4 months in the past, Nvidia (NVDA) shares fell in need of reaching the $500 milestone. At the moment, the value of Nvidia is as soon as once more rallying in the direction of this vital degree.

The essential query now’s whether or not Nvidia’s inventory worth will efficiently surpass the essential Fibonacci (Fib) resistance on the $500 mark. This degree is pivotal, as a profitable breach might sign a powerful bullish momentum. Then again, there may be the potential for one other bearish rejection at this threshold, which might result in a pullback or consolidation within the inventory worth.

Is Nvidia Poised to Break the $493 Fibonacci Resistance?

If Nvidia’s inventory worth efficiently overcomes the Fibonacci (Fib) resistance degree at roughly $493, it could doubtlessly surpass its earlier excessive of round $505.

Nonetheless, the technical indicators current a combined outlook. The Shifting Common Convergence Divergence (MACD) histogram has been trending downwards in a bearish sample for the previous 4 months, though the MACD traces are nonetheless in a bullish crossover. Considerably, the Relative Energy Index (RSI) is indicating a large bearish divergence, a sign that was mirrored within the inventory’s efficiency 4 months in the past.

Throughout September and October, Nvidia’s inventory skilled a decline of about 21%. It then discovered help within the vary of $403 to $410, resulting in a rebound that’s bringing the value again in the direction of the Fib resistance at round $493.

If Nvidia manages to interrupt by means of this resistance degree with bullish momentum, the inventory could possibly be poised to achieve a brand new all-time excessive. That is assuming market situations and firm fundamentals stay favorable. This state of affairs underscores the dynamic nature of inventory market actions. That is influenced by a mix of technical indicators and broader market elements.

Nvidia’s Weekly Chart Exhibits Bearish Divergence in RSI

In Nvidia’s weekly chart, there’s a mixture of bullish and bearish indicators. On the bearish aspect, the Shifting Common Convergence Divergence (MACD) traces are in a bearish crossover, and the Relative Energy Index (RSI) signifies a bearish divergence.

Nonetheless, there are bullish indicators as properly. Notably, the MACD histogram has began ticking upward bullishly since final week, and the Exponential Shifting Averages (EMAs) exhibit a golden crossover. These indicators recommend that the medium-term pattern for Nvidia stays bullish.

If Nvidia faces a bearish rejection on the Fibonacci (Fib) resistance slightly below the $500 mark and subsequently breaks by means of the help zone between roughly $403 and $410, it could discover its subsequent vital help on the 50-week EMA, round $378.

Ought to the value fall additional, the subsequent notable Fib help ranges are anticipated to be round $354 and, extra considerably, round $255. These ranges could possibly be essential junctures for potential rebounds or additional worth corrections.

Nvidia Day by day Chart Reveals Rising Bullish Value Sample

Within the day by day chart for Nvidia, the technical indicators largely sign bullish momentum. The Relative Energy Index (RSI) is impartial, suggesting a balanced market situation with out robust overbought or oversold indicators. The Shifting Common Convergence Divergence (MACD) traces are nearing a bullish crossover. Whereas the MACD histogram is exhibiting an upward pattern, each indicative of potential bullish momentum.

Learn Extra: 9 Finest AI Crypto Buying and selling Bots to Maximize Your Earnings

Moreover, the golden crossover of the Exponential Shifting Averages (EMAs) additional confirms a bullish pattern within the brief to medium time period. This crossover happens when a shorter-term EMA (just like the 50-day EMA) crosses above a longer-term EMA (such because the 200-day EMA). That is typically interpreted as a bullish sign.

An fascinating improvement within the day by day chart is the emergence of a bullish worth sample. Extra particularly, it’s an “inverse head and shoulders” sample. This sample is usually seen as a bullish reversal indicator. If Nvidia’s inventory worth rises above $540, it might affirm a bullish breakout from this sample. This might doubtlessly result in additional upward worth motion.

The inverse head and shoulders sample, mixed with the opposite bullish indicators, suggests a positive outlook for Nvidia within the brief to medium time period. Nonetheless, this depends upon the inventory’s capacity to breach the important thing worth degree of $540.

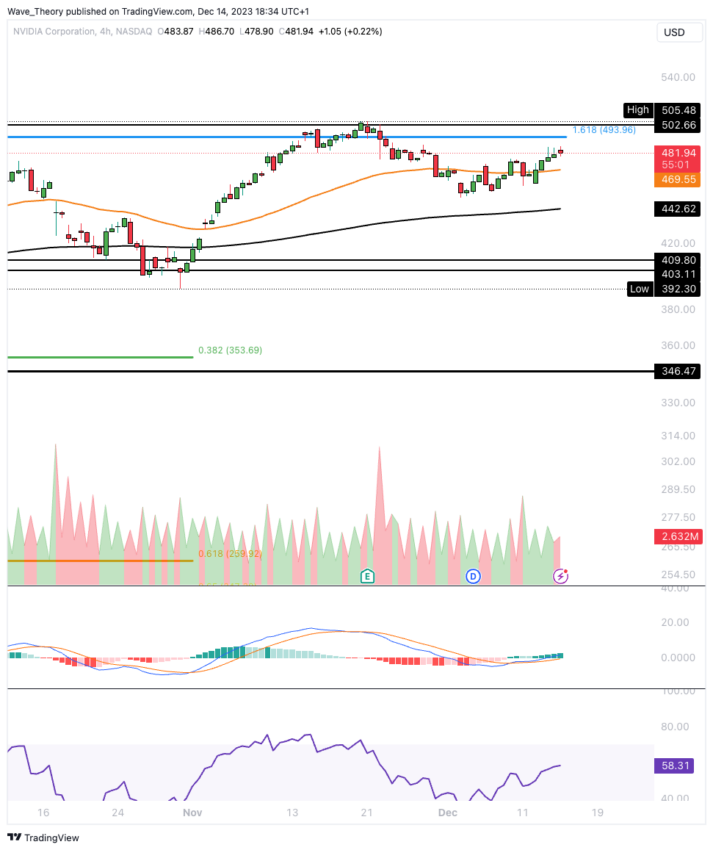

Nvidia’s 4H Chart Evaluation: Indicators Level to Bullish Development

Within the 4-hour (4H) chart for Nvidia, the pattern is predominantly bullish, as evidenced by a number of key indicators. The golden crossover of the Exponential Shifting Averages (EMAs) is a big bullish sign. This crossover happens when a shorter-term EMA (just like the 50-period EMA) crosses above a longer-term EMA (such because the 200-period EMA), suggesting upward momentum.

Moreover, the Shifting Common Convergence Divergence (MACD) histogram is trending upwards. Additional indicating growing bullish momentum, and the MACD traces are in a bullish crossover, reinforcing this optimistic pattern.

Learn Extra: High 9 Telegram Channels for Crypto Alerts in 2023

The Relative Energy Index (RSI), alternatively, is in impartial territory. This neutrality signifies a stability out there. However with no robust overbought or oversold situations, and offers neither distinctly bullish nor bearish indicators right now.

Total, combining a bullish MACD and a golden crossover within the EMAs, together with a impartial RSI, presents a typically bullish outlook within the 4H chart for Nvidia, suggesting a positive short-term pattern.

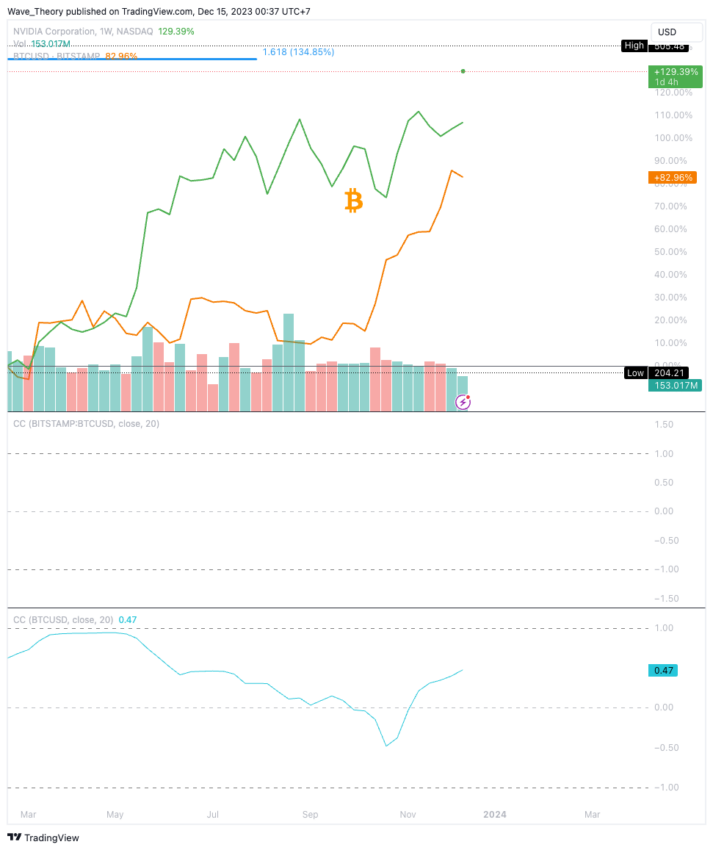

Rising Correlation Noticed Between Bitcoin and Nvidia

At the moment, the correlation between Bitcoin and Nvidia inventory costs is reasonable however has seen a notable enhance in latest weeks. At the moment standing at roughly 0.47. This optimistic correlation coefficient signifies that the value actions of Bitcoin and Nvidia have been considerably aligned. Each have been transferring in an analogous path to a reasonable extent.

It’s vital to notice {that a} correlation coefficient of 0.47, whereas vital, doesn’t indicate a really robust relationship. It means that whereas there may be some degree of synchronization of their worth actions. Nonetheless, they don’t seem to be closely depending on one another.

Traditionally, there have been durations the place the correlation between Bitcoin and Nvidia was extra pronounced. This stronger correlation previously could possibly be attributed to numerous elements, together with market sentiment, technological developments, or funding patterns that linked the efficiency of cryptocurrency markets, notably Bitcoin, with tech shares like Nvidia.

Nonetheless, correlation ranges can fluctuate over time as a consequence of altering market dynamics, financial situations, and investor habits.

Learn Extra: Finest Crypto Signal-Up Bonuses in 2023

Disclaimer

In keeping with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections.