Pendle is on the forefront of a pattern of DeFi 2.0, a brand new set of networks constructing its liquidity. Some initiatives in DeFi 2.0 are trending and infrequently outpace the expansion of Bitcoin (BTC). DeFi 2.0 consists of new L2 scaling networks, whose infrastructure has expanded lately.

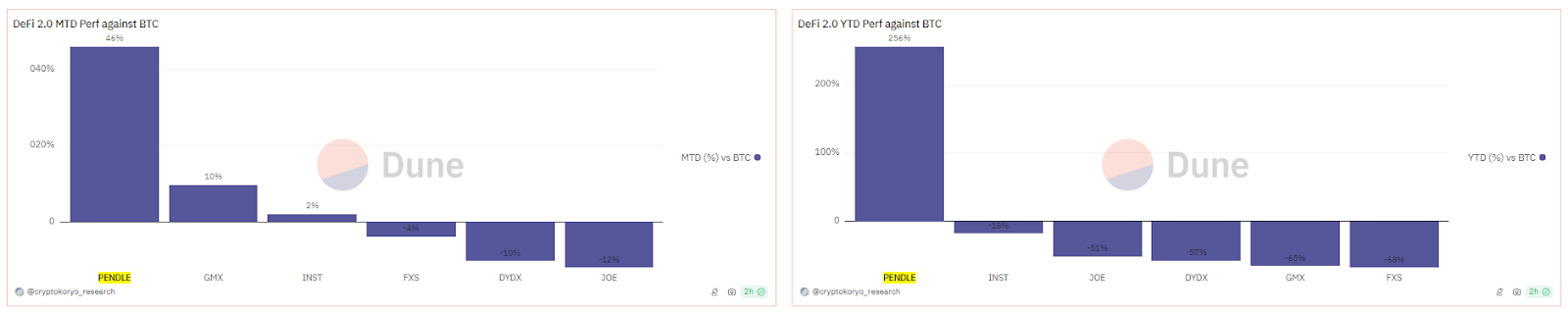

DeFi 2.0 denotes a number of narratives, however current evaluation considers a number of consultant initiatives. Pendle emerged because the rational chief in worth development, each in greenback phrases and in opposition to BTC. Different initiatives within the DeFi 2.0 area of interest embrace Dealer Joe (JOE), GameX (GMX), Instadapp (INST), Frax Share (FXS), and DyDx (DYDX).

The number of tokens managed to broaden in opposition to BTC over the previous month, with Pendle seeing its greatest development to this point this 12 months. DeFi 2.0 consists of smaller tokens, a few of which have taken a step again. Nevertheless, within the year-to-date chart, DeFi 2.0 has a risk-adjusted return of 46% and is the third greatest story behind Liquid Staking Derivatives and BTC itself.

The rise of DeFi 2.0 follows the expansion of the opposite huge number of initiatives often known as DeFi 1.0. These initiatives benefited from the bull market with rising volumes and rising worth underneath administration.

DeFi 1.0 additionally confirmed related efficiency, boosted by Uniswap (UNI), Aave (AAVE), Sushi Swap (SUSHI), Curve (CRV), Compound (COMP), and Maker (MKR). DeFi 1.0 nonetheless advantages from excessive and steady ETH market costs and extra versatile methods to keep away from liquidations.

DeFi 2.0 doesn’t compete instantly, however rises alongside DeFi 1.0. A brand new set of DEX depends on completely different communities, however follows the identical growth sample. DeFi 2.0 can also be tied to the growth by Liquidity Restaking Tokens, a brand new instrument to faucet into the liquidity of staked ETH.

Pendle leads the returns sector in DeFi 2.0

Pendle is a return protocol that reveals a return to passive earnings. After the crash of FTX and different credit score and yield protocols, a brand new bull market made these enterprise fashions viable once more.

The worth captured in Pendle has grown since early 2024, reaching $6.15 billion. Pendle carries worth, which is used as collateral for USDC inside the system, and yields tokens. Pendle’s aim is to function a platform for buying and selling tokenized future yield.

Additionally learn: Pendle Finance regains management: Fast motion versus unauthorized use of property

Pendle depends on direct consumer deposits and holds a number of crypto property. When customers deposit tokens, they obtain Possession Tokens (OT) and Yield Tokens (YT), which characterize a proper to future returns. Income tokens can then be traded to lock in income instantly.

Pendle due to this fact takes tokenization one step additional. As an alternative of a passive return, savers are given the instant freedom to re-trade their returns. Token holders also can present liquidity to help the value of OT and YT property. Moreover, Pendle has USDC and cDAI stablecoins for extra intuitive buying and selling.

Pendle is buying and selling near report highs

Demand for yield helped Pendle attain a double-digit report in 2024. PENDLE market costs returned to close all-time highs in late Could. The token traded at $6.80, with volumes exceeding $43 million in 24 hours.

PENDLE broke out because it constructed worth. Initially, the token was listed on the experimental Binance market, however subsequently acquired two comparatively liquid buying and selling pairs.

Pendle can also be rising by including new swimming pools and incubating liquidity. By way of Pendle, customers can generate factors and reap the benefits of ‘tokenless protocols’. Thus far, Pendle’s cumulative buying and selling quantity has reached $18 billion.

Additionally learn: EigenLayer enhances the Ethereum ecosystem with six new validated providers

The Pendle platform can also be a instrument to tokenize and extract worth from Liquid Restaking Tokens, a brand new asset launched with few worth discovery instruments. Initially a impartial market, Pendle can present liquidity and potential merchants for the Liquid Restaking Token and Eigen Layer initiatives.

Pendle additionally has few rivals, particularly after weeks of hitting all-time highs in worth retention and worth motion.

Cryptopolitan reporting by Hristina Vasileva