- Elevated Invested Age and different metrics instructed that the majority MATIC holders had been opting to HODL.

- Excessive areas of liquidity existed between $0.75 and $0.78, indicating that the value might transfer in direction of these zones.

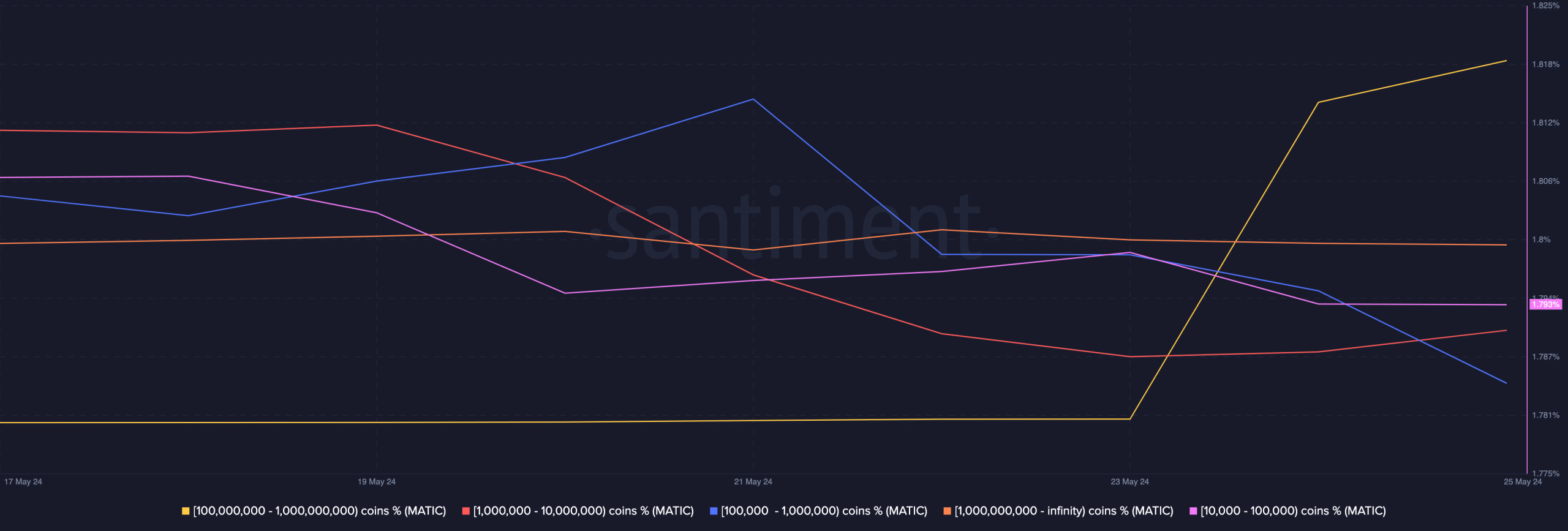

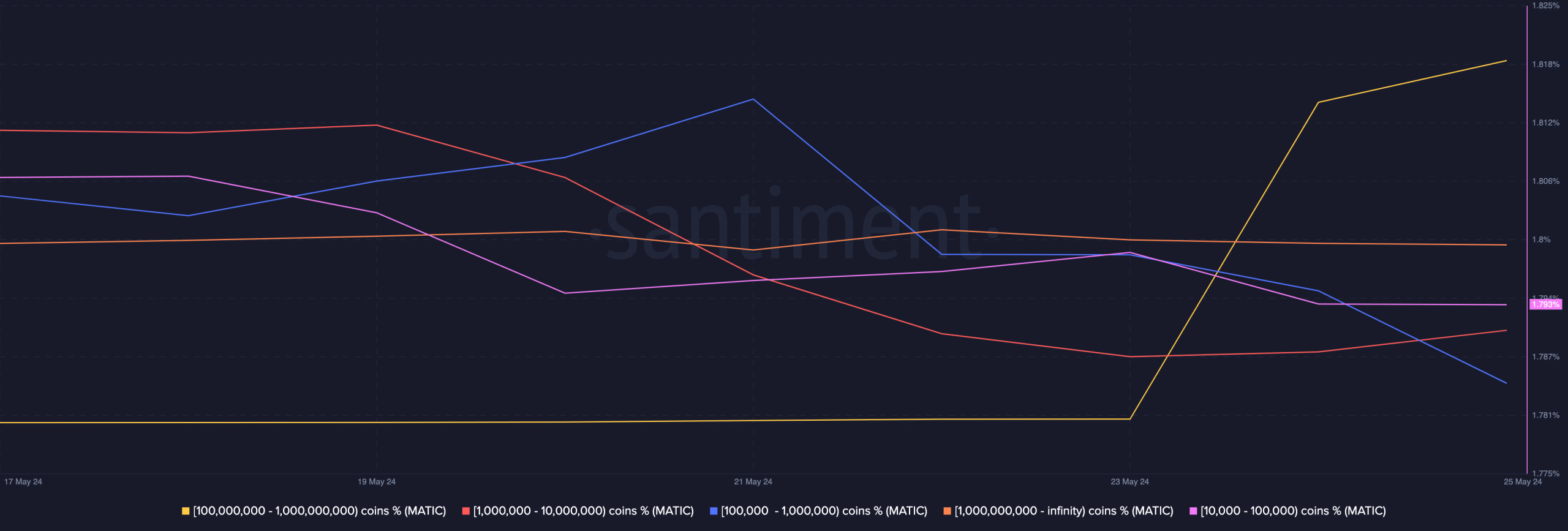

Opposite to what was taking place with different teams, Polygon [MATIC] addresses holding 100 million to 1 billion tokens have been added to their steadiness.

This was in accordance with knowledge supplied by Santiment. In accordance with the on-chain analytic platform, the provision held by this cohort was 16.17% on the twenty third of Might.

However as of this writing, the share had elevated to 17.30%.

Skeptics are not on the town

This improve denotes rising confidence within the long-term potential of the token. Nevertheless, it might additionally affect MATIC’s value motion within the quick time period.

For example, if whales (the time period for the group talked about) determine to distribute a big a part of their holdings, the token concerned might expertise a value lower.

Subsequently, the increase in balance has the potential to drive Polygon’s value greater. At press time, the value of the token was $0.72. This was a 25.48% decline within the final 90 days.

Supply: Santiment

Nevertheless, MATIC has been attempting to commerce greater throughout the final month. However each try to succeed in and surpass the $0.80 resistance, has been met with rejection.

However with the current accumulation, it could possibly be potential for the Polygon native token to climb. Regarding this potential, AMBCrypto evaluated different metrics and indicators to see in the event that they agreed.

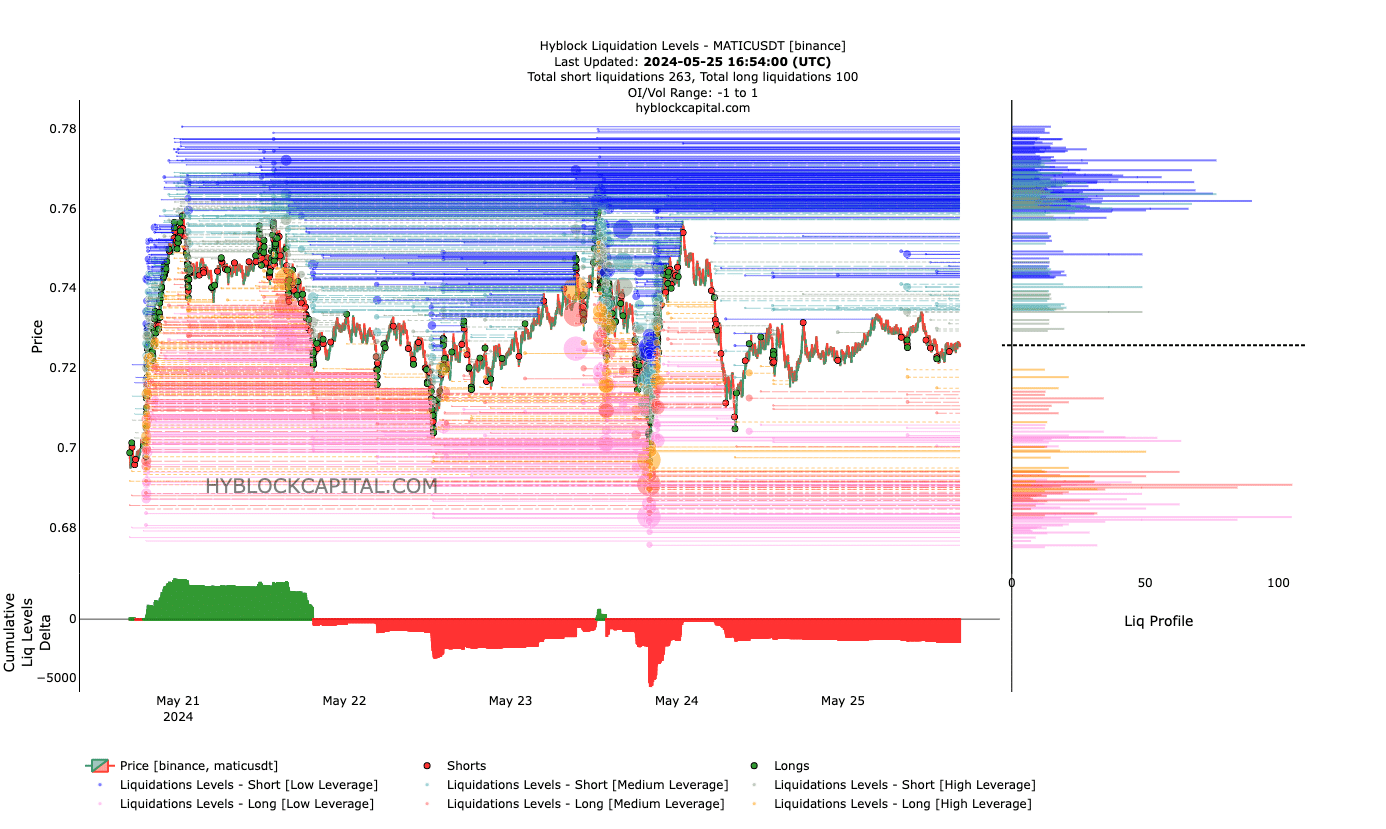

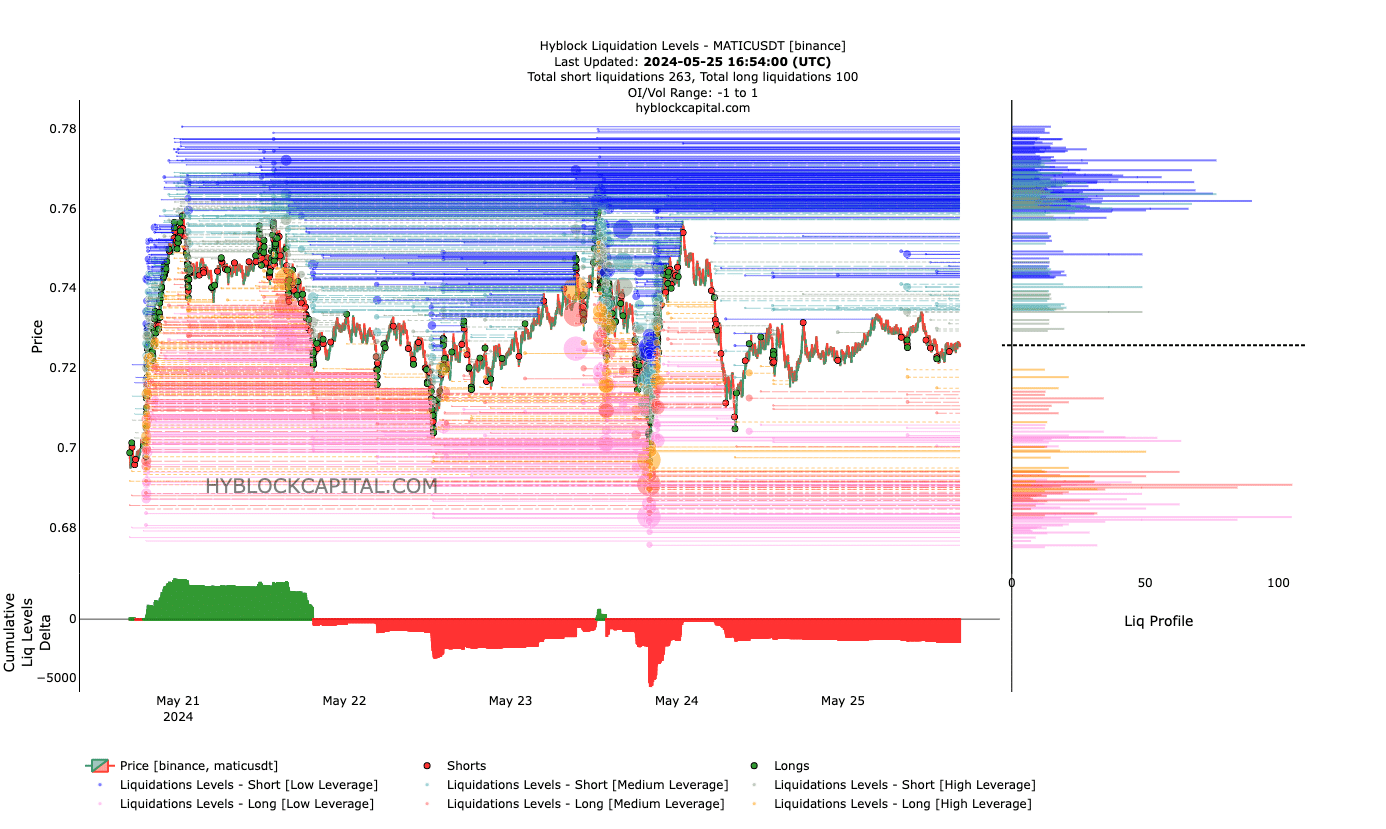

One of many indicators we checked out was the liquidation ranges. This indicator exhibits the value ranges a cryptocurrency can attain by highlighting excessive areas of liquidity.

As of this writing, excessive liquidity on the Polygon chart existed between $0.75 and $0.78. This magnetic zone indicated that the token may quickly begin shifting in that path.

The season of respite is coming

On the identical plot, the Cumulative Liquidation Ranges Delta (CLLD) validated the prediction. For context, the CLLD exhibits the distinction between lengthy and quick liquidations.

Constructive readings of the indicator counsel extra lengthy liquidations than shorts. However, a damaging studying of the CLLD signifies that there are extra quick liquidations than longs.

Supply: Hyblock

Other than this, the indicator influences the value motion. At press time, it was damaging. For Polygon’s value, this indicated {that a} sharp restoration could possibly be shut, and late shorts attempting to catch the dip may get punished.

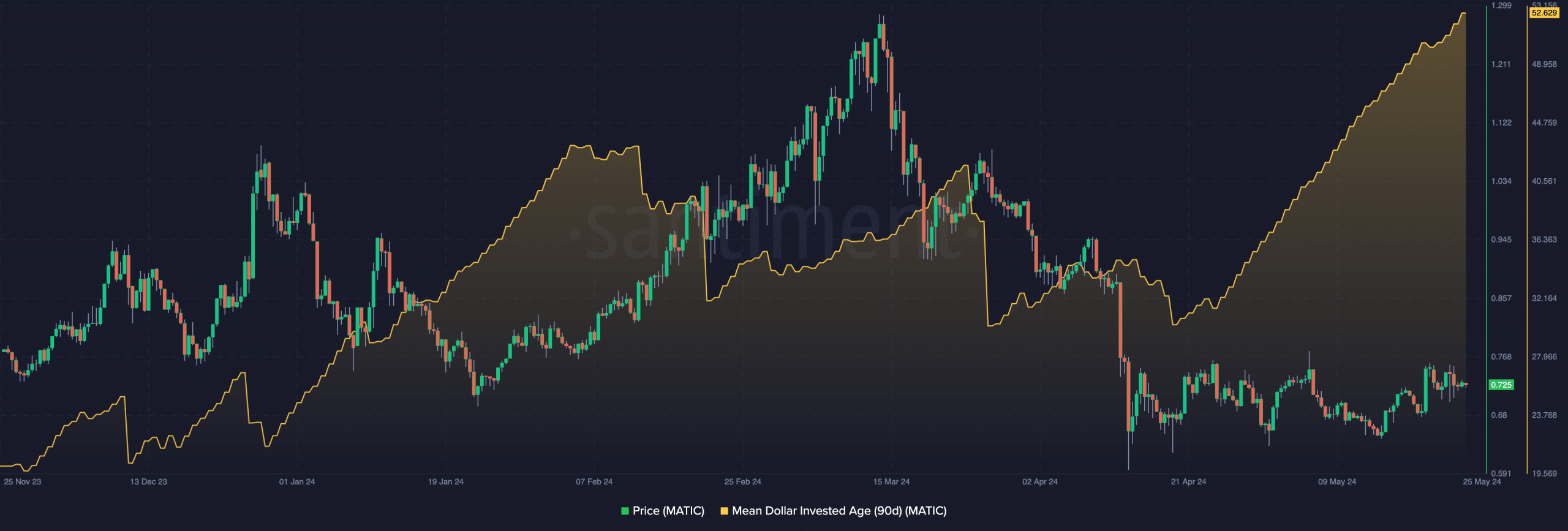

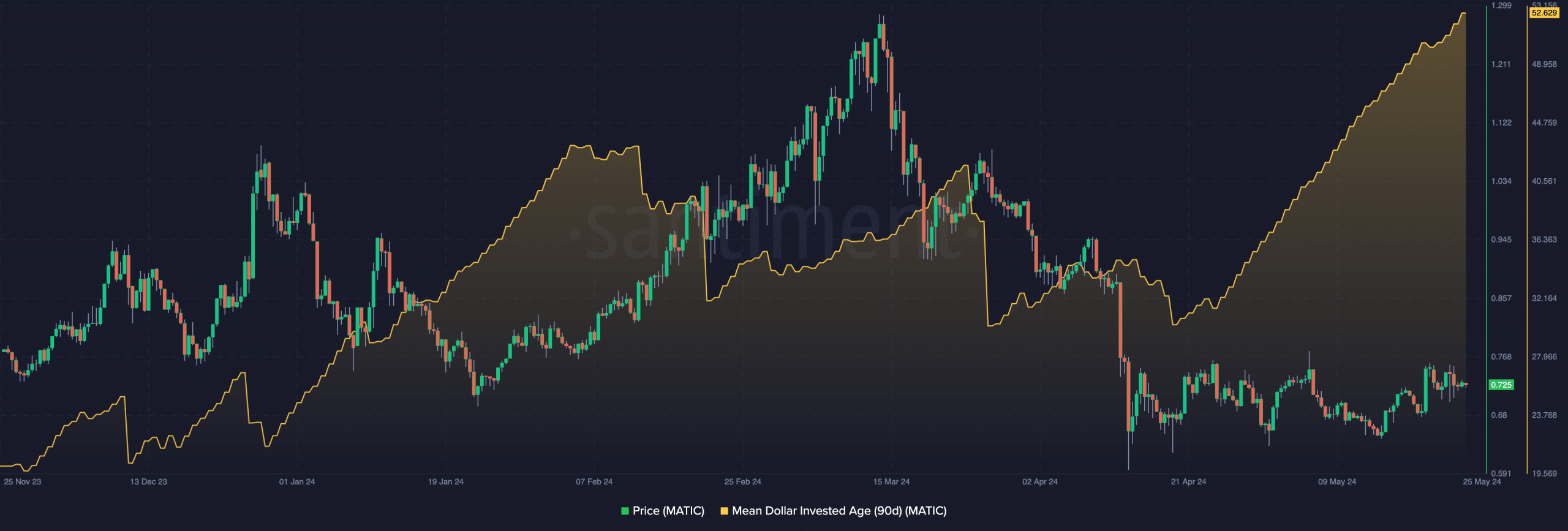

Moreover, the Imply Greenback Invested Age (MDIA) indicated that the majority members had leaned toward HODLing MATIC. The metric exhibits the common time all present Polygon addresses have held their tokens.

Learn Polygon’s [MATIC] Value Prediction 2024-2025

If the studying of the MDIA decreases it signifies rising transaction exercise. Generally, this might gasoline promoting stress. At press time, the 90-day MDIA elevated.

Supply: Santiment

The final time, the metric made such a constant transfer, MATIC went from $0.71 to $1.27. Whereas this won’t be the identical case this time, the value of the token may shut in or surpass $1 within the midterm.

![Why Polygon [MATIC] is on track for a price rise](https://wearecryptonians.com/wp-content/uploads/2024/05/polygon-news-and-mid-term-projection-1000x600.webp)