As a current Messari report outlined, the XRP Ledger (XRPL) showcased notable progress through the first quarter of 2024. The decentralized public blockchain, which facilitates the switch of XRP, fiat currencies, and different digital belongings, has demonstrated substantial exercise.

XRP Ledger Burn Charge Slows Amid Low Charges

Throughout Q1 2024, XRP, the native token of the XRPL, secured its place because the sixth largest cryptocurrency by market capitalization, reaching $34.1 billion (at present $29M). Regardless of a slight value lower, XRP’s circulating market cap witnessed a 1.3% progress quarter-over-quarter (QoQ).

Associated Studying

The XRPL employs a deflationary mechanism by systematically burning transaction charges. This course of exerts downward strain on the full provide of XRP, which stands at 100 billion tokens.

Because the inception of the XRP Ledger, roughly 12 million XRP have been burned. Nonetheless, the low burn charge throughout Q1 will be attributed to the community’s comparatively low transaction charges (lower than $0.002 per transaction).

Moreover, 1 billion XRP is launched from escrow to Ripple every month, with any unutilized tokens being positioned into new escrow contracts. This sample will proceed till the remaining roughly 45 billion XRP turns into liquid; at this level, the deflationary strain from burned charges would be the major variable affecting provide.

Whereas XRP’s value decreased marginally 0.1% QoQ, lagging behind the general crypto market’s 63.0% enhance, it rose 14.8% 12 months over 12 months (YoY).

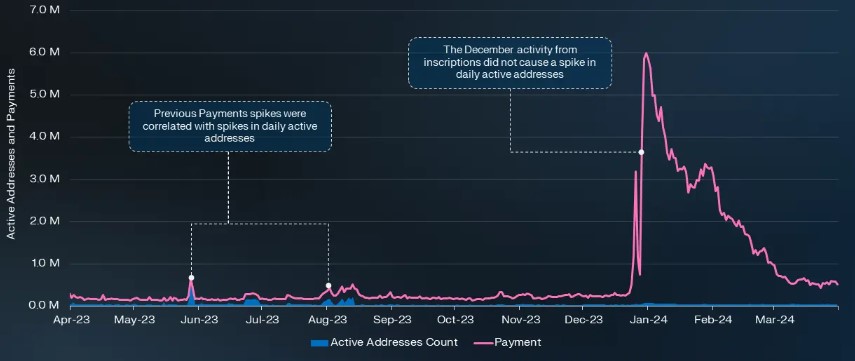

Inscription-Fueled Transactions Propel XRPL Each day Funds

The report highlights that income within the XRPL is measured as whole charges collected by the community, that are subsequently burned, contributing to the redistribution of wealth from transaction charge spenders to XRP holders. Community exercise confirmed vital progress, with energetic addresses and transactions growing by 37% and 113% QoQ, respectively.

A considerable portion of transaction exercise on the XRPL stemmed from inscriptions, a transaction sort popularized in early 2023. Over 30 million transactions have been despatched to a single account by roughly 45,000 accounts engaged in inscription-related actions.

In keeping with Messari, inscriptions, facilitated by XRP Script, performed a key function in driving the surge in day by day funds, which soared 350% QoQ to 2 million transactions.

Associated Studying

Lastly, the report notes that the XRP Ledger blockchain witnessed a web enhance of 150,000 accounts, driving the full variety of accounts up by 3.1% to five.15 million in Q1.

Nonetheless, new addresses decreased 12.4% QoQ to 183,000, primarily as a result of excessive variety of addresses created in This fall, coinciding with the inception of inscription exercise.

As of press time, XRP is valued at $0.5279, down 2.5% up to now 24 hours and three.5% up to now seven days, which is consistent with the broader market development.

Featured picture from Shutterstock, chart from TradingView.com