- The Worldcoin construction and momentum had been on the sellers’ facet within the 1-day timeframe

- The short-term good points had been extra of a respite than a restoration on account of lack of demand

Worldcoin [WLD] introduced its plans for the Layer 2 solution Worldchain, which is scheduled for launch later this summer season. The token WLD will play a task and be utilized for gasoline charges alongside Ethereum [ETH].

Whereas the announcement noticed costs tick upward, it was not sufficient to undo the long-term downtrend that WLD has launched into.

Step one shall be a transfer past $7.48, however are the bulls sturdy sufficient to realize this?

The WLD indicators and value motion each showcase one route ahead

Supply: WLD/USDT on TradingView

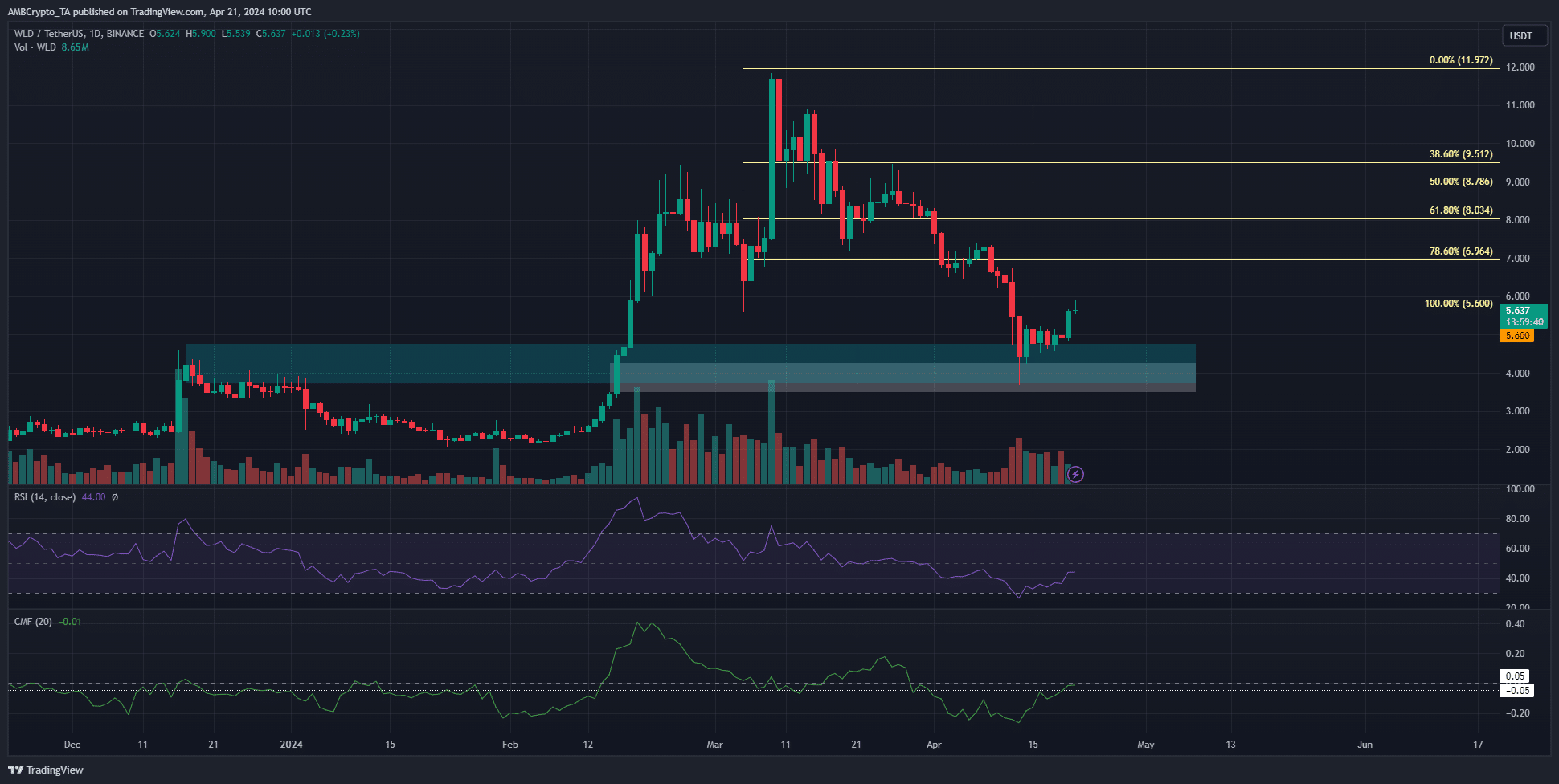

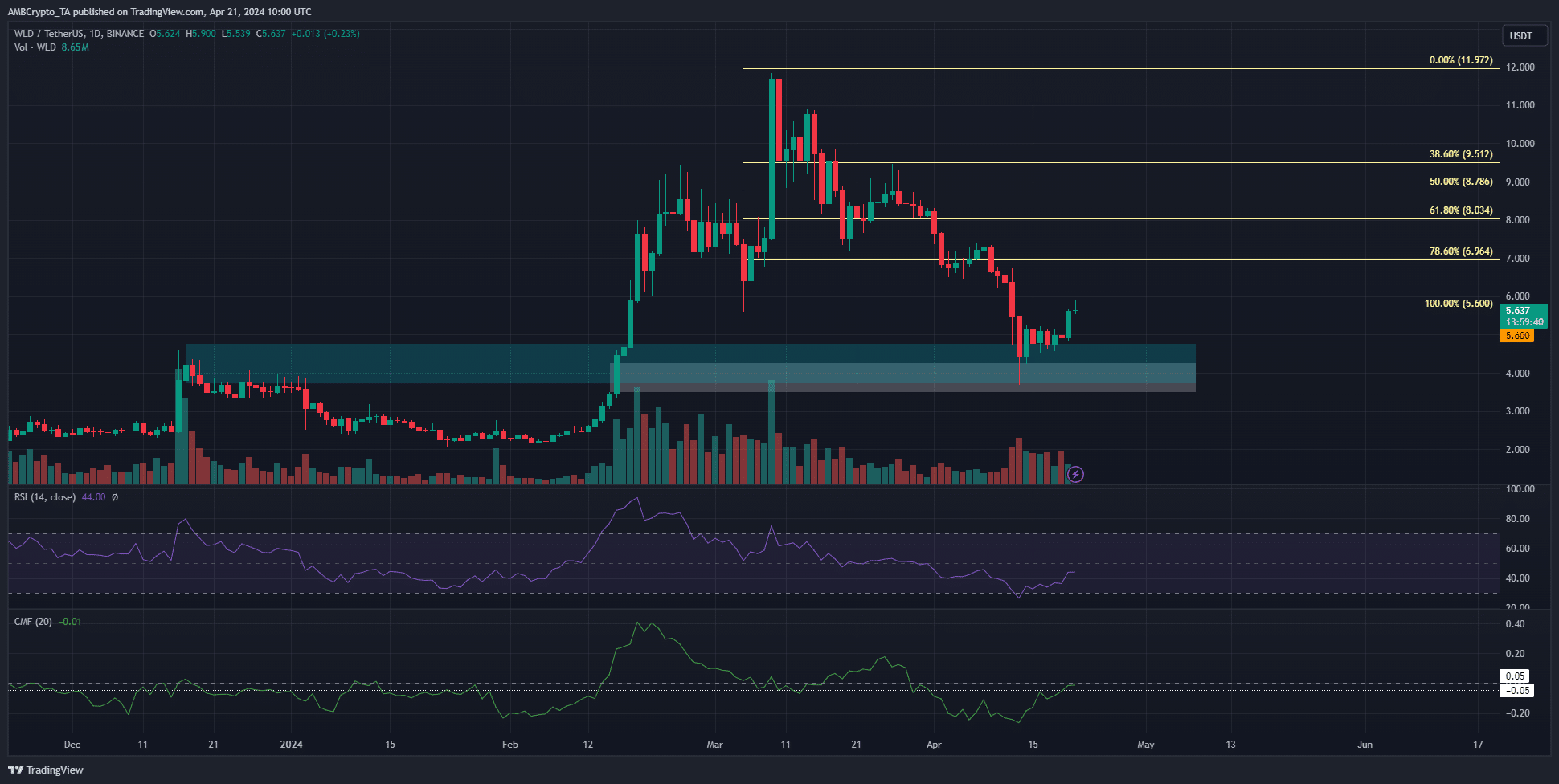

The Fibonacci retracement ranges (pale yellow) confirmed that the present retracement has overwhelmed the earlier swing low at $5.6.

The bullish breaker block (cyan) and the truthful worth hole (white) at $3.7-$4.2 had been examined on the thirteenth of April.

Because the low of that day, WLD has gained 52%. But, its market construction on the one-day chart was firmly bearish.

The decrease timeframe charts confirmed that $5.4-$5.5 was a area the bulls should defend to maintain bullish short-term hopes alive.

The CMF on the every day chart was at -0.01. It confirmed that purchasing stress was not important but and that an uptick in costs was not but anticipated.

Equally, the RSI additionally stayed beneath impartial 50 to sign that bearish momentum was in play regardless of the bounce.

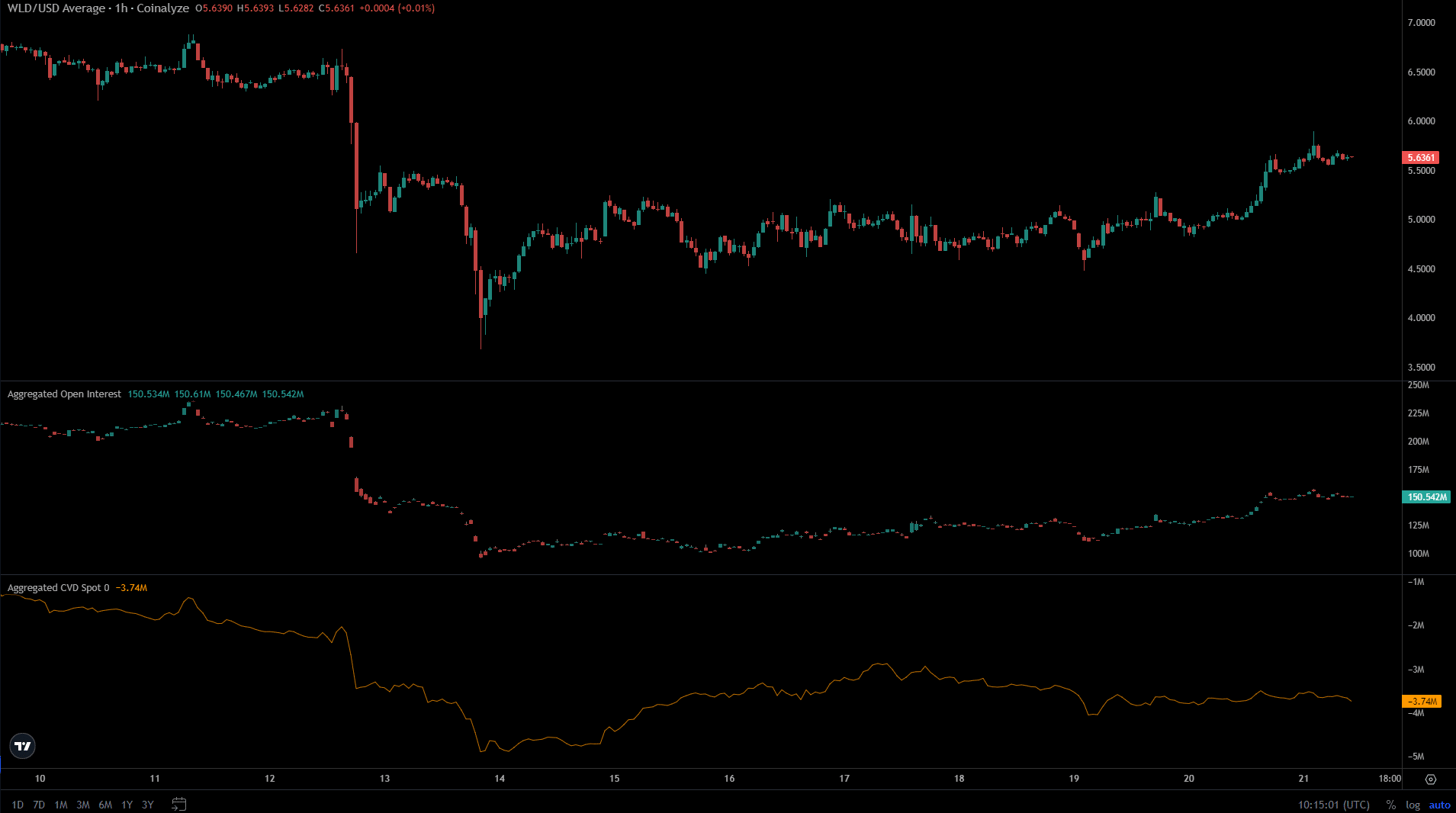

The short-term market sentiment was tiptoeing towards bullish

The good points of the previous few days noticed the Open Curiosity pattern greater. From the fifteenth to the twenty first of April, the OI rose by simply over $50 million.

This confirmed speculators had been keen to bid WLD and believed in its upward momentum.

Learn Worldcoin’s [WLD] Value Prediction 2024-25

Conversely, the spot CVD noticed a minor bounce from the 14th to the seventeenth of this month. The next 4 days to press time noticed the demand within the spot market pattern downward.

Therefore, WLD’s short-term bullish enthusiasm may meet an early finish.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.