- Bitcoin’s current value drop has led to vital market liquidations.

- Poor efficiency of the Hong Kong and U.S. spot ETFs underline market struggles.

As Bitcoin [BTC] continued to battle below vital market stress, dipping beneath the $58,000 mark, analysts are actually projecting a considerable value correction of 30-40% within the present market cycle.

This potential drop may see the main cryptocurrency modify to values not seen since earlier bullish runs, sparking considerations and anticipatory methods amongst traders.

Bitcoin dangles near $55K

Bitcoin’s current market habits has been lower than favorable, with a ten% decline over the previous week, bringing its buying and selling value precariously near $55,000.

In keeping with analyst Scott Melker, Bitcoin has breached essential help ranges that are actually appearing as resistance, doubtlessly resulting in additional declines. He cautioned,

“Nothing however air till round $52,000 on the chart.”

This advised that Bitcoin may face a free-fall if it fails to keep up present help ranges.

The technical perspective presents a bleak outlook as nicely.

Melker identified that the Relative Power Index (RSI), sometimes a dependable indicator of when an asset is oversold and more likely to rebound, has not reached oversold territory.

This deviation suggests an absence of sturdy shopping for curiosity and helps the thesis of additional value drops.

This situation is mirrored within the broader value tendencies noticed on the charts, the place Bitcoin displays a sample of decrease highs and decrease lows, signaling sustained bearish momentum.

In keeping with Melker, the continued plunge is simply a fraction of what’s to return, noting,

“That is nonetheless ONLY A 23% correction, very shallow for a bull market and in step with different corrections on this run. We’re but to see a 30-40% pull again throughout this bull market, like these of the previous.”

Broader market implications

Past the instant value motion, broader market indicators reveal underlying challenges.

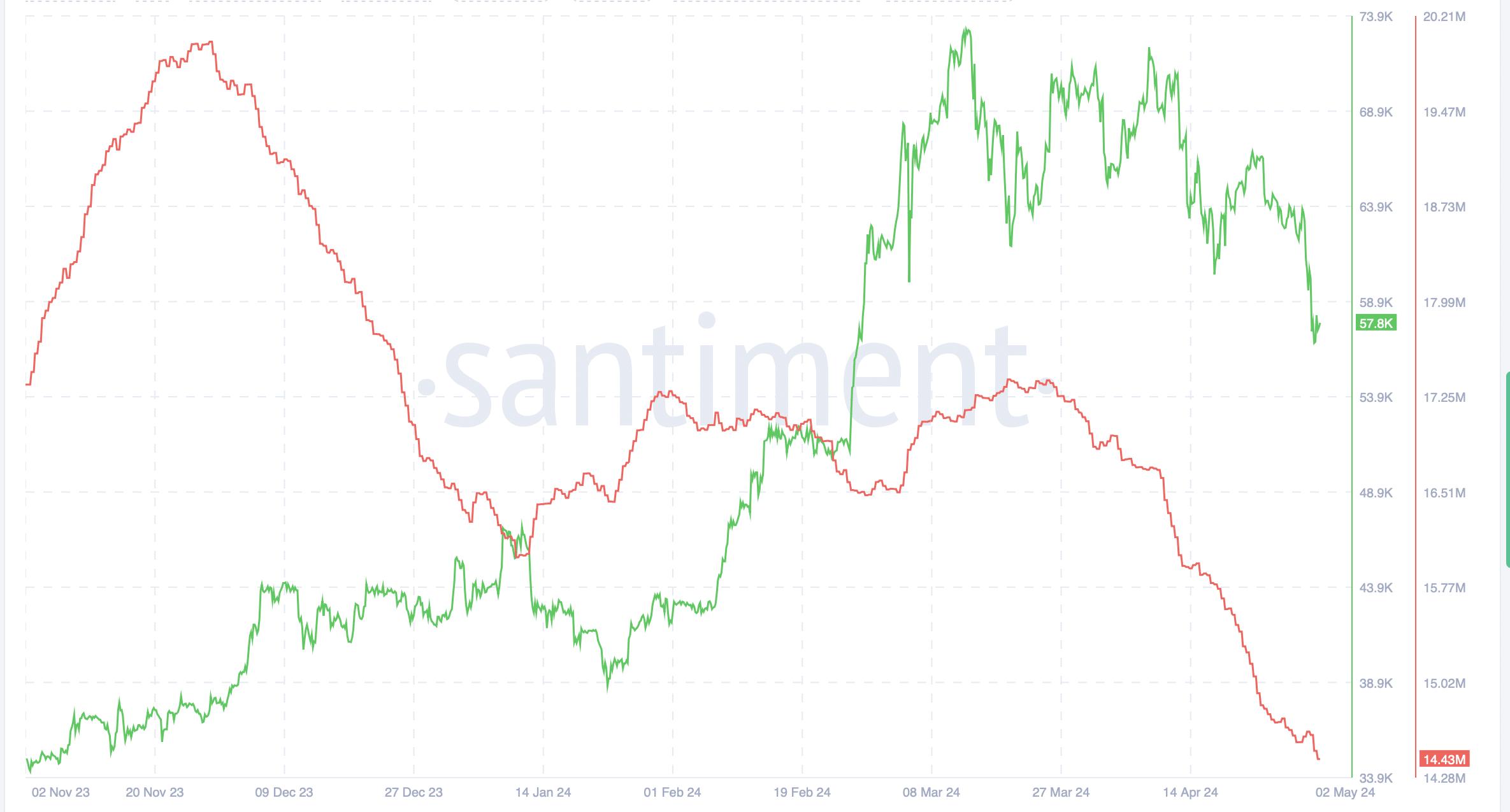

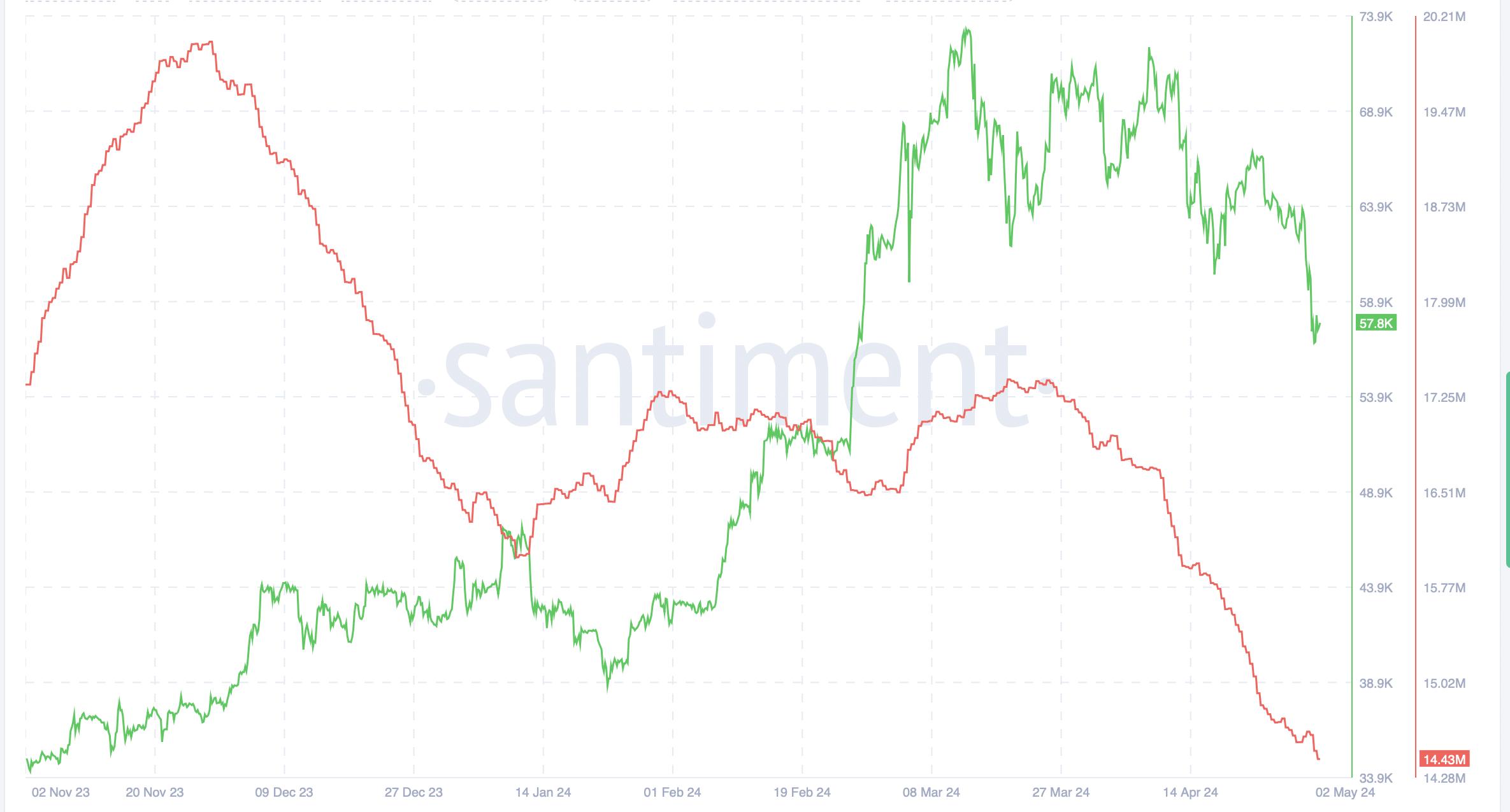

Data from blockchain analytics agency Santiment confirmed a big drop in Bitcoin’s day by day lively addresses.

It plummeted from over 17 million in March to round 14.7 million as of the first of Could, indicating waning consumer exercise and curiosity.

Supply: Santiment

The Social Dominance echoed this sentiment, displaying a 20% fall.

Supply: Santiment

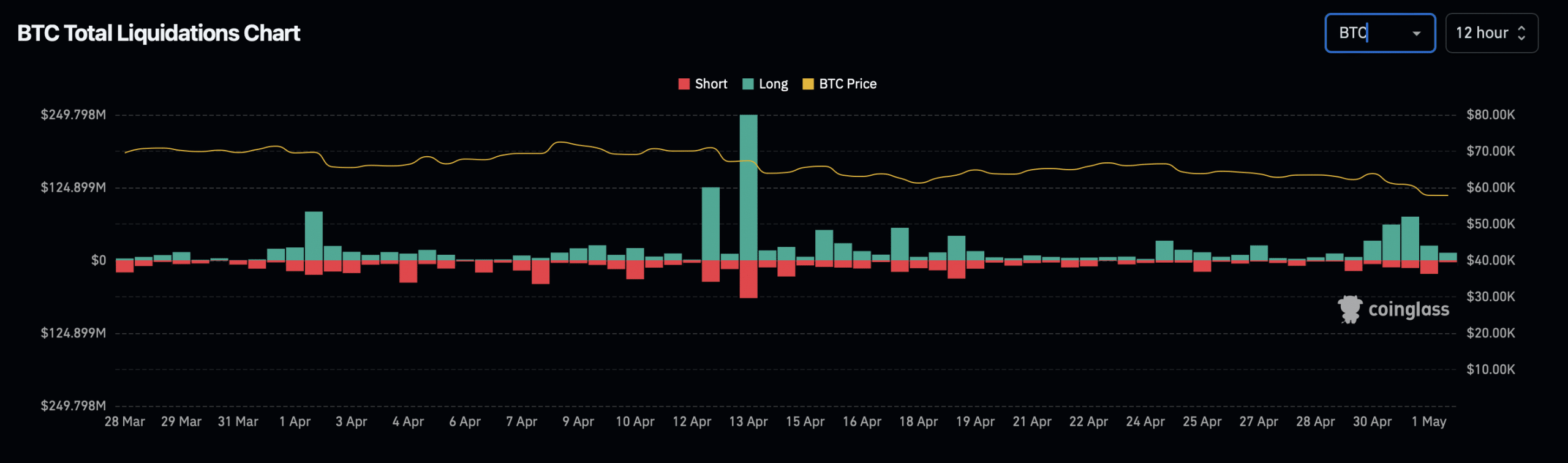

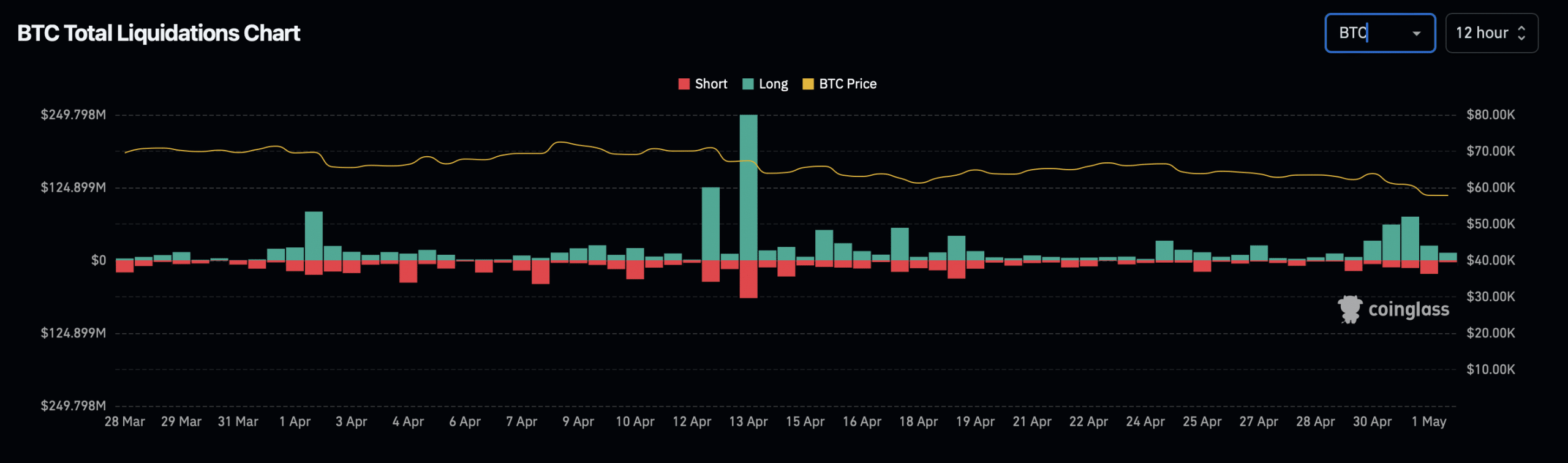

The downturn in Bitcoin’s worth has not solely dampened the aforementioned market metrics however has additionally triggered widespread liquidations, impacting quite a few merchants.

In keeping with Coinglass, within the final 24 hours alone, roughly 60,795 merchants have been liquidated, with complete liquidations amounting to $205.12 million.

Supply: Coinglass

Concurrently, as reported by AMBCrypto, the underwhelming debut of the newly listed spot ETFs in Hong Kong solely exacerbated the scenario.

These ETFs managed a mere $11 million in buying and selling quantity on their first day, starkly contrasting with the a lot greater figures achieved by U.S.-based spot ETFs at their launch in January.

Moreover, U.S. spot ETFs have been experiencing a big outflow, with $161 million withdrawn on Tuesday alone, marking the fifth consecutive day of outflows, as analyzed by AMBCrypto utilizing SoSo Worth information.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Moreover, the anticipation of the U.S. Federal Reserve sustaining regular rates of interest within the upcoming FOMC assembly—on account of higher-than-expected inflation—has led merchants to withdraw from riskier investments.

This added additional stress to an already strained market.