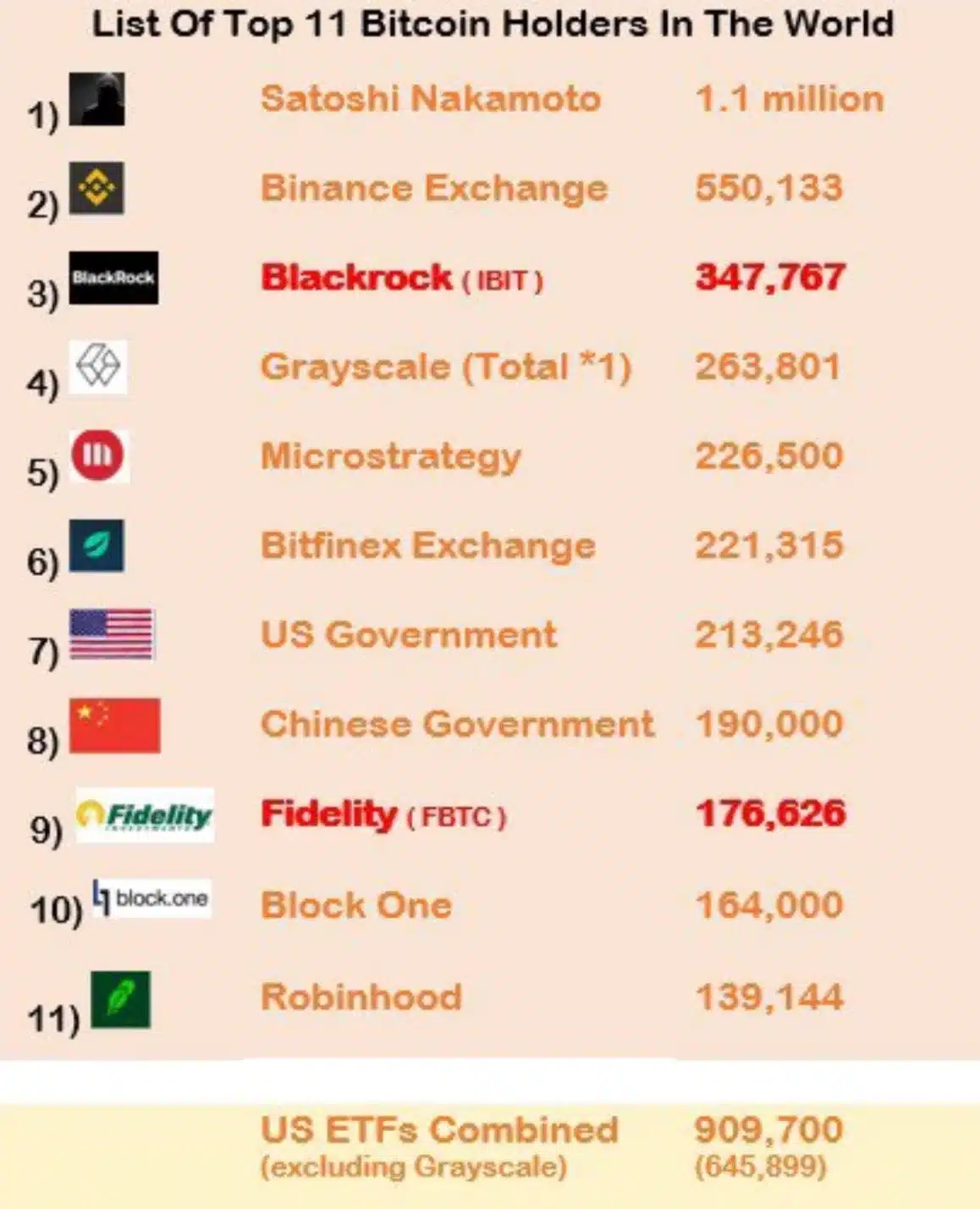

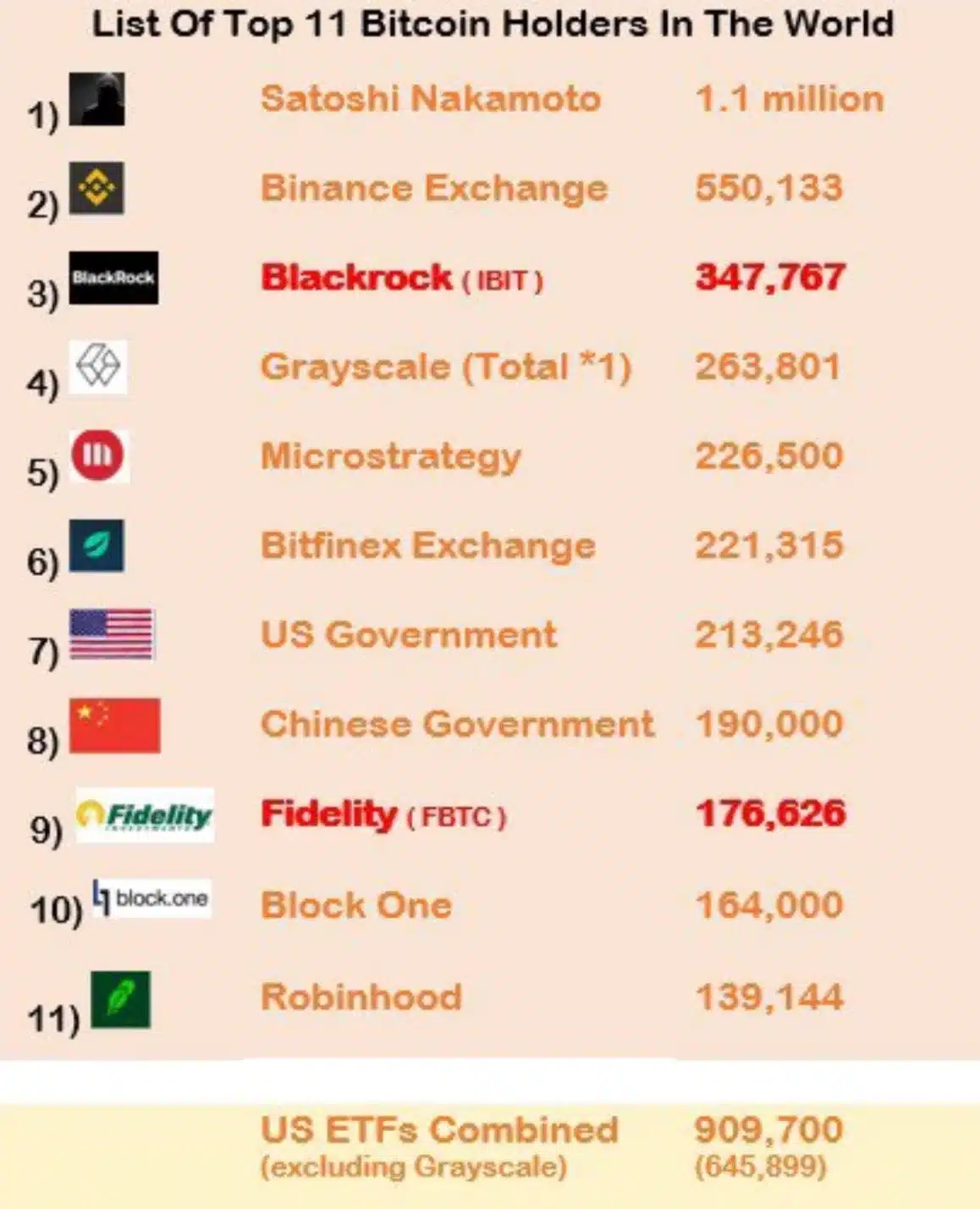

- BlackRock’s BTC ETF has now grow to be the third-largest Bitcoin holder.

- Projections steered that Bitcoin ETFs might surpass prime holders, together with Nakamoto, by late 2025.

The expansion of Bitcoin [BTC] Alternate-Traded Funds (ETFs) has been vital, with BlackRock’s IBIT Bitcoin ETF now positioned because the third-largest BTC holder worldwide, simply behind Grayscale.

Constancy’s FBTC fund is ranked ninth, whereas Satoshi Nakamoto stays on the forefront. This shift underscores the growing institutional adoption of Bitcoin by way of ETF investments.

Bitcoin ETF replace

In response to the most recent replace from Farside Investors, BTC ETFs skilled a internet influx of $27.8 million on the twelfth of August, with whole internet inflows reaching $17.369 billion since their inception.

Amongst these, BlackRock’s IBIT ETF stood out, having attracted a notable $20.330 billion in internet inflows since its launch.

In distinction, Grayscale’s GBTC ETF has confronted outflows totaling $19.462 billion over the identical interval.

Seeing the rise in Blackrock’s BTC ETF funding, Bloomberg’s senior analyst Eric Balchunas took to X (previously Twitter) and stated,

“Didn’t notice US ETFs are on observe to move Satoshi in bitcoin held in October. BlackRock alone is already #3 and on tempo to be #1 late subsequent 12 months, and can doubtless keep there for a really very long time Ht @EdmondsonShaun.”

Supply: Eric Balchunas

This indicated that Bitcoin ETFs would possibly surpass the present main holders by late 2025.

Satoshi Nakamoto’s BTC holdings

At present, Satoshi Nakamoto, the pseudonymous founding father of Bitcoin, is estimated to carry about 1.1 million BTC, making him the biggest particular person holder.

BTC ETFs, excluding Grayscale, collectively possess round 645,899 BTC, with whole U.S. ETF holdings exceeding 900,000 BTC.

Regardless of ongoing debate about Nakamoto’s precise holdings, the anticipated rise of Bitcoin ETFs mirrored a notable shift within the cryptocurrency market.

Highlighting the transformative influence of BTC ETFs, Spencer Hakimian, Founding father of Tolou Capital Administration, remarked,

“Individuals underestimate how reluctant establishments have been to personal Bitcoin on exchanges. Proudly owning through ETF is a recreation changer. Permits threat averse establishments to personal Bitcoin lastly. Recreation changer.”

Within the meantime, whereas Bitcoin ETFs have skilled vital momentum since their debut, BTC itself has had a tumultuous journey in 2024.

The cryptocurrency reached an all-time excessive of $73K earlier within the 12 months. On the time of writing, Bitcoin is on an upward pattern, approaching $60K after a interval of bearish motion.