- Holders are dealing with unrealized losses, indicating a attainable shopping for alternative.

- Circulation decreased, suggesting validation of the bounce to $.7.46.

Worldcoin’s [WLD] value may need decreased by 45.17% within the final 30 days, however indicators on-chain confirmed that the decline might be a blessing in disguise.

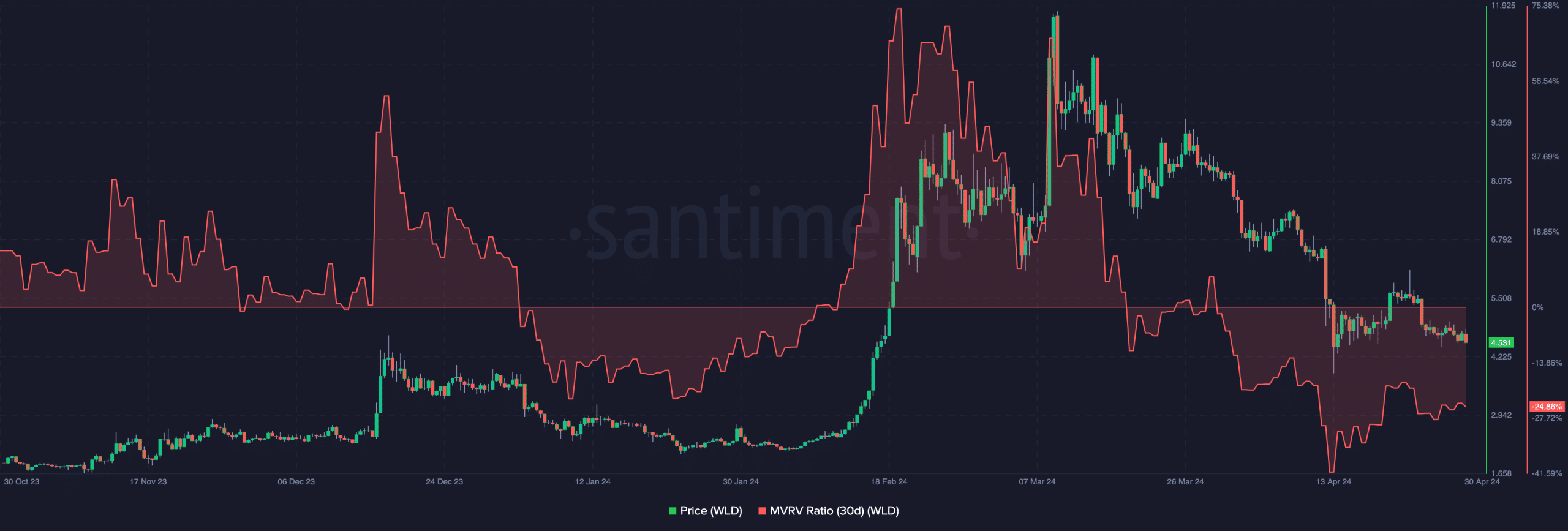

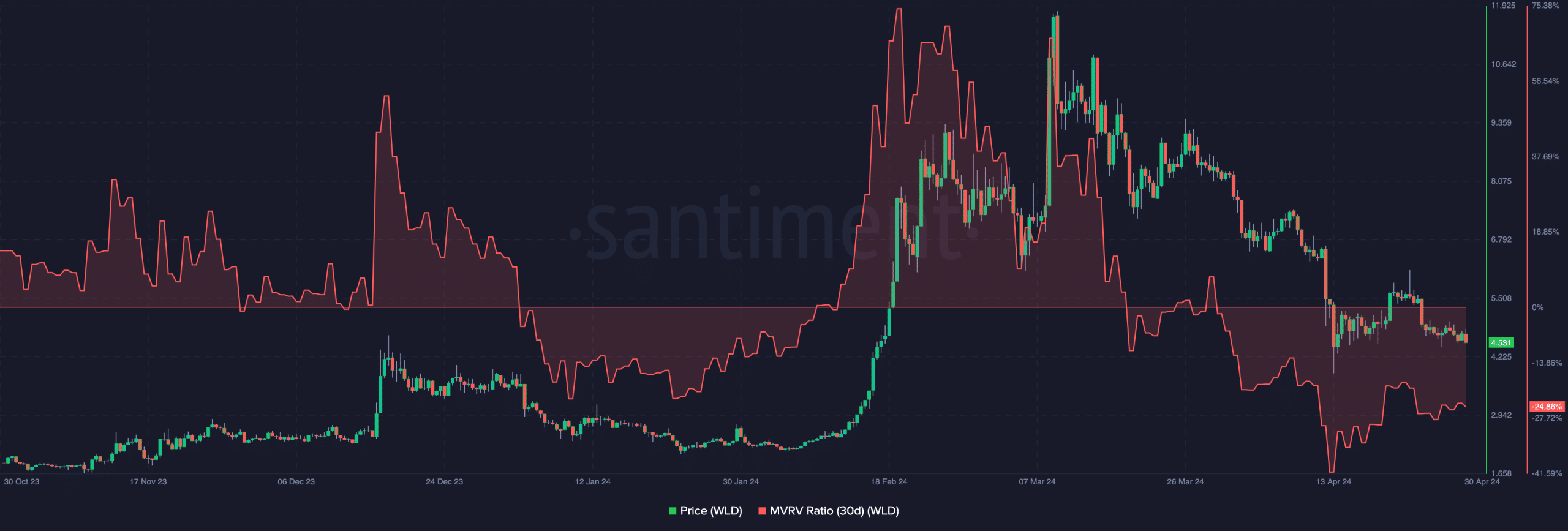

For starters, AMBCrypto evaluated the Market Worth to Realized Worth (MVRV) ratio. In response to knowledge obtained from Santiment, WLD’s 30-day MVRV ratio was -24.86%.

This knowledge implied that almost all holders of the token had been sitting on an unrealized loss. Due to this fact, if all of them determine to promote, the common holder must take care of a decrease funding worth.

However that’s unlikely to occur. For the value, the metric’s position might be a very good shopping for alternative earlier than Worldcoin begins to bounce.

Supply: Santiment

Returns are about to be higher

This inference didn’t come out of the blue, and historical past confirmed {that a} double-digit decline within the MVRV ratio has nearly at all times been a very good stage for restoration.

As an illustration, when the metric was at -22.25% in January, the value rallied from $2.50 to $11.88 a couple of weeks later. Nevertheless, this doesn’t suggest that Worldcoin would produce an identical return within the brief time period.

Nevertheless, there’s a excessive likelihood that the WLD would possibly hit $7.42 as this would depart the common return at $24.57%. Regardless of the bullish sign, individuals must be looking out.

One motive for this was Worldcoin’s decision to inflate its circulating provide. In response to the challenge, the rise was to satisfy the demand for its orb-verified World IDs.

Nevertheless, the assertion talked about that the workforce would solely launch 0.1% to 0.4% of the additional provide weekly. If demand for the token will increase as provide jumps, then WLD would possibly be capable to validate the prediction to $7.

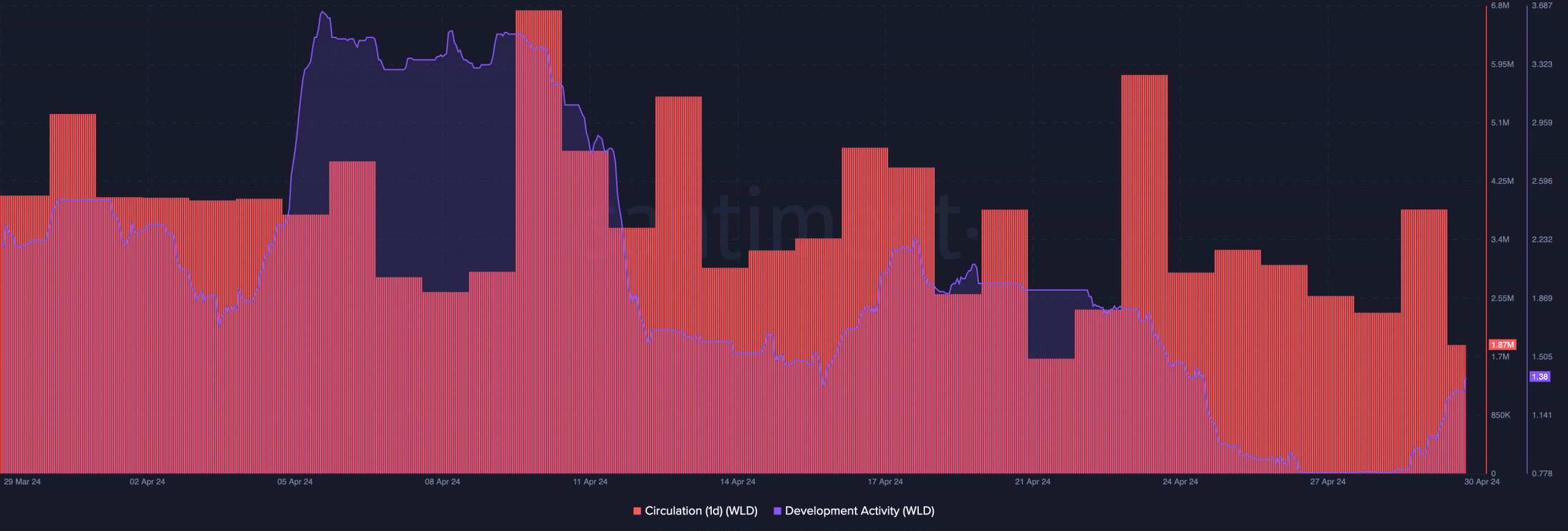

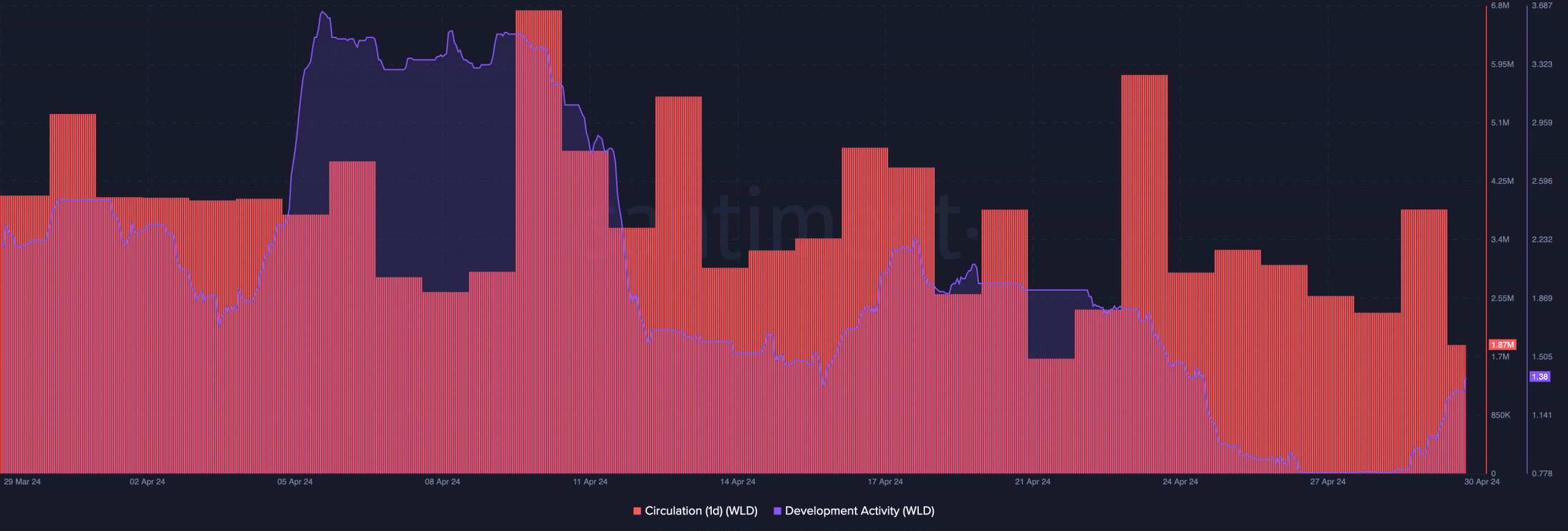

Then again, a bearish market situation with out most bids for the token would possibly stall the value rise. In the meantime, the one-day circulation dropped to 1.87 million, in response to Santiment.

This decline implied that fewer WLDs have been engaged in transactions. As such, promoting strain is perhaps minimal. Moreover, improvement exercise was starting to pick up once more on the Worldcoin community.

Supply: Santiment

Targets start on the higher resistance

The uptrend recommended that the challenge is perhaps transport out a brand new function quickly. Ought to this swing proceed, it might be a bullish validation that might influence the token’s value.

Moreover the on-chain viewpoint, it’s also necessary to examine the potential from the technical perspective. On the day by day chart, WLD shaped a descending channel that lasted from the ninth of March until the time of writing.

Nevertheless, it appeared that the bulls had discovered assist at $4.43, and had been dedicated to defending the realm.

Is your portfolio inexperienced? Try the WLD Revenue Calculator

Moreover, the Relative Power Index (RSI) was near being oversold, indicating {that a} bounce might be shut.

Supply: TradingView

The Cash Move Index (MFI) additionally indicated an identical sign. Ought to this prediction play out, the subsequent goal for Worldcoin might be an increase to $7.46.