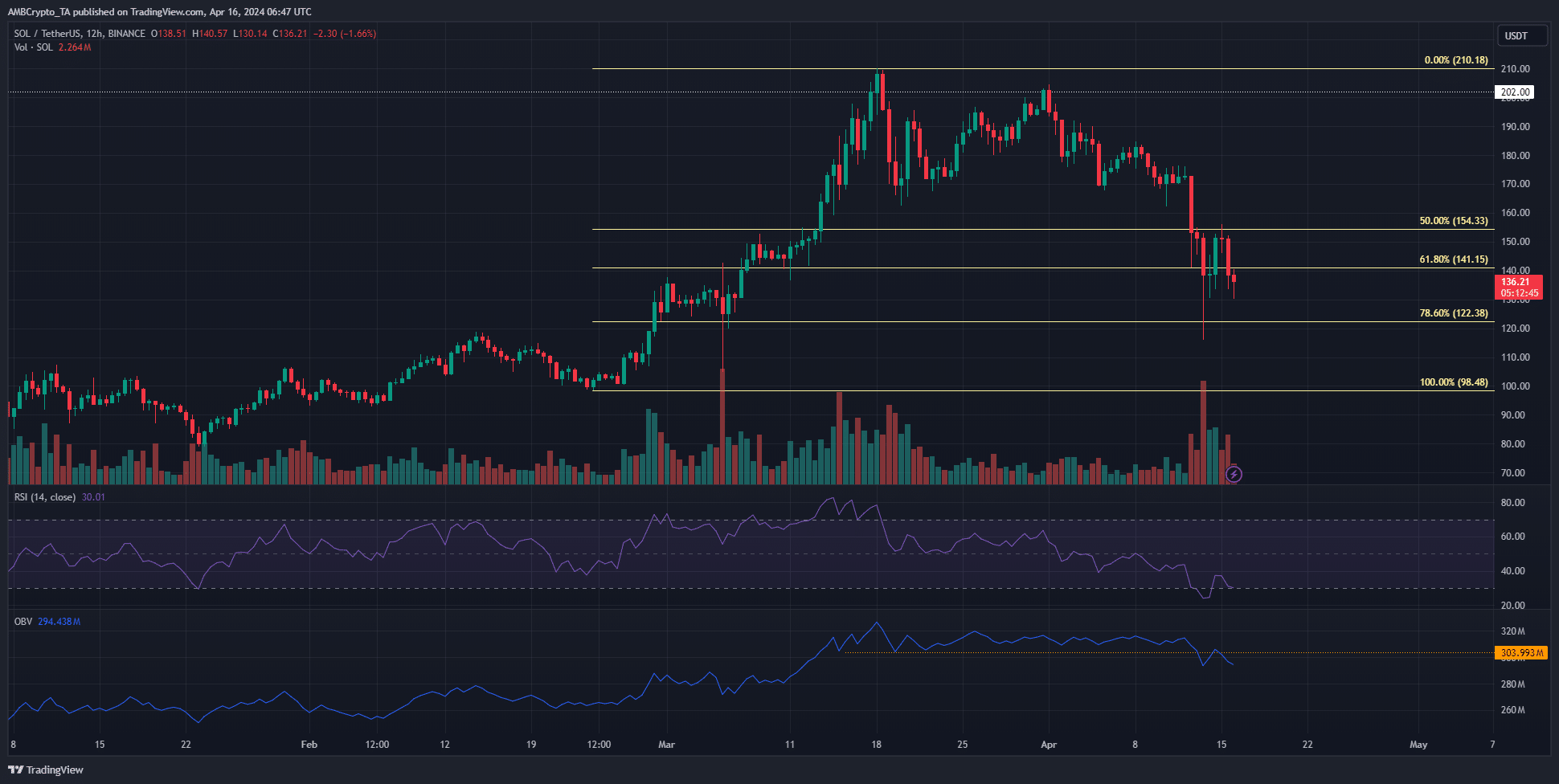

- The bulls ceded the $150 stage to the bears not too long ago as promoting strain intensified.

- Additional losses appeared probably, and $150-$160 is a agency resistance zone.

Solana [SOL] bulls loved a quick respite on the 14th of April, when costs climbed above the $150 psychological stage. The v1.17.31 launch may have contributed to the short-term bounce.

The $155-$162 area was a requirement zone that bears have been testing for practically a month now, nevertheless it was damaged over the weekend. The Fibonacci ranges highlighted that $122 is one stage that the bulls should defend.

Solana’s promoting quantity has gathered energy

Supply: SOL/USDT on TradingView

On fifteenth April Solana bounced to succeed in $156, however this turned out to be a short-term transfer. The market was too bearishly biased, resulting in late bears having their stop-losses hunted in the course of the bounce.

The HTF construction of SOL was nonetheless bullish, with $98.48 being the important thing swing low. A transfer under this stage would flip the 12-hour construction bearishly.

In the meantime, the decrease timeframes already signaled bearishness. One other drop to the $122 stage was anticipated.

The OBV was unable to defend the previous month’s help stage. This highlighted the bulls succumbing to the promoting strain. The RSI was additionally nicely under the impartial 50 mark to focus on agency bearish momentum.

The argument for a sub-$100 Solana

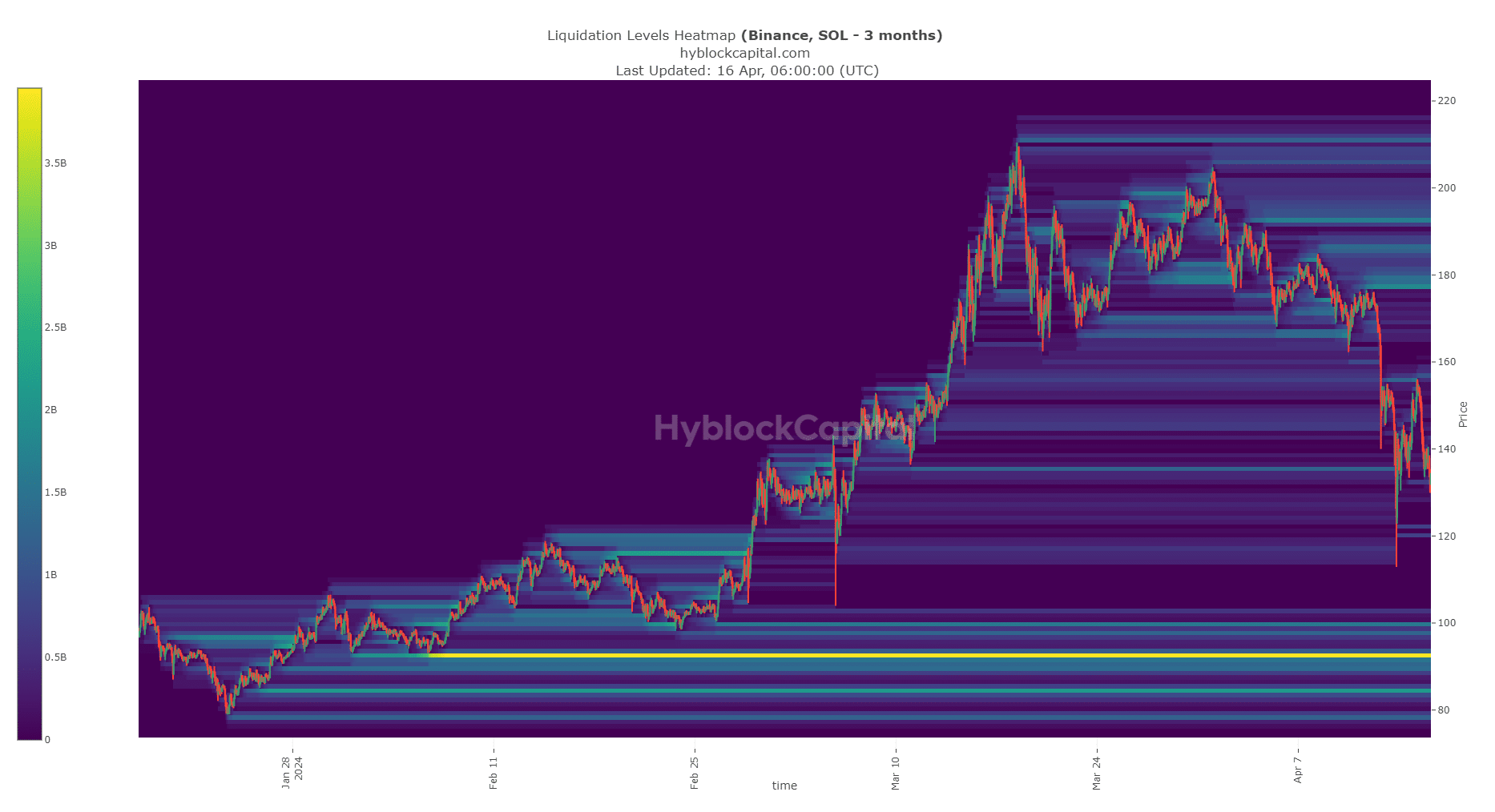

The liquidation heatmap of the previous three months confirmed that the following key space of curiosity was $92.57. The liquidation ranges concentrated at this stage have been in place since February.

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

To the north, the $160 space was additionally a magnetic zone however of far lesser pull. It was potential that SOL may drop to $92.

Nonetheless, worth needn’t go to each pocket of liquidity. A 1-day session shut under $122 would vastly enhance the possibilities of a drop to $92.57.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.