- Bitcoin doesn’t have a bullish sentiment within the brief time period, however a transfer towards $67k may very well be probably.

- Macro information occasions concerning September expectations might have dealt a bearish blow to BTC.

Bitcoin [BTC] is the king of crypto, not simply because it has the most important market capitalization. It’s the most sturdy and the earliest out there, and has been a wind vane for the sentiment over the previous decade.

Its worth actions affect many of the crypto market and may help reply the query of why crypto is down at this time.

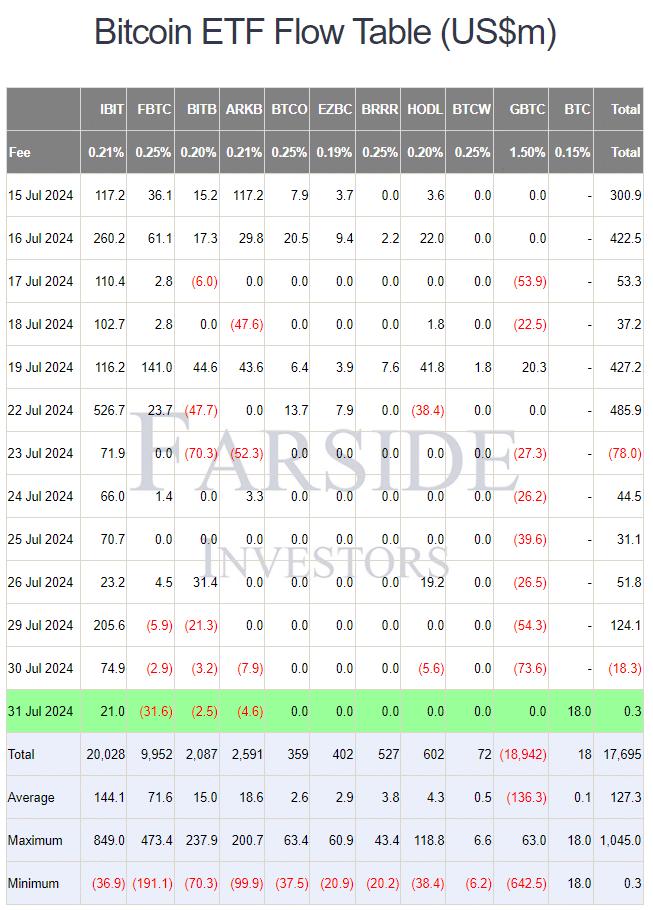

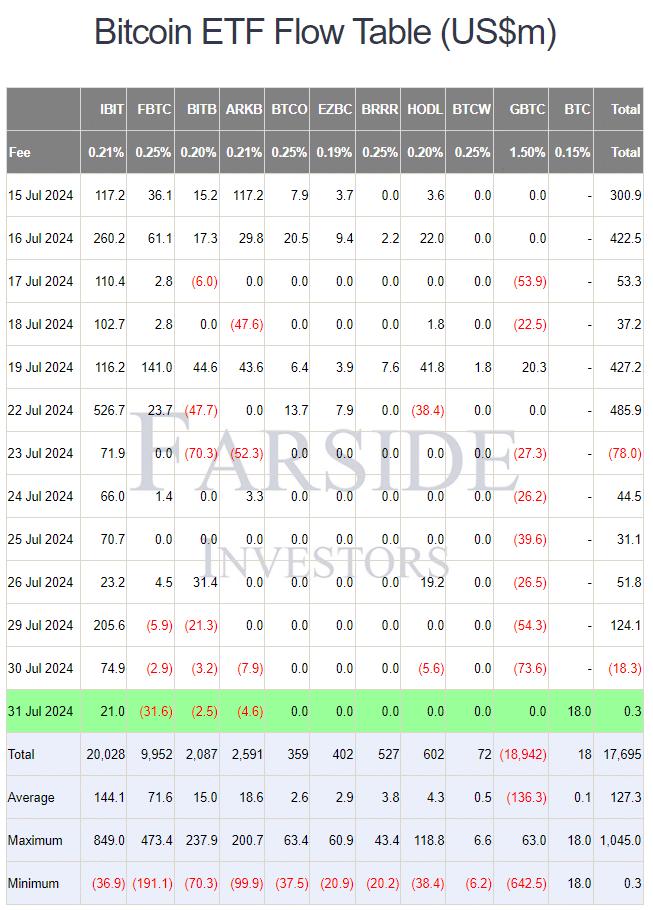

Supply: Farside Traders

The ETF flows have been subdued over the previous two days, a short-term signal of bearish sentiment. It probably won’t dictate the long-term development. That is because of liquidity and what the broader market expectations are.

The FOMC assembly threw a spanner within the works

The US Federal Reserve has not modified its benchmark fed funds charge from the 5.25%-5.5% vary. Whereas this was excellent news, it additionally didn’t give any optimistic indications a few September charge lower.

FOMC’s assertion learn,

“Inflation has eased over the previous yr however stays considerably elevated.”

It continued,

“The Committee seeks to attain most employment and inflation on the charge of two p.c over the longer run.”

Knowledge from the CME FedWatch confirmed that the market doesn’t count on a charge lower in mid-September. Earlier than the FOMC assembly, this was not the case, and a 0.25% (25 foundation level) charge discount was anticipated in September.

This hawkish information may need led to Bitcoin’s costs tanking.

Clues from metrics and liquidation ranges

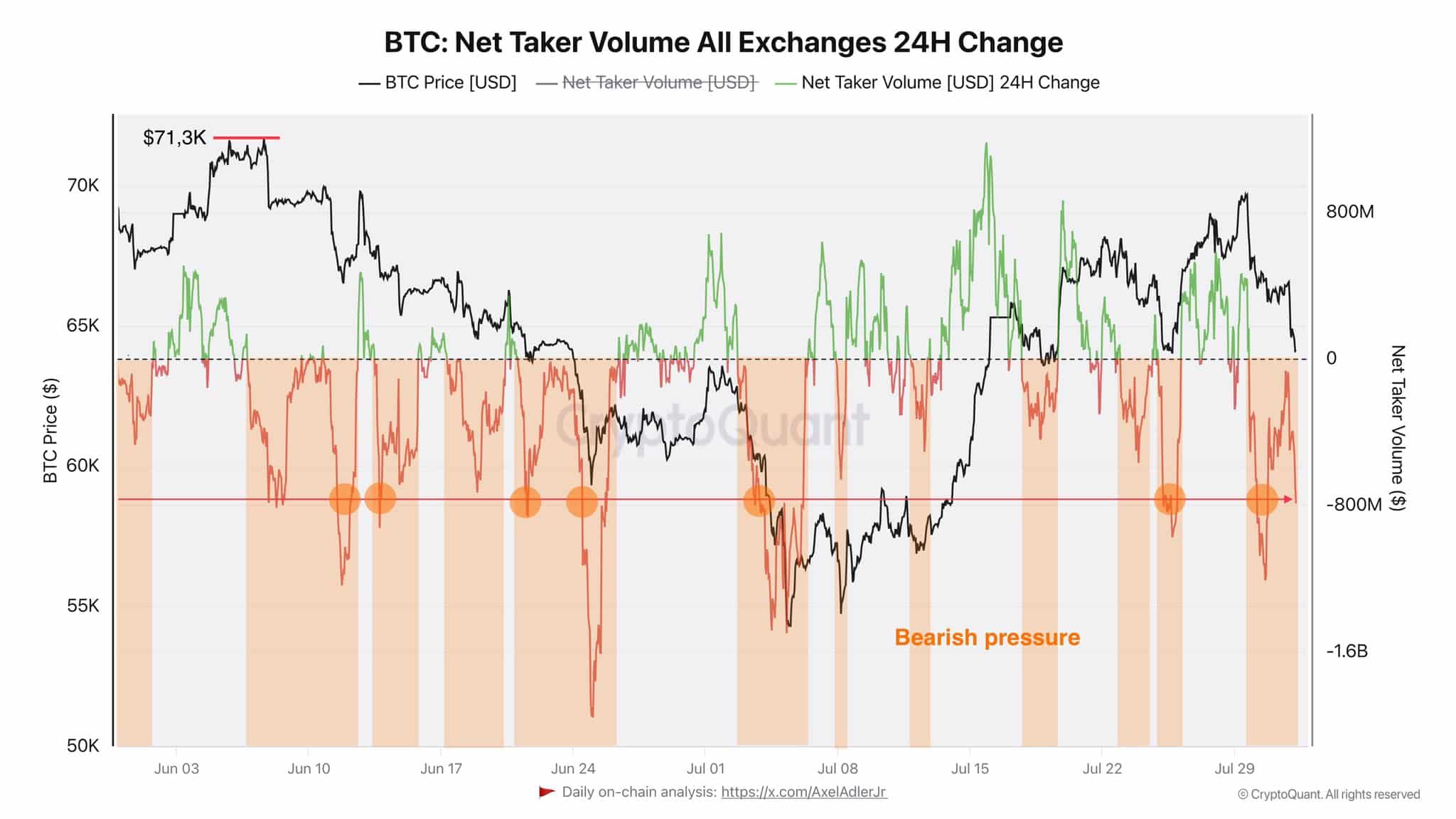

Crypto analyst Axel Adler posted on X (previously Twitter) that the web taker quantity has proven predominantly bearish stress over the previous two months.

Measuring the distinction between taker purchase and taker promote orders can provide hints in regards to the sentiment. For reference, taker signifies market orders and maker signifies restrict orders.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

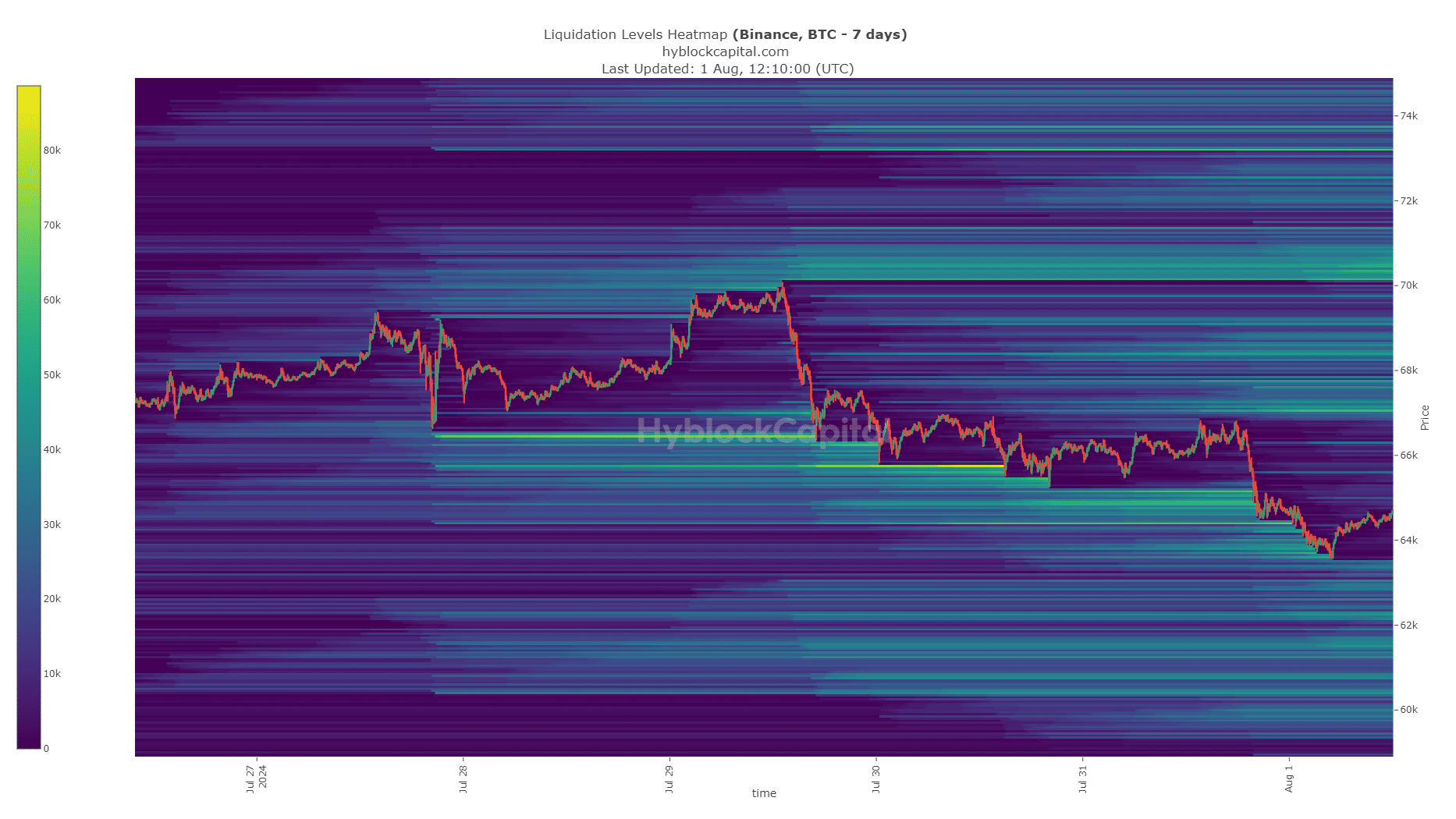

The liquidation cluster at $63.7k-$63.9k was reached, and the worth has begun to maneuver away from it. The short-term liquidation heatmap confirmed that $67k is the following goal.

General, the market sentiment was bearish and the September expectations of a charge lower have been numbed. Collectively, they defined why the crypto market costs and sentiment have been down prior to now couple of days.