- Boston FED President Susan Collins hinted at rate of interest cuts

- Analysts are nonetheless hopeful that cryptos will proceed to surge

Federal Reserve Financial institution of Boston’s President Susan Collins not too long ago indicated that it’d quickly be applicable to begin easing rates of interest. What this implies is that the Federal Reserve may minimize charges by as quickly as 18 September, probably triggering a major bull run within the markets.

Nonetheless, alarm bells have been ringing in some quarters. Donald Trump, for example, has raised some issues, warning that the U.S is likely to be heading in the direction of a extreme recession, one just like the 1929 crash, whereas additionally predicting the opportunity of a world warfare quickly.

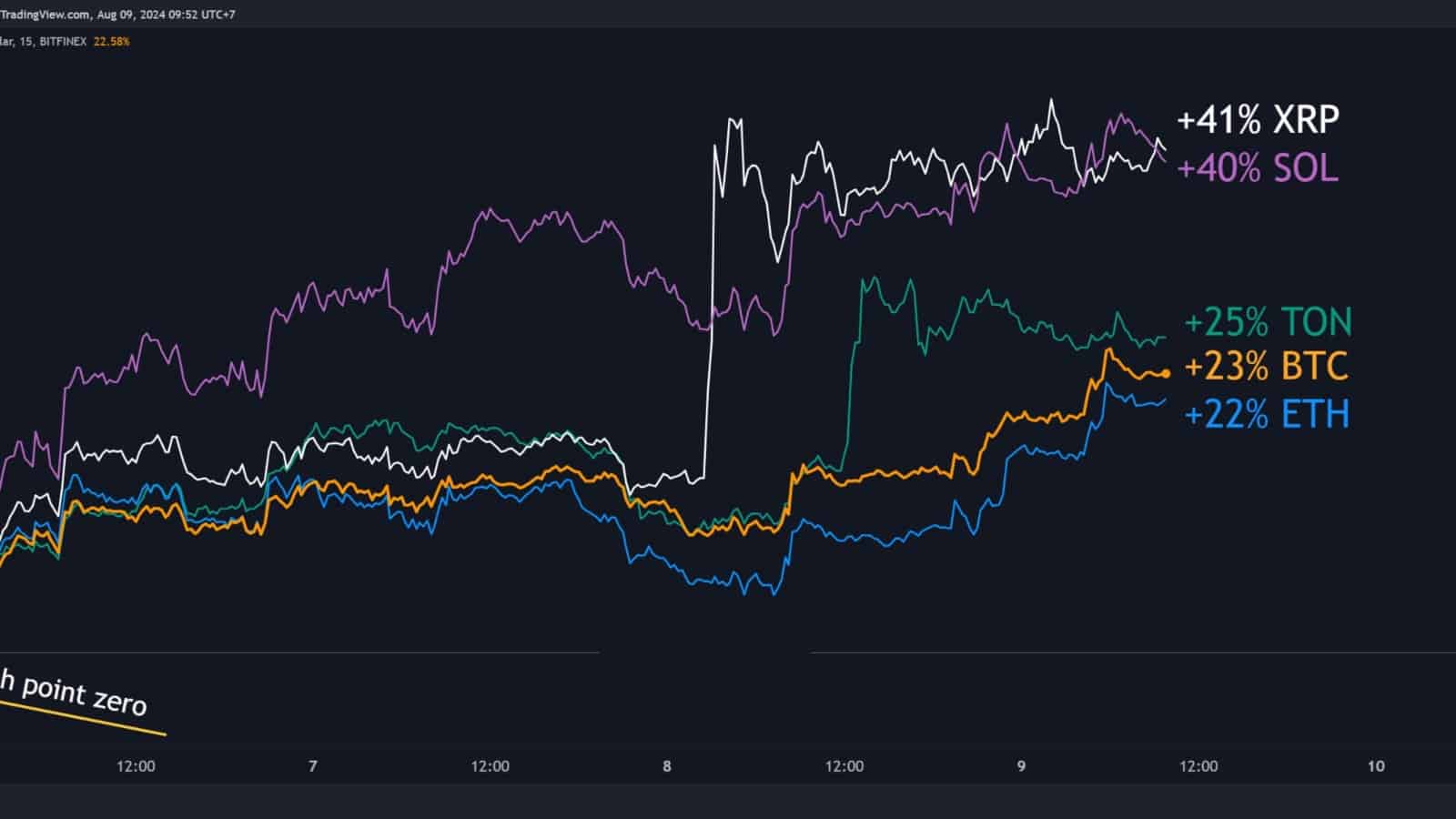

XRP & SOL clear winners as BTC & ETH observe

XRP and Solana have been standout performers over the previous week, surging by 41% and 40%, respectively. This enhance follows XRP’s settlement with the SEC, which concerned a $125M effective. As anticipated, this has pushed XRP’s worth up, with expectations of additional features on the charts.

Bitcoin and Ethereum additionally noticed notable hikes, rising by 23% and 22% from their weekly lows.

The Federal Reserve’s trace at potential rate of interest cuts may additional improve these features, as it could make it simpler for merchants and traders to safe loans to purchase these belongings.

Supply: TradingView

Bitcoin is up by 23% this week

Main monetary companies stay assured in Bitcoin, as neither MicroStrategy nor BlackRock have offered any of their Bitcoin holdings regardless of the crypto’s current bouts of worth depreciation. For its half, Bitcoin alone has risen by over 20% prior to now week from this week’s low.

With the Federal Reserve hinting at potential charge cuts subsequent month, expectations are that Bitcoin’s worth will proceed to understand as traders achieve extra entry to capital.

Supply: TradingView

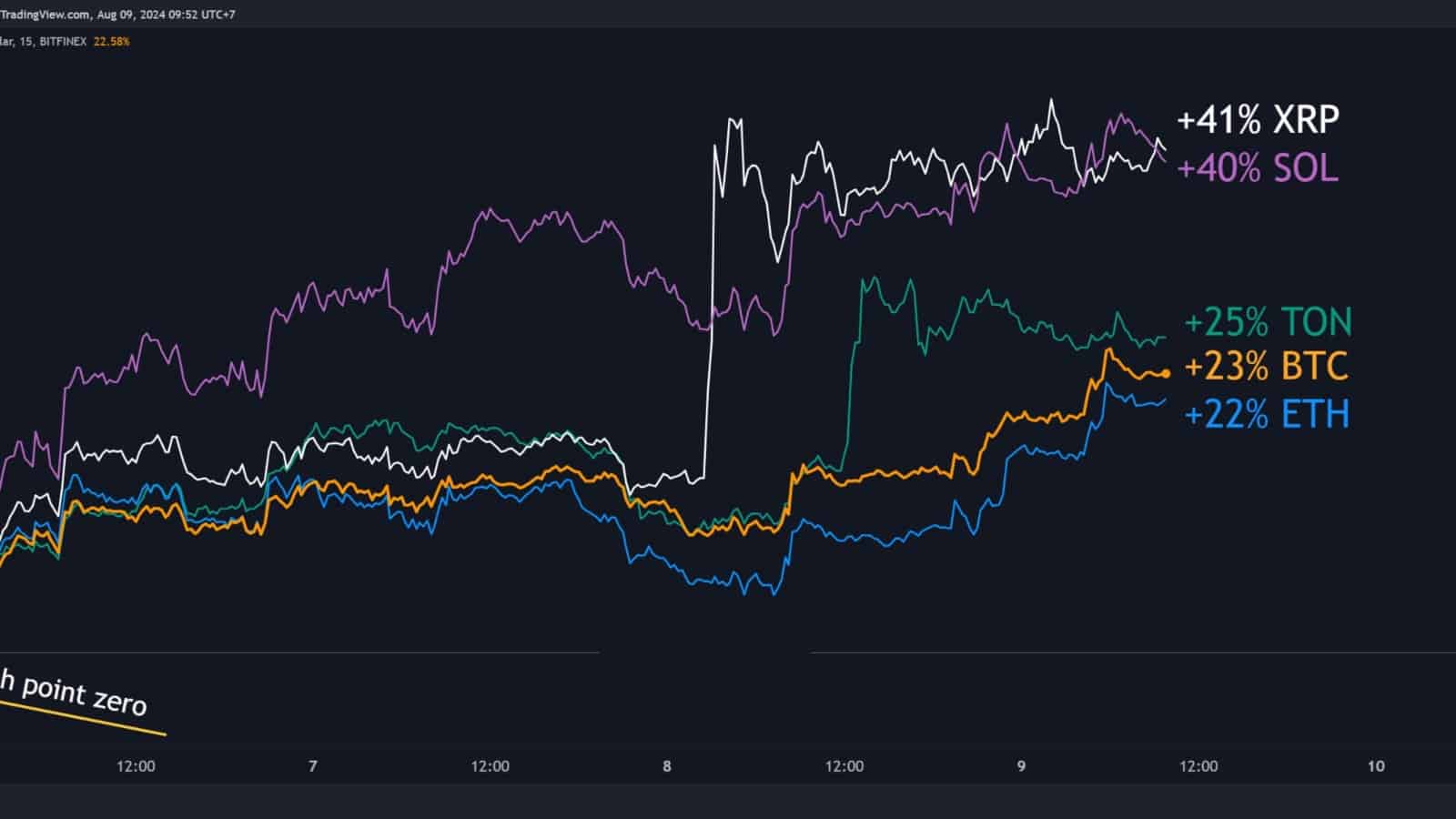

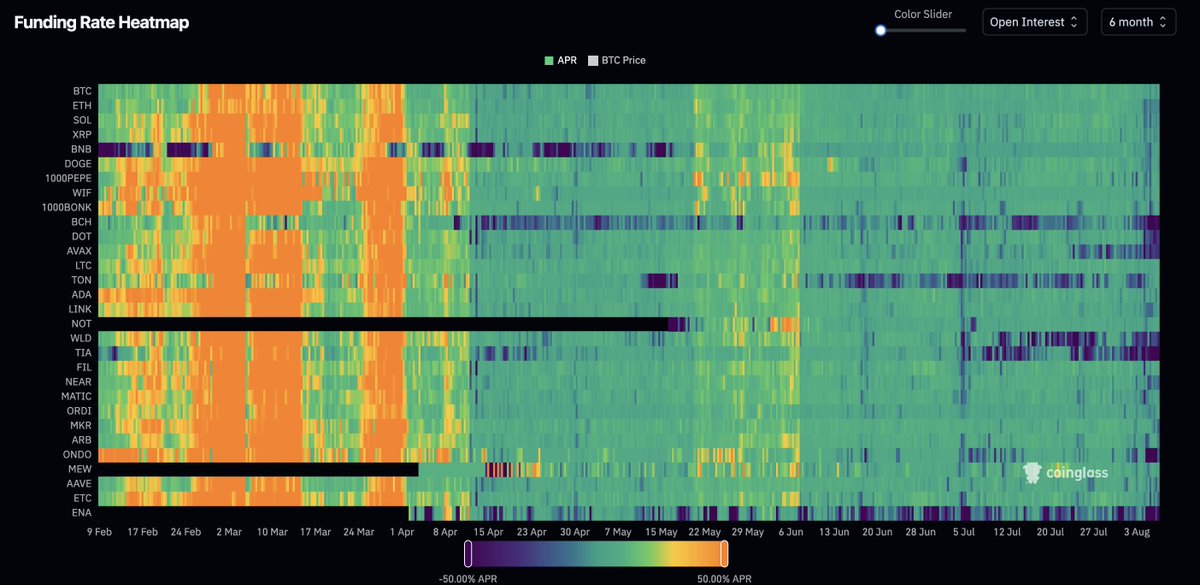

Crypto funding charges for prime 30 cash

Crypto funding charges have considerably shifted for the reason that overheated markets of February and March. In reality, at the moment, they’re at their lowest ranges of 2024.

Such durations of low charges can final for prolonged occasions, however the FED’s current hints at attainable charge cuts may quickly alter the market dynamics, probably driving modifications in these funding charges.

Supply: Coinglass

Altcoins excluding BTC type a cup & deal with sample

Lastly, macro charts have been displaying some constructive indicators once more. For example, the weekly candle returned to the low level of a 2.5-year cup & deal with sample.

Thus, after the FEDs hinted at charge cuts, an upward development is inevitable. The market has been held again lengthy sufficient, and this ultimate upward transfer may quickly occur, with the candle closing in two days.

Supply: TradingView