- The surge in BTC shopping for by whales, coupled with the inflow of newly minted USDC, seemed to be key driving components.

- Declining alternate reserves and adverse Netflow indicators indicated that the rally was prone to persist.

Within the final 24 hours, Bitcoin [BTC] has appreciated by 4.13% and was buying and selling at $57,054.21 at press time. Indications are that this upward pattern might proceed into the next days.

Nonetheless, it stays puzzling why BTC skilled a sudden rise regardless of $34.79 million being guess on its decline per data from Coinglass.

Whales propel BTC rally with strategic accumulation

Latest monitoring information highlighted important Bitcoin accumulation by whales, signaling their elevated confidence within the asset and making a noticeable impression on market dynamics.

Because the starting of September, Lookonchain has observed whales buying 2,814 BTC. In a notable transfer, a whale just lately arrange a brand new pockets to switch 300 BTC, value roughly $17.19 million.

Moreover, in two transactions 600 BTC was withdrawn from Binance and moved to a brand new pockets.

These transfers from centralized exchanges to non-public wallets recommend that these main gamers are positioning their Bitcoin for long-term holding, lowering potential promote stress in the marketplace.

Concurrently, the USDC Treasury minted 50 million USDC, including substantial liquidity to the market. Such infusions are recognized to extend shopping for stress on property, together with BTC, main costs upward.

BTC upswing prone to proceed

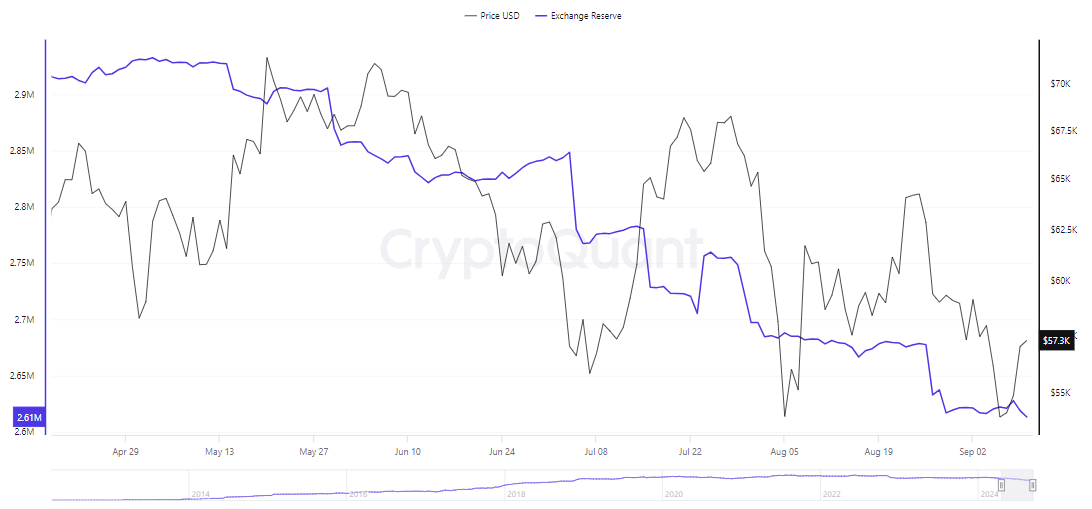

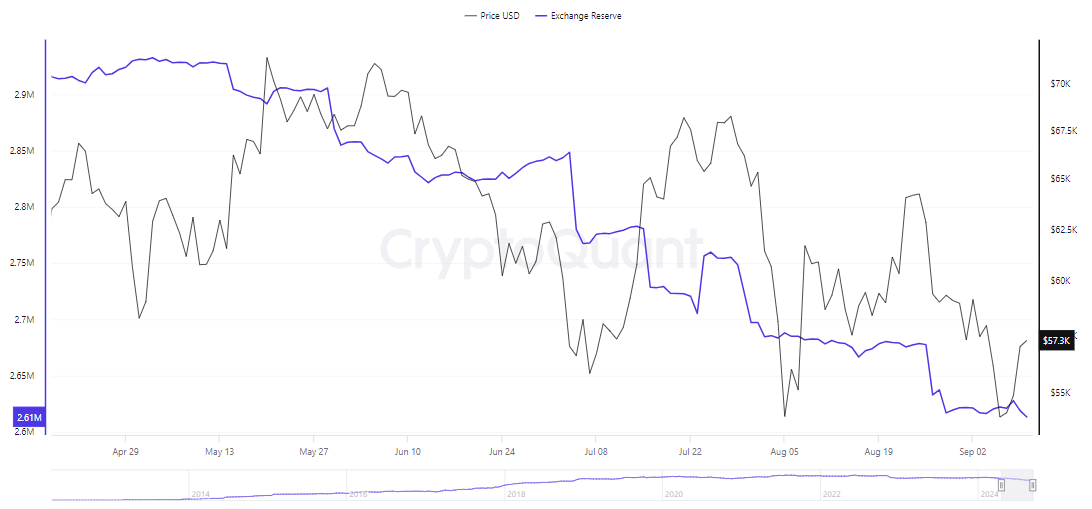

CryptoQuant’s insight of Trade Reserve and Netflow metrics indicated that Bitcoin’s present upward trajectory was anticipated to persist, because it recovered from the latest market downturn.

The Trade Reserve for BTC, which measures the quantity of the cryptocurrency held in alternate wallets, has sharply decreased to 2,613,649.772.

Sometimes, a rising alternate reserve suggests a bearish outlook as a result of ease of promoting in liquid markets.

Conversely, a declining reserve factors to a provide squeeze and rising long-term confidence amongst buyers, giving an indication of bullish sentiment.

Supply: CryptoQuant

Additional supporting this bullish outlook, AMBCrypto discovered that the Trade Netflow throughout all centralized exchanges has predominantly been adverse.

This adverse Netflow signifies that property are being moved from exchanges to non-public wallets, lowering the potential promoting stress on BTC. Such developments are sometimes influenced by large-scale buyers or whales.

As these whale actions proceed, retail investor sentiment has additionally shifted, and it’s now predominantly bullish.

Retail merchants capitalize on BTC’s upward pattern

Retail merchants are more and more bullish on Bitcoin, as evidenced by their rising bets on the cryptocurrency’s worth rise.

This shift is mirrored by a big improve in Buying and selling Quantity, which has surged by 47.98%, amounting to $64 billion. Equally, the Choices Quantity has seen a dramatic 91.90% improve.

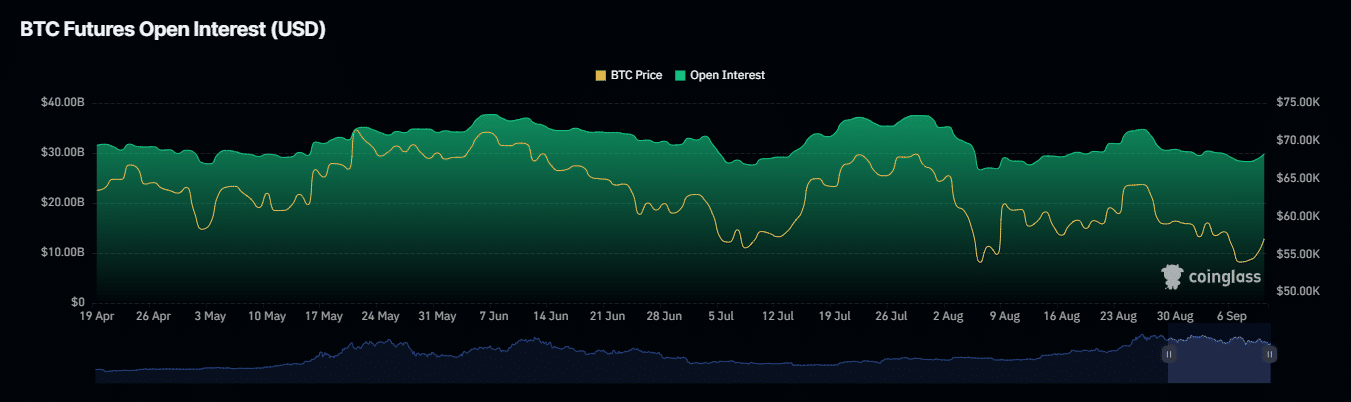

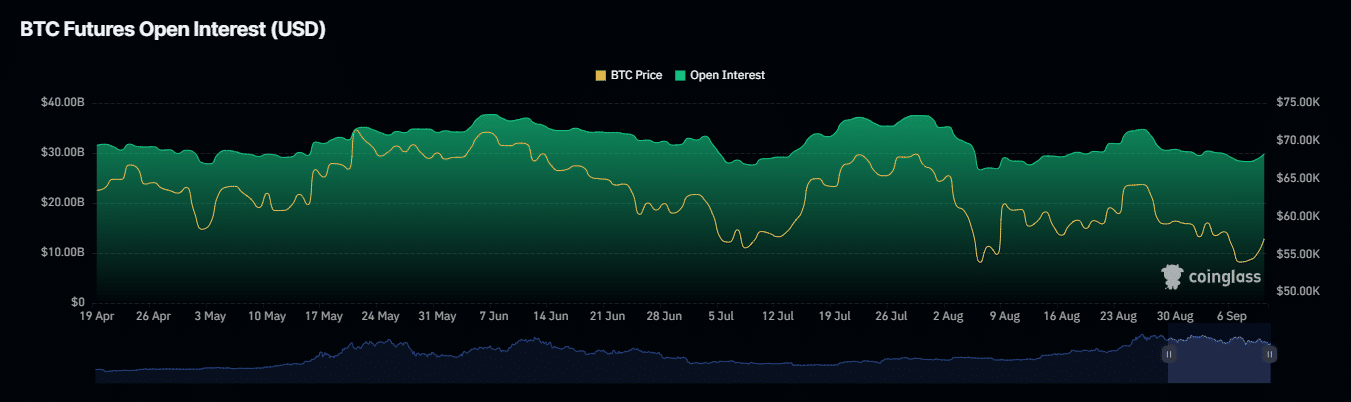

Furthermore, the Open Curiosity (OI), according to Coinglass, has additionally risen by 3.66% to $29.98 billion at press time.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This uptick in each quantity and OI indicated a considerable inflow of cash into the BTC Futures market, underscoring the power of the present worth pattern.

If this momentum continues, Bitcoin is prone to see even greater costs within the days forward, signaling sustained curiosity from retail buyers.