- BTC was down by greater than 10% within the final seven days.

- A number of metrics prompt that there have been probabilities of a value uptick.

Bitcoin [BTC] witnessed a significant value correction within the current previous, sparking concern amongst traders. The situation would possibly get even worse as BTC fails to check a key help stage. Nonetheless, if historical past is to be believed, then this won’t be the top of BTC’s bull rally.

Bitcoin goes underneath $58k

In response to CoinMarketCap, BTC witnessed a double-digit value drop final week as its worth plummeted by 10%. Within the final 24 hours alone, the king of cryptos’ value dropped by 4.5%.

On the time of writing, BTC was buying and selling at $57,440.15 with a market capitalization of over $1.13 trillion.

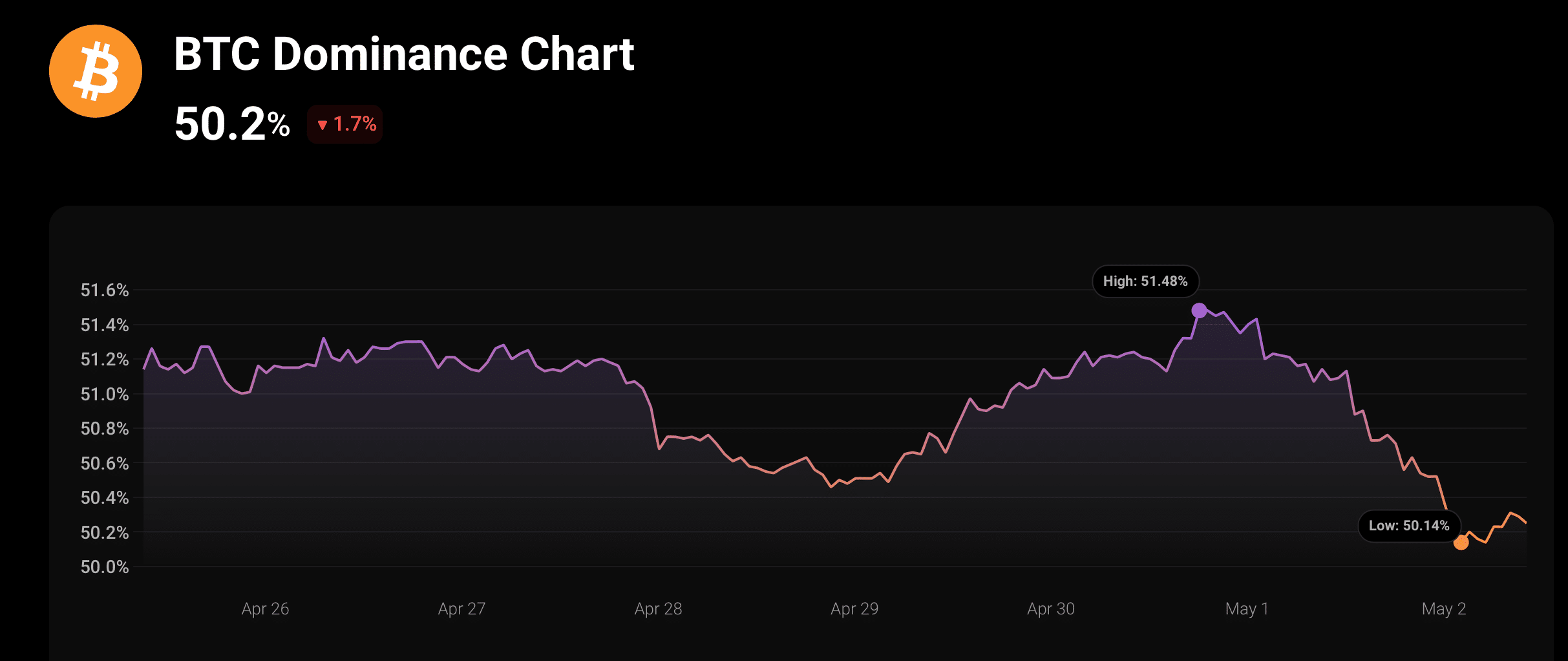

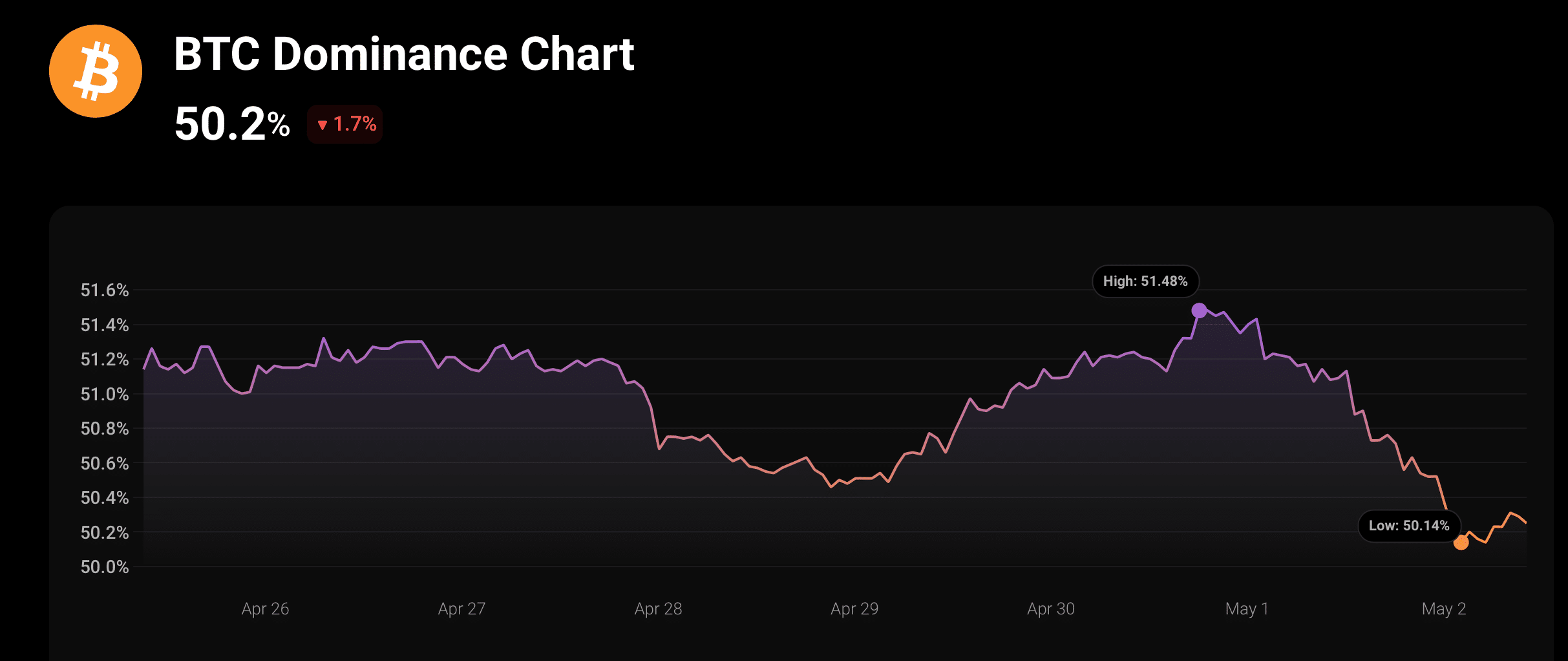

The appreciable decline in value additionally had a adverse influence on Bitcoin’s dominance. As per CoinStats’ information, BTC’s dominance dropped by 1.7% within the final 24 hours, because it had a price of fifty.2%.

Supply: CoinStats

World of Charts, a well-liked crypto analyst, posted a tweet highlighting how BTC’s value was shifting inside a parallel channel. If the coin examined the sample, then its value might have as soon as once more touched $70k.

Nonetheless, this wasn’t the case, as Bitcoin’s worth fell beneath the $58k help.

Subsequently, AMBCrypto checked Hyblock Capital’s information to search for its subsequent help stage. We discovered that if the downtrend continues, BTC would possibly discover help close to the $56.5k to $55k value vary, as liquidation would rise considerably at that stage.

If it fails to check that help, then traders would possibly as nicely witness BTC dropping to $51k within the coming days or even weeks.

Conversely, if a pattern reversal occurs and the coin’s value strikes northward, BTC would possibly face robust resistance at $65k.

Supply: Hyblock Capital

That is higher information

Within the meantime, Elja, a well-liked crypto analyst and influencer, posted a tweet mentioning that BTC was mimicking its 2020 value motion. As per the tweet, BTC’s was following the identical sample because the 2020 rally, suggesting that BTC’s newest bull run is way from getting over.

The truth is, AMBCrypto’s evaluation of CryptoQuant’s data revealed fairly just a few metrics that hinted at a pattern reversal. For example, BTC’s internet deposit on exchanges was low in comparison with the final seven-day common.

BTC’s aSORP was inexperienced, which means that extra traders have been promoting at a loss. In the midst of a bear market, it could actually point out a market backside.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Moreover, its binary CDD additionally prompt that long-term holders’ actions within the final 7 days have been decrease than common, indicating their motive to carry.

If these indicators are to be believed, then Bitcoin is perhaps establishing the stage for a value uptick.

Supply: CryptoQuant