- Rising accumulation might validate LTC’s transfer northward.

- Most holders kept away from promoting, indicating a attainable rise above $180.

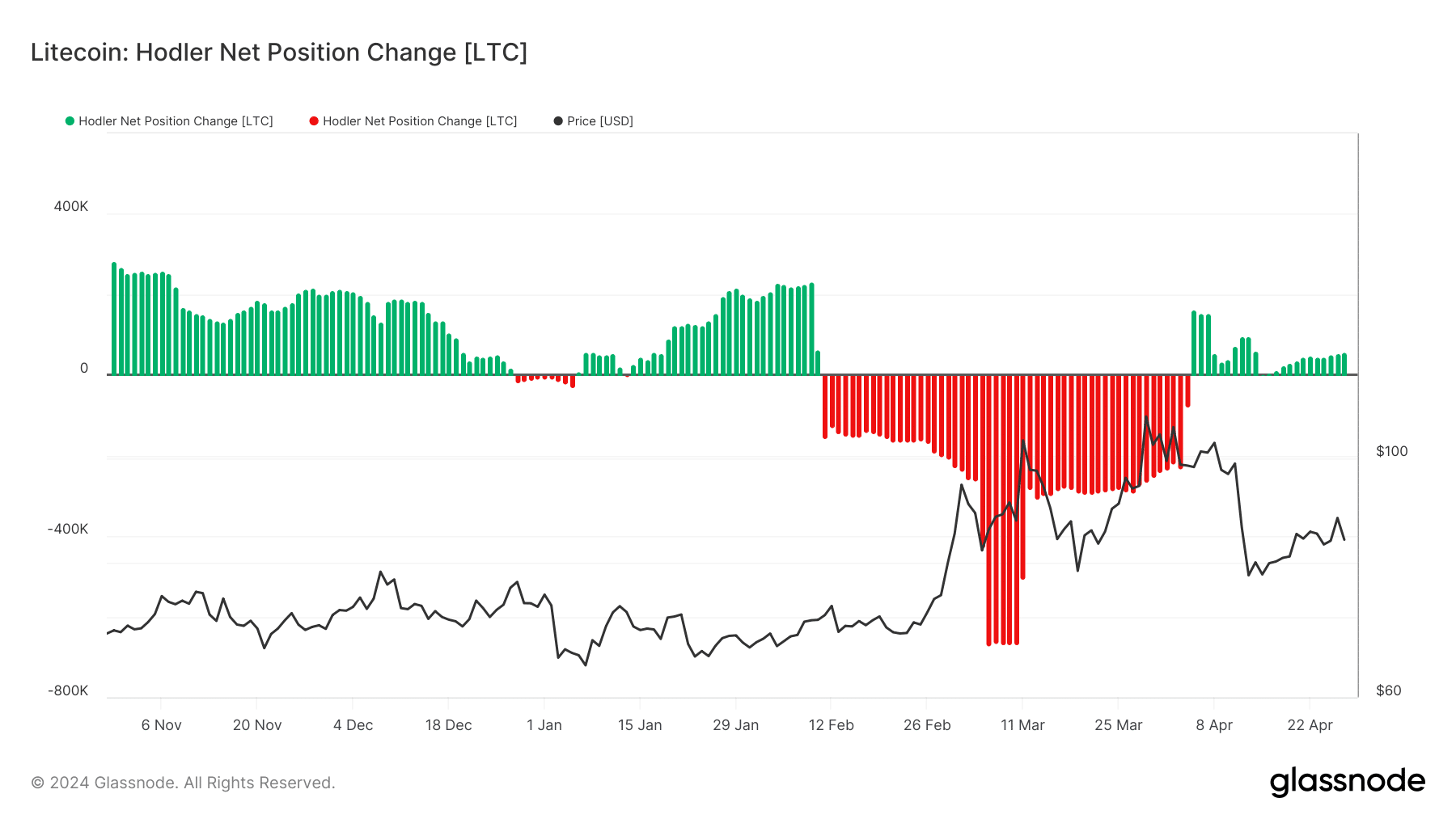

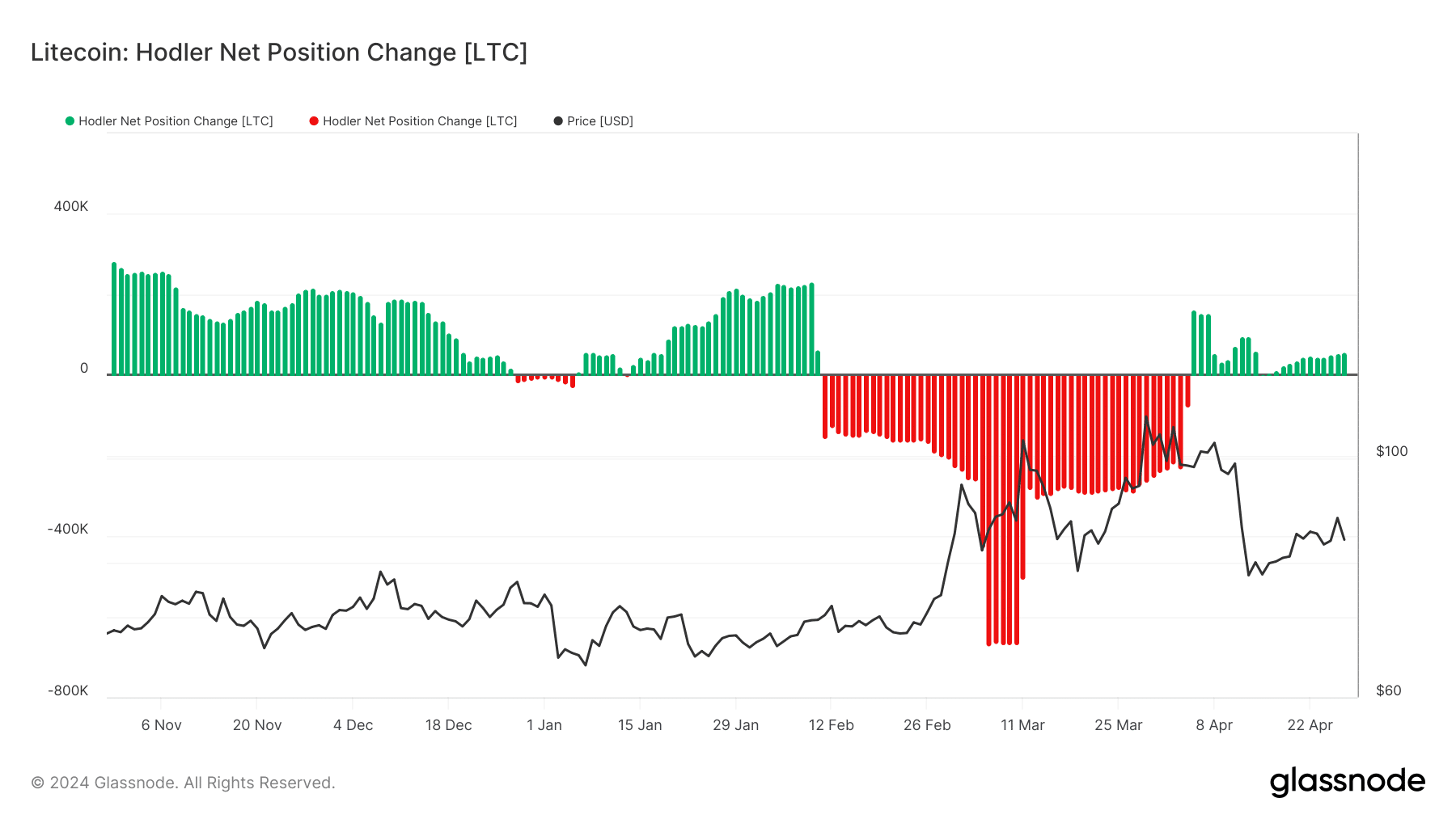

For many of April, issues modified for a big a part of the crypto market, and Litecoin [LTC] was not exempted. Nevertheless, this isn’t in regards to the value efficiency. As an alternative, the notable rotation occurred with the Hodler Web Place Change.

If this metric is unfavorable, it means buyers are cashing out. However a constructive studying suggests accumulation. Based on AMBCrypto’s evaluation of Glassnode knowledge, the Hodler Web Place Change was constructive, indicating that long-term holders purchased 57,095 cash on twenty seventh April.

No extra cash-out

From the second week in February to the entire of March, this metric was unfavorable. This led to hypothesis that LTC is perhaps out of the league of altcoins anticipated to blow minds within the coming months.

Supply: Glassnode

Nevertheless, that may now not be the case as the online place change has been constant since fifth April. Ought to we see extra accumulation than money out, then Litecoin would possibly defy bearish expectations, and tilt towards the bullish finish.

At press time, Litecoin modified arms at $18.37, representing an 18.42% lower within the final seven days. Whereas AMBCrypto mentioned a attainable enhance to $110 within the brief time period, LTC would possibly climb larger than that within the coming months.

The bulls are making ready

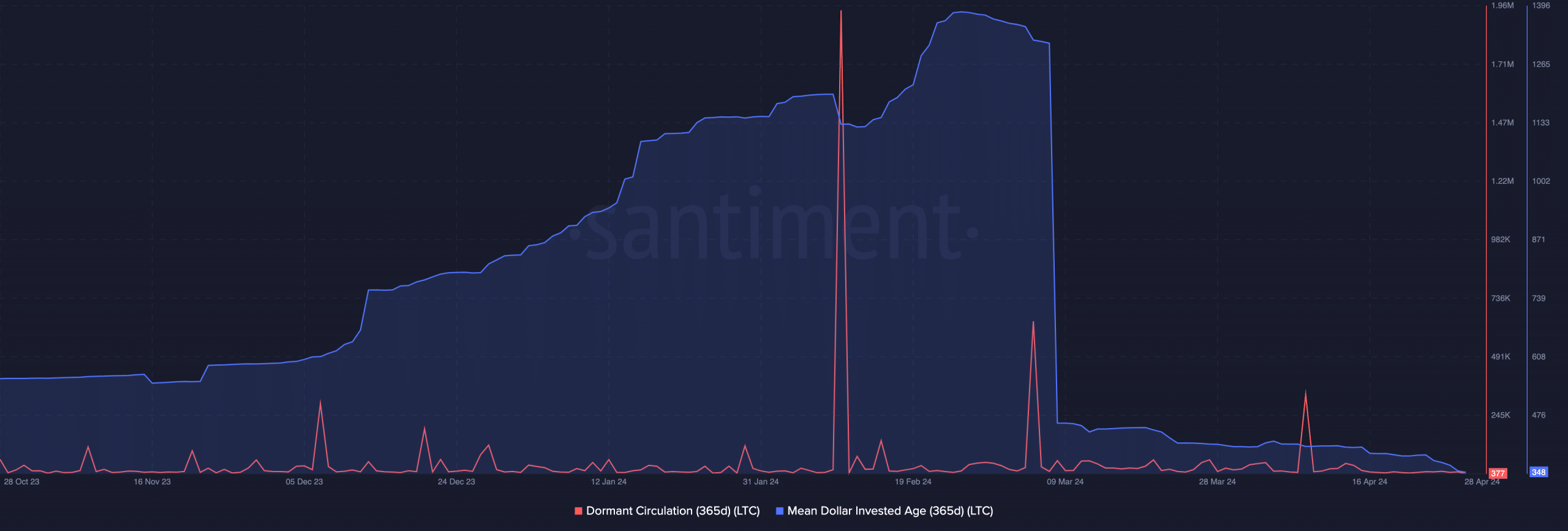

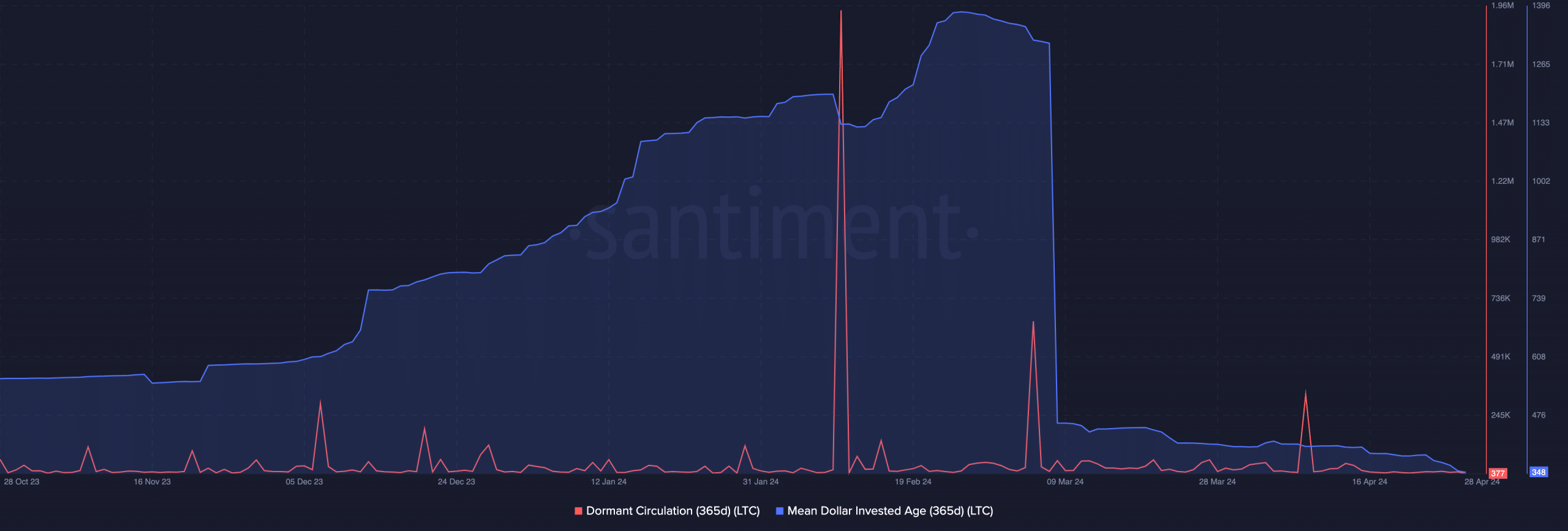

To place it into context, we analyzed another metrics that would impression the coin in the long run. First off, we thought-about the dormant circulation.

This on-chain metric tracks the variety of distinctive cash which have been idle for an extended whereas however had been transacted in a day. Most time, spikes in dormant circulation trigger costs to lower.

Nevertheless, the 365-day dormant circulation on the Litecoin community was its lowest since 9 April. With this determine, one can assume that the majority long-term holder would rather keep their coins than promote them for reasonable.

Moreover, the Imply Greenback Invested Age (MDIA) fell to a low of 348. The MDIA is the typical age of all cash gauged by the acquisition value.

Supply: Santiment

If the typical age of investments in Litecoin had elevated, it could have implied that the coin is near a neighborhood high. However because it decreased, it indicated a bull run may very well be across the nook.

The projected bull run isn’t any assure that LTC will rise to the $400 area. However seeing the coin change arms between $180 and $250 can’t be ignored.

Learn Litecoin’s [LTC] Value Prediction 2024-2025

Nonetheless, you will need to word that the potential rise would possibly seem linear. If LTC jumps, it would endure a correction at a unique level.

As such, a lower under $84 is perhaps attainable earlier than the coin tries to double or triple its worth.