By Simon White, Bloomberg Markets Dwell reporter and strategist

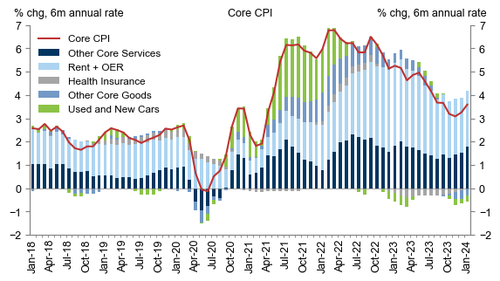

Fairness markets are going through mounting focus dangers as only a handful of shares drive returns. Not solely that, the primarily tech-related names dominating the transfer are extremely uncovered to inflation which is on the precipice of re-accelerating. Buyers face probably steep draw back, however it’s potential to construct a portfolio of corporations properly positioned to climate a resurgence in worth development.

When one firm’s earnings have the power to affect the macro narrative and materially have an effect on the $43 trillion S&P, it’s clear the threats from slender breadth are elevated. Nvidia’s outcomes, launched on Wednesday night, might have exceeded expectations and are on the cusp of taking the index to new highs, however that solely underscores the truth the tech-heavy market leaves portfolios acutely uncovered to inflation. This needs to be a clarion name that it’s time to behave. What higher time to repair the diversification roof than when the disinflation solar continues to be shining?

Focus dangers are at 50-year highs. The highest 5 shares within the within the S&P 500 now account for over 1 / 4 of its market cap, from solely about an eighth a decade in the past. You must return to the time of the Nifty Fifty within the late Nineteen Sixties and early 70s to see management as slender as it’s right this moment.

Again then, it was the tech titans of the day — Xerox, IBM, Polaroid – that have been among the many few shares disproportionately powering the advance. And in what might show to be an omen for the present cycle, the Nifty Fifty’s destiny was sealed by rising inflation, which triggered probably the most brutal bear market seen because the Nice Despair.

It’s much more of an issue right this moment as tech corporations have excessive period, leaving them singularly weak to a revival in worth development. A higher proportion of money flows sooner or later leaves a inventory’s complete current worth in danger from larger actual charges.

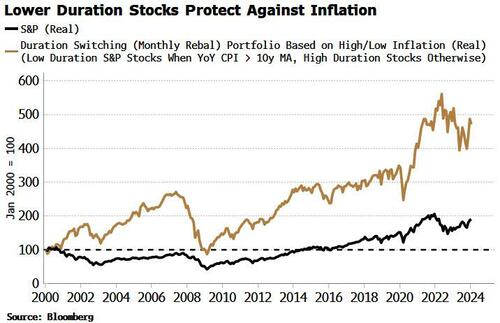

The advantages of avoiding high-duration shares when inflation is elevated could be seen within the chart beneath. The blue line reveals a rebalancing technique that goes lengthy low-duration shares when US CPI is over its 10-year shifting common, and high-duration shares when inflation is underneath it (utilizing the inverse of the dividend yield as an approximation for an fairness’s period).

As we are able to see, the technique cleanly outperforms the S&P in actual phrases.

However we are able to do higher than that. It’s potential to construct a portfolio of shares resilient to inflation that’s not simply depending on their period. In any case, it’s a reasonably blunt instrument. Ideally we need to discover shares that ought to do properly if inflation re-accelerates (as I count on it’s going to – see beneath), however just isn’t totally reliant on that end result.

Firms which can be capital mild and have sturdy pricing energy needs to be well-placed to climate – if not prosper in – elevated inflation. The businesses also needs to have demonstrated actual development over the long run.

Extra particularly, display screen for corporations with:

- over $1 billion market cap

- actual dividend development and gross sales development

- low mounted prices

- sturdy pricing energy

- affordable valuations

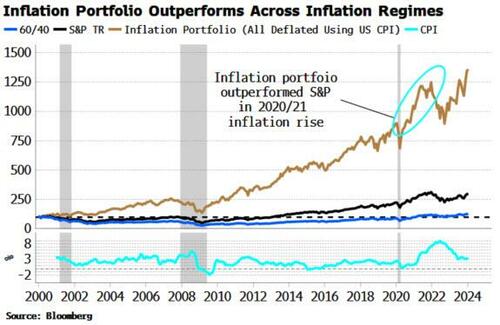

That provides us a portfolio of about 15-20 names which is rebalanced month-to-month. The true return of the portfolio is proven within the chart beneath, together with the true returns of the S&P and the 60/40 equity-bond portfolio.

The portfolio is designed to be ahead trying — the approaching years are unlikely to seem like the earlier many years given we at the moment are in an inflationary regime — searching for shares which can be strong to cost development that’s above its long-term common and susceptible to lurching larger.

It’s nonetheless reassuring to see that the portfolio does properly on its backtest. It has outpaced the S&P in actual phrases during the last quarter century. It additionally outperformed within the rising inflation interval in the course of the pandemic. Extra usually, a technique that went lengthy the Inflation Portfolio when inflation was elevated, and lengthy the market in any other case, fared higher than the S&P during the last 25 years.

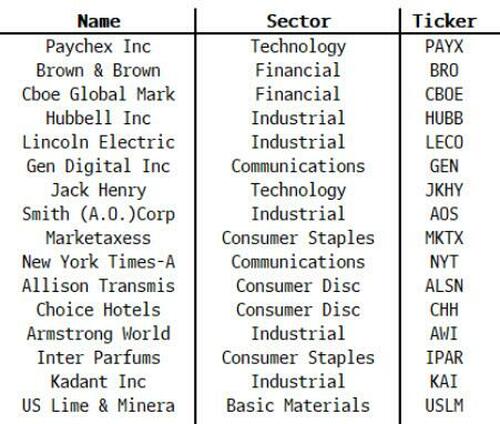

The present portfolio accommodates 16 names. All are good high quality corporations with most having affordable valuations, the common P/E ratio being equal to the market’s. Solely two are tech corporations.

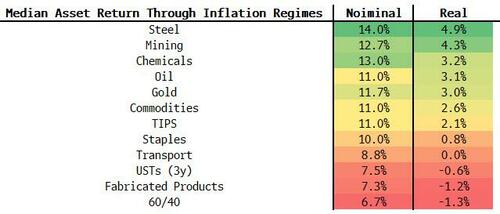

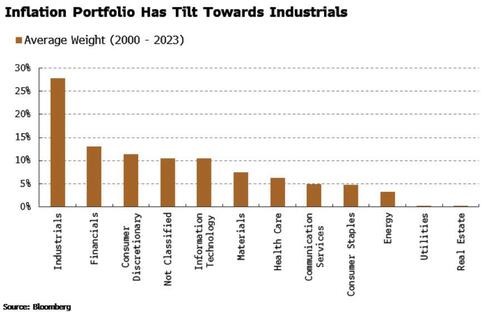

The commonest grouping is industrials. Once more, that is reassuring as in inflation regimes during the last 5 many years, the highest performing sectors have been metal, mining and chemical substances.

By means of the lifetime of the portfolio (2000-2023), industrials has had the biggest common weight, adopted by financials.

Banks are usually not a great holding when inflation is excessive as they sometimes lend lengthy and borrow quick, and see the true worth of their belongings decline greater than their actual liabilities. However there are a number of non-bank financials, such because the CBOE (within the portfolio now) and MSCI, that are high quality companies with sturdy pricing energy who stand in good stead when worth development is elevated.

None of this is able to be obligatory if inflation was going the way in which Group Transitory assume it already has. However there may be a mounting physique of forward-looking indicators that count on inflation ought to quickly re-accelerate. We might already have a glimpse of this with the latest hotter-than-expected CPI and PPI stories.

Nonetheless, with any portfolio screening technique there are caveats. There are turnover and price-slippage prices that might materially have an effect on the realized return. There’s additionally, after all, no purpose why the backtested previous ought to seem like the longer term.

Nonetheless, the deep focus of high-duration shares leaves the market as uncovered to inflation because it has been because the early Nineteen Seventies. The potential draw back justifies a distinct method that tries to mitigate inflation dangers with out turning into overly depending on them. In any case, we might quickly discover that the Magnificent Seven’s title sounds simply as ironic because the Nifty Fifty’s.

Loading…