- The cryptocurrency market witnessed a massacre that worn out $500M in each lengthy and quick positions.

- The massacre was fueled by escalating geopolitical tensions within the Center East.

The cryptocurrency market traded within the purple on the 2nd of October as the whole market capitalization fell by greater than 5% to $2.25 trillion at press time.

Bitcoin [BTC] succumbed to the bearish stress and plunged to a seven-day low under $61,000. Most altcoins additionally wiped their current features, as Ethereum [ETH] dropped by 6.5% to commerce at $2,473 at press time.

Binance Coin [BNB] and Solana [SOL] had been additionally down by 4.9% and 5.7%, respectively, whereas Ripple [XRP] fell under $0.60 after a 3.6% dip.

Dogecoin [DOGE] recorded essentially the most losses among the many prime ten largest cryptocurrencies by market capitalization after dropping by 9% to commerce at $0.108 at press time.

Comparable drops had been additionally seen throughout conventional monetary markets, with Japan’s Nikkei 225 index falling by 2.5% in response to Google Finance.

Crypto market reacts to geopolitical tensions

Escalating geopolitical tensions within the Center East after Iran fired a whole bunch of missiles towards Israel fueled these widespread losses. The occasion noticed merchants develop anxious in regards to the efficiency of danger belongings.

Throughout occasions of uncertainty, buyers are inclined to flee from danger belongings resembling crypto and flock to safe-haven belongings.

For example, as crypto costs plunged, gold noticed minimal losses of lower than 1%.

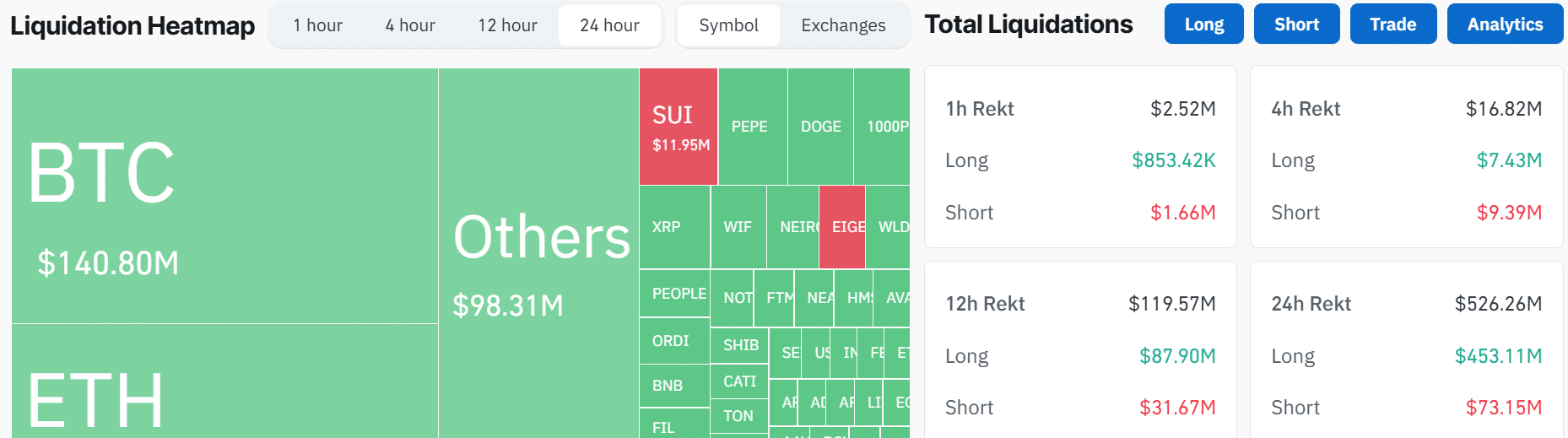

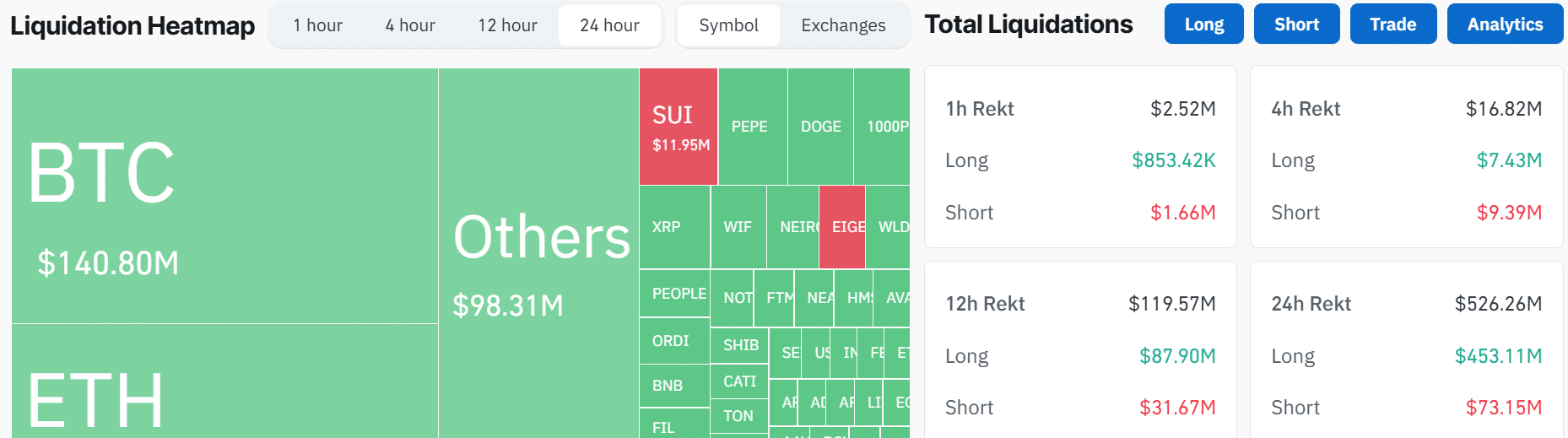

Supply: Coinglass

Knowledge from Coinglass exhibits that within the final 24 hours, greater than $500 million was liquidated from the market, with $450 million of those being lengthy positions. These liquidations impacted greater than 155,000 merchants.

Bitcoin and Ethereum noticed the best liquidations of $140 million and $110 million, respectively. Per Coinglass, the most important single liquidation occurred on Binance, the place one dealer was liquidated for greater than $12 million.

Crypto ETFs put up outflows

Knowledge from SoSoValue exhibits that on the 2nd of October, U.S. spot Bitcoin exchange-traded funds (ETFs) noticed $242 million in outflows, the best stage since early September.

Constancy’s Bitcoin ETFs noticed the largest outflow of $144 million. All different Bitcoin ETF merchandise noticed zero to adverse flows other than BlackRock. The iShares Bitcoin Belief ETF continued its constructive streak, with $40M in inflows.

Ethereum ETFs additionally got here in adverse with $48M in outflows, the best stage in additional than per week.

The adverse knowledge comes because the Bitcoin Fear and Greed Index plunged to 42, its lowest rating in additional than two weeks, as worry gripped the market.