- Bitcoin has a bearish construction on the weekly chart.

- The latest losses may be reversed subsequent week, however it’s unclear if the bulls can drive costs past $69k.

Bitcoin [BTC] costs fell by one other 2.2% on Thursday, the twenty fifth of July, and the each day buying and selling session will not be over but. Since Monday, Bitcoin has fallen by 5.84%. The breakout previous $60k was hailed as necessary, nevertheless it appeared the value could possibly be headed towards it as soon as once more.

Whereas Bitcoin doesn’t want a purpose or information occasion for costs to pattern a technique or one other, the latest losses have a believable purpose. So, why is Bitcoin down at the moment?

Liquidation ranges point out BTC would possibly transfer towards $69k subsequent week

In a post on X (previously Twitter) crypto analyst CrypNuevo laid out a prediction that Bitcoin costs would fall towards $64.5k. This was due to the liquidity pool on this space on the decrease timeframes.

It was prone to entice costs towards it, and his prediction has been proper to this point. At press time, BTC was exchanging fingers at $64.2k. He additionally predicted that it will bounce towards $68.9k.

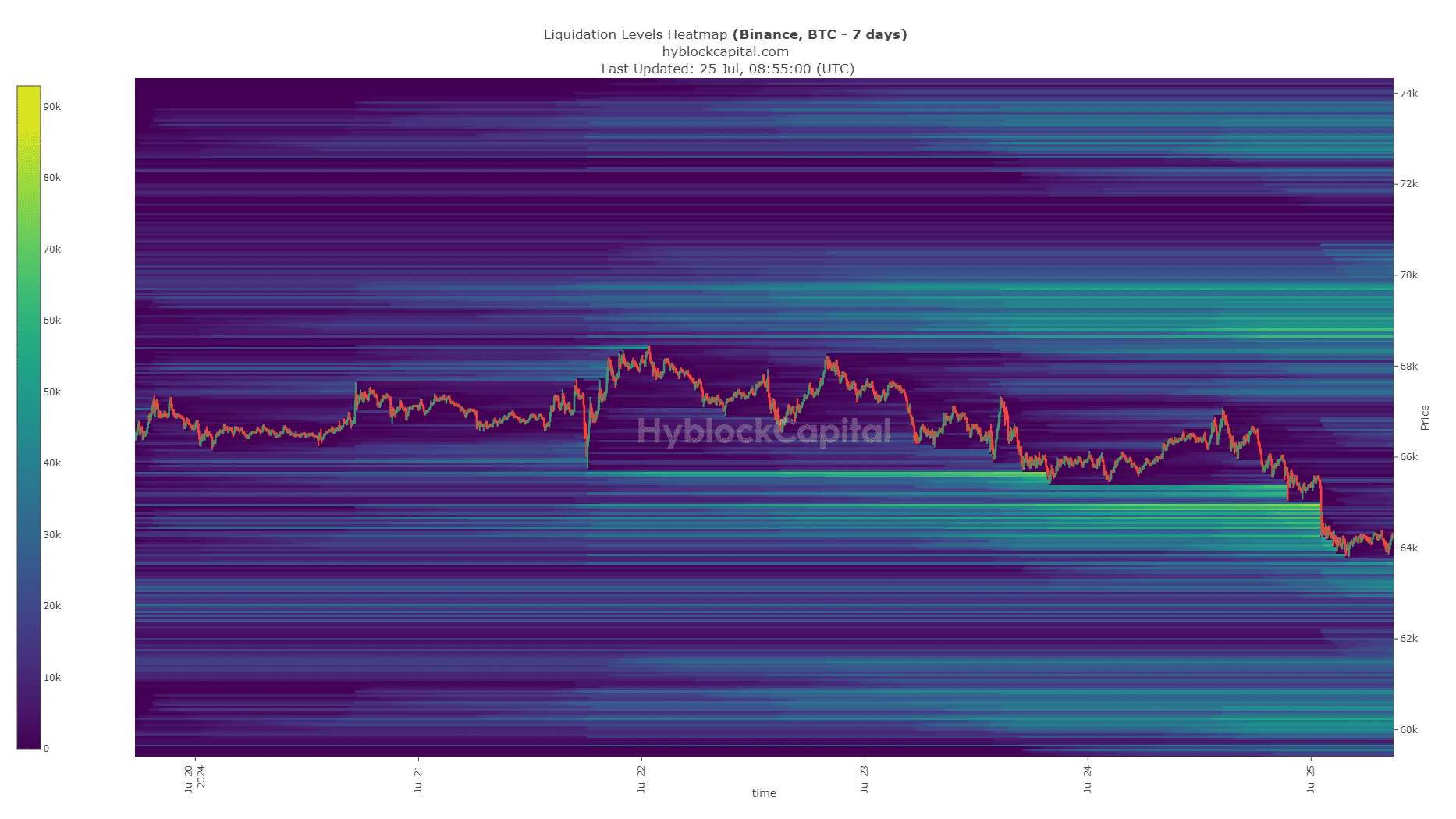

AMBCrypto seemed on the 7-day liquidation heatmap and noticed that the $64k-$64.8k zone was a cluster of liquidation ranges.

Because the analyst had identified on the twenty first of July, Sunday, a retracement to those ranges seeking liquidity was possible.

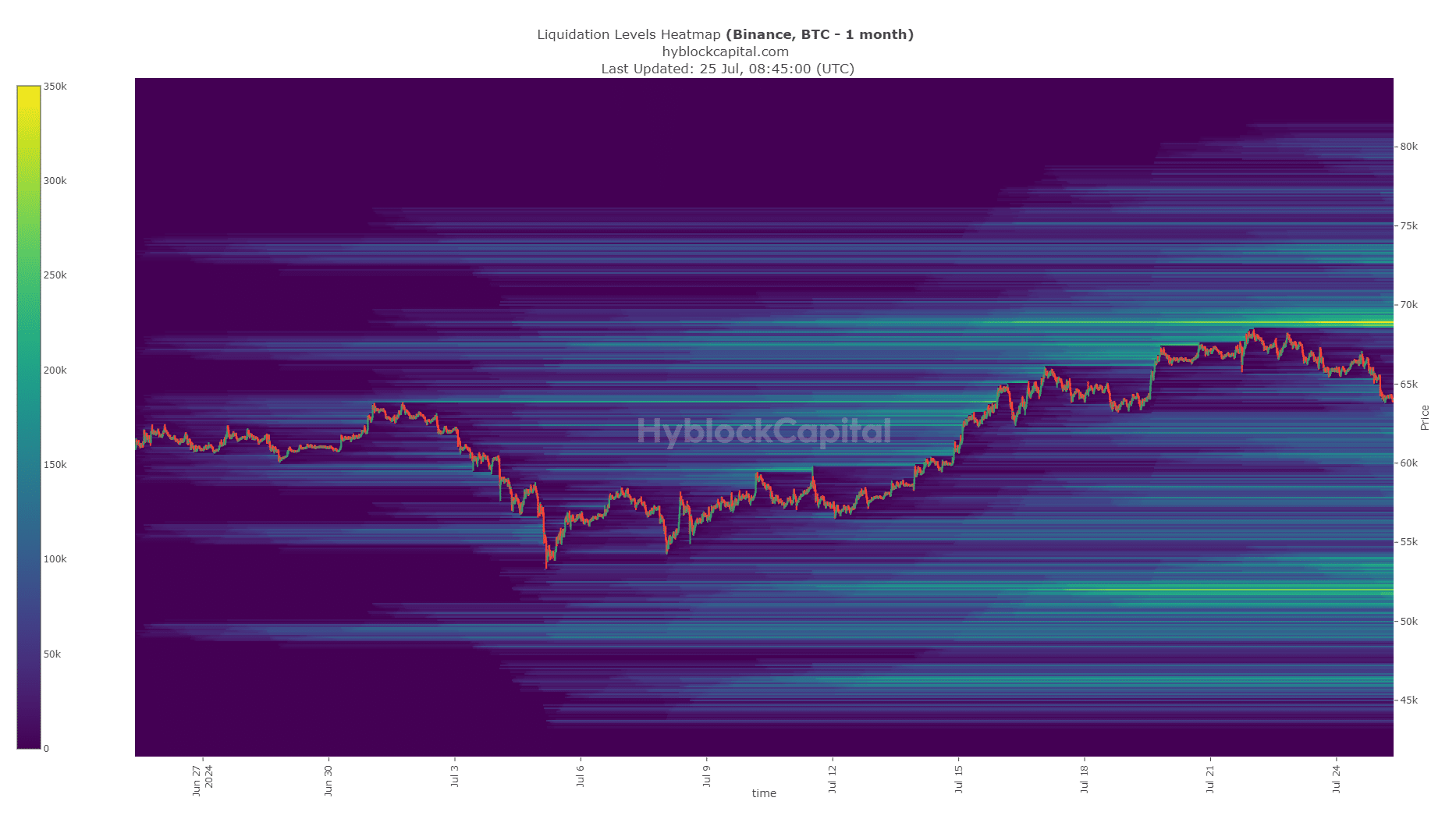

Whereas that helps clarify why Bitcoin is down at the moment, AMBCrypto seemed on the 1-month chart to grasp the place costs may go subsequent. To the north, the $69k stage was vibrant with liquidation ranges and is prone to entice costs to it.

Disturbingly, the $52k and $46k ranges additionally had a clump of liquidation ranges. These ranges may get denser over the approaching days, making it extra probably BTC would check them.

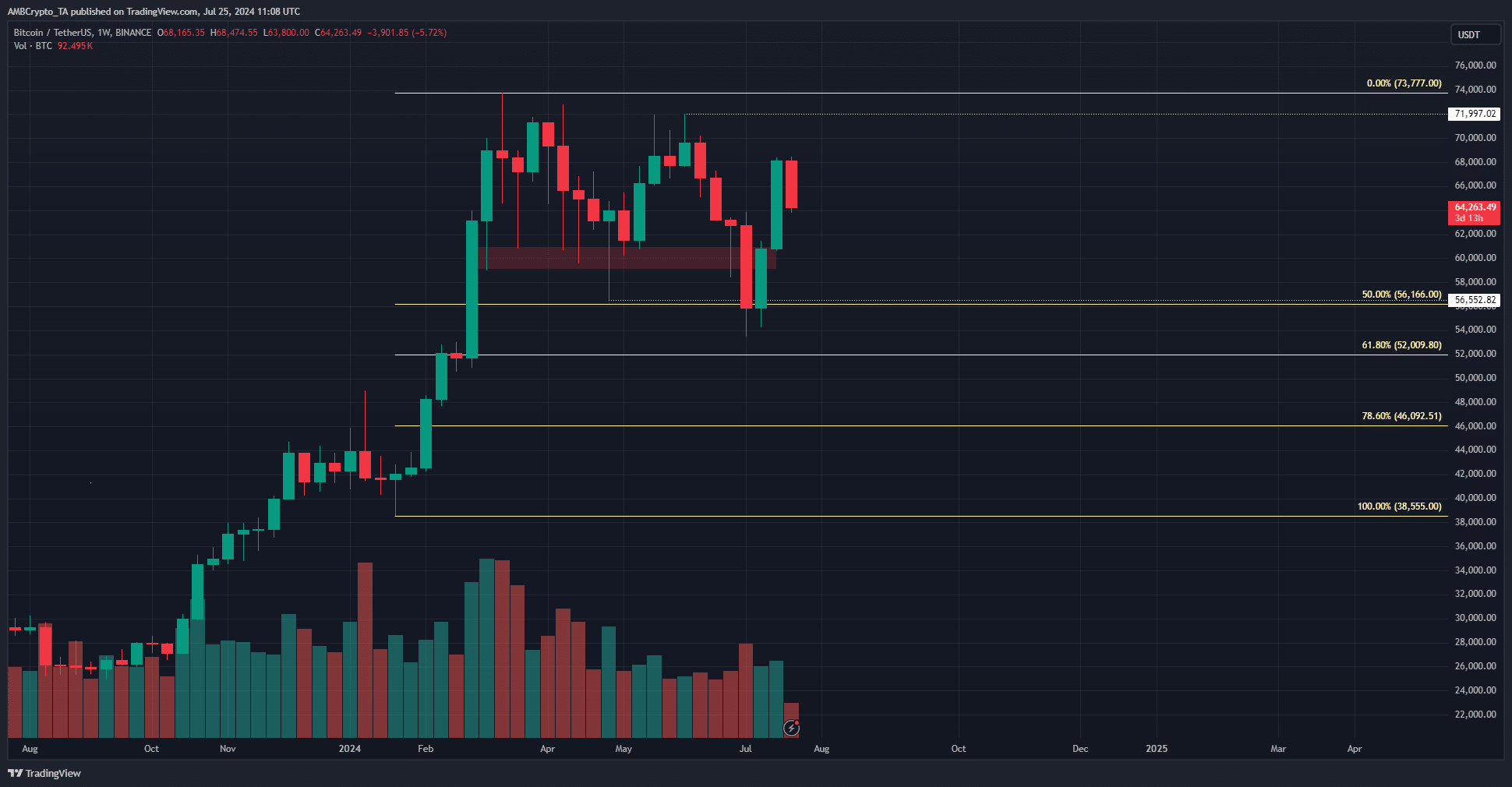

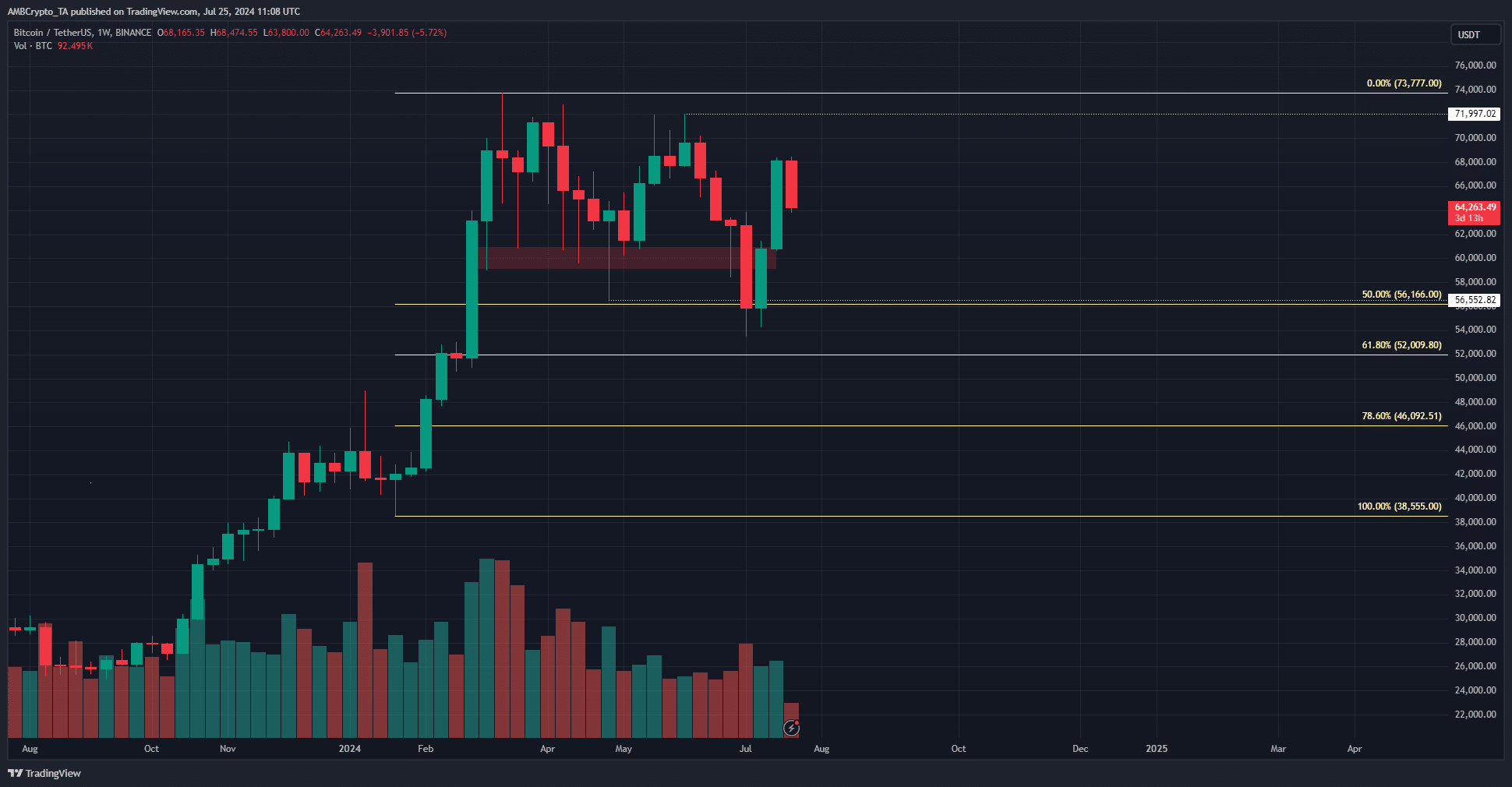

The weekly chart hints at a continuation

Supply: BTC/USDT on TradingView

In a post on X, Trader Mayne, a well-liked crypto dealer, identified that the weekly construction was nonetheless bearish. It grew to become bearish after the upper low from April at $56.5k was breached in early July.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In the meantime, the native excessive at $72k was not visited or damaged within the 1-week timeframe, which indicated {that a} bearish swing may be in play. This could possibly be unhealthy information for long-term holders.

The Fibonacci retracement ranges confirmed the $52k and $46k ranges, which have been additionally liquidity swimming pools, have been the 61.8% and 78.6% retracement ranges.