- BTC dropped close to the $60K psychological help after FOMC Minutes.

- Will U.S. CPI knowledge set off a rebound or escalate the decline?

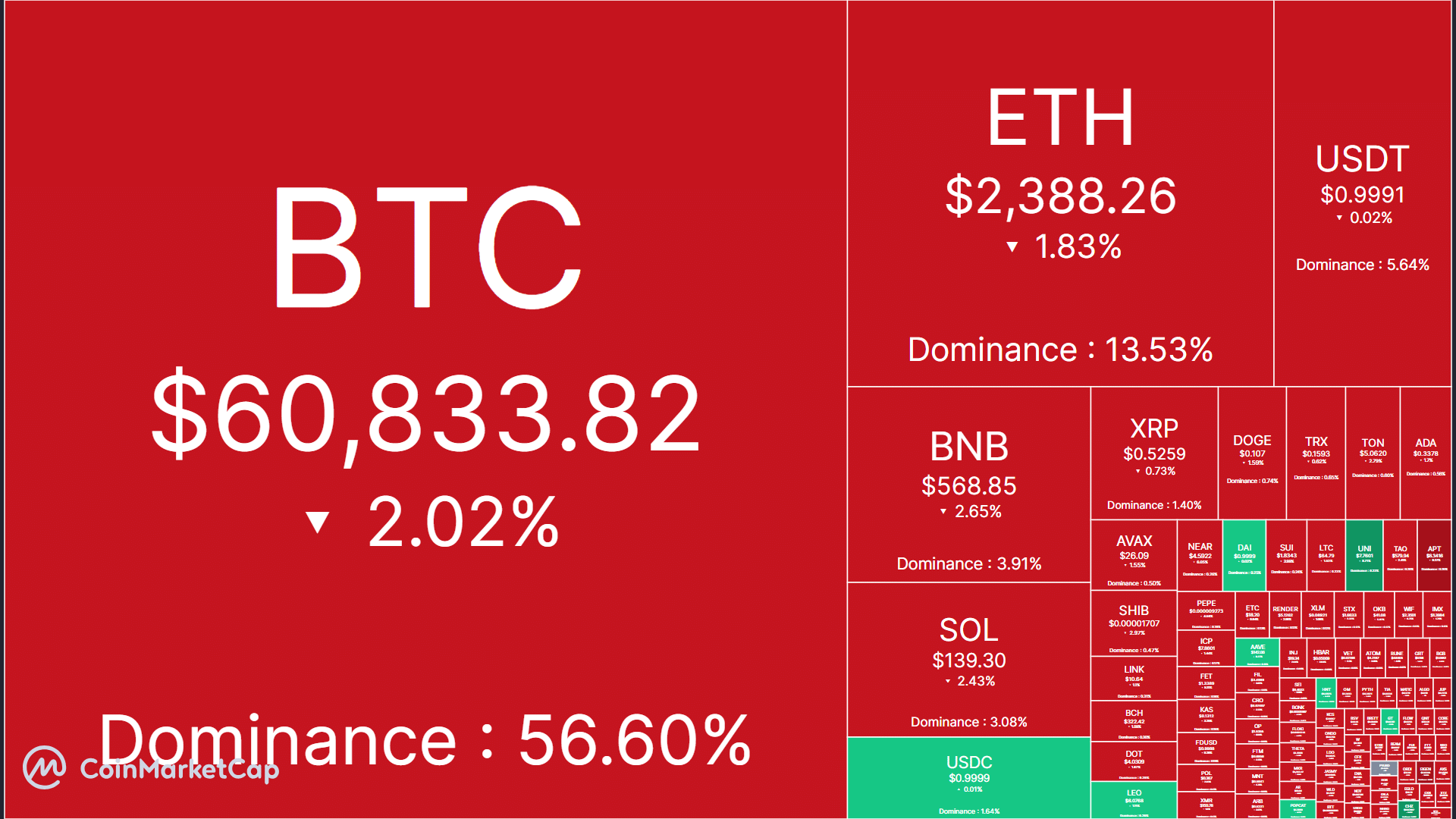

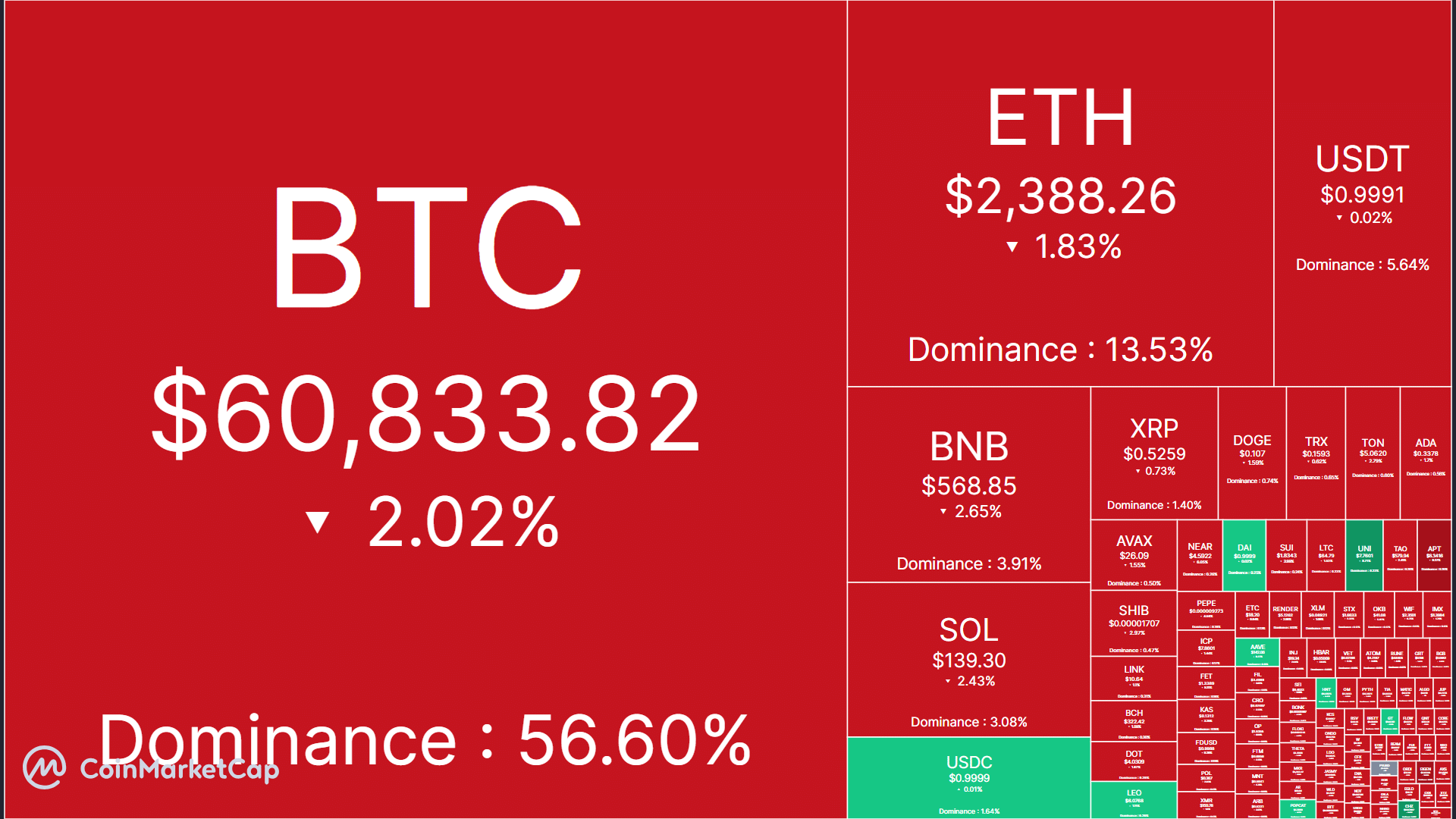

On the ninth of October, Bitcoin [BTC] led the crypto market decline, shedding 2.45% and sinking to important help.

The world’s largest digital asset misplaced $1.5K, dropping from $62.5K to a low of $60.3k, following the discharge of FOMC Minutes from the September assembly.

FOMC minutes sink BTC, crypto

Supply: CoinMarketCap

Among the many majors, Binance [BNB] noticed the very best retracement at 2.65% at press time.

XRP noticed a negligible decline, whereas Solana [SOL] and Ethereum [ETH] had been down 2.4% and 1.8% respectively. However Uniswap [UNI] emerged as a high each day gainer.

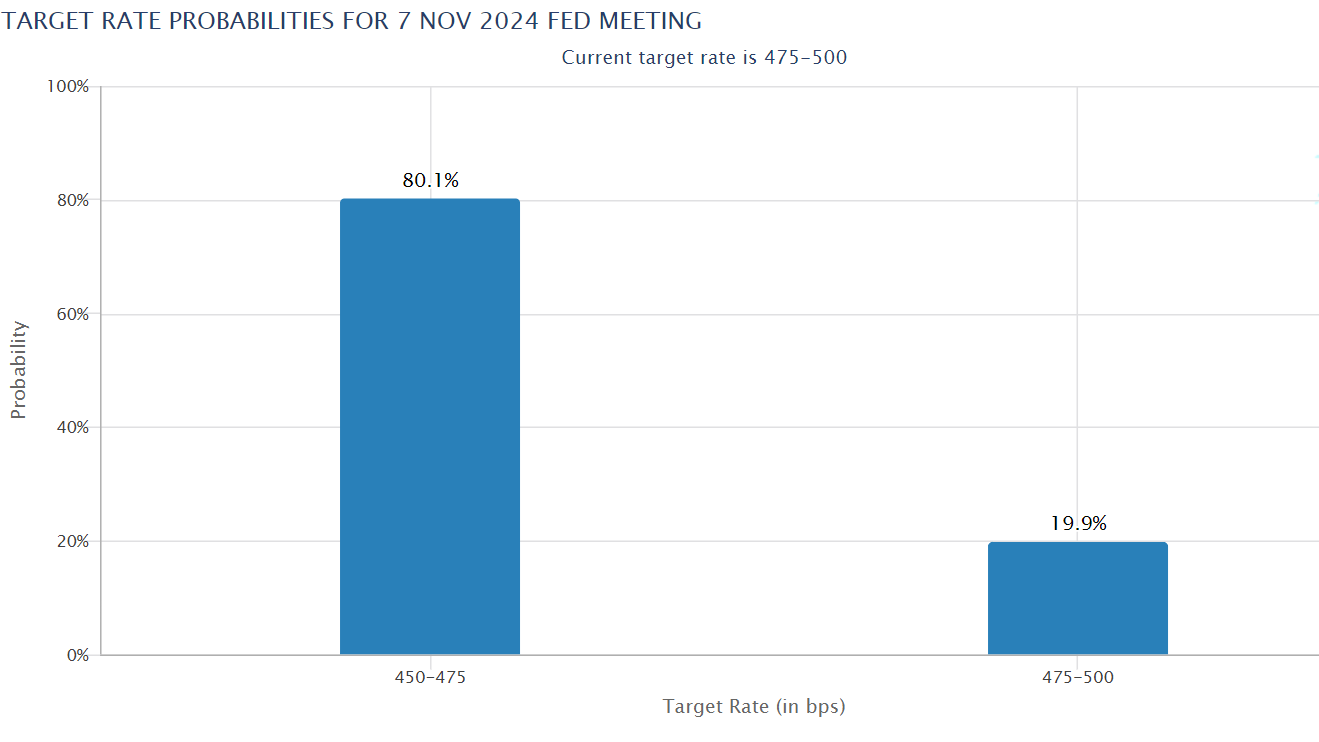

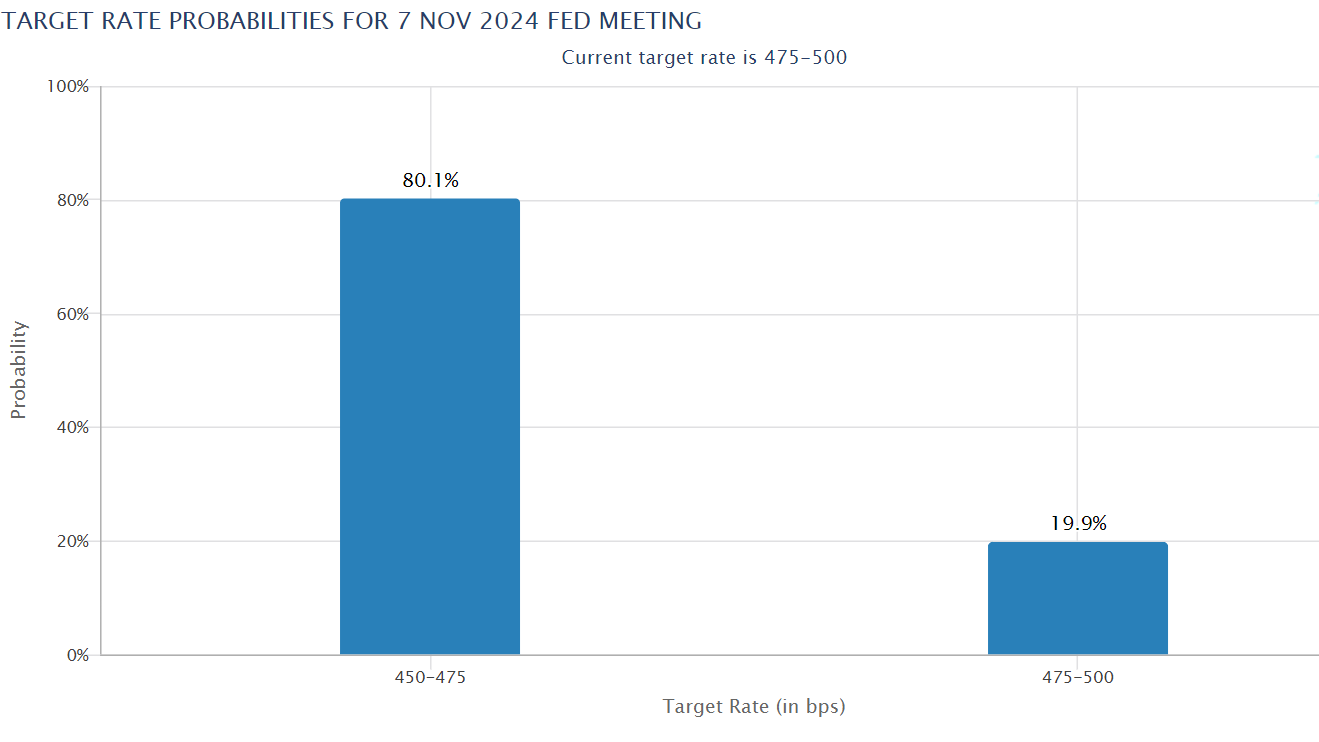

The market decline was as a result of FOMC Minutes, which lowered expectations of one other 50 bps (foundation factors) Fed price lower in November.

Notably, the minutes confirmed that the majority members supported the aggressive 50 bps Fed price cuts in September, citing weak US labor market circumstances. This was based mostly on the information at the moment.

Nevertheless, the U.S. labor market has since seen exceptional progress. Based on data launched on the 4th of October, 250K roles had been added in September, exceeding analysts’ expectations.

This meant that labor market concern, a important think about an aggressive price lower projection, was off the desk.

Ergo, analysts projected that the Fed would select to implement a 25 bps price lower or preserve present charges unchanged.

At press time, merchants had been pricing 80% of a 25 bps lower and a 20% probability of maintaining the present charges unchanged.

Supply: CME FedWatch

Nevertheless, this might change relying on the September inflation knowledge (CPI). BTC has proven elevated sensitivity to Fed price lower expectations and U.S. equities, a typical response widespread with ‘risk-on’ belongings.

Curiously, U.S. equities didn’t sink like crypto markets after the FOMC Minutes. U.S. shares closed in inexperienced, as BTC confronted elevated promote stress.

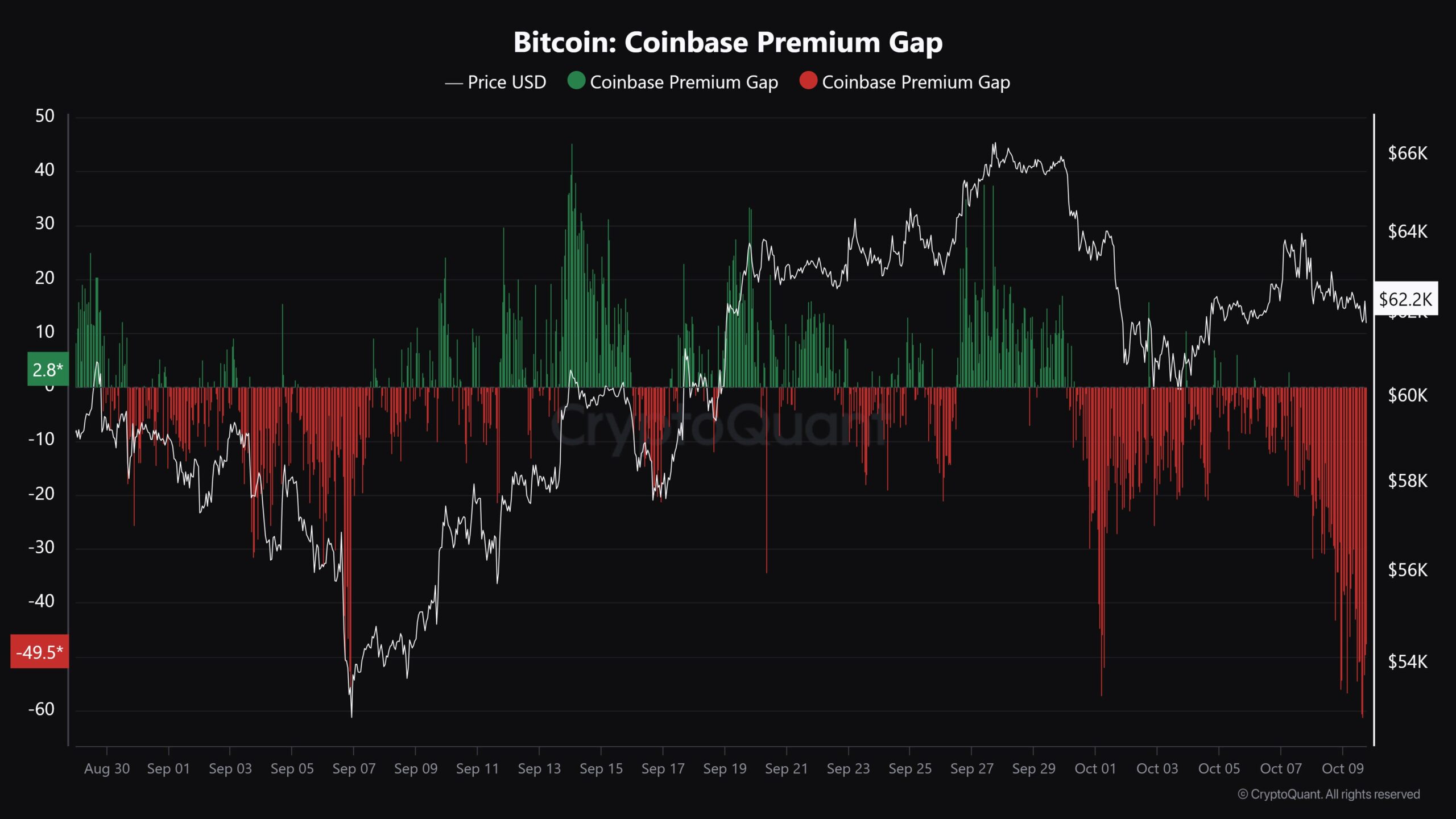

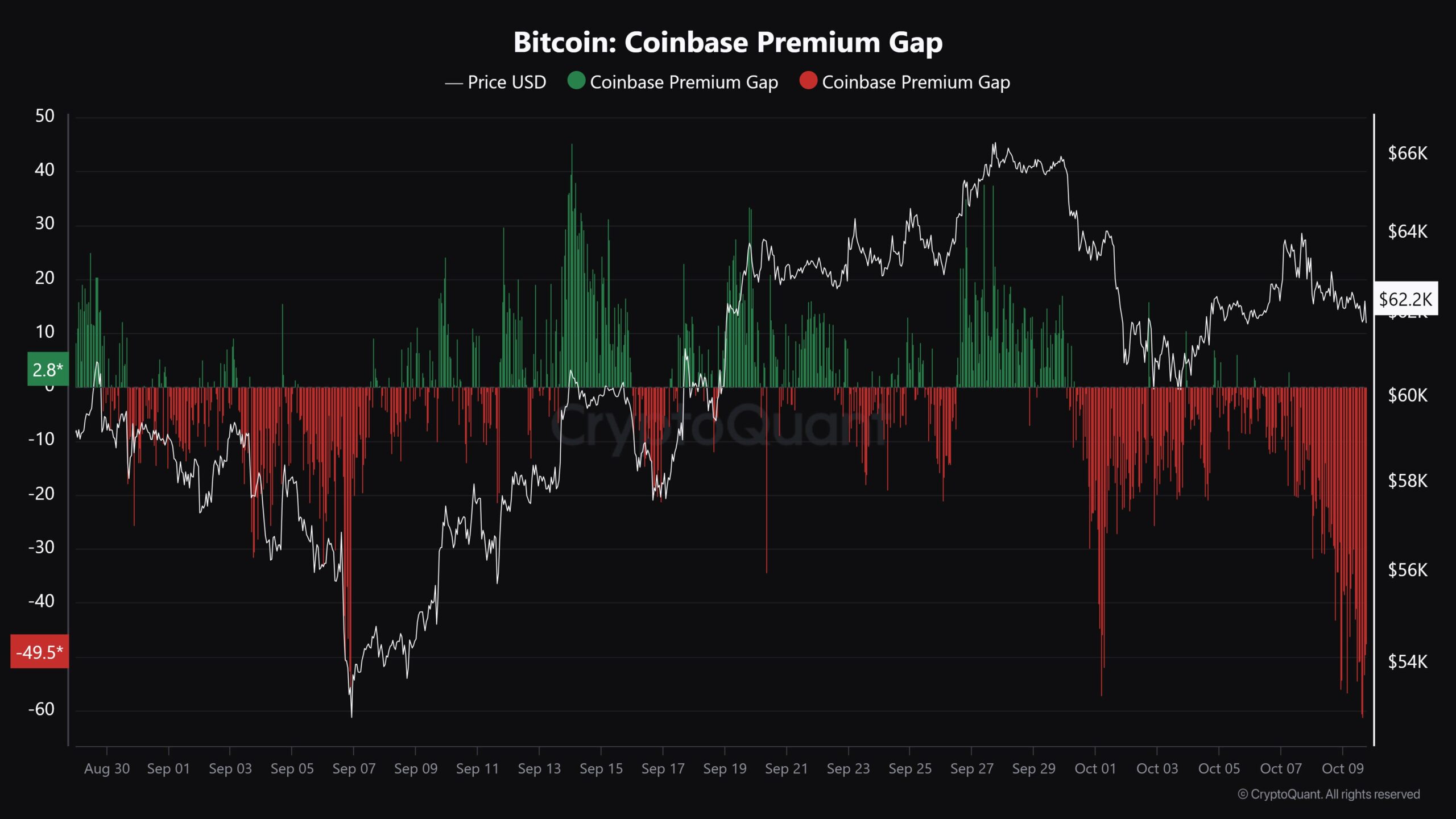

Based on CryptoQuant’s JA Maartun, the BTC plunge may reverse if the U.S. traders eased the promoting stress.

“Prediction: Bitcoin is poised for a pointy rise as soon as the Coinbase vendor is completed.”

Supply: CryptoQuant

On value charts, BTC was at key help close to $60K. Though the help stopped the plunge in early October, whether or not it would maintain after the U.S. CPI knowledge remained to be seen.

Ought to the $60K help maintain, a rebound towards the 200-day MA (Transferring Common) of $63.5K could be possible.

Nevertheless, a crack under the help post-CPI may drag BTC to the subsequent help at $58K.

Supply: BTCUSDT, TradingView