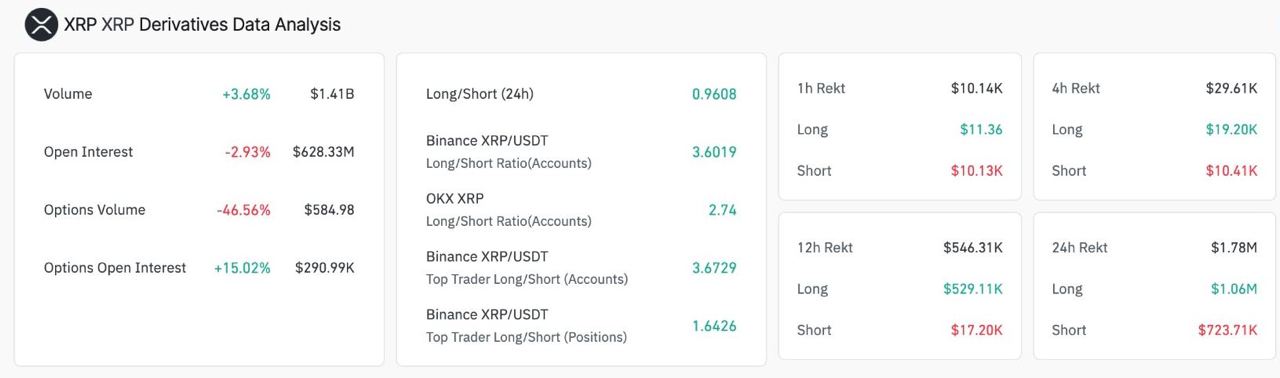

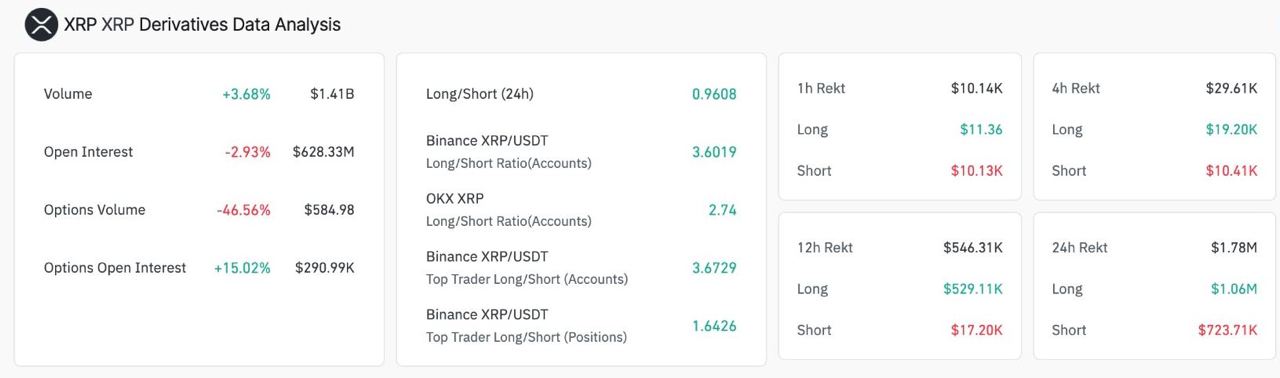

AMBCrypto’s take a look at Coinglass’ data revealed that XRP’s buying and selling quantity has elevated barely by 3.68%, totaling $1.41 billion, indicating a reasonable rise in buying and selling exercise.

Nonetheless, Open Curiosity has decreased by 2.93%. This lower instructed a slight cooling off in market enthusiasm or a consolidation section.

Supply: Coinglass

The Lengthy/Quick Ratio throughout platforms confirmed a mixture of bullish and bearish sentiments. These blended indicators instructed a cautious sentiment amongst merchants and traders.

The distinction in Lengthy/Quick Ratios indicate that whereas some high merchants are bullish, the broader market stays divided. If the highest merchants’ bullish bets show appropriate, we would see an upward value motion for XRP.

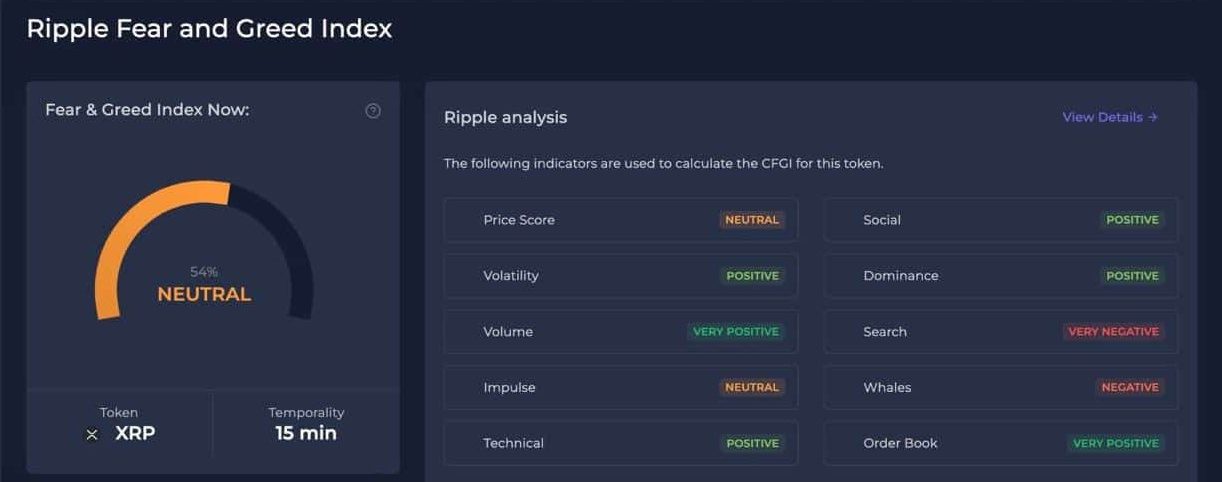

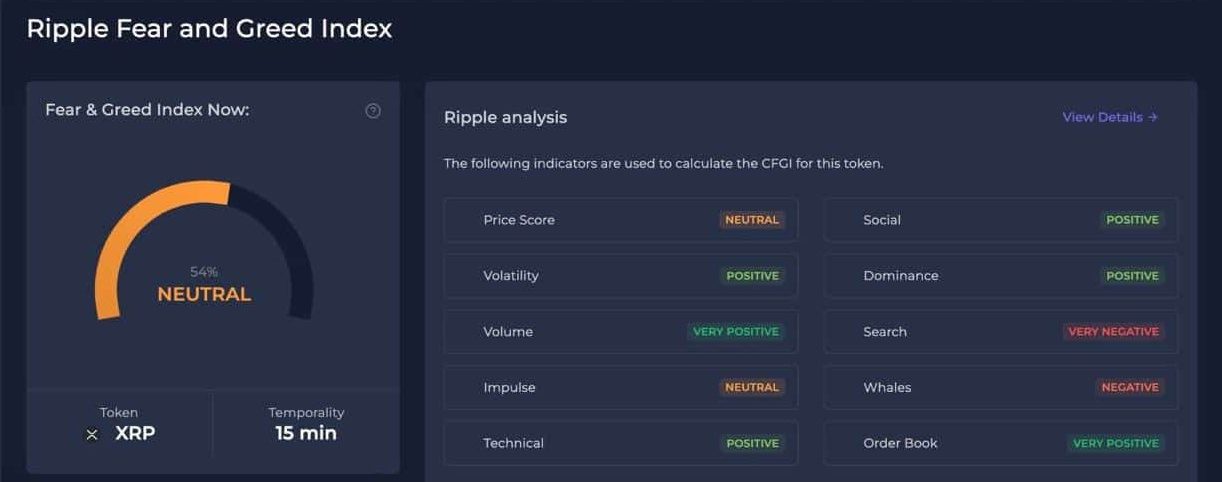

In the meantime, AMBCrypto’s take a look at the social sentiment data revealed that the Ripple Worry and Greed Index stood at 54% at press time, which indicated a impartial market sentiment for XRP.

Supply: CFGI

Is your portfolio inexperienced? Try the XRP Revenue Calculator

Traders may contemplate sustaining their positions as instructed by the index’s “Maintain On” funding suggestion whereas keeping track of the quantity dynamics, order e-book situations, and whale actions.

These components might shift the market sentiment rapidly both manner.