Black_Kira/iStock by way of Getty Photographs

Introduction

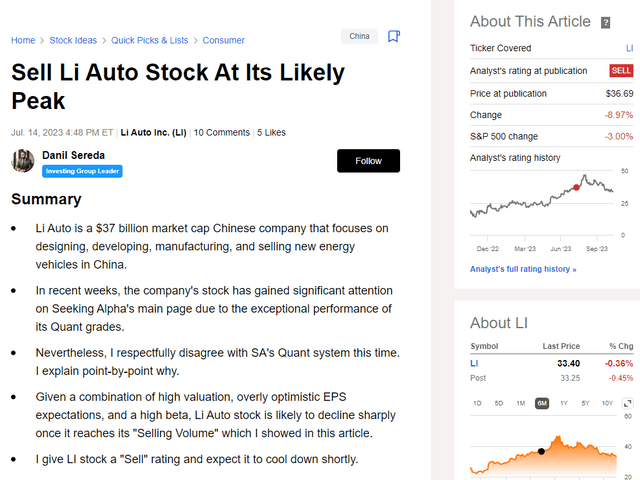

3 months in the past, I began overlaying Li Auto (NASDAQ:LI) inventory precisely when it grew to become one of many 10 most promising shares in keeping with Searching for Alpha’s Quant Rating System. At the moment, I approached the evaluation qualitatively fairly than quantitatively, so my conclusions differed from these of SA’s system, which is among the best of its form for my part.

As luck would have it, my article with the promote advice was the one one on Searching for Alpha, however that didn’t stop my bearish name from ultimately materializing after three months:

Searching for Alpha, creator’s protection on LI inventory

Lots of fascinating issues have occurred up to now quarter, each within the EV market in China and the world and with the corporate particularly, so I believe my earlier Promote thesis must be revised.

Assessing Li Auto’s Progress

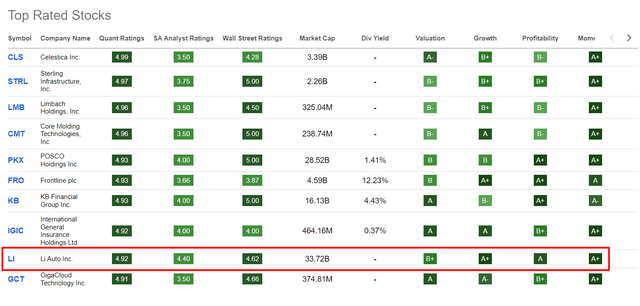

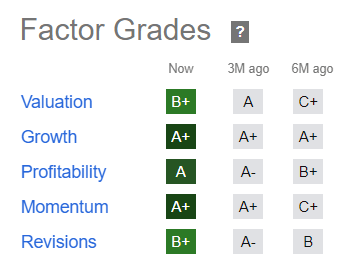

So the very first thing that catches your eye is that LI’s inventory nonetheless has very constructive Quant grades and continues to be considered one of SA’s top-rated shares, albeit now not within the first positions:

Searching for Alpha’s High Rated Shares

Searching for Alpha, LI inventory’s grades

At first look, little has modified: LI nonetheless has all of its grades in “inexperienced”, but when we take a look at their dynamics, we see colossal progress:

| LI’s valuation metrics (all FWD) | July 2023 | October 2023 | % ch. |

| P/E GAAP | 94.91 | 46.14 | -51.4% |

| PEG non-GAAP | 0.1 | 0.11 | 10.0% |

| EV/Gross sales | 2.08 | 1.58 | -24.0% |

| EV/EBITDA | 48.14 | 26.57 | -44.8% |

| P/S | 2.6 | 2.1 | -19.2% |

| P/Money Circulate | 20.93 | 12.81 | -38.8% |

| LI’s profitability metrics (all TTM) | July 2023 | October 2023 | b.p. ch. |

| Gross revenue margin | 19.18% | 19.90% | 72 |

| EBIT margin | -5.20% | -0.31% | 489 |

| EBITDA margin | -2.70% | 1.81% | 451 |

| Levered FCF margin | 21.34% | 23.51% | 217 |

| ROE | -2.44% | 4.03% | 647 |

| ROCE | -3.24% | -0.26% | 298 |

| LI’s progress metrics | July 2023 | October 2023 | % ch. |

| Income TTM progress | 65.20% | 102.87% | 37.7% |

| Income FWD progress | 72.03% | 79.07% | 7.0% |

| EPS FWD 3-5Y CAGR | 530.65% | 305.11% | -225.5% |

| FCF/sh. FWD progress | 23.42% | 45.48% | 22.1% |

| OCF TTM progress | 44.11% | 159.88% | 115.8% |

| OCF FWD progress | 27.16% | 43.16% | 16.0% |

Supply: Searching for Alpha knowledge, creator’s work

It is laborious to not discover: LI’s key valuation multiples have dropped 20-50% in simply 3 months. The one exception has been the PEG ratio, which has risen from 0.1 to 0.11 in that point, apparently defined by the discount within the EPS progress forecast. To be trustworthy, I did not anticipate the a number of contraction we see in only one quarter to be so large. The corporate has additionally made some progress in bettering its margins – a slight enchancment in gross revenue margin led LI to interrupt even when it comes to TTM EBITDA.

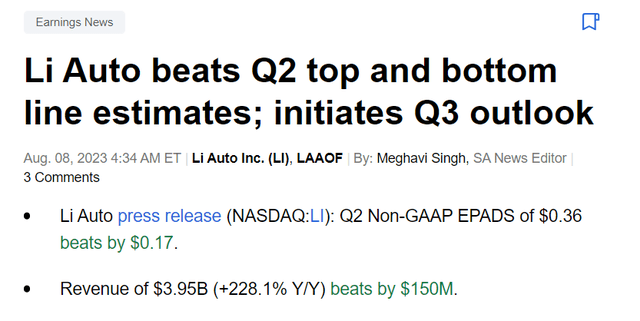

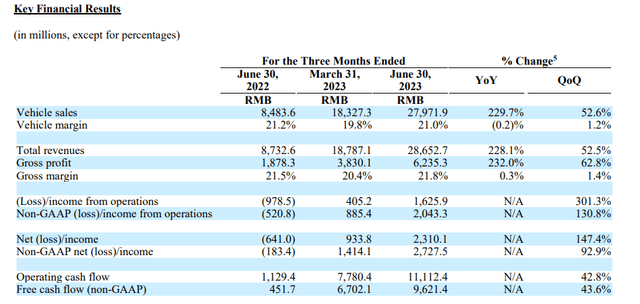

In Q2 FY2023, Li Auto achieved exceptional milestones in each operational and monetary features, beating the underside line estimate at $0.36 (a beat of $0.17) and income at $3.95 billion (a beat of $150 million).

SA Information

The corporate skilled substantial progress in deliveries, with over 30,000 autos delivered in June alone, contributing to a complete of 86,533 autos delivered for the quarter. This marked a major threefold improve in comparison with the identical interval within the earlier yr. Notably, in early July, Li Auto celebrated the supply of its 400,000th car because the graduation of deliveries in December 2019, setting a report amongst Chinese language rising NEV OEMs.

Financially, the corporate reported record-breaking leads to income, web revenue, and FCF for the 2nd quarter: Income for the quarter reached RMB 28.65 billion, demonstrating a considerable year-over-year improve of 128.1%. Internet revenue soared to RMB 2.31 billion, and free money movement reached a powerful RMB 9.62 billion.

LI’s press launch

Li Auto has maintained a powerful place within the Chinese language automotive market, significantly excelling in premium and NEV segments, with its 3 fashions main of their respective market segments and holding a major market share, which elevated from roughly 11% within the first quarter to about 14% within the second quarter, the administration mentioned in the course of the newest earnings name.

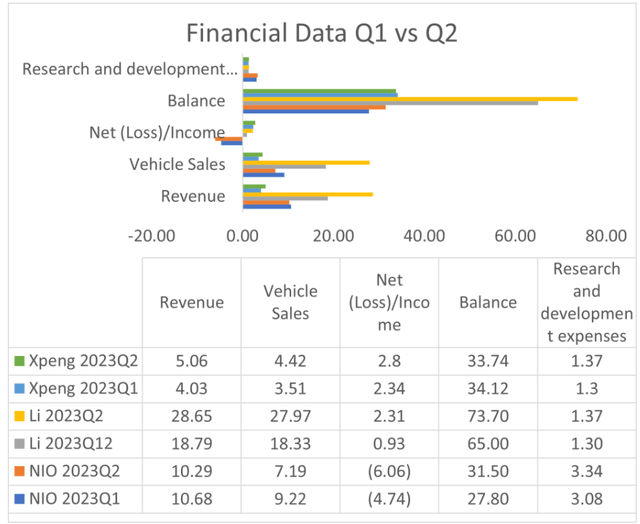

If we evaluate the event of LI with that of its direct rivals, the following picture says greater than a thousand phrases – LI wins the competitors by far with its progress and high quality:

Elizabeth Cooke’s article on just-auto.com

Wanting forward, Li Auto has set bold targets and offered a constructive outlook for its future (though the market did not prefer it, sending the inventory 10% decrease that day). The corporate anticipates deliveries for the third quarter of 2023 to be within the vary of 100,000-103,000 models, representing a exceptional improve of 277-288.3% YoY. Moreover, LI is assured in exceeding its inner supply goal for FY2023 by 10-20%, with annual income projected to surpass RMB 100 billion (>$13 billion, i.e. by ~208% larger vs. FY2022).

Li Auto additionally goals to achieve a major milestone by reaching 40,000 month-to-month deliveries by the tip of FY2023, planning to foster coordination throughout manufacturing, provide chain, and gross sales whereas increasing manufacturing capability and enhancing provide chain administration processes.

Past deliveries and gross sales, Li Auto is making fast progress in autonomous driving and high-power charging options, with plans to convey city-level autonomous driving to extra households and deploy an in depth 5C supercharging community. The corporate firmly believes in its “twin vitality technique” to interchange ICE autos at scale, positioning it for a promising future within the evolving automotive trade.

Typically, after the progress I’ve seen, LI now not appears to be like like an apparent “Promote” to me: In its phase, the corporate may be very actively gaining market share from its direct rivals, and moreover, the expansion in its monetary efficiency is resulting in a a lot sooner a number of contraction than I had beforehand anticipated, which ought to look very constructive for shareholders.

Nonetheless, there are a selection of dangers that hold me from upgrading LI’s inventory to “Purchase” this time round.

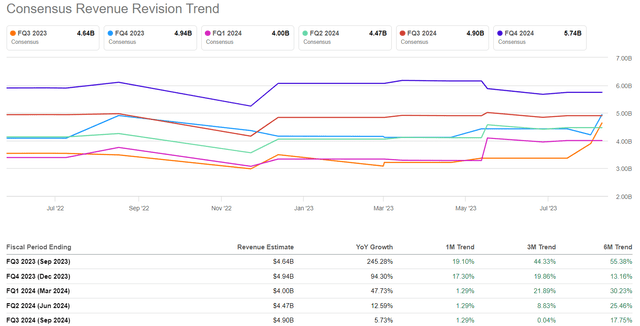

Li Auto’s problem lies in its concentrate on luxurious EV market phase. According to CarNewsChina.com, the common sale worth of Li Auto in China in March 2023 was $58,300, primarily based on the agency’s gross sales of ~20,000 autos throughout that month. However the common EV automotive worth in China in 2023 is around $23,000. BYD and Wuling, which focus on reasonably priced vehicles for China’s center class, are thriving in that lower-end market area of interest. And judging by the best way the patron power panorama in China is altering, shoppers usually tend to change to these extra reasonably priced niches, so LI’s top-line progress is prone to sluggish sooner than Wall Road analysts predict primarily based on the agency’s historic precise knowledge.

Searching for Alpha, LI’s income revisions

The Backside Line

It might be that I am a bit biased in upgrading Li Auto to “Maintain” solely as a result of I was adverse concerning the firm and that adverse expectation has ultimately paid off because of the inventory’s underperformance for the previous quarter. However what actually confuses me is the constructive angle of analysts who hold elevating income forecasts for the corporate, apparently due to its current success, however as in the event that they barely contemplate the dangers of the close to future, in my opinion.

The European Union’s current investigation into Chinese language state subsidies for its electrical car trade poses a further danger for traders: plans for worldwide enlargement might show too optimistic given current competitors.

Nonetheless, it must be famous that LI’s administration has finished an incredible job in sustaining gross revenue margin and increasing EBITDA margin. The FCF LI is already producing solidly because it continues to develop. And the valuation grew to become a lot much less scary after key multiples dropped 20-50% in simply 3 months, which is fantastically good.

After weighing all the professionals and cons, I’ve determined to improve LI from “Promote” to “Maintain”.

Thanks for studying!