The long-awaited “crypto spring” could also be upon us as Bitcoin (BTC) and different cryptocurrency markets rise in anticipation of a full-on bull market.

Over the current crypto winter, many various initiatives have been rising, gaining customers and constructing new networks. A few of these, like Polygon, are layer-2 (L2) options to assist scale the first protocol, Ethereum. However what are the implications of L2s? Are they a greater protocol to construct on or spend money on? Are different layer 1s (L1s) doing something to remain aggressive?

These questions and extra are the main focus of a brand new report from the Cointelegraph Analysis Terminal. The report appears to be like at up-and-coming initiatives within the cryptoverse, in addition to case research for L1s like Avalanche and Hedera and the way they evaluate to the brand new tech that’s on the rise.

Obtain the report on the Cointelegraph Analysis Terminal.

Cointelegraph’s “L1 vs. L2: The Blockchain Scalability Showdown” report is a primer to why scaling options are needed for the shortcomings of L1s. The report offers explanations of what’s at the moment occurring on the planet of scalability options to bridges and initiatives that concentrate on interoperability.

Layer-1 blockchains, equivalent to Bitcoin and Ethereum, are base protocols that can be utilized at the side of third-party layer-2 protocols and are often known as mainnets or main chains.

A layer-0 (L0) protocol permits builders to mix components from totally different L1 and L2 protocols whereas retaining their very own ecosystem to intensify interoperability.

L2 protocols allow 1000’s of low-value transactions to be processed after validation on parallel blockchains, with information then being transferred to the principle blockchain or mainnet to make sure they’re immutably recorded. This report will assist get the reader prepared for “crypto summer time” with all the knowledge and insights to make better-informed selections.

Fuel charges are simply the beginning

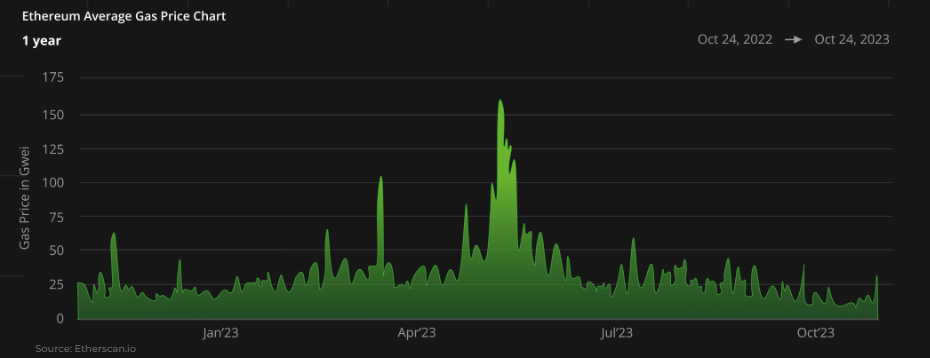

As veterans within the blockchain area know, Ethereum fuel charges have been a major situation, generally costing customers extra within the Ether (ETH) transaction price (measured in gwei) than the worth of the underlying asset. Because the chart beneath exhibits, the value of transactions on Ethereum can fluctuate dramatically, leaving customers with an unpredictable expertise that may harm additional adoption.

This sparked the creation of options to fight the difficulty, in addition to elevated scalability, together with transactions per second (TPS), interoperability and ease of consumer experiences for builders and customers.

Ethereum common fuel value chart

Protocol comparability, extra than simply pace

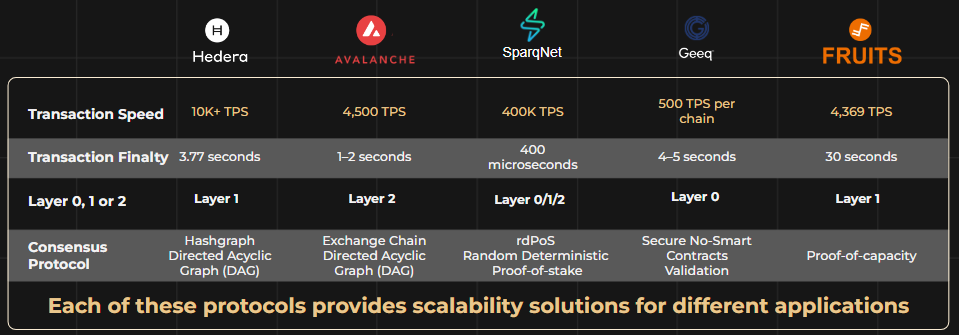

TPS is one essential issue that separates newer protocols from the older generations, equivalent to Bitcoin and Ethereum. Bitcoin and Ethereum act as their very own L1s however shouldn’t have intrinsic options to working at speeds corresponding to newer networks, as seen within the desk beneath.

At the moment, there are layer-0 protocols that function a base layer by which totally different protocols can work interoperably. Layer-2 protocols are constructed on prime of L1s to assist fill in and overcome gaps which will exist on the L1.

For instance, if a protocol has a low TPS, an L2 could present a cheap and environment friendly approach to nonetheless use the identical programming language and infrastructure of the L1 for safety.

TPS speeds of newer protocols. Supply: Cointelegraph Analysis

Prime developments for the long run

The report offers a number of insights, together with the highest rising developments which are main the narrative of protocols outdoors of the normal L1s, equivalent to asset tokenization and account abstraction.

Asset tokenization, together with the digital illustration of real-world belongings (RWA) onto decentralized ledger protocols, will play a major function within the unfold of next-generation protocols.

The migration of belongings to those protocols will improve transaction congestion as adoption charges climb. This elevated adoption additionally has penalties, together with the necessity to make custody for common customers simpler. That is the place the following development, account abstraction, comes into play.

Account abstraction will assist consumer experiences by eradicating necessities like holding seed phrases for account restoration. It may additionally enable for the batching of good contract executions like complicated cost constructions to be simplified. By making consumer experiences simpler, L0s and L2s might help spur the following leg of mass adoption.

Cointelegraph Analysis’s newest report is a beginning place to assist analyze these newer protocols. The report additionally consists of insider insights from business professionals who’re on the innovative of various applied sciences within the decentralized ledger area.

The Cointelegraph Analysis crew

Cointelegraph’s Analysis division contains a few of the greatest skills within the blockchain business. Bringing collectively educational rigor and filtered by sensible, hard-won expertise, the researchers on the crew are dedicated to bringing probably the most correct, insightful content material obtainable available on the market.

The analysis crew contains subject material consultants from throughout the fields of finance, economics and expertise to convey the premier supply for business studies and insightful evaluation to the market. The crew makes use of APIs from a wide range of sources to be able to present correct, helpful info and analyses.

With a long time of mixed expertise in conventional finance, enterprise, engineering, expertise and analysis, the Cointelegraph Analysis crew is completely positioned to place its mixed skills to correct use with the “L1 vs. L2: The Blockchain Scalability Showdown” report.

The opinions expressed within the article are for basic informational functions solely and usually are not meant to offer particular recommendation or suggestions for any particular person or on any particular safety or funding product.