Solana’s (SOL) worth has elevated since January 23, breaking out from a corrective sample yesterday.

The long run SOL development could be decided by the value motion this week. Will SOL get away or get rejected?

Solana Breaks Out From Corrective Sample

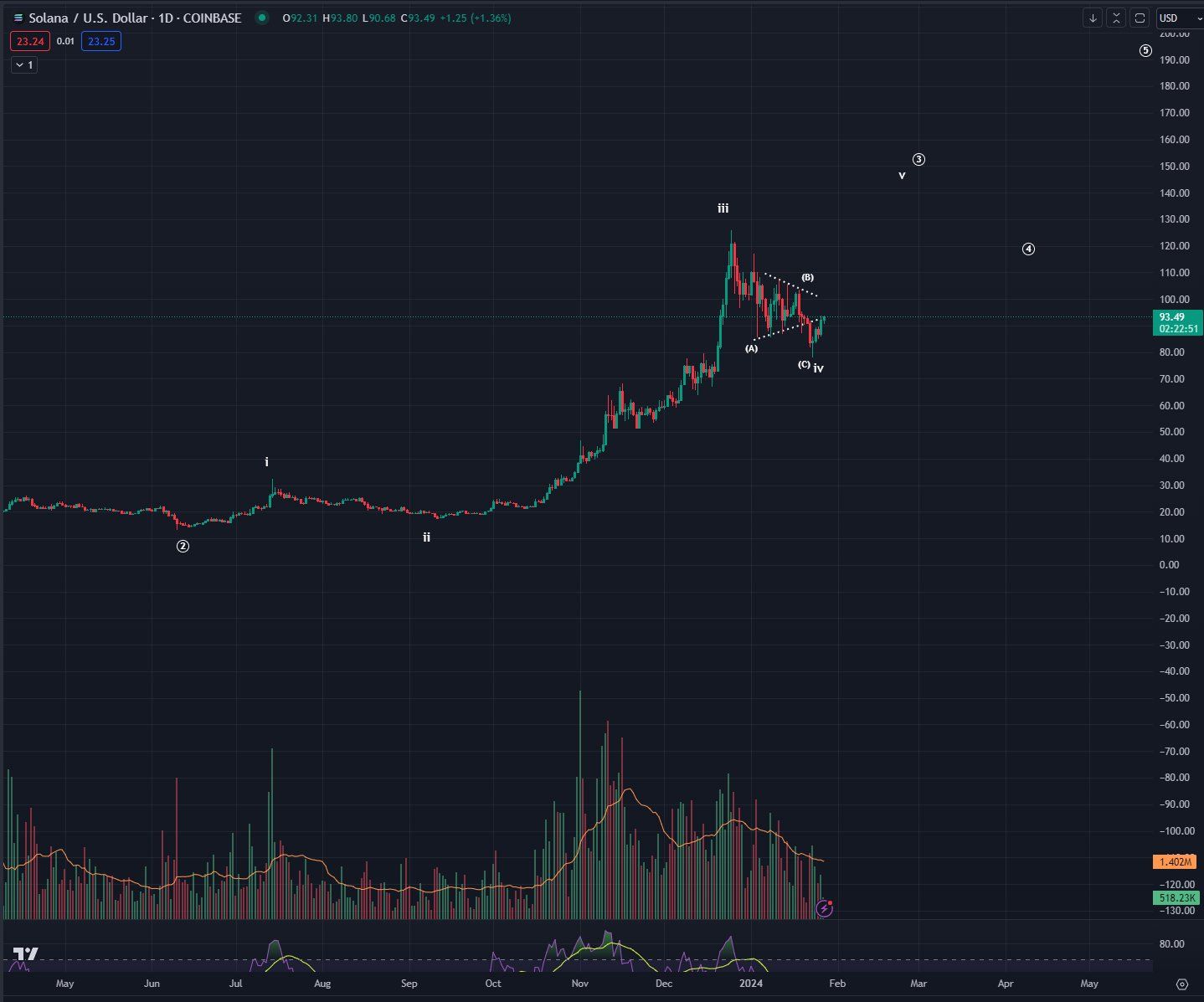

The technical evaluation of the every day time-frame exhibits that SOL has fallen since reaching its 2023 excessive of $126 on December 25. The lower has been contained inside a descending parallel channel and led to a low of $78 on January 23, 2024.

SOL bounced afterward and has elevated since. Yesterday, it broke out from the channel however has not elevated considerably. The breakout occurred shortly after a decentralized trade on Solana reached $250 million in buying and selling quantity.

The every day RSI provides an attention-grabbing studying. The RSI is a momentum indicator merchants use to judge whether or not a market is overbought or oversold and whether or not to build up or promote an asset.

Readings above 50 and an upward development recommend that bulls nonetheless have a bonus, whereas readings beneath 50 point out the alternative.

Final week, the RSI fell beneath 50 (purple circle) for the primary time because the upward motion started in September 2023 (purple icon). Whereas the indicator has moved above 50, it has not confirmed the rise, which is essential for the long run development.

Learn Extra: Methods to Purchase Solana (SOL) and Every thing You Must Know

What do Analysts Say?

Cryptocurrency merchants and analysts on X are bullish on the long run SOL development.

Bluntz Capital mentioned that SOL has accomplished sub-wave 4, and the subsequent upward transfer will take it to $150. He tweeted:

sol reclaimed breakdown vary, transfer as much as 150+ now mainly confirmed. bears about to study the true which means of ache.

Comparable ideas are given by CryptoMichNL, who tweeted:

#Solana is prepared for upward continuation right here. After the preliminary push upwards, there’s all the time a interval of consolidation, and it appears it’s ended. The next timeframe assist take a look at at $80 supplied assist. Appears to be like doubtless we’ll be persevering with in direction of $140.

Learn Extra: Prime 6 Solana Initiatives With Large Potential

SOL Value Prediction – When Will Value Break By way of $100?

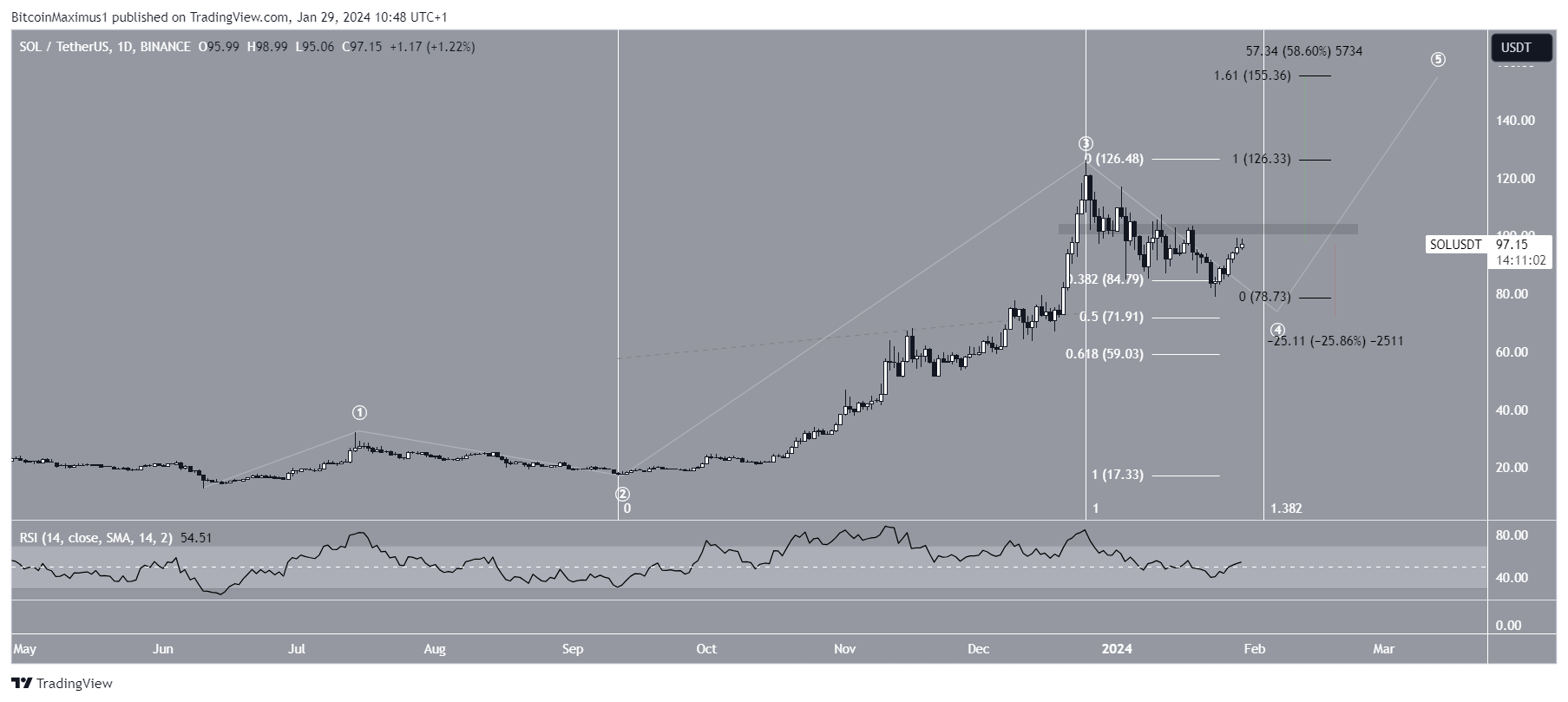

A better take a look at the wave rely and worth motion doesn’t affirm the development’s route.

Technical analysts make use of the Elliott Wave principle to establish recurring long-term worth patterns and investor psychology, which helps them decide the route of a development.

The wave rely means that the SOL worth is in wave 4 in a five-wave upward motion. Nevertheless, it doesn’t affirm whether or not wave 4 is full or not.

The argument for completion is that the SOL worth bounced on the 0.382 Fib retracement assist stage (inexperienced icon), a possible spot for wave 4 to finish.

Nevertheless, the argument towards it exhibits that the correction has been extraordinarily quick timewise, failing to achieve the 0.382 Fib size of wave two.

As outlined above, the every day RSI doesn’t affirm if the bullish development reversal has began. Because of this, the response to the $100 resistance space will likely be key in figuring out the long run SOL development.

A breakout above $100 can set off a 60% Solana worth improve to the subsequent resistance at $155, whereas a rejection will trigger a 25% drop to finish wave 4 on the 0.5 Fib retracement assist stage at $72.

For BeInCrypto‘s newest crypto market evaluation, click on right here.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.