LifeJourneys/E+ through Getty Pictures

Gold is an underrated asset. Gold additionally hit a brand new all-time excessive (“ATH”), just lately surging to round $2,150. Whereas the market might consider that present gold costs are unsustainable, the elemental backdrop is extremely favorable, and the yellow metallic may go a lot increased. Along with constructive basic components, the technical picture is bullish, and enhancing sentiment may ship gold costs and gold shares to considerably increased ranges subsequent 12 months.

Many high-quality gold shares commerce at low multiples, and their future earnings estimates seem predicated on a decrease or falling gold value. Gold is establishing a foothold above $2,000 because the Fed transitions to a better financial stance, making a extra accessible monetary setting in future years. Gold tends to outperform throughout easing cycles, and the explanation gold held up so effectively through the latest tightening course of was rampant inflation.

The gold market seems ahead to a rising economic system and an increasing financial base. Furthermore, the gold market seems ahead to the subsequent spherical of inflation. Deflation is probably going the one factor that would preserve gold costs down. Nonetheless, a smooth touchdown state of affairs implies the economic system may skirt a recession. This dynamic signifies that gold may get away quickly, shifting to new ATHs from right here.

Gold – A Breakout 12 Years In The Making

Gold value (goldprice.org)

Observe the Tremendous-bullish long-term cup and deal with sample.

Gold first tried to achieve the $2K stage in late 2011. I bear in mind it like yesterday. I watched gold skyrocket to over $1,900 as I sat in a diner in Maine, gazing my laptop computer that late summer season season.

I used to be lengthy gold then and fairly a little bit of silver (quintupled in about 2.5 years). From a longer-term perspective, gold had a large transfer, appreciating from round $200 to over $1,000 through the “unique” home market bubble, enabling a Greenspan-led simple financial period within the early to mid-2000s.

Then gold acquired a large enhance after dropping briefly to round $700 due to deflation fears. Then, the helicopter-Ben, post-financial disaster easing period, made gold skyrocket, practically tripling from its 2008 low in just below three years.

In fact, costs elevated too rapidly after practically a 10x return in about ten years. Subsequently, we had large profit-taking and quick positioning, leading to a long-term bear market that took a number of years to clear. The first basic motive behind the large selloff was the expectation that the Fed would unload its steadiness sheet, returning the economic system to progress below a “normalized” financial regime.

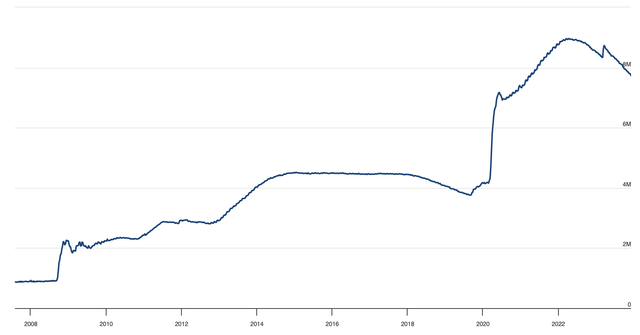

However The Fed Could By no means Unload Its Stability Sheet

Fed’s steadiness sheet (Federalreserve.gov)

This era jogs my memory of the 2014-2018 tightening time-frame. The method was slow-motion then, and now the whole lot is being sped up. Briefly, the Fed tightens, and after a while, the economic system begins buckling beneath the strain of excessive charges.

The reality is that the Fed might by no means unload its steadiness sheet. We have change into accustomed to a simple financial economic system, and there is not a easy highway again. First, we should point out that debt has skyrocketed. The nationwide debt is round $34 trillion, roughly 122% of GDP. In comparison with different intervals, the federal government debt was roughly 55% of GDP in 2000 and beneath 35% in 1980.

Additionally, it isn’t simply authorities. Many types of debt are exploding to new heights. Have a look at bank cards, mortgages, scholar loans, automobile loans, and many others. Nonetheless, the nationwide debt is alarming, and the federal government deficit is now practically $2T. The estimated annual servicing cost on the $34T nationwide debt is an estimated $1T, staggering. Sure, the U.S. now “spends” (extra like waste) $1T to service its debt. How is that this sustainable, and for the way lengthy? Nobody is aware of exactly, nevertheless it may finish badly.

The first motive why authorities debt servicing funds have grown astronomically is due to excessive rates of interest. When treasury yields are 1.5% as a substitute of 5%, the U.S. pays a lot much less premium to service its debt. On the identical time, I am primarily discussing the federal government’s debt, an analogous precept regarding most debt that permeates each layer of our economic system.

Our consumer-driven, closely debt-based economic system can’t face up to an elevated rate of interest setting for lengthy. We noticed the economic system buckle towards the tip of 2018 after the Fed launched a tighter financial environment for a number of years. This time, the Fed jacked charges up even increased, and the economic system has been resilient. Nonetheless, it will not final lengthy. The warning indicators are throughout us, and the Fed must decrease charges quickly.

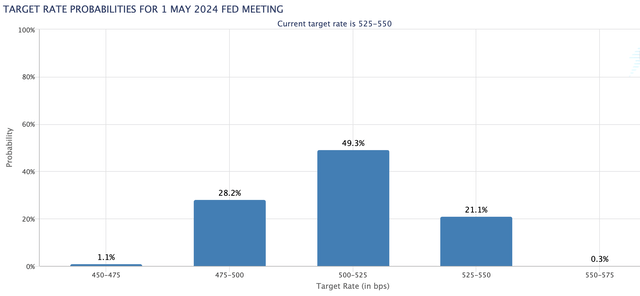

The Fed Probably To Drop Charges Early Subsequent 12 months

Fee possibilities (CMEGroup.com)

There’s an awesome (79% probability) that the Fed will decrease rates of interest by at the very least 1 / 4 level or extra by Could subsequent 12 months. We might even get the first-rate lower on the March FOMC assembly, and possibilities will transfer increased if unemployment will increase. Furthermore, continued progress on inflation and different variables ought to allow the Fed to contemplate dropping charges sooner slightly than later, a dynamic extremely favorable for gold.

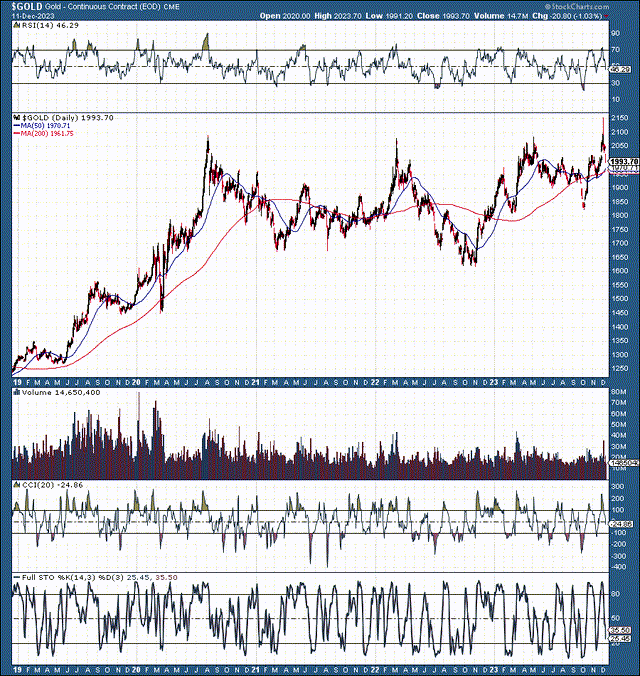

Gold: 5-12 months Chart – Value Probably Going A lot Greater

Gold 5 12 months value (StockCharts.com )

As soon as gold strikes decisively above $2,000, no technical components stop the value from melting up. Additionally, the constructive basic backdrop ought to enhance sentiment, compounding the impact and enabling gold to maneuver considerably increased in future years. This breakout has been a very long time coming, and gold’s value has not modified a lot during the last decade.

Gold delivered practically a 10x return through the 2001-2011 time-frame. Nonetheless, the value of gold was primarily flat through the subsequent ten years. Gold’s value nonetheless seems just like the market expects gold costs to go decrease, however the reverse will in all probability happen. Gold may have a major breakout, with its value doubtless surging to $2,500 or increased in 2024/2025 because the Fed adopts a extra accommodating financial stance.

My High Three Gold Miners That Might Skyrocket

Many analysts are nonetheless behind the curve on gold, anticipating stagnant or decrease gold costs in future years. As a substitute, I see a major breakout, which ought to allow high gold miners to develop revenues rather more quickly than anticipated, increasing profitability significantly.

1. Barrick Gold (GOLD) – Barrick is without doubt one of the most important gold miners globally. The typical AISC is round $1,300-$1,400 globally. As gold breaks out above $2,000, Barrick and different high-quality gold miners ought to make rather more cash than anticipated.

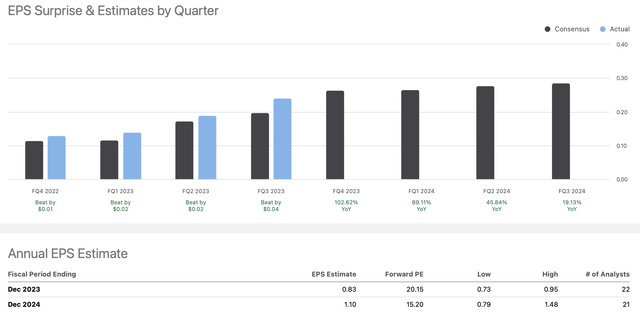

Barrick More likely to Proceed Beating The Estimates

EPS progress (SeekingAlpha.com )

Barrick supplied 70 cents in EPS vs. the 61-cent consensus estimate within the TTM. This dynamic represents a 15% beat price over the forecast, and the outperformance may speed up. There aren’t any optimistic earnings revisions, and as soon as gold’s value breaks out above $2,000, widespread upward revisions may ship Barrick’s share value a lot increased.

Consensus EPS estimates are $1.10 in 2024, but when Barrick achieves a 20% beat price, EPS might be round $1.32. Additionally, higher-end bullish estimates go as much as virtually $1.50, implying that some analysts and the market are catching on to the concept we might even see sustainably increased gold costs in future years.

With Barrick’s inventory round $16, $1.32 in EPS suggests Barrick trades round 12 occasions ahead earnings right here. Furthermore, momentum may propel gold costs increased for years. Additionally, company optimization and economies of scale may preserve AISC beneath $1,500 for years for high gold producers. Subsequently, Barrick and different high-quality companies may see substantial EPS progress for years. Nonetheless, that is a lot totally different from what the estimates say.

Depressed EPS and Income Estimates

EPS and income estimates (SeekingAlpha.com )

Many analysts should not factoring a lot, if any, earnings progress into their estimates. Moreover, there are few income progress forecasts, with the consensus income curve dropping after 2025. It is difficult to think about why Barrick would expertise a income dropoff if gold strikes decisively above $2,000 in future years. Quite the opposite, income progress may persist and speed up as gold costs proceed increased from right here.

Barrick’s Undervalued Inventory Value

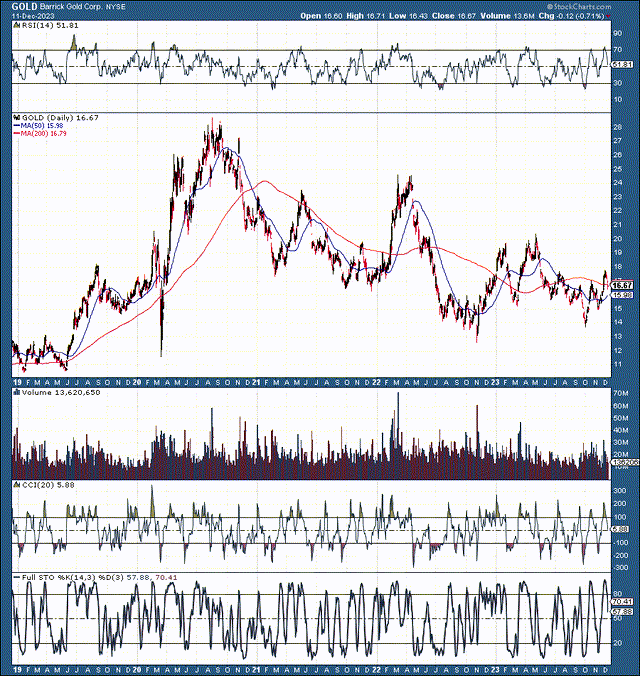

GOLD (Barrick) (StockCharts.com )

Regardless of gold being round an ATH, Barrick’s inventory value remains to be round 40% beneath its excessive in 2020. Moreover, Barrick is far decrease than its 2011 ATH, above $50. As soon as the market realizes gold can have a sustainable transfer above $2,000, it is prone to push Barrick above $20 and considerably increased. Furthermore, future earnings progress and upward revisions ought to present assist, pushing costs to new highs for Barrick. We must always see an analogous dynamic with different high-quality gold mining shares.

2. Agnico Eagle Mines (AEM) is one other high-quality gold miner effectively beneath its ATH round $80. AEM has additionally outperformed latest EPS estimates, and ahead EPS appears extremely depressed. As a substitute of the $2.30 2024 consensus EPS estimate, AEM may earn nearer to the $3 higher-end forecast. This dynamic implies that AEM might be buying and selling round a 16 ahead P/E right here, and its inventory might transfer a lot increased with increased earnings revisions because of the rising value of gold. Along with having substantial upside potential, AEM pays a hefty 3.2% dividend.

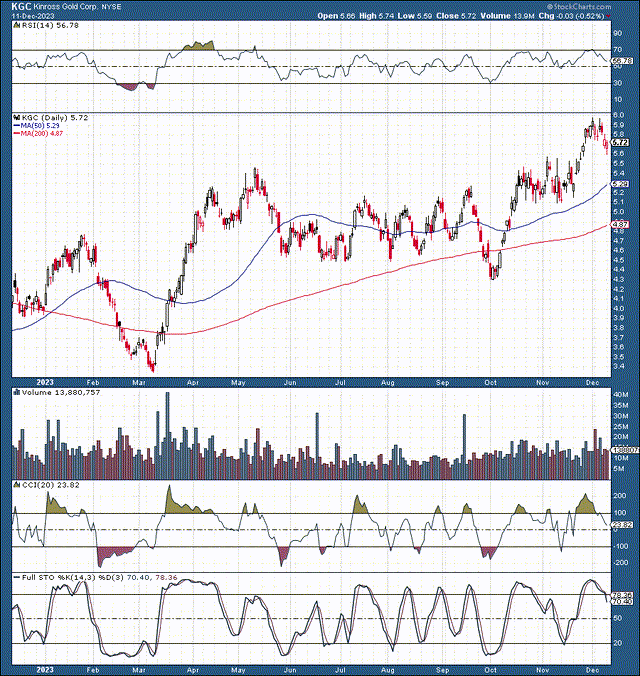

3. Kinross Gold (KGC) is one other vital gold producer that’s considerably undervalued proper now. Regardless of gold costs round ATHs, EPS revisions have decreased sharply for the reason that 2020 highs and haven’t moved up but.

KGC (StockCharts.com )

Kinross inventory’s value motion has improved significantly for the reason that begin of the 12 months. The inventory is forward of analysts, establishing a robust uptrend earlier than upward revisions are made. Nonetheless, KGC trades at solely 14 occasions this 12 months’s EPS estimates, and ahead EPS expectations will doubtless get revised increased with the rising value of gold.

2024 12 months-end Estimates

- Gold: $2,500

- Barrick Gold: $30-$35

- Anglico Eagle Mines: $80-$100

- Kinross Gold: $12-$15