- BTC could also be mirroring its 2020 worth development, Is a post-COVID pump state of affairs on the playing cards?

- QCP Capital analysts projected that the latest BTC dip could possibly be short-lived

Since peaking above $73k in March, Bitcoin [BTC] has been consolidating for six months, swinging between $50k and $70k. In response to Bloomberg ETF analyst James Seyffart, nevertheless, the present worth motion mirrors its 2020 sample.

“Bitcoin proper now round $50k-$70k during the last 6 months kinda sorta reminds of BTC buying and selling round $7k – $10k from mid-2019 via early to mid-2020.”

After breaking the $7k – $10k worth vary in 2020, BTC closed the yr practically at $30k, tripling its worth. By 2021, BTC peaked at $69k, greater than double its worth on the finish of 2020.

As highlighted by Seyffart, 2020 and 2024 share extra than simply comparable worth patterns. Additionally they share BTC halving occasions traditionally related to huge rallies.

Is a parabolic rally seemingly for BTC?

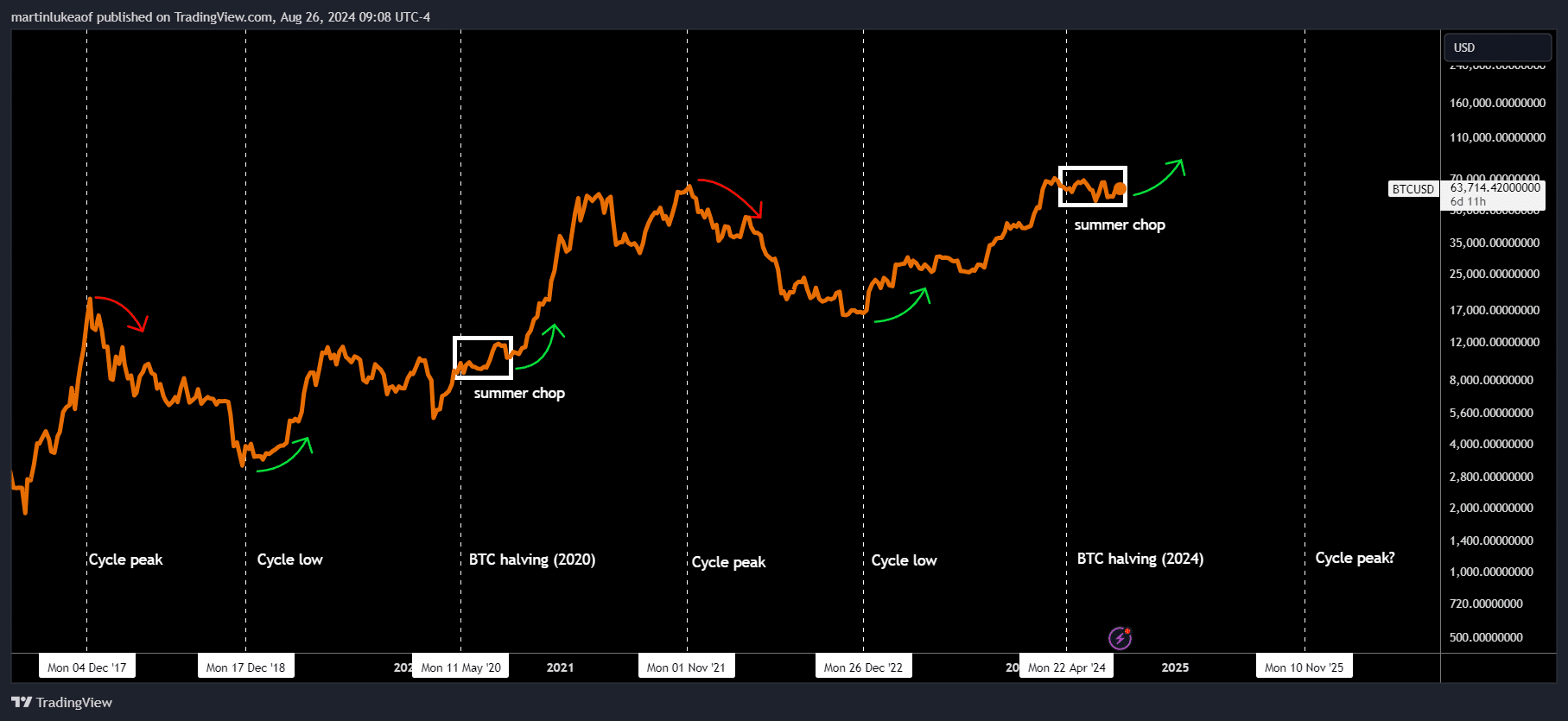

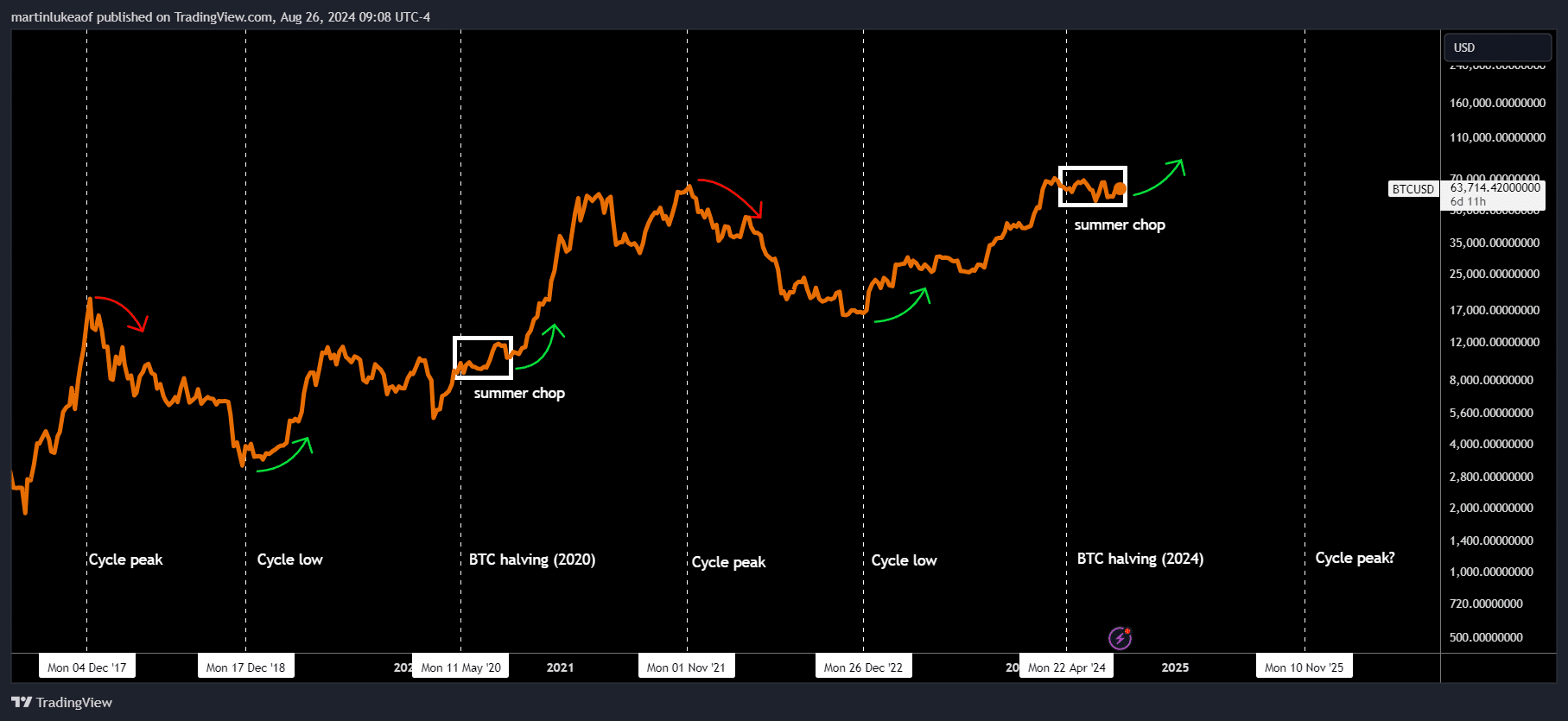

Though historic efficiency doesn’t dictate future outcomes, historical past all the time rhymes. Most market cycle analysts nonetheless preserve that BTC’s post-halving rally remains to be on the playing cards.

One of many analysts, Luke Martin, shared an analogous evaluation to Seyffart’s and projected a probable pump after the summer time’s uneven market.

“Yup! Very comparable setup to mid/summer time 2020. Uneven market post-halving, consolidation throughout uptrend, cycle low ~1.5 years in the past.”

Supply: X

Related post-halving projections have been made too, the newest being a worth goal of $200k per BTC by 2025.

That being stated, BTC has been whipsawing over the previous few days regardless of constructive alerts from the Fed a few potential coverage pivot in the direction of rate of interest cuts. The world’s largest cryptocurrency just lately mounted above $64k, solely to slide beneath $60k, stoking confusion amongst buyers and analysts.

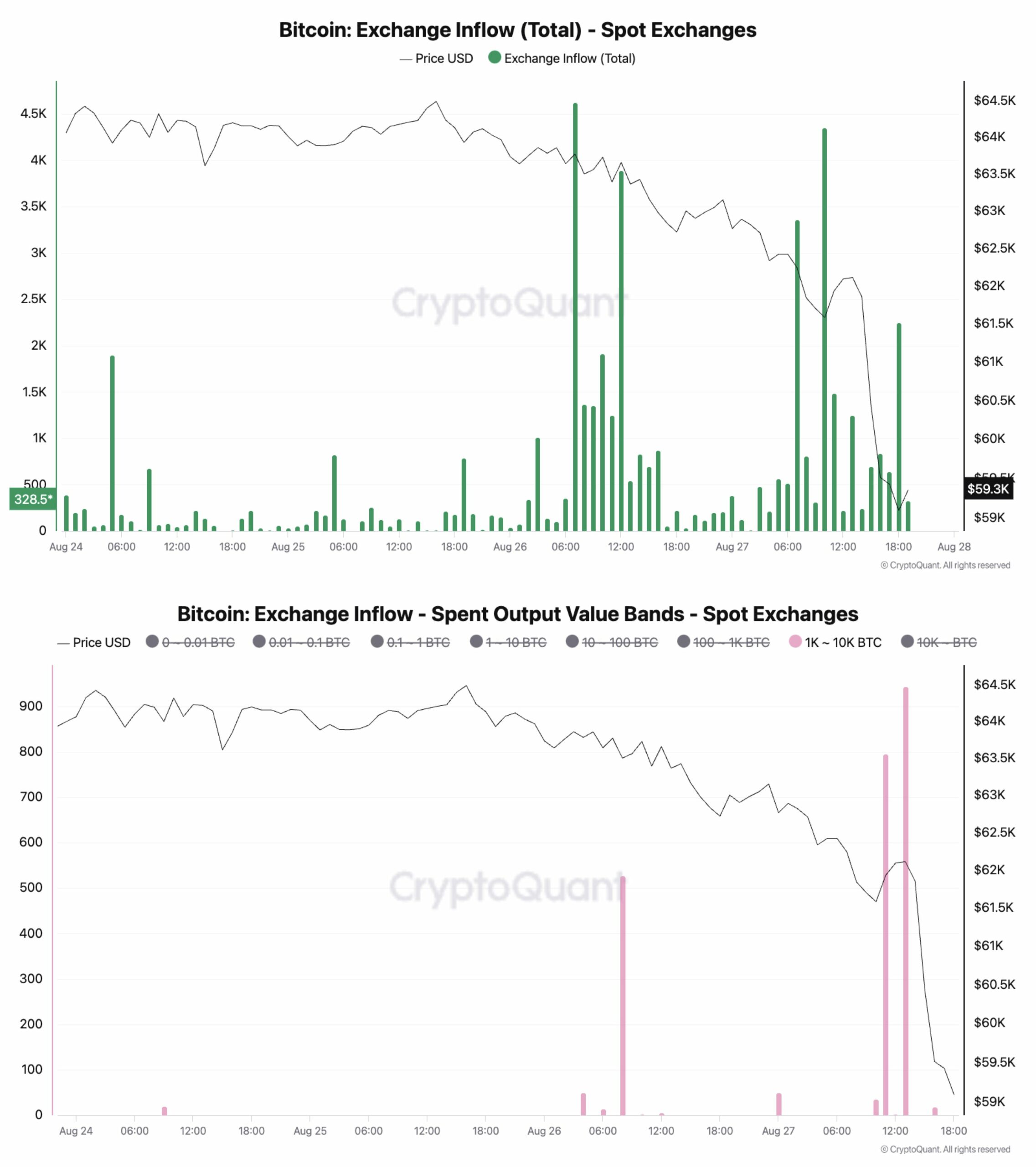

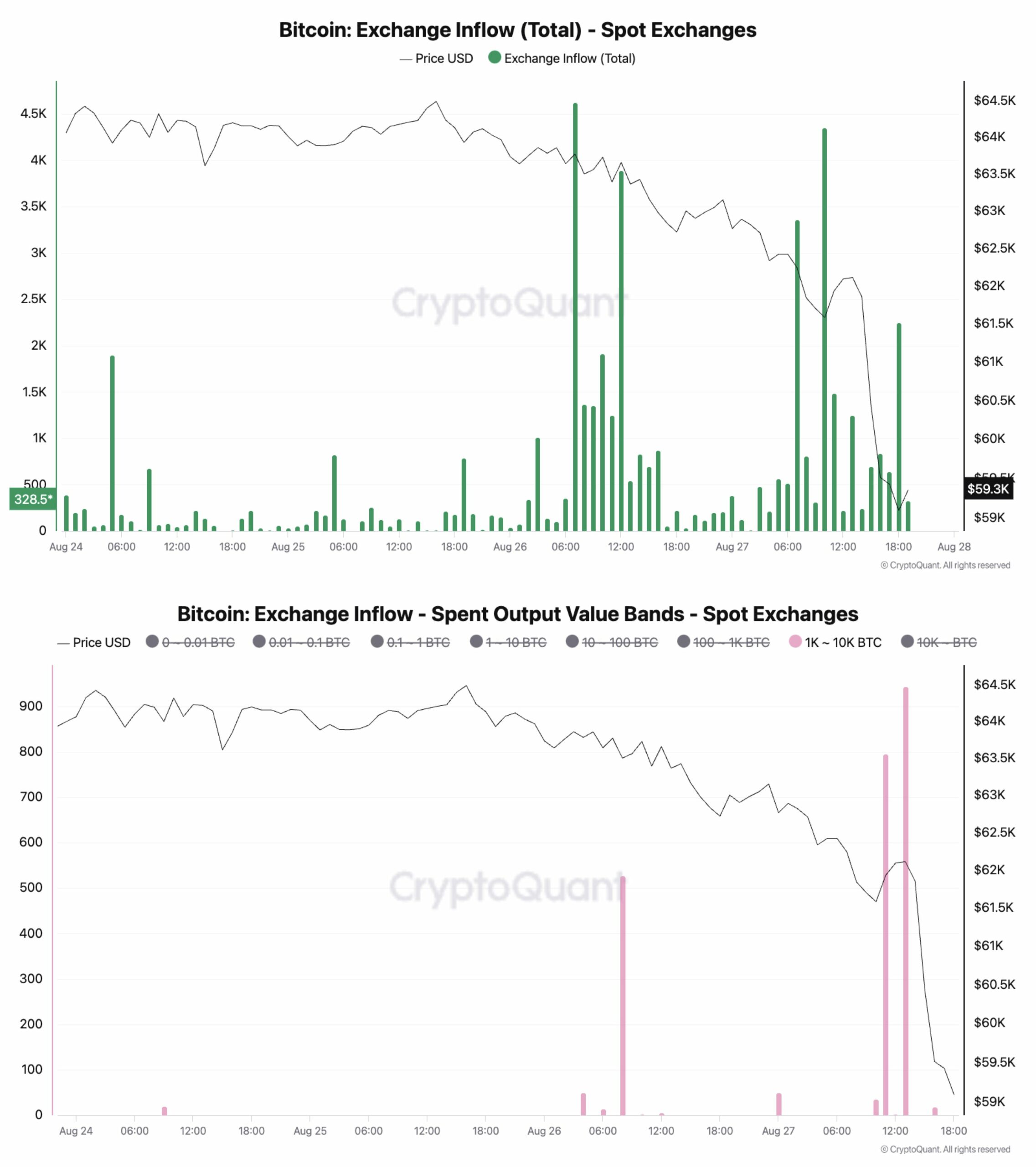

CryptoQuant’s Head of Analysis, Julio Moreno, noted {that a} huge BTC dump on centralized exchanges from some massive wallets triggered the mid-week plunge.

“There have been rising #Bitcoin inflows to identify exchanges simply earlier than in the present day’s sell-off (first chart).”

Supply: CryptoQuant

Quite the opposite, QCP Capital analysts revealed that given the constructive macro outlook, the present downward stress could possibly be short-lived earlier than the subsequent leg up begins.

“We consider that any dip in equities (and crypto) can be short-lived. With Powell and the Fed able to kickstart a rate-cutting cycle, elevated liquidity will finally push danger property increased.”