- Analysts predicted that Bitcoin’s value might attain $107K earlier than a significant sell-off, which might trigger a fall to $50K.

- Regardless, analysts remained optimistic about Bitcoin’s long-term potential.

Regardless of a latest decline in Bitcoin’s [BTC] value, analysts remained optimistic about its long-term potential. At press time, Bitcoin was priced at $63,986.45, with a 24-hour buying and selling quantity of $25,273,209,651.

This mirrored a -1.28% value decline within the final 24 hours however an 11.93% value improve over the previous seven days.

Analyst predictions

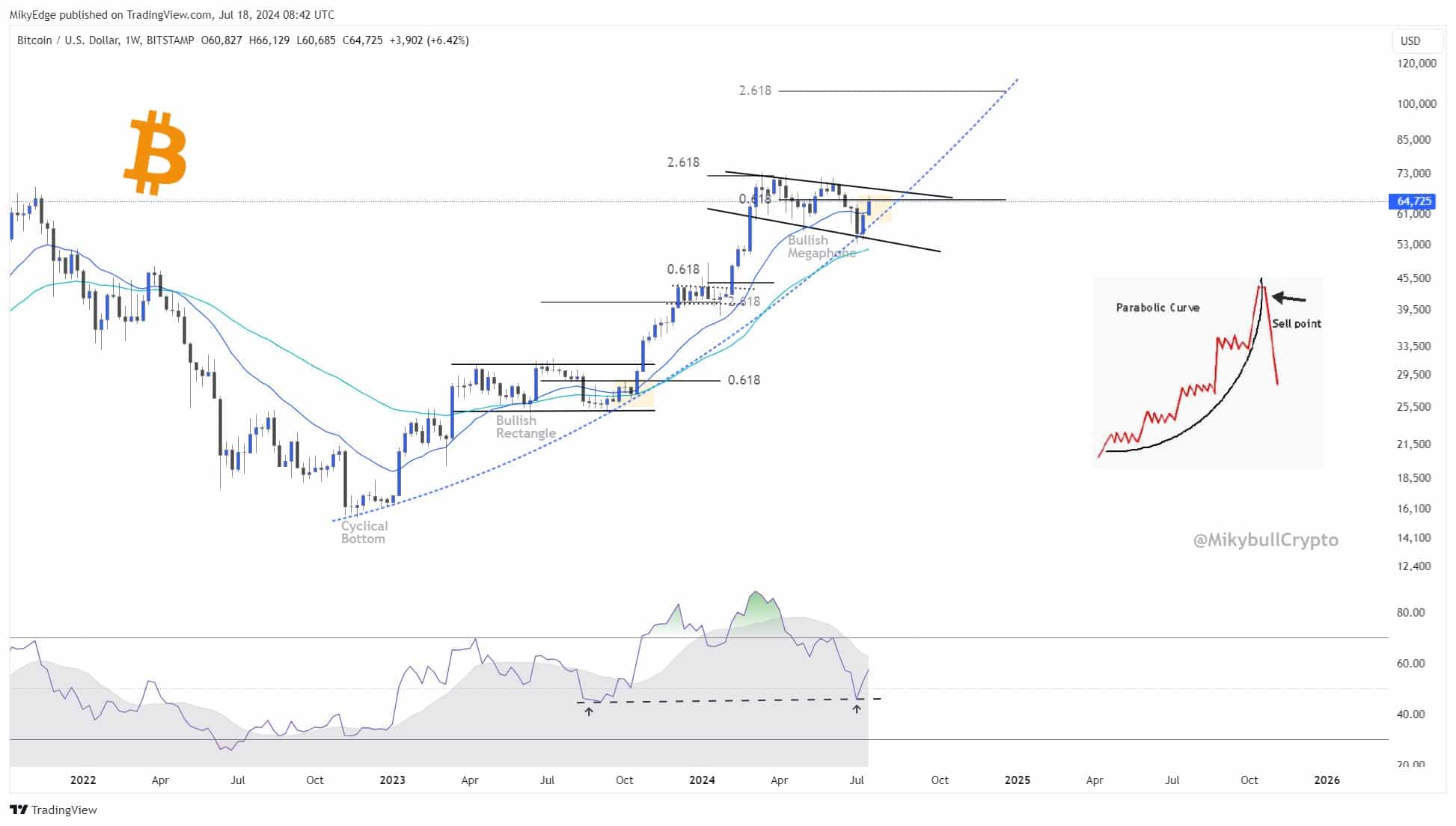

Mikybull Crypto noted on X (previously Twitter) that Bitcoin’s conservative parabolic curve goal stood at $107,000 earlier than an enormous sell-off to $50,000.

He acknowledged,

“I don’t know the way that is going to occur however I merely comply with what the chart tells me slightly than emotion.”

Supply: X

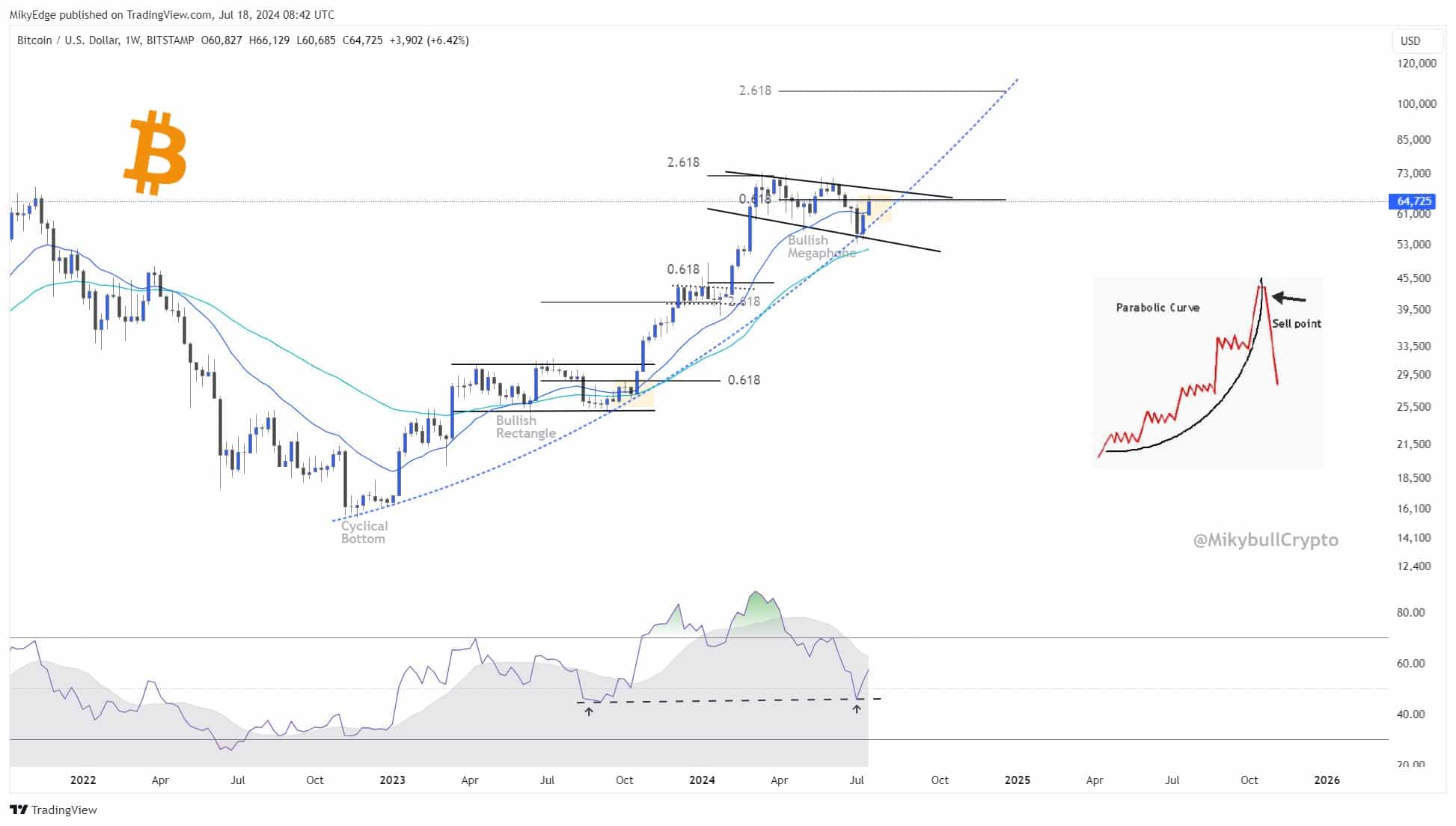

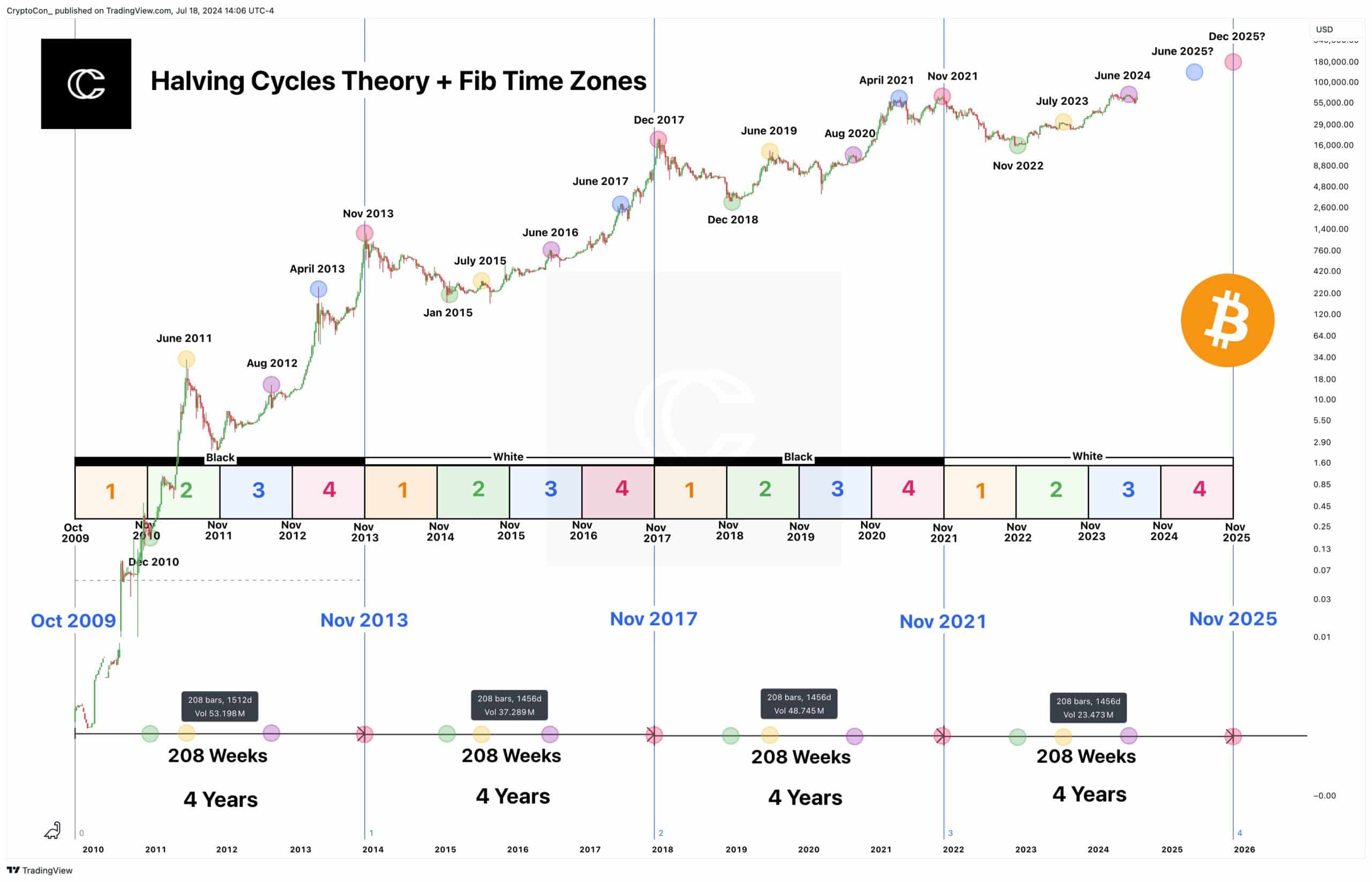

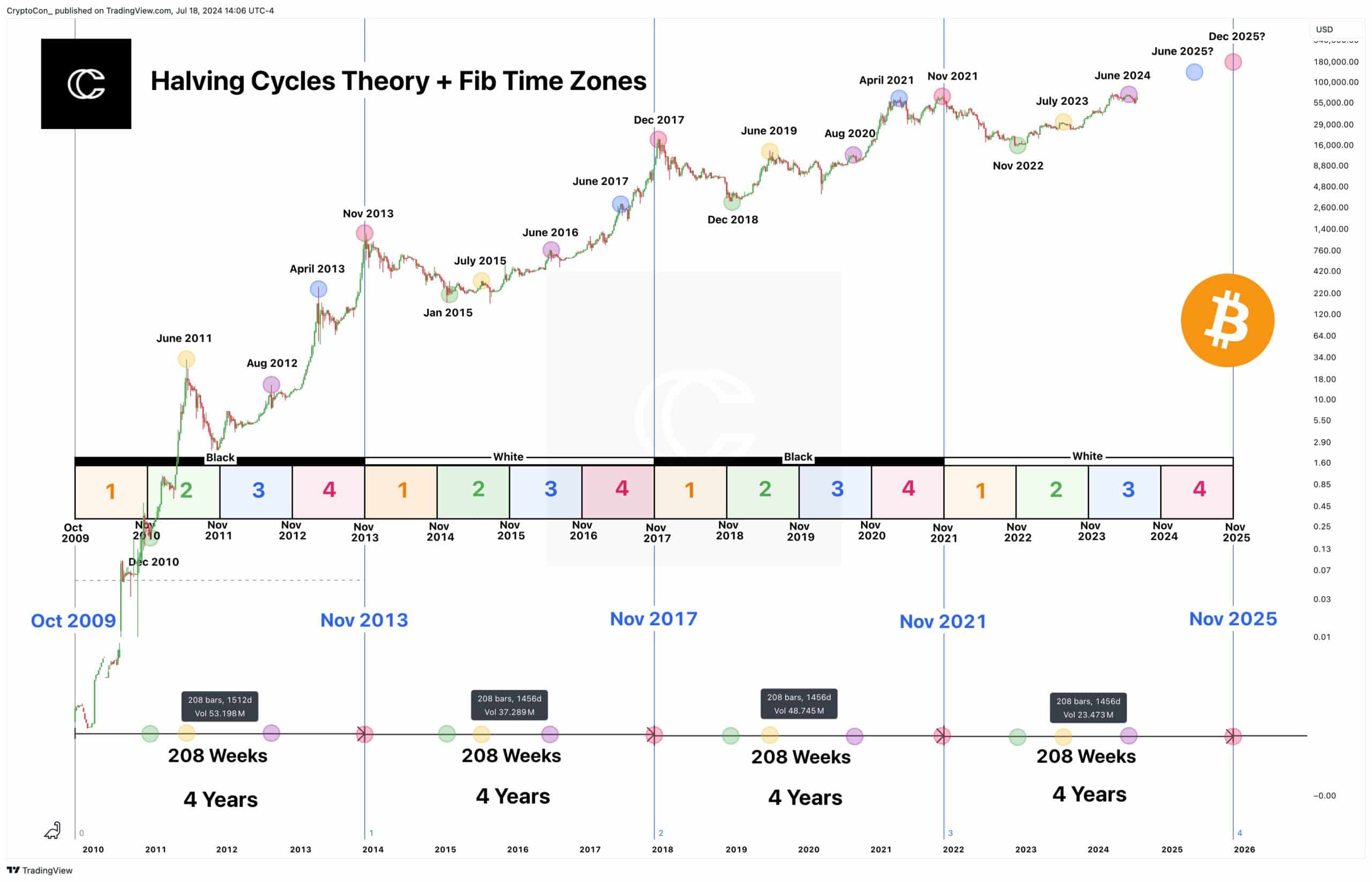

CryptoCon, one other analyst, noted,

“Though there are nonetheless indicators of acceleration within the #Bitcoin cycles, I sincerely hope authentic timing finds its manner again. Good 4-year cycles since inception, 208 weeks precisely.”

CryptoCon famous that the March 2024 excessive was an early deviation, leading to a decrease excessive in June. Regardless of these variations, he believed that the long-term cycle patterns would persist.

The analyst additional highlighted the potential for Bitcoin to comply with historic patterns, citing BitTime and The Halving Cycles Concept, which predicted a primary prime in June 2025 and a last prime in December 2025.

He famous,

“As a lot as I like the Halving Cycles Concept, I’m ready for something.”

Supply: X

Bitcoin technical evaluation

AMBCrypto’s take a look at the BTC/USDT 1-day chart from TradingView revealed that the 9-day transferring common (MA) was appearing as a help degree round $61,891.7 at press time.

The latest value improve from mid-June lows recommended a possible continuation of the bullish pattern.

Bitcoin’s value transferring above the 9-day MA indicated constructive short-term momentum.

Supply: TradingView

The MACD (Transferring Common Convergence Divergence) indicator confirmed a bullish crossover, with the MACD line above the sign line, reinforcing the upward momentum.

The histogram’s constructive territory additional confirmed this bullish sentiment, suggesting that purchasing stress would possibly proceed, probably pushing costs larger.

At press time, the Relative Power Index (RSI) stood at 58.19, putting Bitcoin in a impartial zone however edging nearer to overbought territory.

This recommended room for additional upward motion, although merchants ought to look ahead to potential overbought situations.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

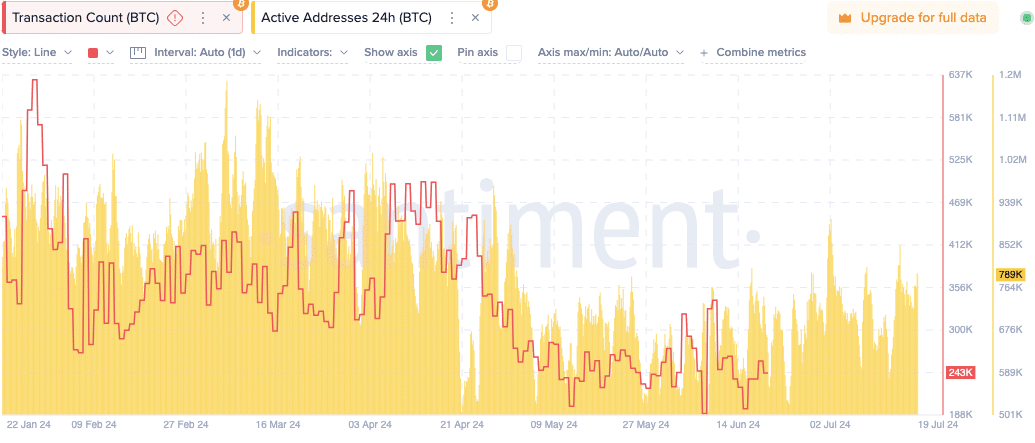

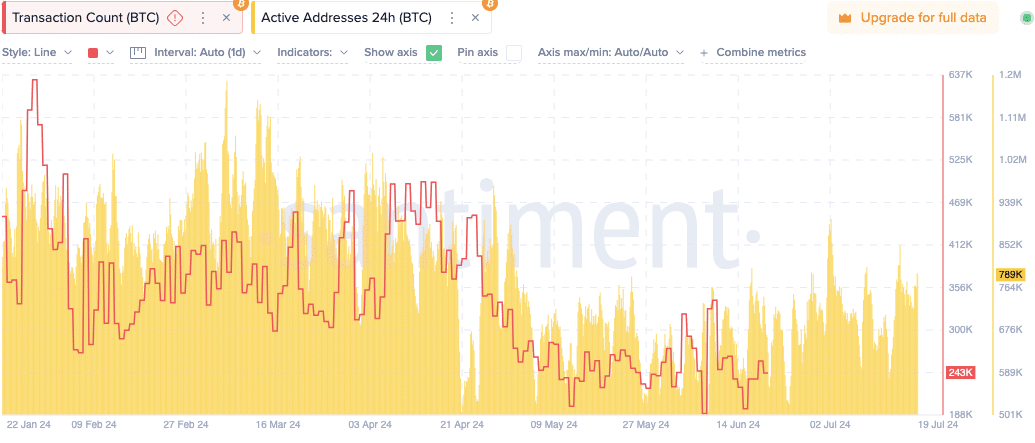

Decline in community exercise

In the meantime, energetic addresses have dropped from peaks above 500,000 in January to round 243,000 at press time.

Supply: Santiment

Equally, transaction counts have decreased from over 1.1 million to roughly 796,000 throughout this era. This discount recommended decreased engagement and exercise on the Bitcoin community.