- XRP broke above the $0.54 stage and hinted at bullishness.

- The momentum and shopping for quantity had been but to indicate purchaser energy.

Ripple [XRP] has trended downward in 2024, which was an anomaly amongst the large-cap crypto tokens. The worth motion of the previous ten days showcased a doable shift in bias in favor of the patrons.

AMBCrypto reported earlier this month {that a} distinguished CEO advocated for XRP, highlighting it as a supply of considerable returns with out being a serious danger. But, evaluation confirmed that within the quick time period, traders might shield their capital and train warning.

The bullish construction shift could be a entice

XRP broke a latest decrease excessive at $0.54, which was highlighted in white above. This represented a bullish construction break on the day by day chart. But, captured in crimson was the longer-term downtrend that XRP has been on since early January.

Coupled with the bulls’ incapability to defend the 78.6% Fibonacci retracement stage (pale yellow) at $0.5284, it was an indication that the respite of the previous ten days was a short lived surge. The $0.57-$0.6 was a zone of resistance which doubtless has an enormous variety of promote orders.

The OBV was again at a stage that has acted as assist and resistance since final July. If it sinks beneath this stage, it will be one other signal of bearish dominance. The RSI was at 51, displaying impartial momentum.

As issues stand, the inference was {that a} transfer above $0.6 is required to substantiate a bullish bias.

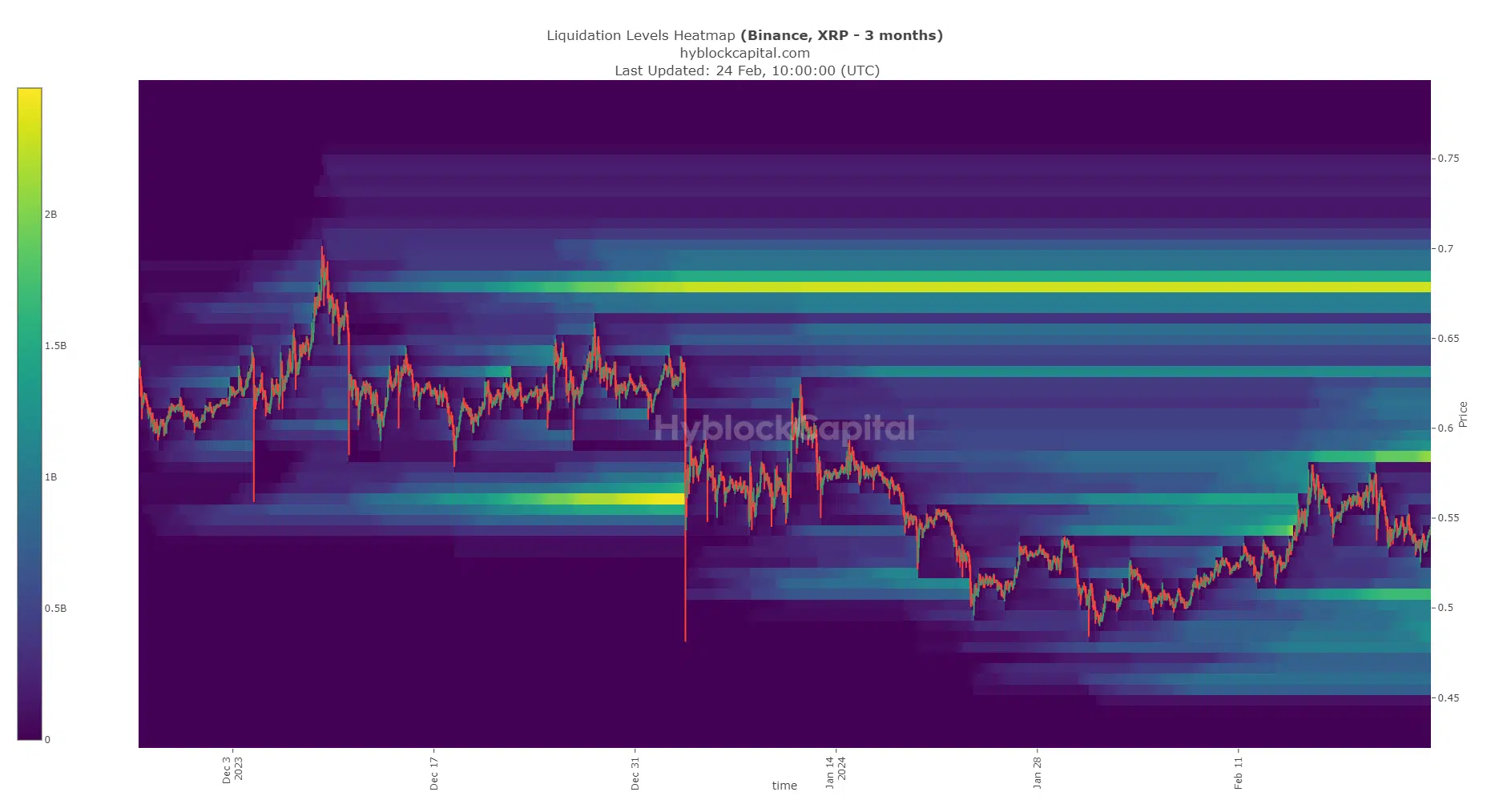

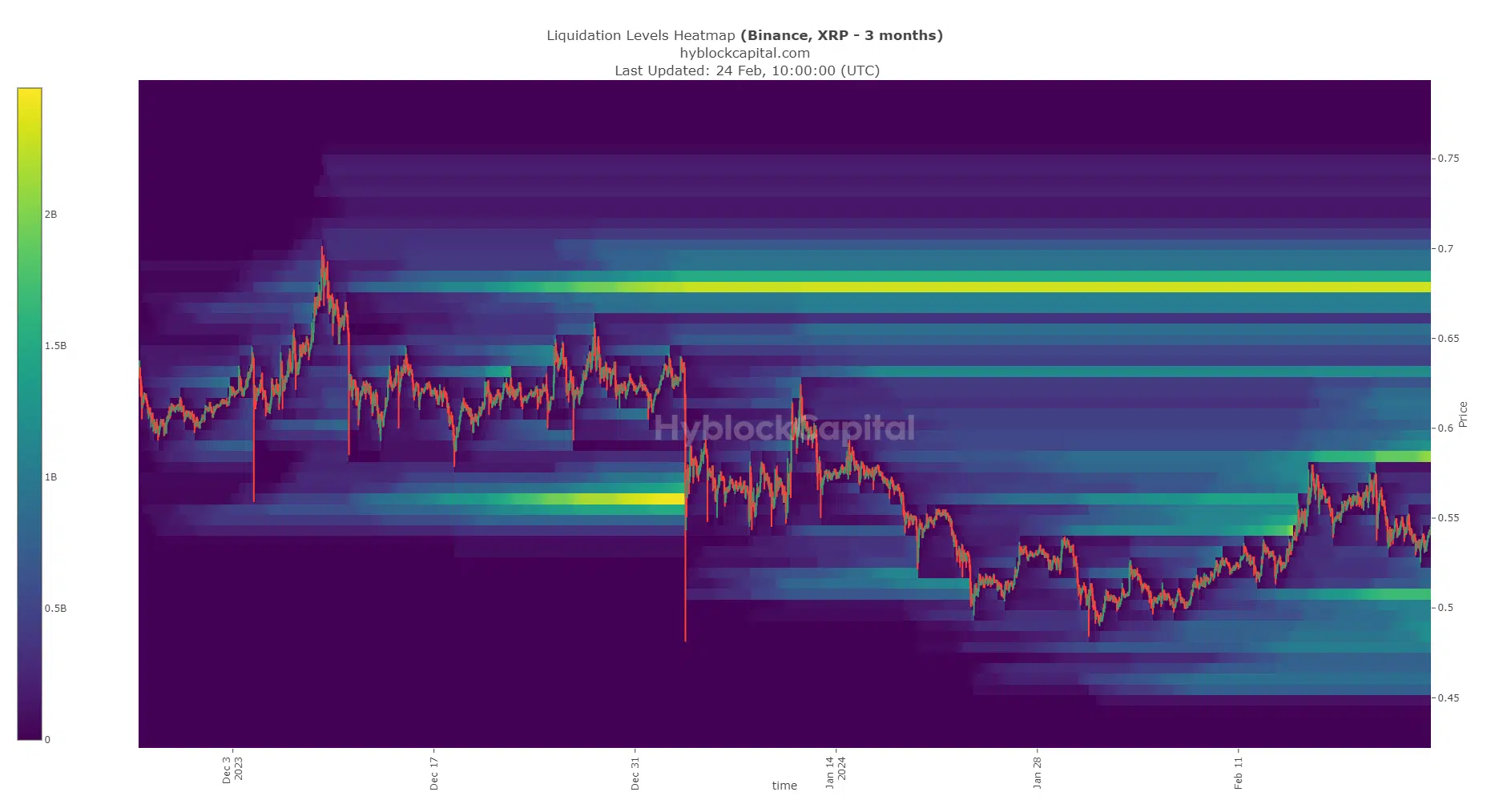

Understanding key areas of curiosity from liquidity

Supply: Hyblock

The liquidation ranges heatmap from Hyblock supplied helpful insights that aided AMBCrypto’s evaluation. The 2 zones of curiosity for traders now are the $0.58-$0.6 resistance, and the $0.5-$0.515 assist.

Is your portfolio inexperienced? Test the XRP Revenue Calculator

The previous was estimated to have over $2 billion in liquidations, and the latter to have simply over $1 billion. Therefore, a transfer into or simply previous these areas could possibly be adopted by a reversal.

Past $0.6, the $0.63 and $0.68 ranges are additionally anticipated to function stiff resistances.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.