- Exercise on the Litecoin community hit a mind-blowing quantity, suggesting that LTC may rally.

- Targets from evaluation confirmed that the value may attain $85.

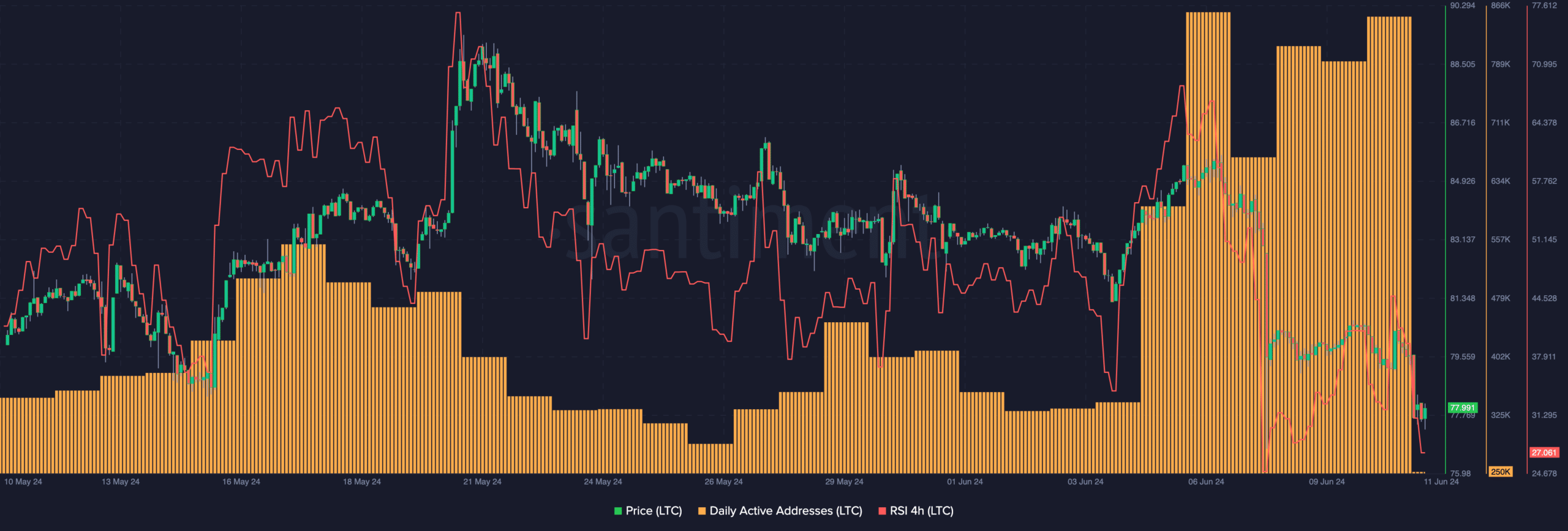

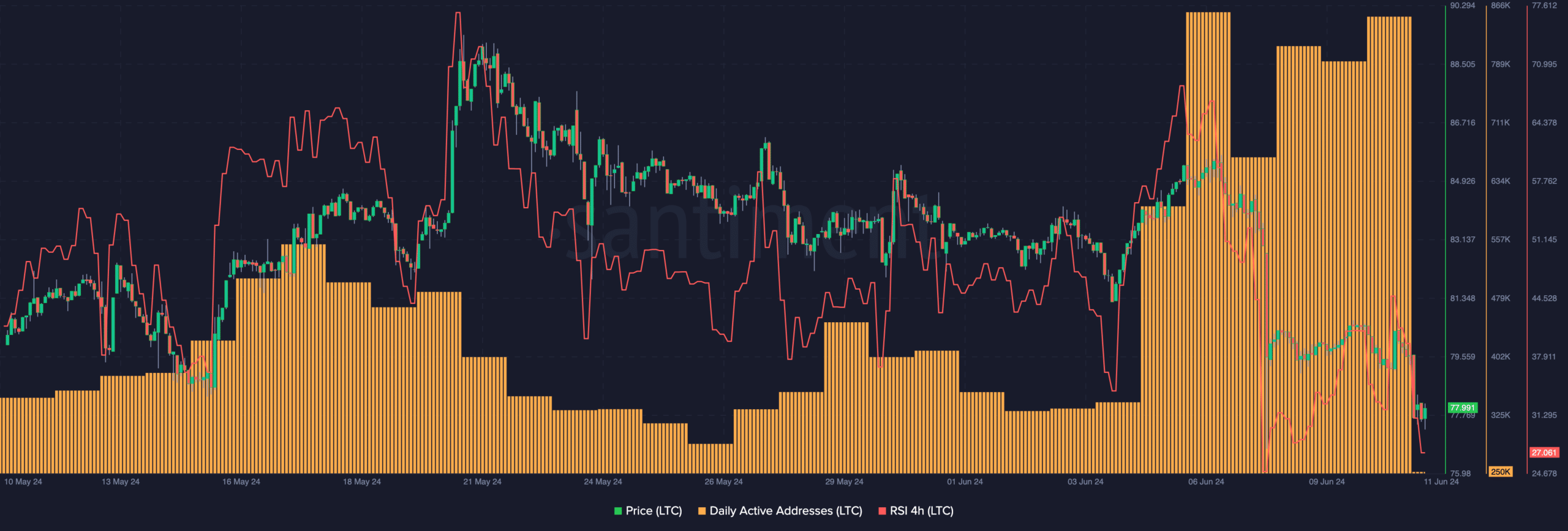

Litecoin [LTC] has shaped a bullish divergence that would lead the value to the next stage, AMBCrypto found. A bullish divergence marks the top of a downtrend.

It happens when the value of a coin falls, the oscillator drops however exercise on the community will increase. This was the case with Litecoin.

In accordance with information from Santiment, the variety of distinctive addresses interacting with LTC hit 704,000 within the final seven days.

In Could, the entire variety of energetic addresses was 345,000. An energetic tackle refers to a market participant engaged in a profitable transaction.

Subsequently, the rise meant that interplay on Litecoin within the first few days of June was rather more than your complete Could.

Are LTC sellers exhausted?

The final time such an occasion occurred, LTC moved from $78.60 to $84.63 inside a number of days. Nonetheless, the rise in community exercise was not the one metric supporting a possible bounce.

AMBCrypto additionally seemed on the Relative Power Index (RSI) and located that it aligned with the prediction. The RSI measures momentum and assist contributors establish overbought or oversold ranges.

Studying at 70 and above means that an asset is overbought. Then again, a studying at 30 or under point out {that a} cryptocurrency was oversold.

At press time, the RSI on Litecoin’s 4-hour chart was near the oversold area, indicating that the coin was near being oversold. From a value level, this place could lead on LTC towards $75.

Supply: Santiment

Nonetheless, with rising community exercise, the value of the coin might bounce. If so, a goal of $85 is likely to be believable.

One other transfer could also be within the works

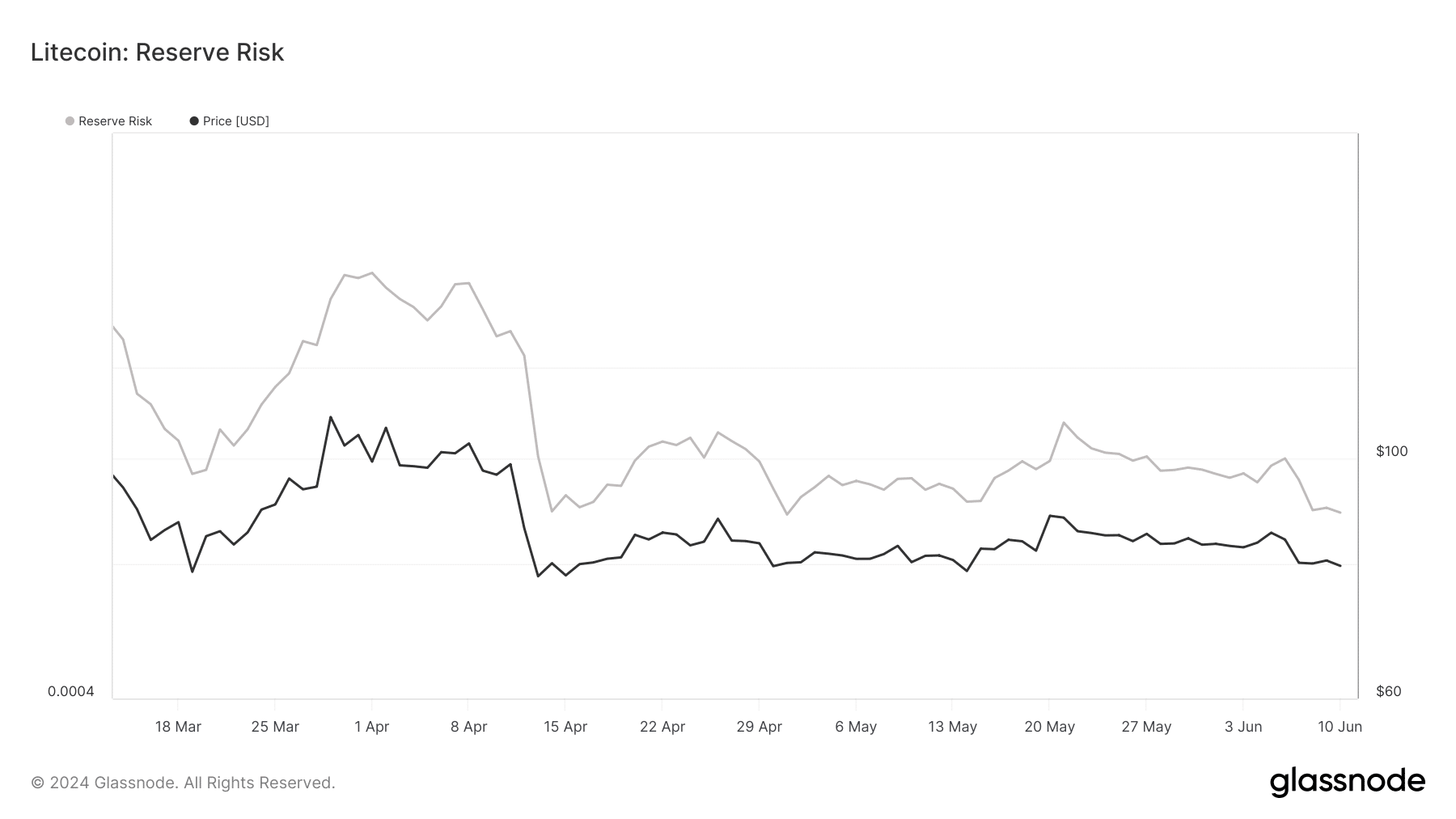

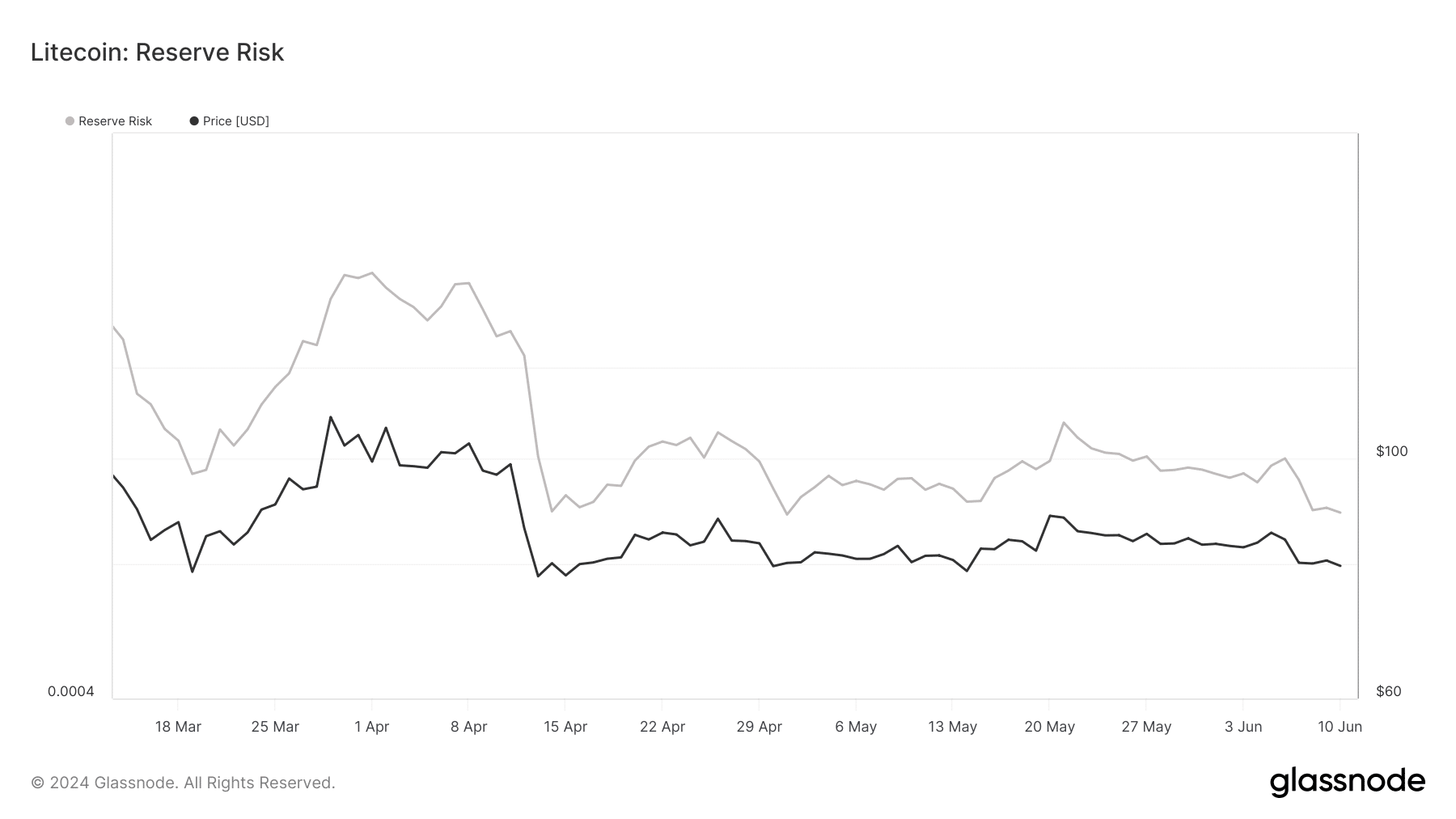

Wanting down the rabbit gap to evaluate if the LTC may quickly development larger, AMBCrypto thought of trying on the Reserve Danger. Reserve Danger measures the boldness out there, and risk-to-reward ratio of an asset.

When the metric is excessive, it signifies that confidence is low, and the chance shouldn’t be definitely worth the reward. Then again, a low Reserve Danger breeds excessive confidence, and a horny risk-to-reward ratio.

Supply:Glassnode

As of this writing, the metric for Litecoin was at a low studying of $0.00050, suggesting that it might be a superb time to purchase LTC. However what are the potential targets for LTC within the quick time period?

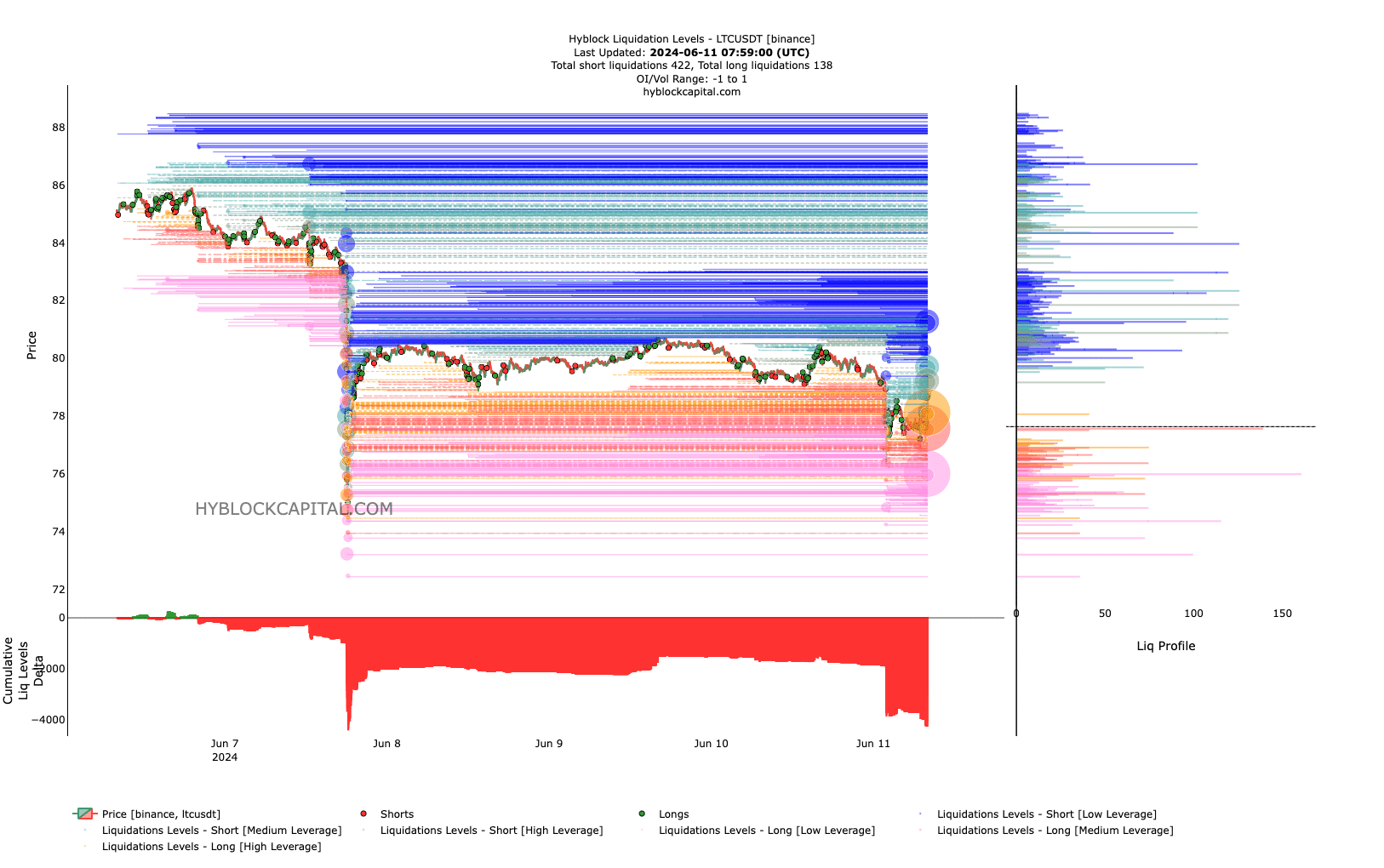

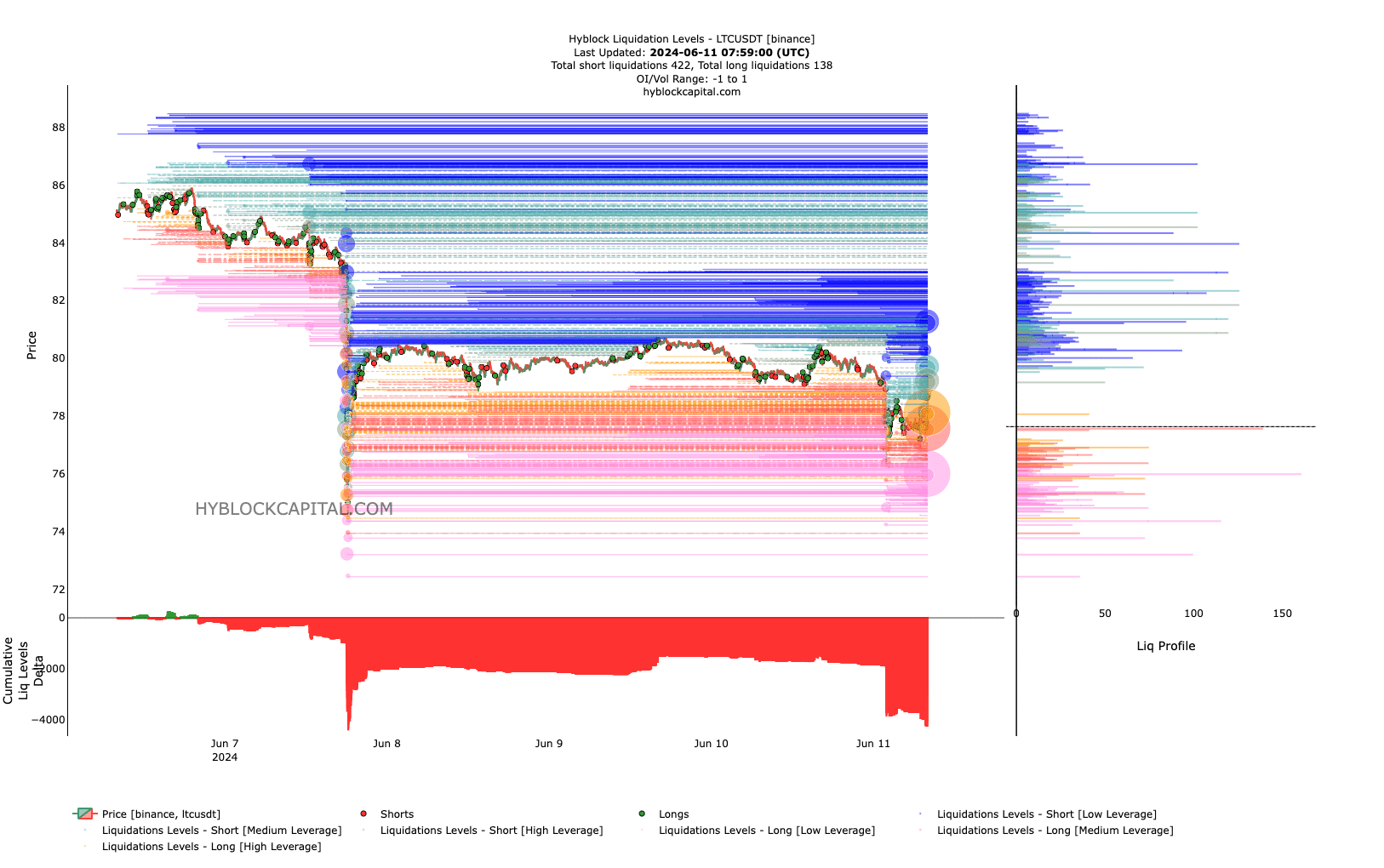

To get a cling of this, we analyzed the liquidations ranges. These ranges are value factors the place liquidation occasions may happen. At press time, a cluster of liquidity appeared from $80.20 as much as $87.65.

Supply: Hyblock

Learn Litecoin’s [LTC] Worth Prediction 2024-2025

These excessive areas of liquidity recommend that the value can transfer towards such ranges. As well as, the Cumulative Liquidation Ranges Delta (CLLD) was damaging.

This suggests that Litecoin’s value may retrace as restoration was shut. Ought to this be the case, the value of the token may head above $85 inside the subsequent few weeks.