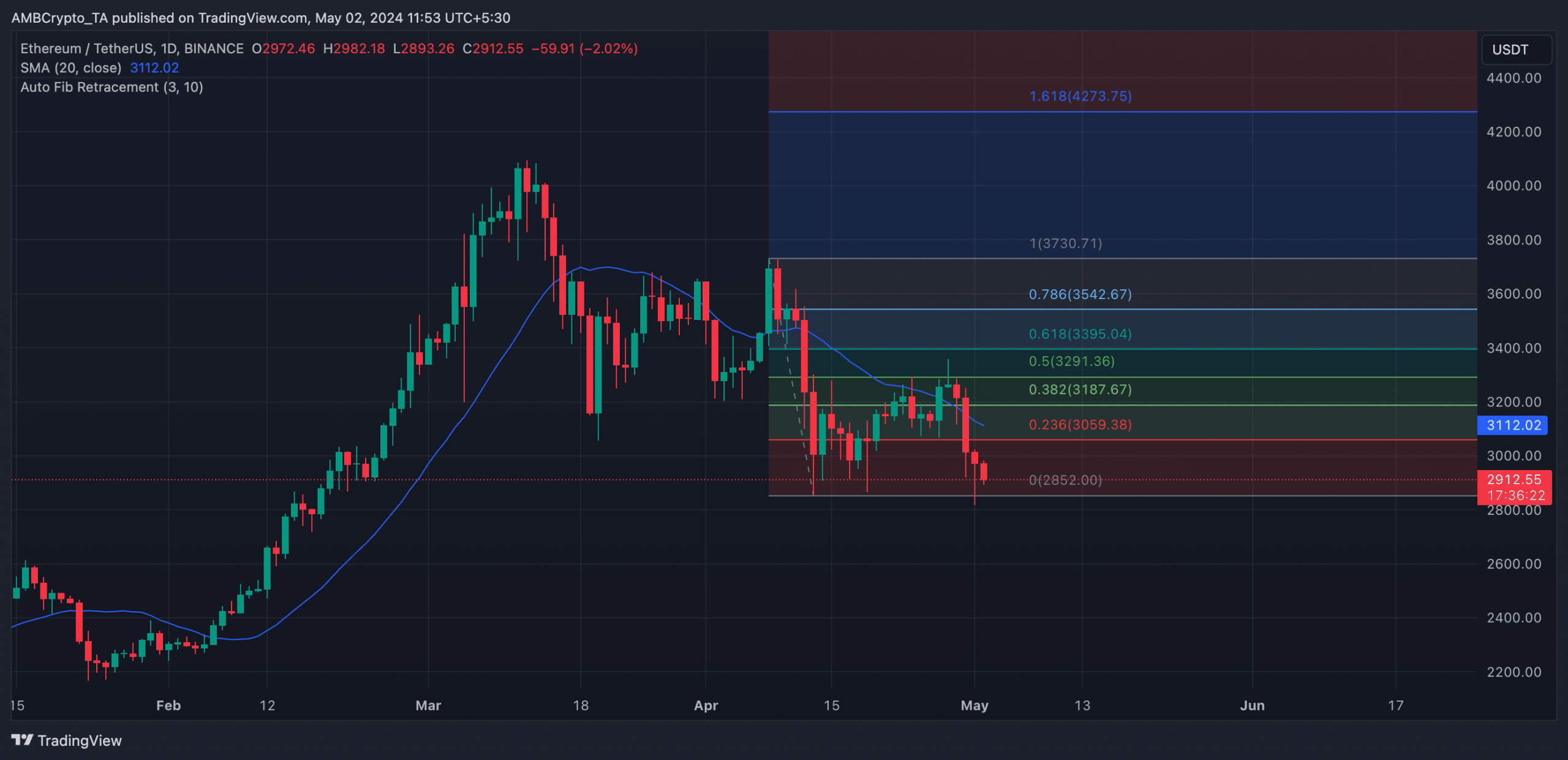

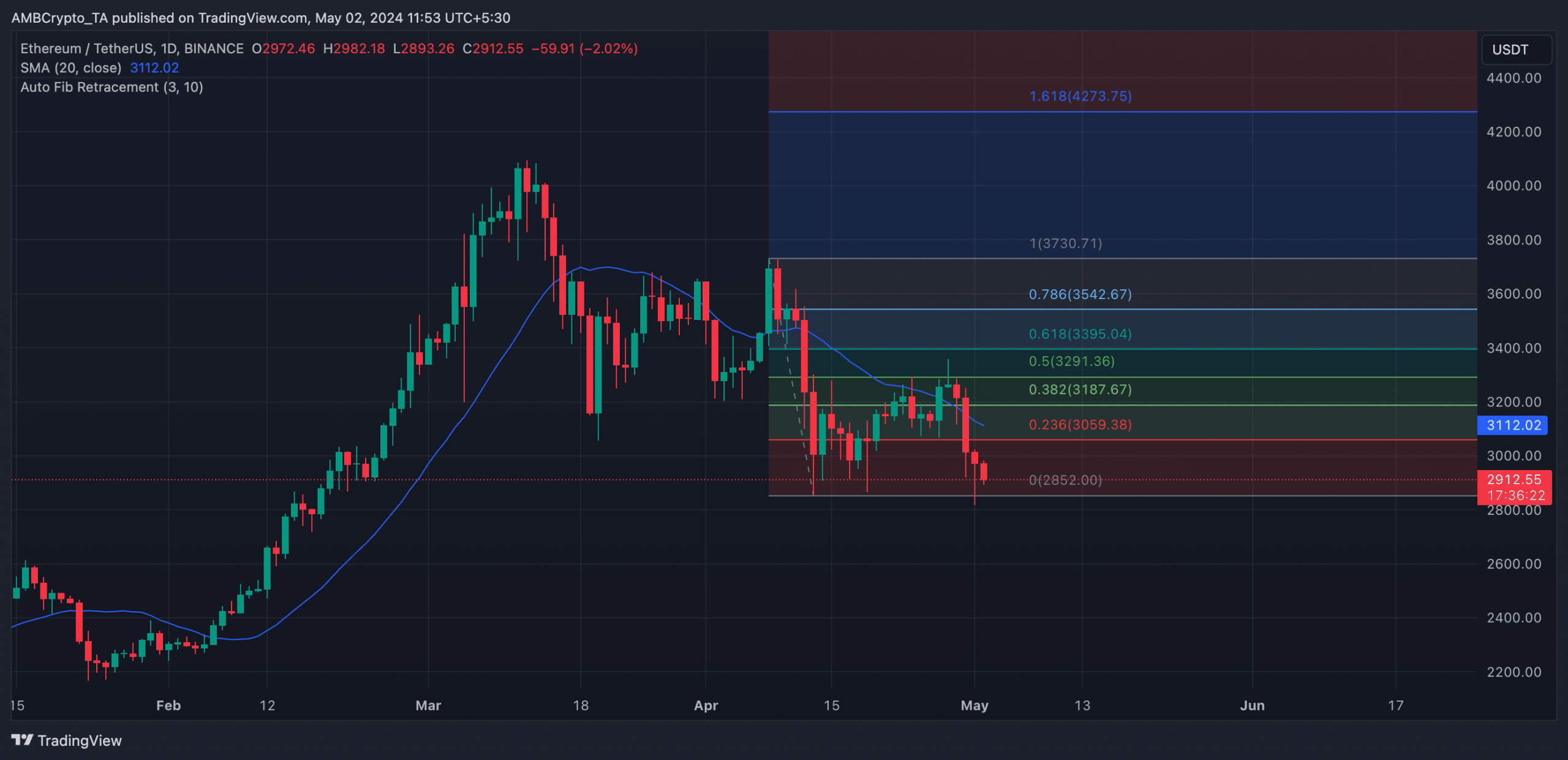

- ETH briefly broke help and traded at a low of $2852 on the first of Might.

- Its Futures Open Curiosity declined significantly because the tenth of April.

Ethereum [ETH] not too long ago crossed beneath its 20-day easy transferring common (SMA), placing it vulnerable to an additional decline within the quick time period.

When an asset’s value falls beneath its 20-day SMA, it means that the short-term pattern for the asset is downward.

Market individuals usually view this as an indication that sellers are in management and that the asset’s value will probably proceed declining.

Readings from ETH’s value motion on a 1-day chart confirmed that its value fell beneath its 20-day SMA on the thirtieth of April.

As coin selloffs intensified, ETH broke help and closed the buying and selling session on the first of Might at a low of $2850.

Supply: ETH/USDT on TradingView

Bulls are nowhere to be discovered

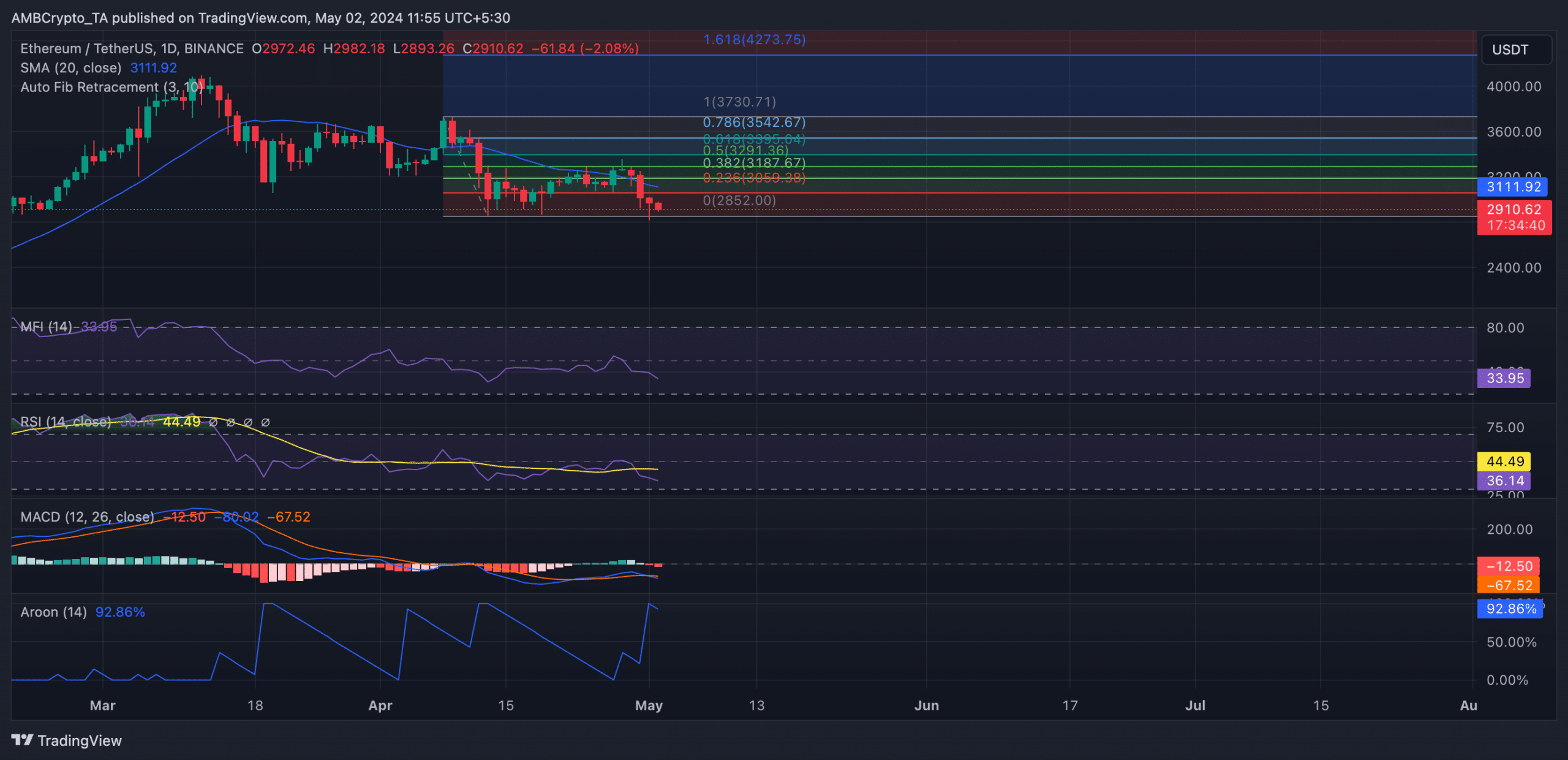

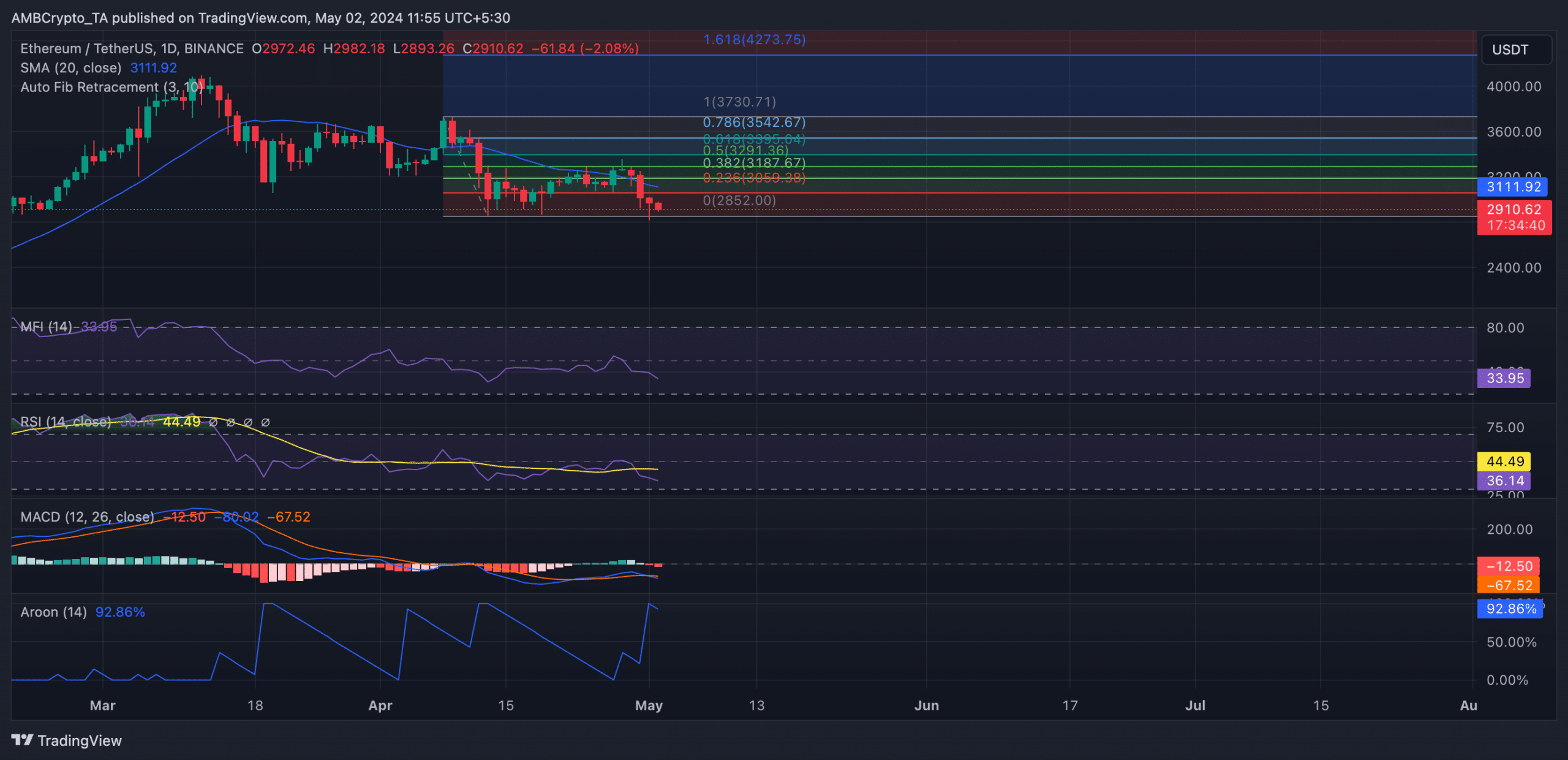

Though the coin’s value retraced within the final 24 hours to change palms at $2,913 on the time of press, bullish stress stays too weak to maintain any important rally within the quick time period.

AMBCrypto discovered that on the first of Might, ETH’s MACD line (blue) intersected its sign line (orange) in a downtrend when the coin’s fell broke beneath help.

This intersection is a bearish signal. Each traces beneath the zero line, when it occurred, confirmed the present downtrend and signaled the potential of an additional decline in ETH’s value.

Additionally confirming the energy of the present market downtrend, ETH’s Aroon Down Line (blue) was 92.86% as of this writing.

This indicator identifies an asset’s pattern energy and potential pattern reversal factors in its value motion.

When the Aroon Down line is near 100, it signifies that the downtrend is robust and that the newest low was reached comparatively not too long ago.

Additional, ETH’s key momentum indicators pointed to a big decline in demand for the altcoin. Its Relative Power Index (RSI) was 36.46, whereas its Cash Circulate Index (MFI) was 33.96.

The values of those indicators confirmed that market individuals favored ETH distribution over the buildup of newer cash.

Supply: ETH/USDT on TradingView

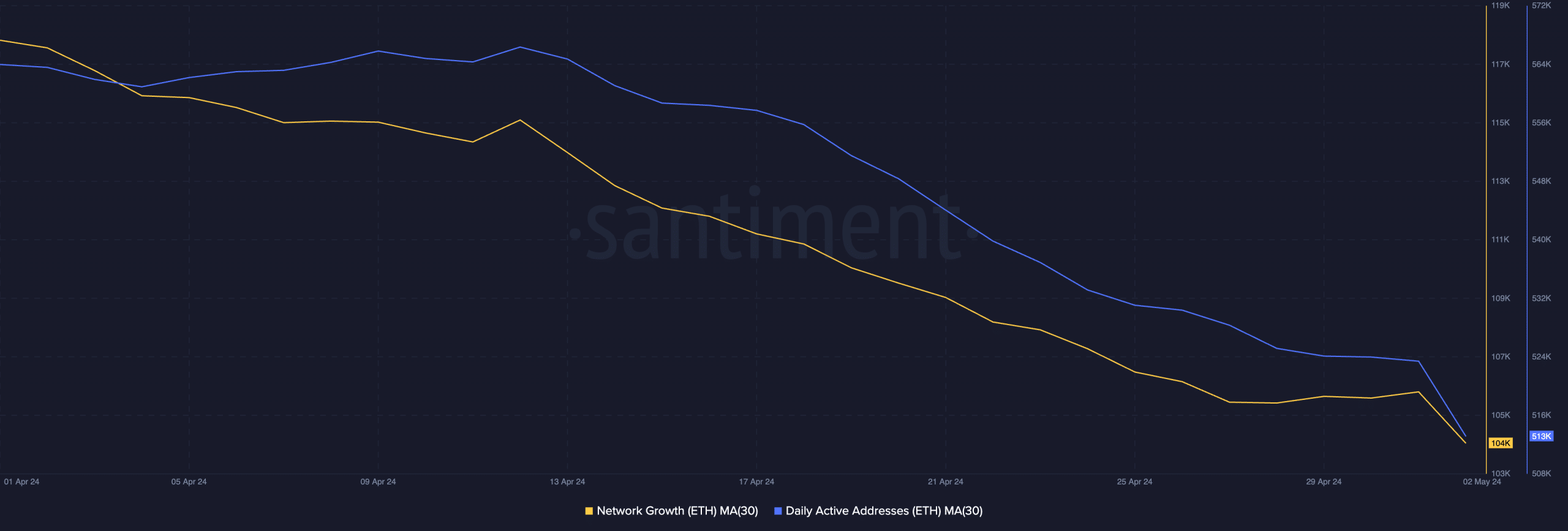

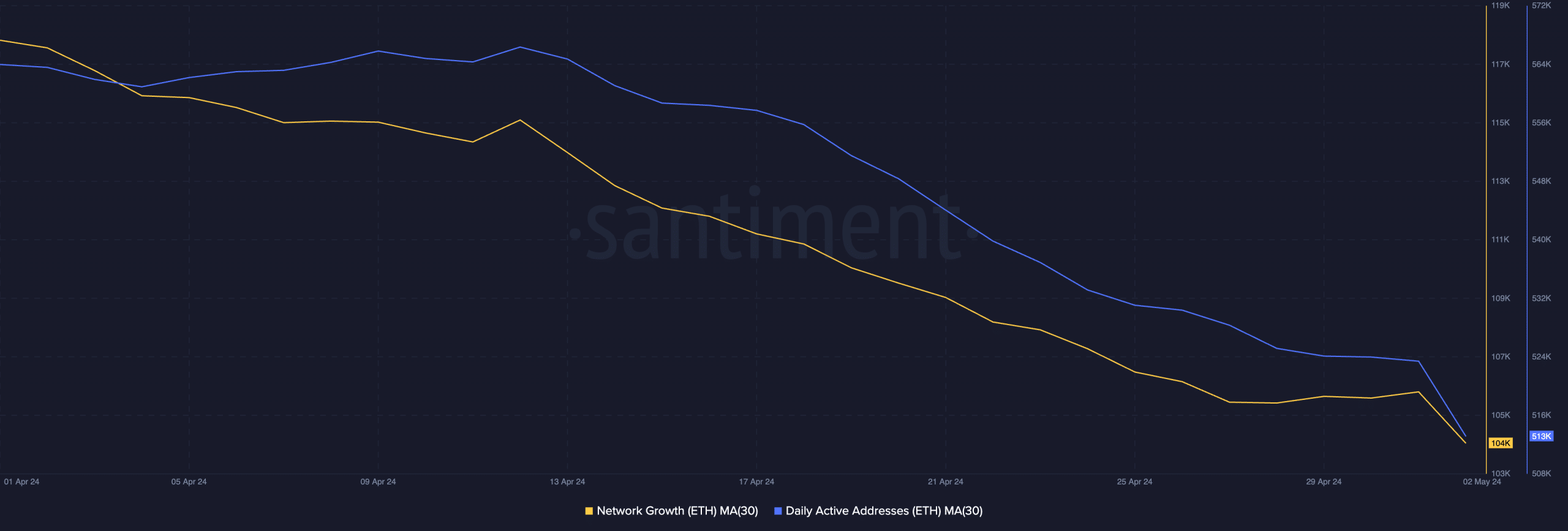

AMBCrypto’s evaluation of ETH’s community exercise utilizing a 30-day common confirmed the decline in demand for the altcoin within the final month.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

In keeping with Santiment’s information, the day by day rely of addresses concerned in no less than one ETH commerce within the final month has dropped by 7%.

Equally, the variety of new addresses created to ETH has decreased within the final month. On-chain information confirmed that this has fallen by 10% prior to now 30 days.

Supply: Santiment