- Bitcoin’s alternate reserves prompt that promoting strain was excessive

- Market indicators hinted at a bullish pattern reversal

Bitcoin [BTC], regardless of a quick bout of restoration, is struggling as soon as once more after its value slipped under $55,000 on the charts. Within the meantime, an institutional investor deposited BTC price thousands and thousands of {dollars}, fueling sell-off issues. Does this imply that BTC could also be poised to see one more value correction within the coming days?

Are traders promoting BTC?

Bitcoin, like most different cryptos, additionally recorded a value drop final week because the coin’s value plummeted by practically 8%. The bearish value pattern continued within the final 24 hours as a result of it dipped by over 2%. On the time of writing, BTC was buying and selling at $54,284.69 with a market capitalization of over $1 trillion.

Whereas that occurred, a large-scale investor bought a considerable quantity of BTC. To be exact, Galaxy Digital deposited 1,458 BTC price $78.5 million to Coinbase Prime. This update from Lookonchain prompt that whales at the moment are promoting BTC. At any time when whales promote BTC, it signifies that they’re anticipating an asset’s value to drop additional.

Therefore, it’s price taking lots at different datasets to see whether or not promoting strain on the coin has been rising or not.

In response to AMBCrypto’s evaluation of CryptoQuant’s knowledge, Bitcoin’s alternate reserves have risen these days. By extension, this meant that promoting strain on the coin has been excessive.

Other than that, at press time, each BTC’s Coinbase Premium and Funds Premium had been purple – An indication that promoting sentiment was dominant amongst U.S and institutional traders.

Supply: CryptoQuant

What do the market indicators counsel?

We then assessed the crypto’s metrics to seek out out whether or not in addition they hinted at an additional value correction.

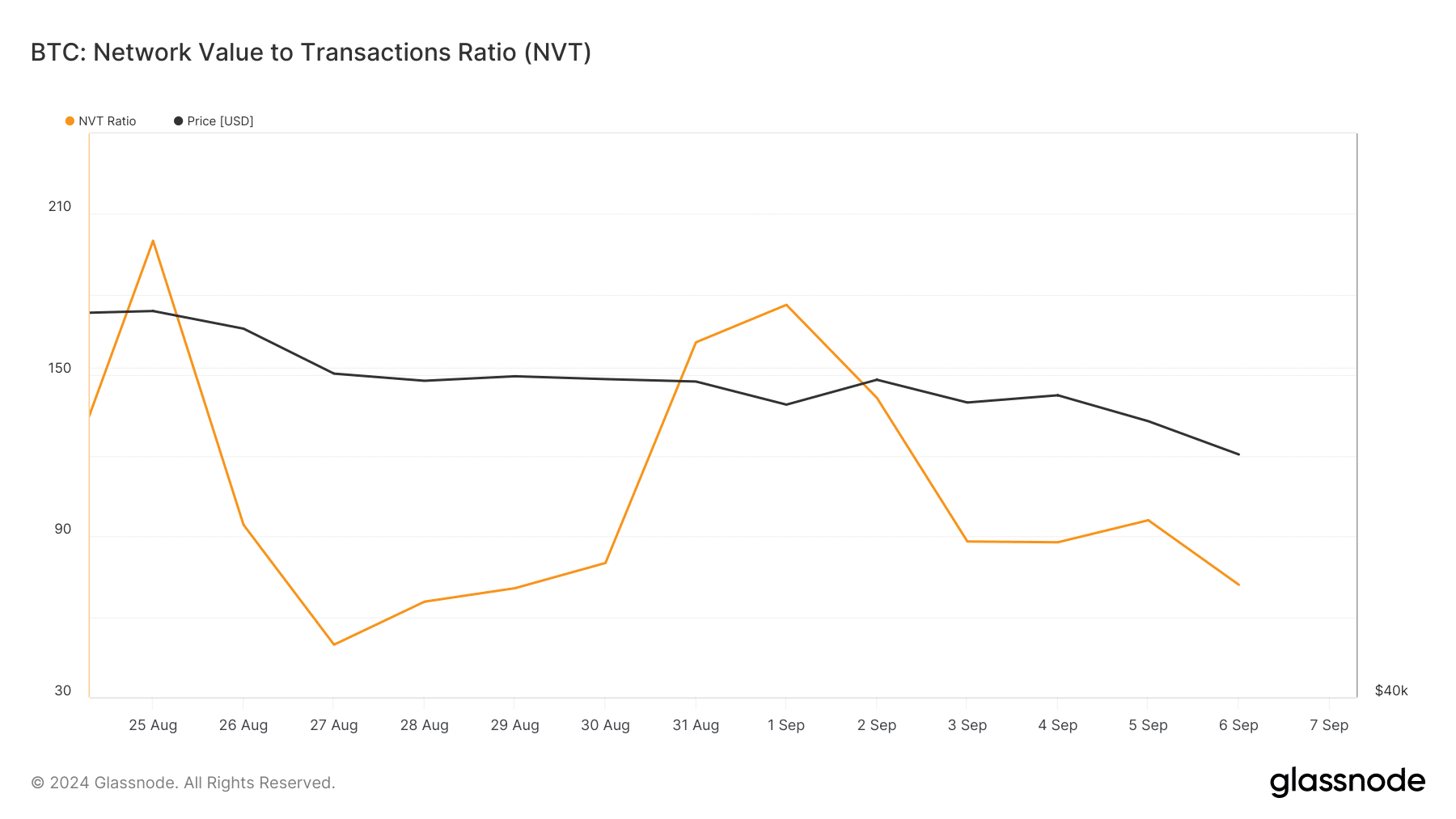

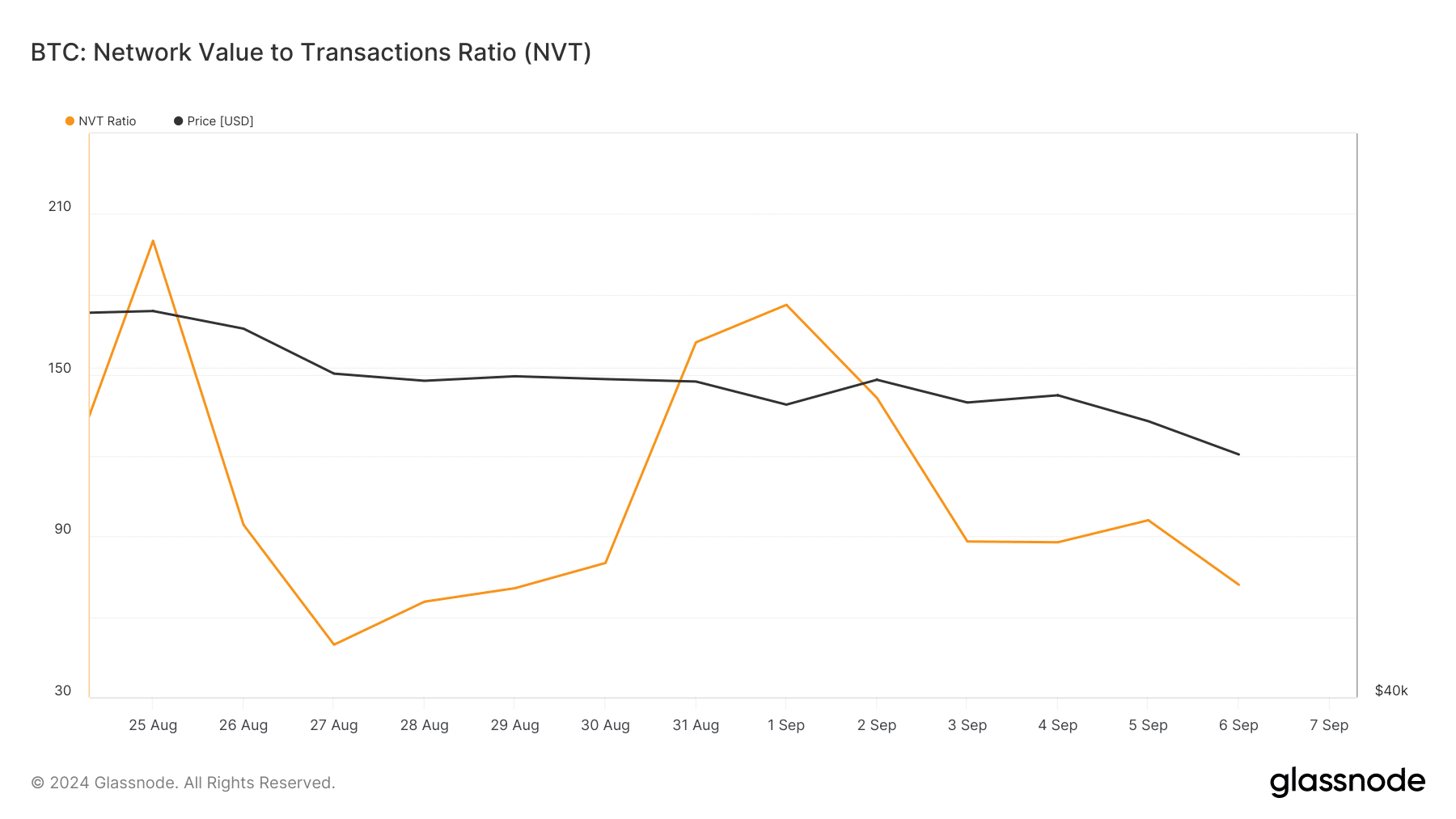

As per our evaluation of Glassnode’s knowledge, BTC’s NVT ratio fell on the charts. At any time when that occurs, it means that an asset is undervalued, hinting at a value hike.

Supply: Glassnode

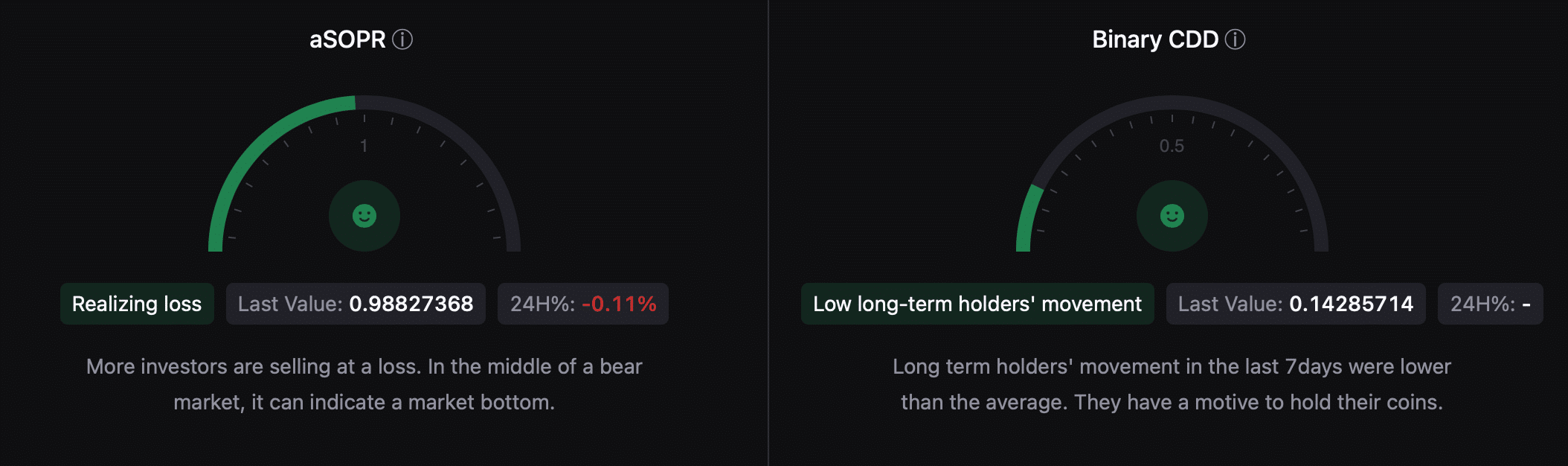

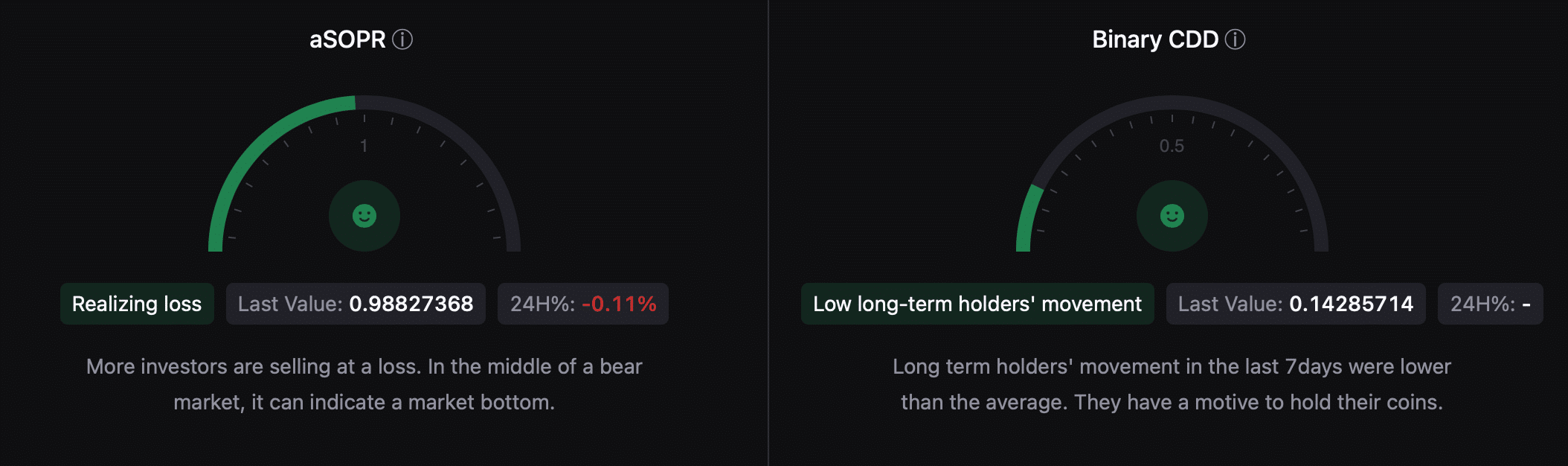

Moreover, BTC’s aSORP was inexperienced, that means that extra traders have been promoting at a loss. In the midst of a bear market, it may well point out a market backside.

Additionally, its binary CDD implied that long-term holders’ motion within the final 7 days was decrease than the common. They’ve a motive to carry their cash. This may be inferred as a bullish sign.

Supply: CryptoQuant

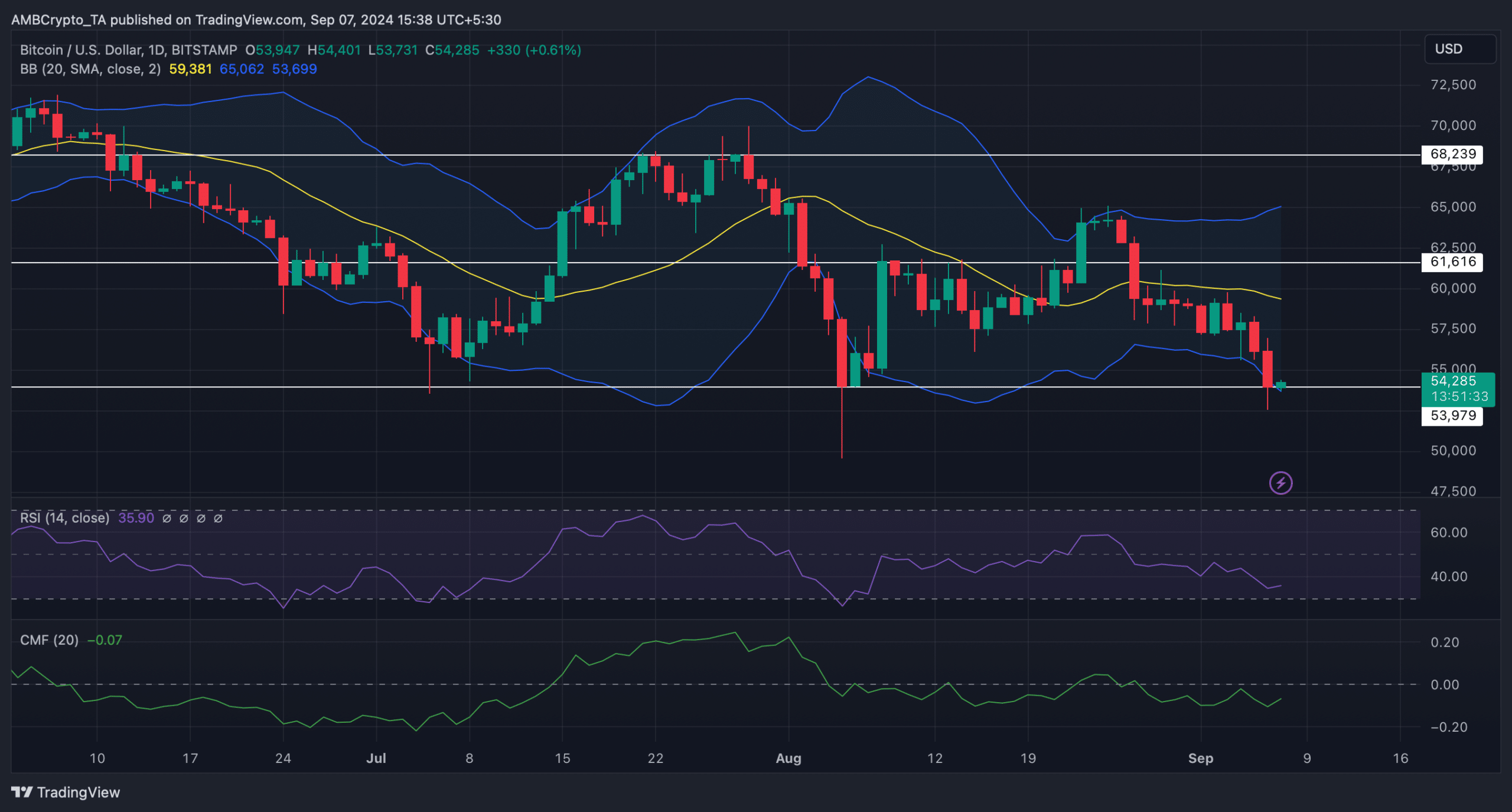

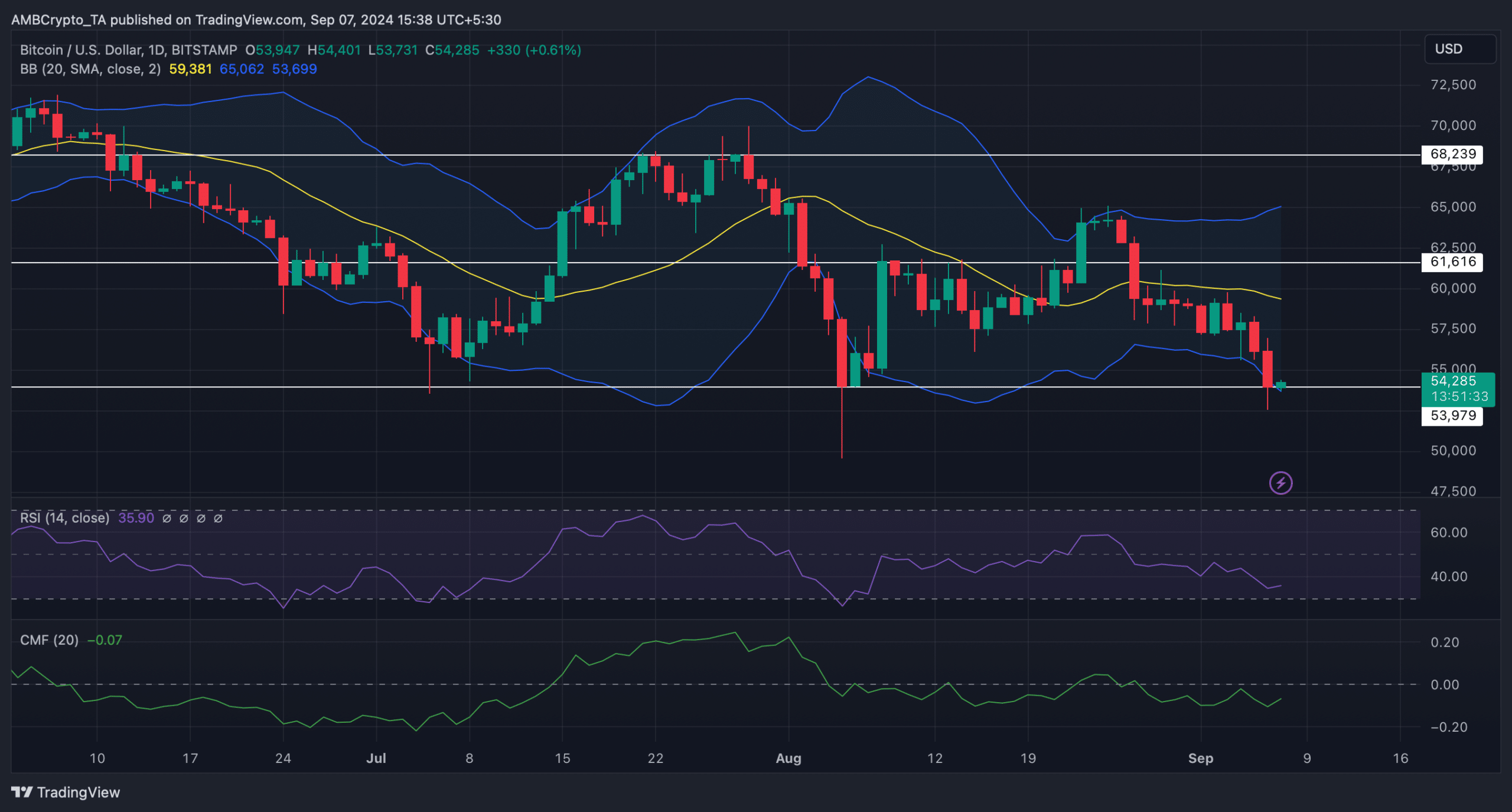

Therefore, we took a have a look at the coin’s each day chart to higher perceive which approach it could be heading. Our evaluation revealed that BTC gave the impression to be testing a help degree. The coin’s value additionally touched the decrease restrict of the Bollinger Bands, which regularly ends in value hikes.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Lastly, each its Relative Power Index (RSI) and Chaikin Cash Stream (CMF) registered upticks too – Once more, indicator of an upcoming hike.

Supply: TradingView