Ripple [XRP] climbed to an area excessive of $0.744 on the eleventh of March. Since then, the market-wide sell-off pressured the altcoin’s costs to tumble.

The continued SEC vs. Ripple case has some important dates arising. This might influence investor sentiment.

One other signal that bullish sentiment was cooling down was whales transferring their XRP holdings to centralized exchanges.

The courtroom rulings within the SEC-Ripple tussle, alongside the broader market forces, would doubtless play an important position in XRP’s value motion within the coming weeks.

Ripple Labs 101

XRP is a cryptocurrency that Ripple Labs makes use of to conduct transactions on its community.

Whereas Ripple is a centralized fintech firm that started as RipplePay in 2004, it was later co-founded by Chris Larsen and Jed McCaleb in 2012 with the imaginative and prescient of making a sooner and safer means of doing transactions world wide.

Though the 2 have been used interchangeably, Ripple is a expertise firm whereas XRP is its open-source digital asset.

The crypto operates on its blockchain often called the XRP ledger (XRPL) the place transactions are facilitated by RTXP or the Ripple transaction protocol.

It’s pre-mined, in contrast to a variety of different cryptocurrencies, with a most token provide of 100 billion. The primary goal of the crypto is to function a settlement layer that aids in transactions with the Ripple community.

It has been, nonetheless, traded as a cryptocurrency that’s obtainable on numerous exchanges together with choices, swap exchanges, spot exchanges, futures, custodian, and non-custodian exchanges.

XRP vs. SEC: The conflict

The US SEC filed a lawsuit towards Ripple Labs in 2020 for promoting XRP as an “unlicensed safety,” claiming that the distribution of $1.3 billion price of the crypto to its stakeholders violated the regulation.

The main bone of competition right here was whether or not XRP was a safety and, due to this fact, whether or not it was a share in Ripple or if it was a cryptocurrency like Bitcoin.

Ripple has been at loggerheads with the SEC for a number of years now.

The SEC claimed that Ripple’s sale of XRP to buyers was to fund itself and relied on the 1946 SEC judgment of SEC vs. W.J. Howey Co. to make its case.

In doing so, the company acknowledged that whether or not an investor has management over revenue is a deciding issue if an funding contract is a safety or not.

Ripple Labs, alternatively, argued that the SEC had neither notified nor warned the group.

After three years of deliberation, the case was lastly ruled on in July 2023. The courtroom discovered that XRP was NOT a safety in itself.

The SEC was additionally denied the request for an interlocutory attraction. Later, it needed to drop its securities violation prices towards Ripple and XRP.

The SEC obtained authority over cryptocurrency gross sales to establishments, whereas crypto-transactions on exchanges wouldn’t be handled as securities transactions.

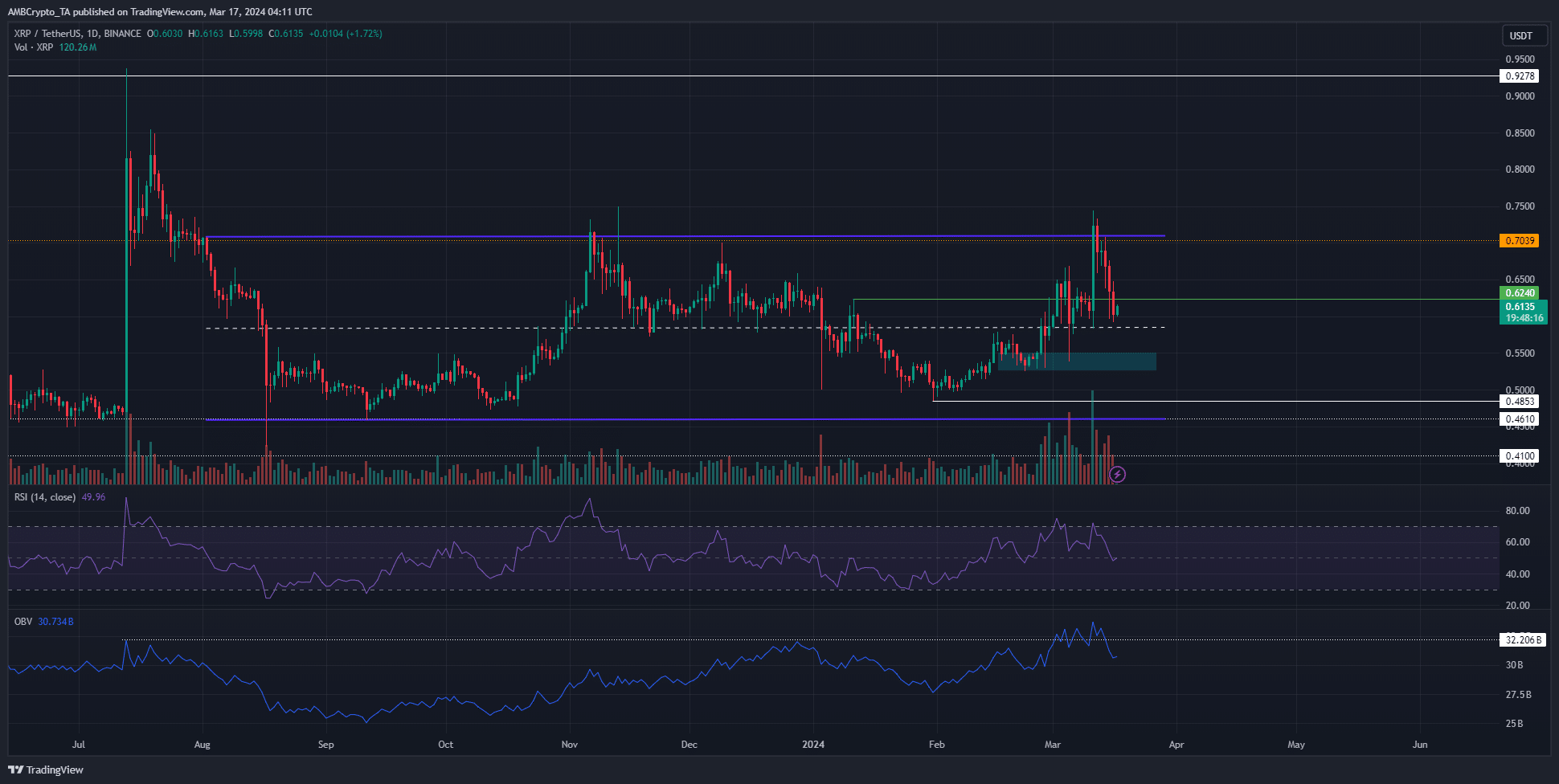

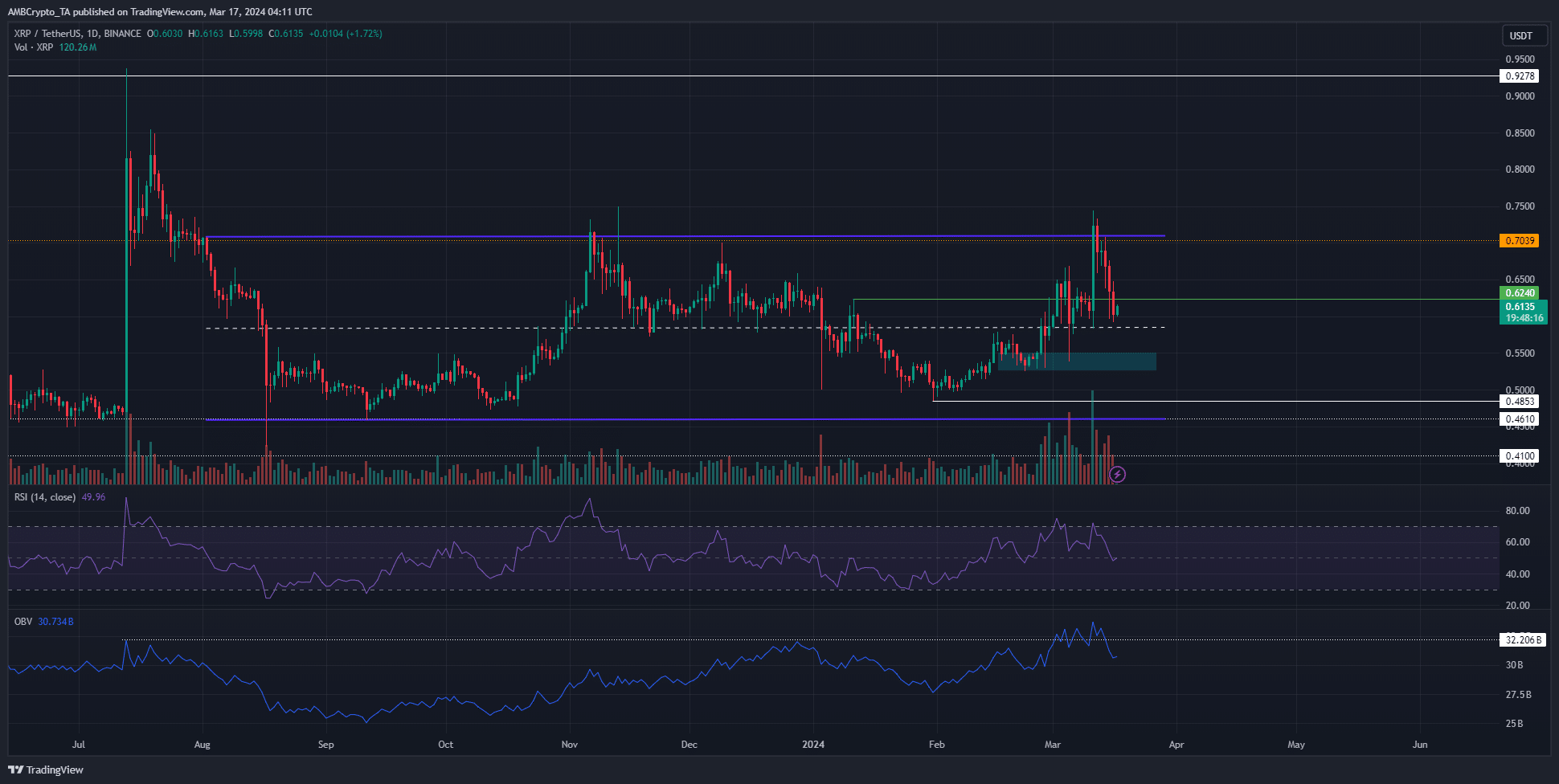

Technical evaluation of the one-day chart

Supply: XRP/USDT on TradingView

Within the one-day timeframe, the swing low was on the $0.525 degree. This was additionally a requirement zone that the token has examined a number of occasions up to now month.

At press time, the momentum on the every day chart has begun to shift bearishly.

Therefore, it was attainable {that a} transfer to the $0.52-$0.54 demand zone may arrive over the following few days. The OBV was unable to flip the resistance degree to assist.

This confirmed that consumers didn’t have a transparent superiority in numbers over the sellers but.

Mixed with the momentum and the losses up to now week, extra southward motion appeared doubtless.

A have a look at the decrease timeframe charts reminiscent of 4-hour or decrease indicated that the $0.65 was a key short-term resistance area.

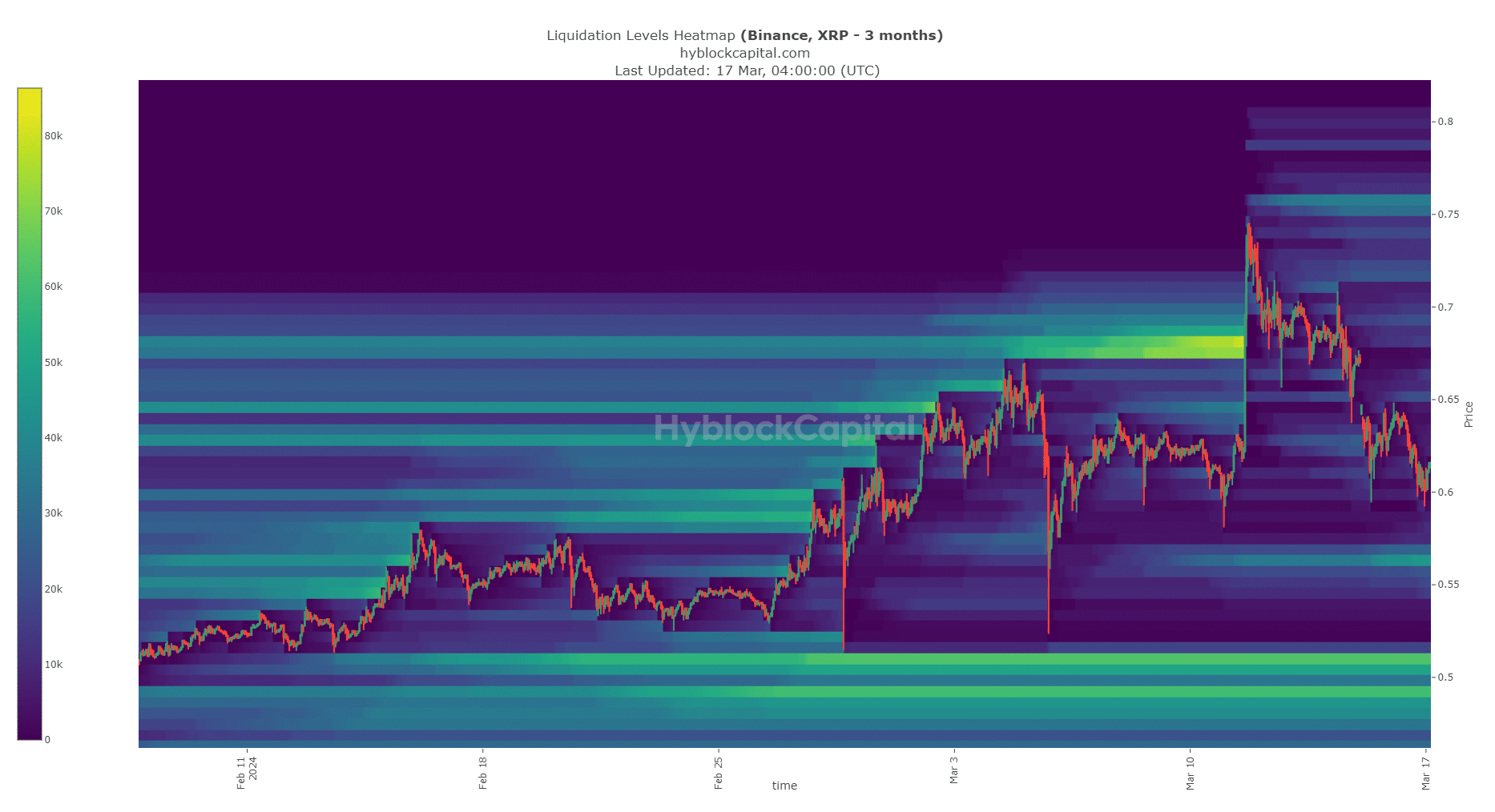

The magnetic zones have been stronger to the south

The worth is drawn to liquidity. Subsequently, numerous purchase and promote orders or liquidation ranges would appeal to costs like a magnet. At press time, the $0.56 degree has a comparatively excessive quantity of liquidation ranges.

In the meantime, the $0.65 and the $0.75 ranges overhead may see a response from XRP. But the probabilities of a bounce remained low.

AMBCrypto thinks {that a} transfer towards $0.56 is probably going. The $0.51 degree, which was the following important liquidity pocket, was additionally attainable.

In the meantime, a bounce to the $0.65 degree or larger was deemed much less doubtless, primarily based on the liquidation heatmap.

Conclusion

XRP has remained rangebound since August 2023. Its incapacity to breach the $0.7 resistance and keep there even when Bitcoin is at all-time highs didn’t spotlight bullish power. Buyers and swing merchants may anticipate additional losses earlier than shopping for XRP, in search of to take income close to the vary highs.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.