- Bearish sentiment across the token elevated.

- $0.93 was MATIC’s subsequent essential help stage.

Polygon [MATIC] crossed a crucial resistance zone in the previous couple of days that hinted at one more bull rally. Nonetheless, issues have been fast to vary as MATIC’s worth dropped sharply on the first of April. Will MATIC bears management the start of Q2?

Polygon traders are in shock

World of Charts, a preferred crypto analyst, not too long ago posted a tweet highlighting the truth that MATIC managed to interrupt above a resistance stage. This was the case as its worth elevated towards $1.

If MATIC examined that stage, then the token’s worth may have reached $1.01. Nonetheless, that didn’t translate into actuality because the token witnessed a worth correction.

In keeping with CoinMarketCap, MATIC was down by over 3% within the final 24 hours alone. On the time of writing, it was buying and selling at $0.9659 with a market capitalization of over $9.5 billion, making it the seventeenth largest crypto.

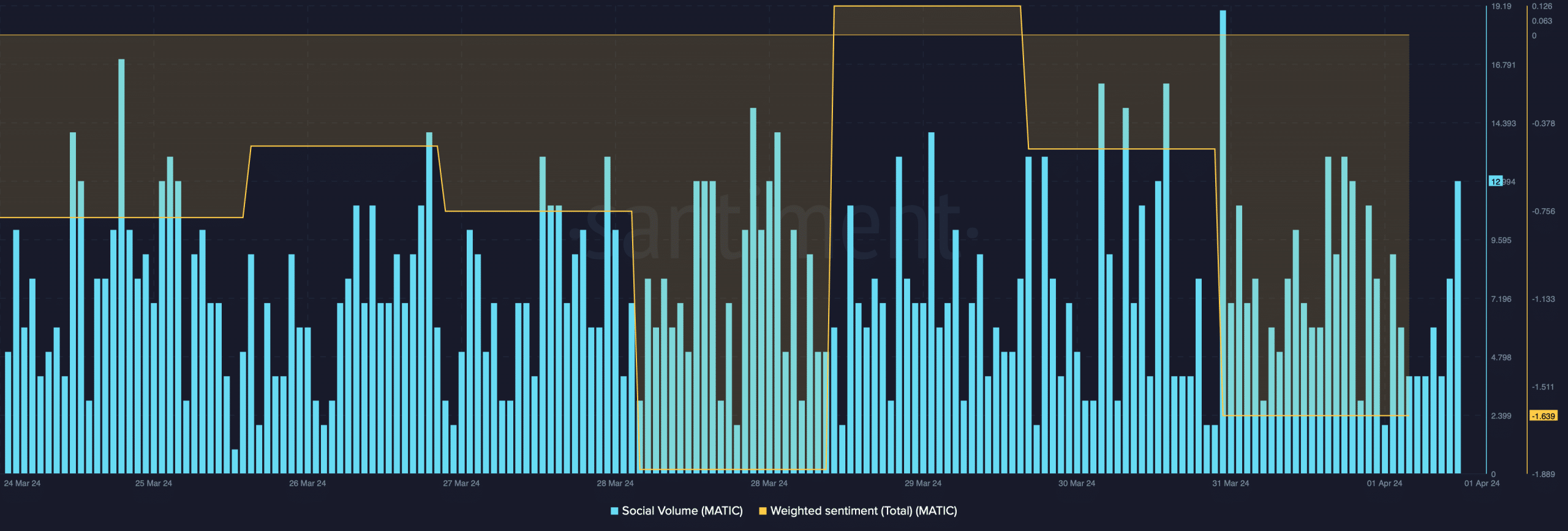

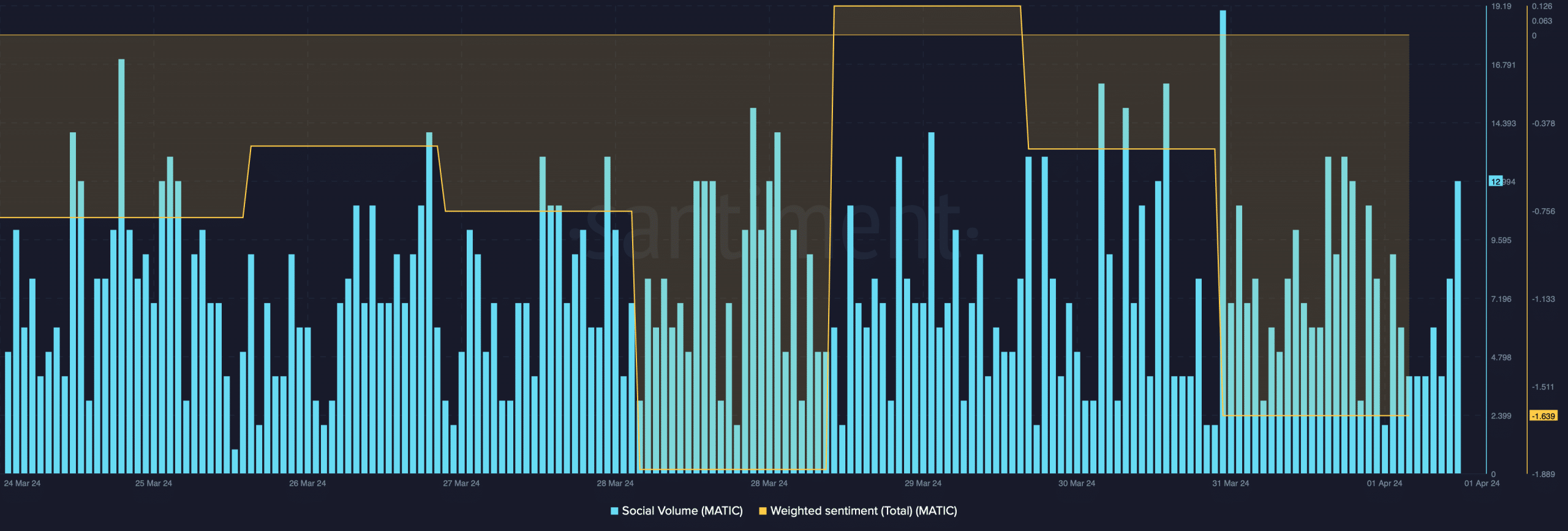

The worth drop additionally had an impression on its social metrics. Polygon’s social quantity elevated, reflecting that the crypto area was speaking concerning the token.

Bearish sentiment round it additionally elevated considerably, which was evident from the huge dip in its weighted sentiment.

Supply: Santiment

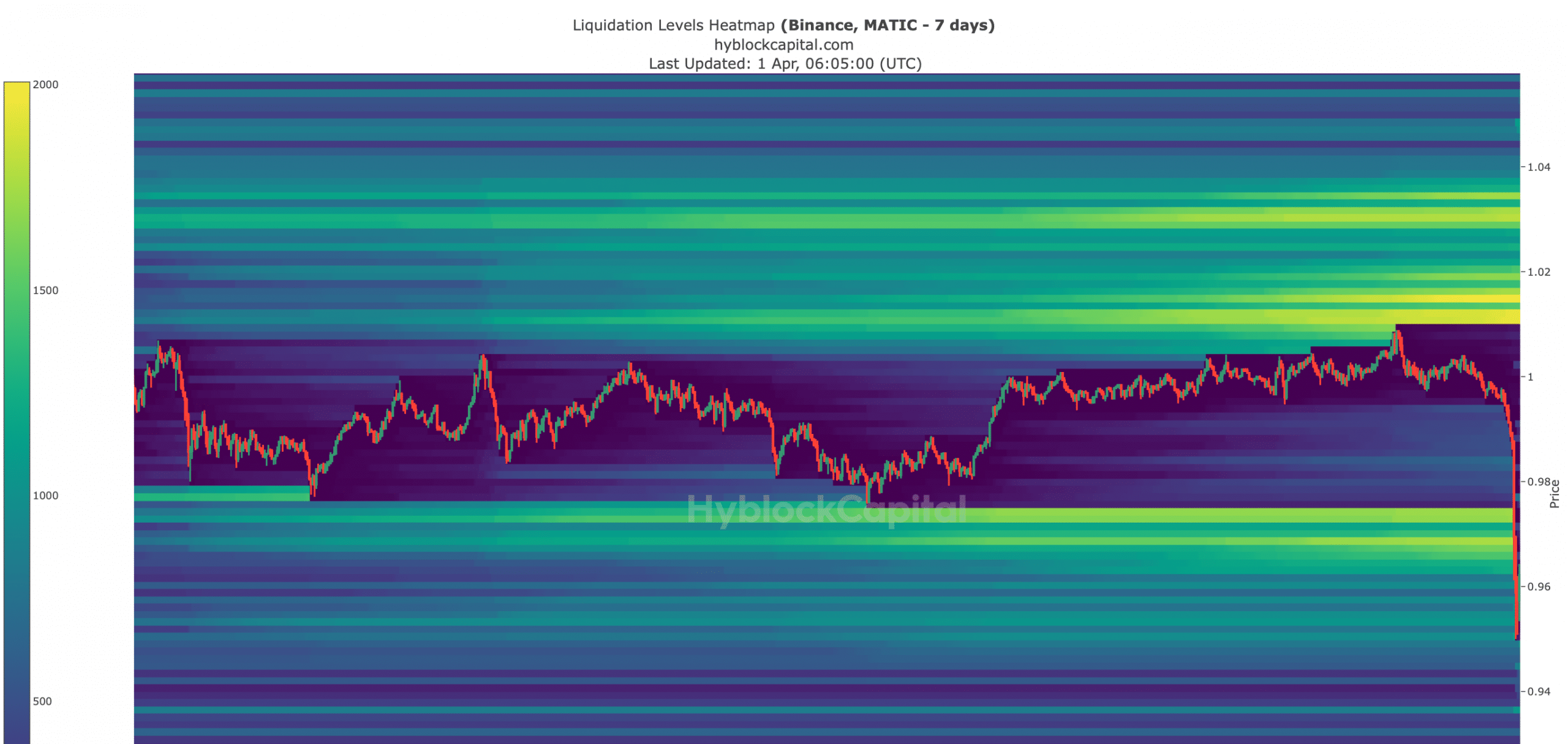

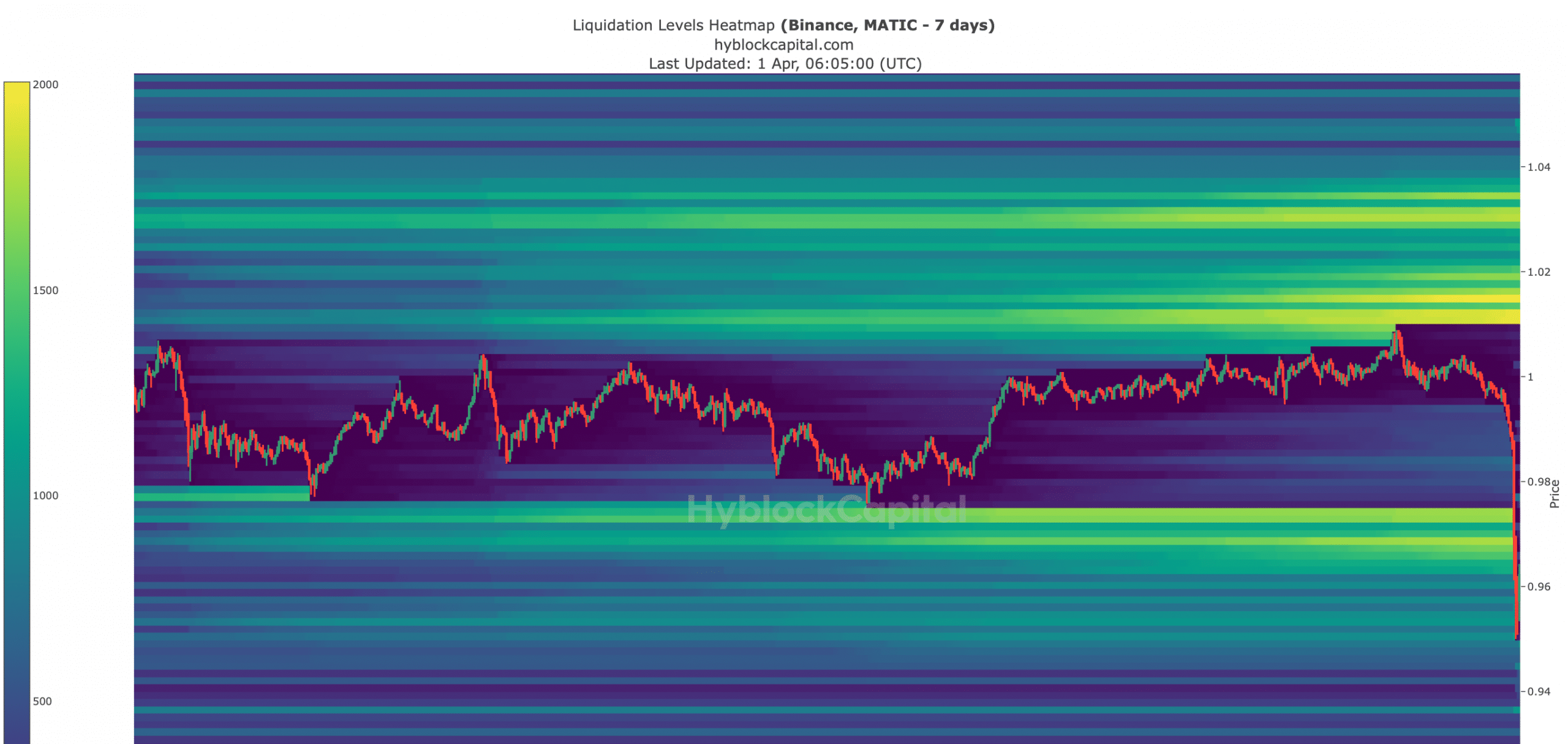

AMBCrypto then checked Hyblock Capital’s knowledge to grasp what brought about this downtrend. Our evaluation revealed that MATIC’s liquidation skyrocketed when its worth touched $1.

Excessive liquidation means excessive promoting strain, which typically causes worth drops. The worst half was that MATIC wasn’t capable of take a look at its help stage close to $0.97 and fell underneath. This indicated that the token’s worth would possibly go down additional.

Supply: Hyblock Csapital

Will Polygon’s downtrend final?

To grasp whether or not the downtrend would final, AMBCrypto took a take a look at CryptoQuant’s data. We discovered that MATIC’s alternate reserve was rising, that means that promoting strain on the token was excessive.

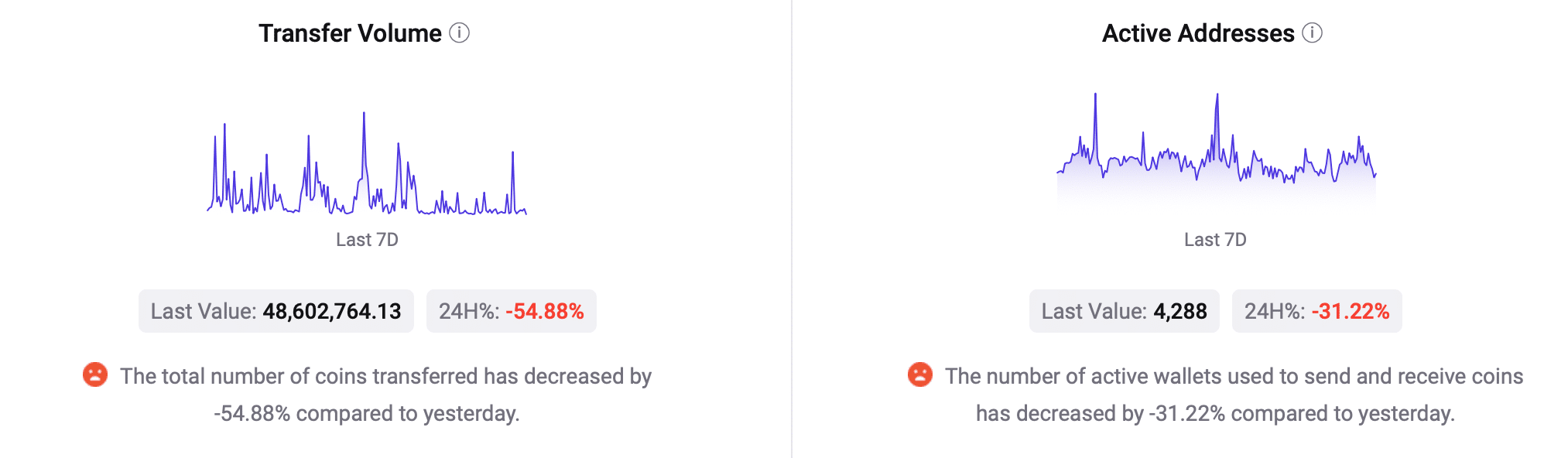

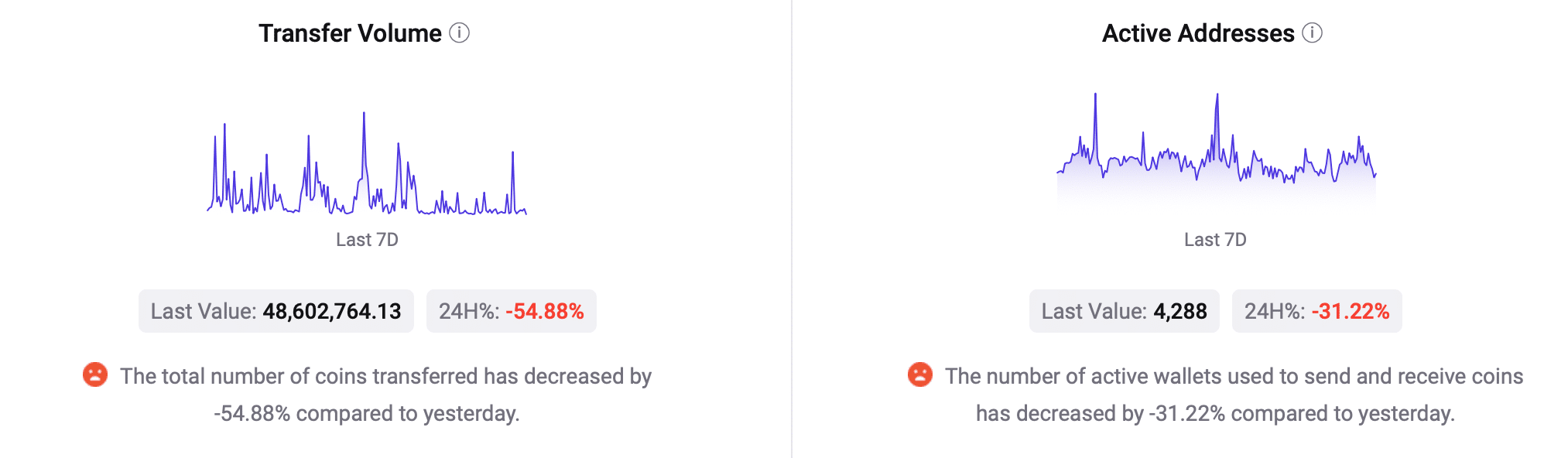

Different bearish metrics have been its every day energetic addresses and transaction quantity, which additionally declined within the latest previous.

Supply: CryptoQuant

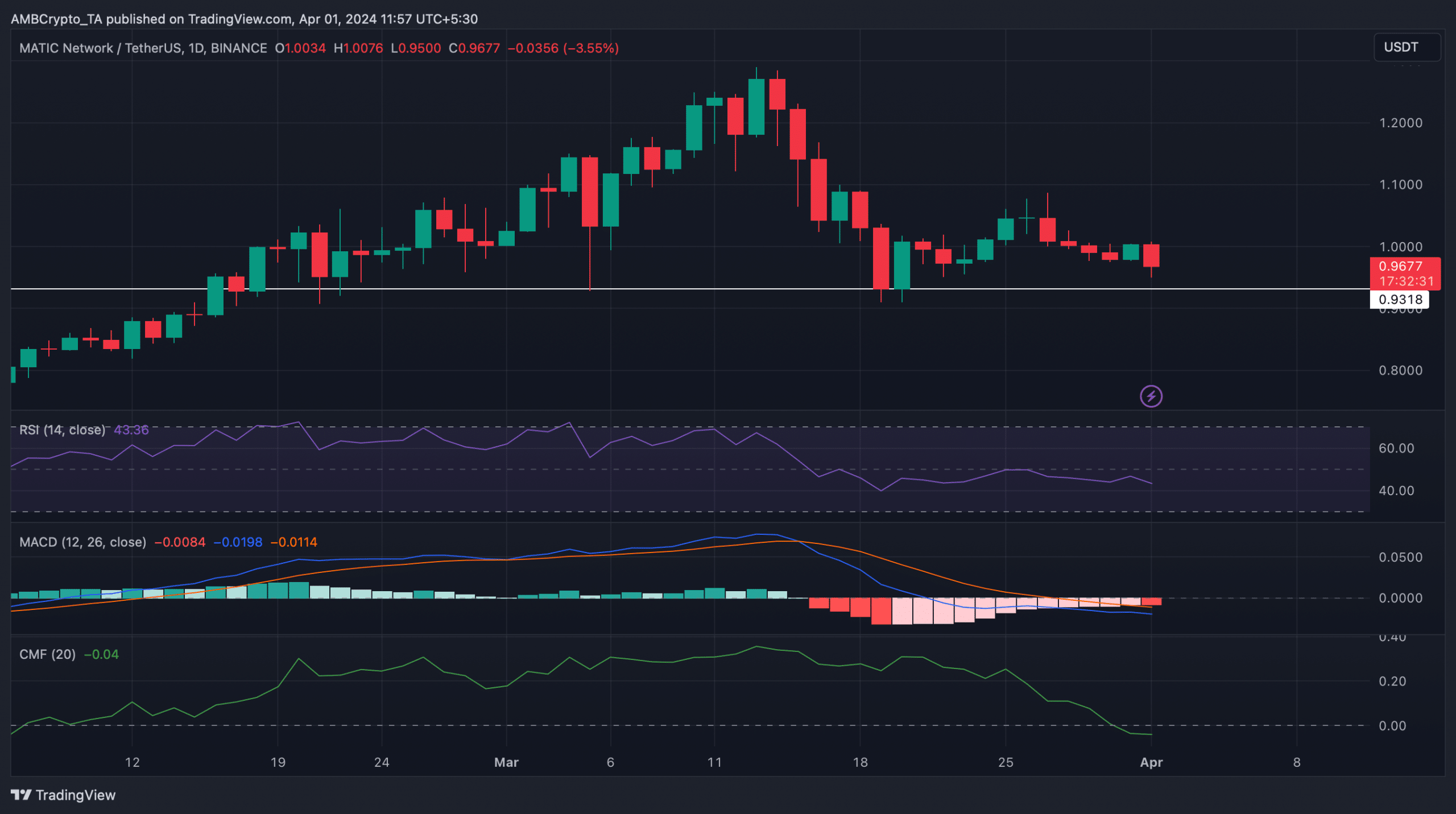

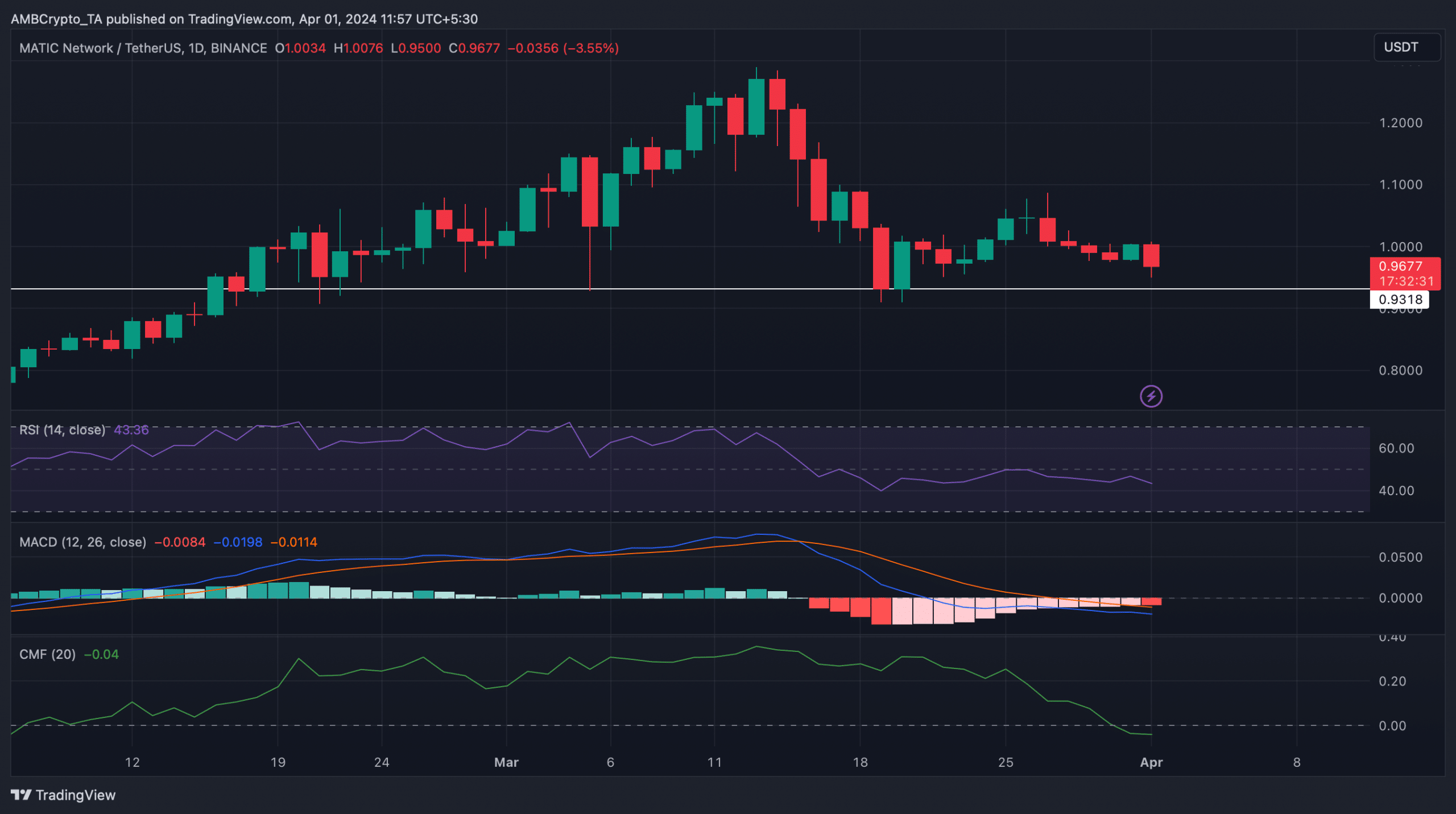

The technical indicator MACD displayed a transparent bearish benefit out there. Its Relative Energy Index (RSI) registered a pointy downtick.

Learn Polygon’s [MATIC] Value Prediction 2024-25

On high of that, Polygon’s Chaikin Cash Movement (CMF) additionally adopted an analogous declining pattern, hinting that the probabilities of a continued worth decline have been excessive.

If the downtrend continues, traders should be careful for the $0.93 resistance zone, as a plummet underneath that may very well be regarding.

Supply: TradingView