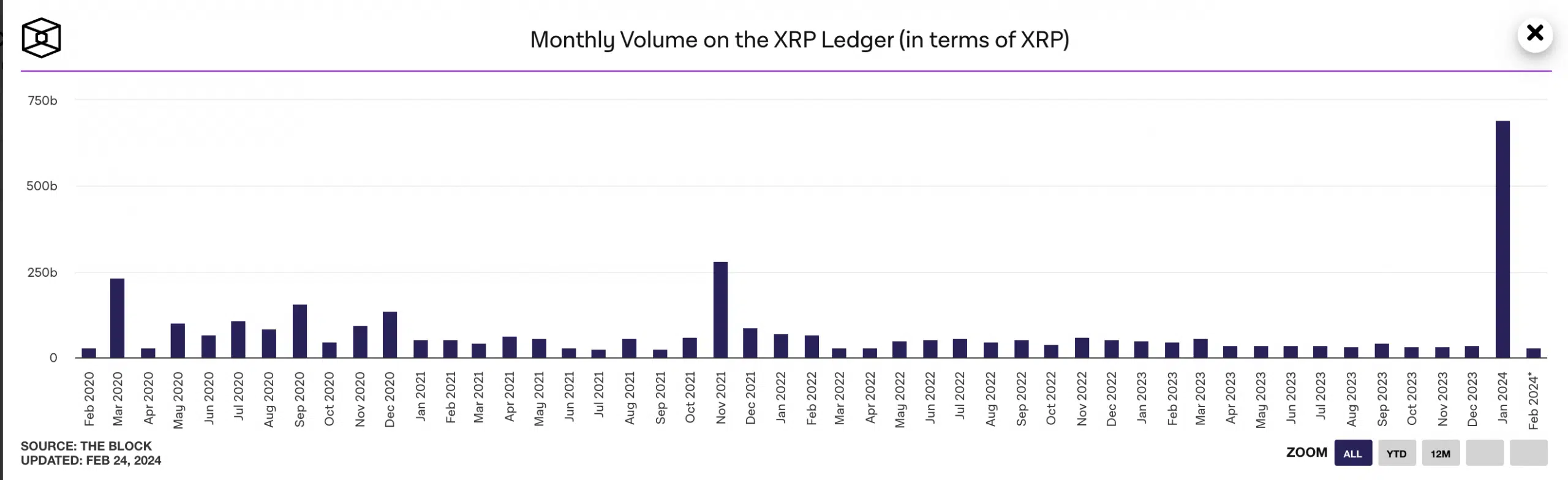

- XRPL’s month-to-month transaction quantity totaled 26 billion XRP in February.

- This represented its lowest since April 2022.

The XRP Ledger [XRPL] is poised to shut February with its lowest month-to-month quantity, as measured in XRP, since April 2022, in accordance with The Block Information dashboard.

With 4 days until the tip of the month, the full worth moved in XRP transactions on the open-source and decentralized blockchain has totaled 26 billion XRP.

This decline comes after the community recorded an all-time excessive of 691 billion XRP in month-to-month transaction quantity in January.

AMBCrypto reported earlier that this milestone occurred regardless of an tried hack on cryptocurrency alternate Bitfinex on the 14th of January by means of the “Partial Funds Exploit” function.

In keeping with The Block, the final time XRPL’s month-to-month transaction quantity was under 30 billion XRP was in April 2022, when its transaction quantity throughout the 30-day interval totaled 26 billion XRP.

Are the bears making a comeback?

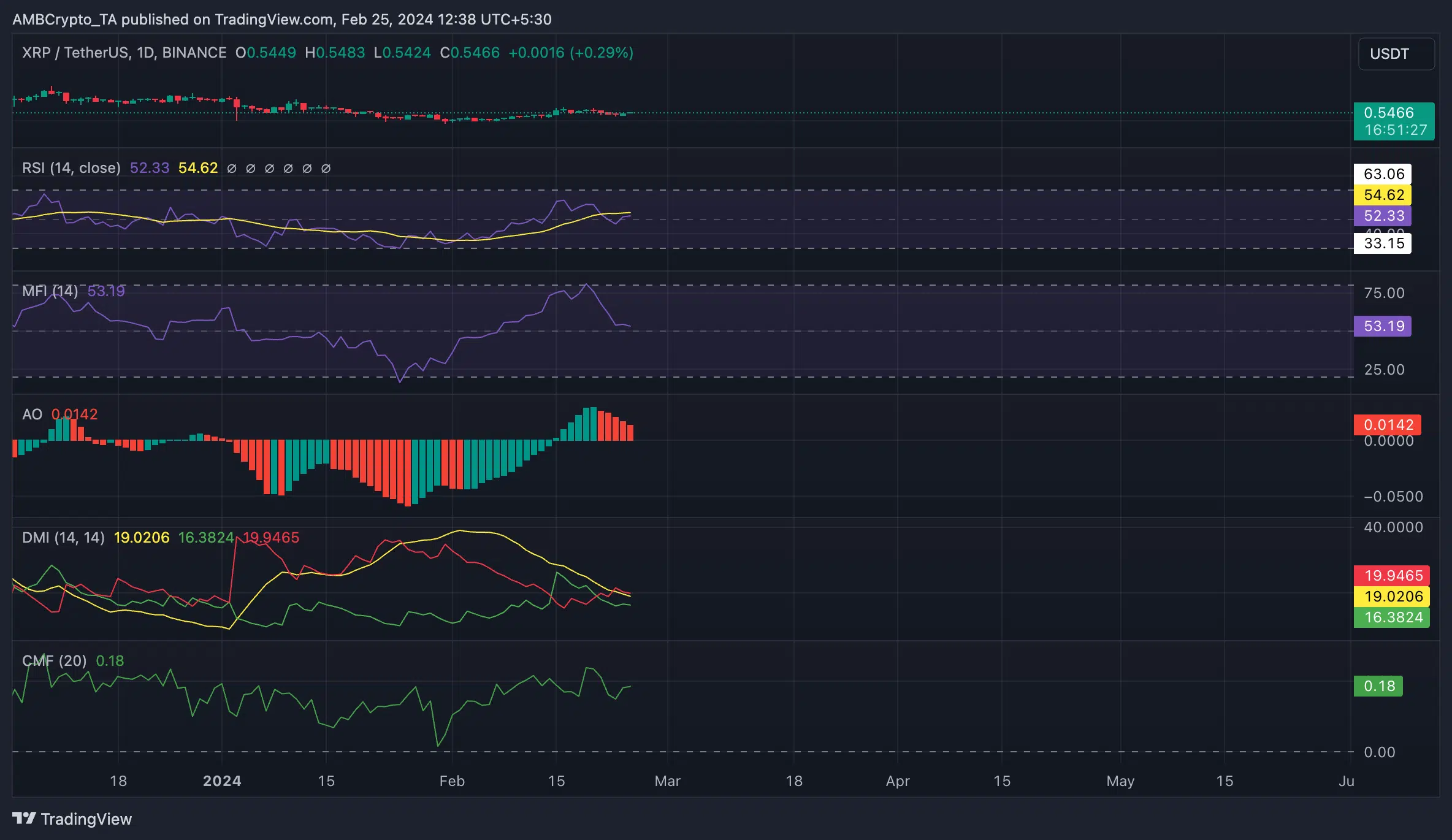

AMBCrypto’s evaluation of XRP’s efficiency on a each day chart revealed {that a} bearish crossover between its constructive directional index (inexperienced) and unfavorable directional index (purple) occurred on the twentieth of February.

When such readings are constructed from an asset’s Directional Motion Index (DMI), it suggests a weakening of upward momentum and a possible shift in the direction of a bearish development.

As well as, the token’s Superior Oscillator indicator has posted solely purple upward-facing histogram bars for the reason that twentieth of February.

This meant that regardless of the widely bullish outlook, the XRP market nonetheless harbors some bearish parts.

Nevertheless, regardless of this, token accumulation stays regular amongst spot market members.

At press time, XRP’s Relative Energy Index (RSI) and Cash Move Index (MFI) returned values of 52.33 and 53.19, respectively.

Above their respective heart strains, these indicators confirmed that purchasing stress was past token selloffs.

Additionally, XRP’s Chaikin Cash Move (CMF) was 0.18. A CMF worth above zero is seen as an indication of energy available in the market.

The rising constructive CMF worth urged a gradual influx of liquidity wanted to take care of XRP’s 30-day-long value rally.

Relating to exercise within the token’s derivatives market, its Futures Open Curiosity has elevated for the reason that month started.

Learn Ripple’s [XRP] Value Prediction 2024-2025

At $681 million as of this writing, XRP’s Futures Open Curiosity has climbed by 28% for the reason that 1st of February, per information from Coinglass.

This and the considerably constructive Funding Charges recorded throughout derivate exchanges confirmed that XRP buyers proceed to open commerce positions in favor of sustained value development.