Jeremy Poland

Most individuals do not discover investments interesting which have the notion of getting finite upside. The perfect-performing shares usually rise constantly over a long-period of time, however do not double in a single day. Nonetheless, whereas skilled buyers know that almost all investments will not respect at greater than 8-10% a 12 months over the long run, many individuals like the concept their shares have limitless potential.

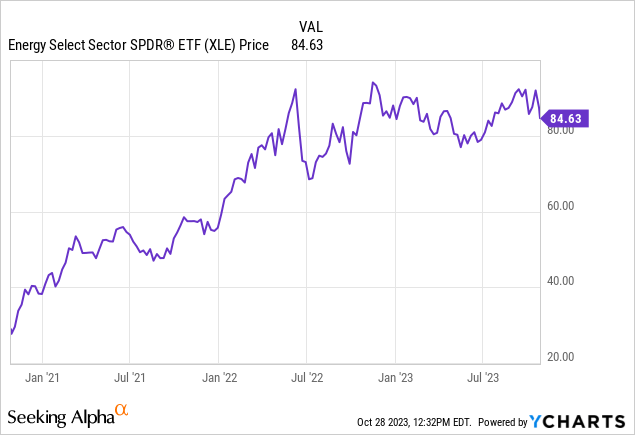

The power sector has been one the perfect areas available in the market for each development and worth buyers to allocate capital during the last a number of years. Most oil and gasoline shares constantly and considerably underperformed the benchmarks between 2016 and 2020, many oil and gasoline firms had been low cost previous to the run-up in power costs during the last three years. Some of the well-known power funds is the Power Choose Sector SPDR Fund (NYSEARCA:XLE).

This exchange-traded fund has been one of many best-performing ETFs available in the market during the last a number of years.

This power fund has provided buyers a complete return of 232.34% since October of 2020, whereas the S&P 500 has provided buyers complete returns of 27% throughout this identical time interval.

I rated this fund a maintain in Might due to the prospect of a recession. I’m now upgrading this fund to a purchase. The worth of oil ought to stay excessive for a number of causes even when the financial system continues to sluggish. Geopolitical threat, restricted provide, and robust demand ought to proceed to raise costs. Most Western governments within the EU and the present administration within the US additionally stays dedicated to the inexperienced power motion, there may be not prone to be important new drilling or exploration for oil and gasoline in Europe or america. Many oil firms are seeing file income and free money move proper now, this power fund is well-positioned to supply robust revenue and stable capital features for a while.

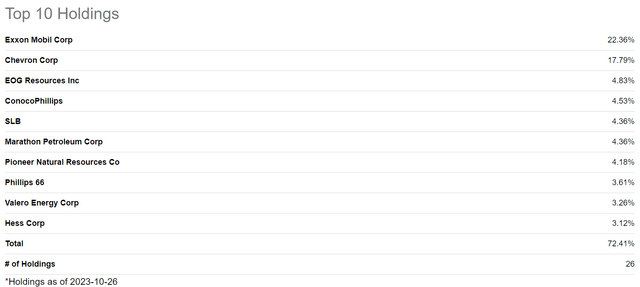

XLE is closely concentrated fund with the 2 largest holdings being Exxon Mobil (XOM) and Chevron (CVX).

An inventory of XLE’s core holdings (In search of Alpha)

The Power Choose Sector fund has $38.08 billion in belongings underneath administration, the expense ratio is .1%, and this ETF is 99.6% invested in power shares. The fund is weighted to power shares within the S&P 500, which is why the State Avenue fund has 40% of the ETF’s belongings allotted to Chevron and Exxon-Mobil. This technique has strengths and weaknesses, however these two firms have been a number of the best-performing oil and gasoline shares in each the power sector and the general market during the last three years. This ETF can also be closely focused on upstream power firms, with the fund having lesser holdings in downstream refiners similar to Valero (VLO) and Phillips 66 (PSX).

Predicting the value of any commodity within the close to time period is almost unimaginable, however there are a number of causes to consider crude costs ought to stay at excessive ranges even when the financial system enters a average recession. The latest battle within the Center East shouldn’t be prone to finish quickly, Israel is set to get rid of Hamas from Gaza, and the struggle between Russia and the Ukraine continues as effectively. The power business can also be nonetheless recovering from an prolonged interval of great underinvestment from 2016 to 2020 when costs had been usually at low ranges. Upstream investments within the power sector have fallen from $700 billion a 12 months in 2014, to between $370 billion to $400 billion immediately. The common decline fee per 12 months globally of oil fields can also be 6%. Whereas the pure gasoline market remains weak in North America, however that truth has been well-known for a while and priced into markets.

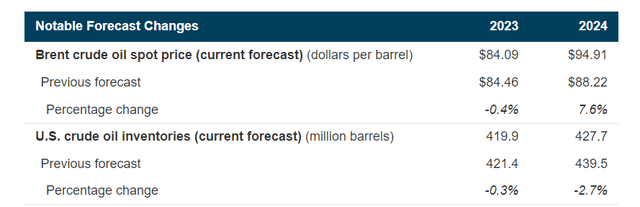

Most main power producers additionally had file money move final 12 months, oil costs are expected to stay excessive as effectively. Exxon Mobil had money move of $62.1 billion, a rise of 64% year-over-year, and Chevron reported file money move in 2022 of $49.6 billion. ConocoPhillips (COP) has additionally mentioned the corporate expects to generate $115 billion in free money move over the subsequent ten years, and people projections had been primarily based on a really conservative worth of oil of $60 a barrel. The IAEA can also be at present projecting Brent crude oil costs to common $84 {dollars} this 12 months, and $94.91 in 2024.

An inventory of the IAEA’s projections for the oil market (IAEA)

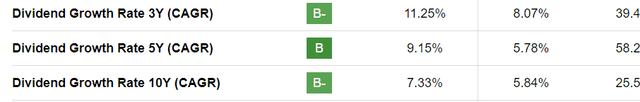

This fund has a historical past of robust dividend development, and that truth ought to proceed transferring ahead. The 5-year dividend development of this fund is 8.09%, and the 10-year dividend development of this fund is 9.22%.

An inventory of XLE’s latest dividend development (In search of Alpha)

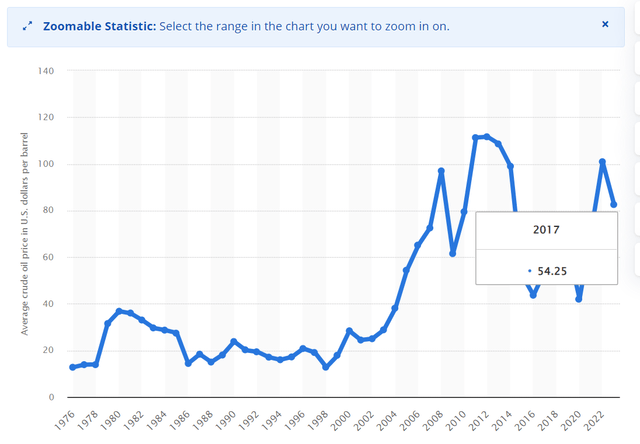

The common worth of oil during the last 5 years has been practically $72 a barrel, and consensus projections are for worth this 12 months and subsequent to be 15-20% larger than these ranges.

A chart of Brent Crude Oil Costs (Statista)

Most power firms even have far stronger stability sheets now than in earlier years too, for the reason that robust latest money move they’ve generated has enabled these producers to pay down debt that was constructed up throughout Covid. To ensure that a dividend to double in six years utilizing compounding returns, the speed of enhance needs to be simply over 12% per 12 months. With many main power firms having robust stability sheets, record-free money move, and administration groups dedicated to maximizing shareholder returns with important buybacks and dividend will increase, that quantity ought to be achievable.

Predicting short-term worth strikes in any risky market has minimal worth, however forecasting costs ranges over an extended time frame by evaluating the basics of an business is essential. The world wants oil and gasoline, that truth shouldn’t be going to alter. Whereas power firms had been a number of the worst performing shares for a while, this sector is now effectively positioned to supply stable capital features and spectacular revenue over the long run.