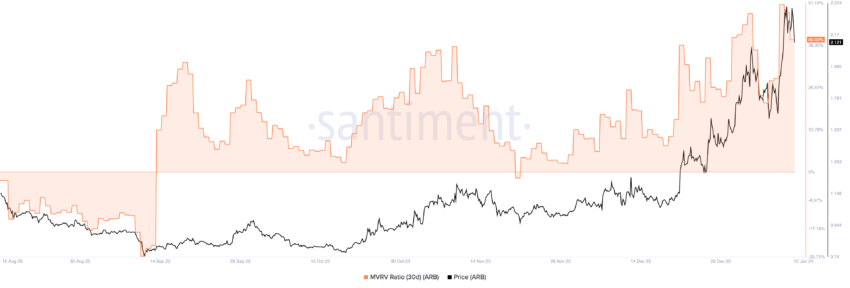

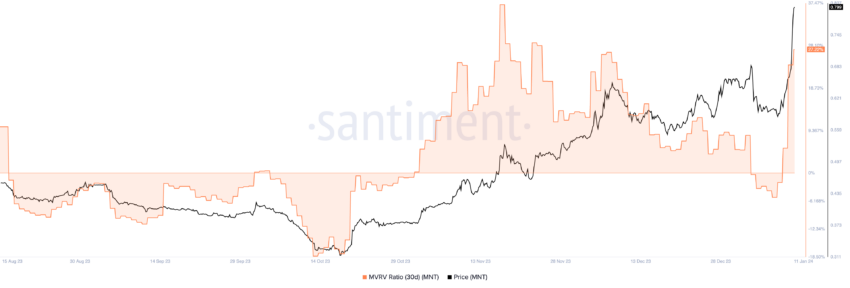

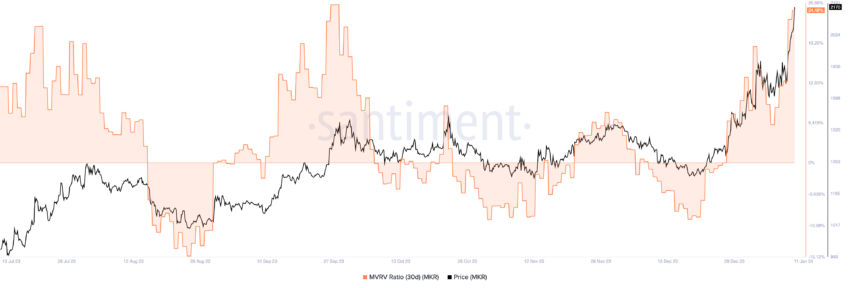

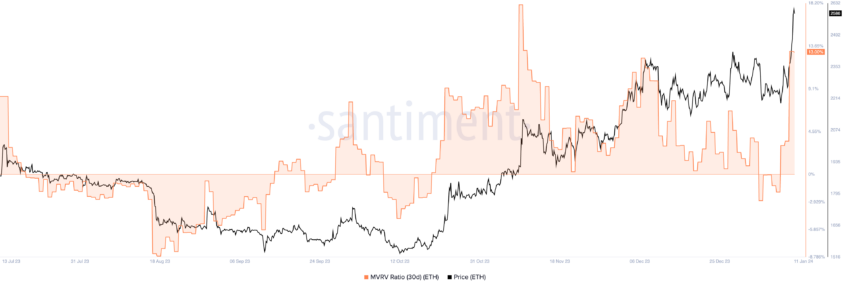

Savvy buyers keenly monitor market indicators to gauge potential shifts preemptively. One such metric, the MVRV (market-value-to-realized-value) ratio, has not too long ago highlighted a curious pattern amongst 5 altcoins.

Presently displaying excessive MVRV values, these digital belongings could also be poised for a value adjustment as a result of a spike in profit-taking actions.

The Most Overbought Altcoins

The MVRV ratio, evaluating an asset’s market capitalization to its realized capitalization, presents a window into whether or not an altcoin’s value aligns with its “truthful worth.”

When the market cap overtakes the realized cap, it indicators that unrealized earnings are peaking. This situation sometimes suggests an impending sell-off as buyers look to capitalize on positive aspects. Conversely, a decrease market cap relative to the realized cap would possibly sign undervaluation or tepid demand.

Learn extra: Prime 10 Most cost-effective Cryptocurrencies to Put money into January 2024

At current, these 5 altcoins exhibit elevated 30-day MVRV values, which suggests they commerce at overbought territory:

These figures point out that a good portion of the holdings in these belongings are in revenue, a traditional marker of market exuberance. This setting typically tempts buyers to liquidate holdings, aiming to maximise returns.

Is It Time to Promote Cryptos?

The choice to promote shouldn’t be taken flippantly. Certainly, cryptocurrency markets are notoriously risky, and what presently seems as an overbought asset might proceed to understand in worth.

The MVRV ratio, whereas insightful, just isn’t the one issue buyers ought to take into account. The broader market pattern, world financial circumstances, and particular cryptocurrency information additionally play pivotal roles in shaping an asset’s future worth. For example, updates in know-how, regulatory shifts, or modifications in investor sentiment can dramatically sway crypto costs.

Learn extra: 7 Should-Have Cryptocurrencies for Your Portfolio Earlier than the Subsequent Bull Run

Ethereum Identify Service, Arbitrum, Mantle, Maker, and Ethereum every have distinctive traits and narratives influencing their market positions. For that reason, buyers ought to weigh these alongside the MVRV ratio to type a holistic market view. This balanced method, tailor-made to at least one’s private funding technique and danger tolerance, is essential in navigating the market.

The present situation, marked by these altcoins’ excessive MVRV values, presents a crucial juncture for buyers. Whereas it could appear opportune to money in on the value positive aspects, a hasty choice might result in missed alternatives ought to the asset’s worth climb additional.

The crypto market’s inherent volatility calls for a measured method, mixing analytical insights with a sound understanding of market dynamics.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.