- Resistance at $3,353 might pressure ETH to say no to $3,120.

- Within the midterm, the value would possibly fail to surpass $4,000.

Ethereum’s [ETH] rise to $3,300 on the twenty eighth of April returned optimism to the market. Nonetheless, in response to AMBCrypto’s evaluation, the enjoyment market members may need had could possibly be momentary.

One cause for this prediction could possibly be linked to a current transaction. Within the early hours of the identical day, a participant despatched 14,999 ETH to the Coinbase trade.

Whereas we’ve not been in a position to observe who the precise wrongdoer was, the switch might have an effect on ETH’s value. It is because numerous cash despatched to trade normally find yourself in a sale.

Additionally, relying on the quantity, the sale might cease the worth from transferring greater.

Excessive liquidity comes with resistance

Therefore, it could possibly be that ETH’s surge within the final 24 hours was a false breakout.

For context, a false breakout is terminology that explains how a cryptocurrency tries to interrupt sure resistance however loses momentum afterward.

With out taking a look at different indicators, this conclusion would possibly sound too hasty. Therefore, AMBCrypto determined to look at different components of the market associated to the altcoin.

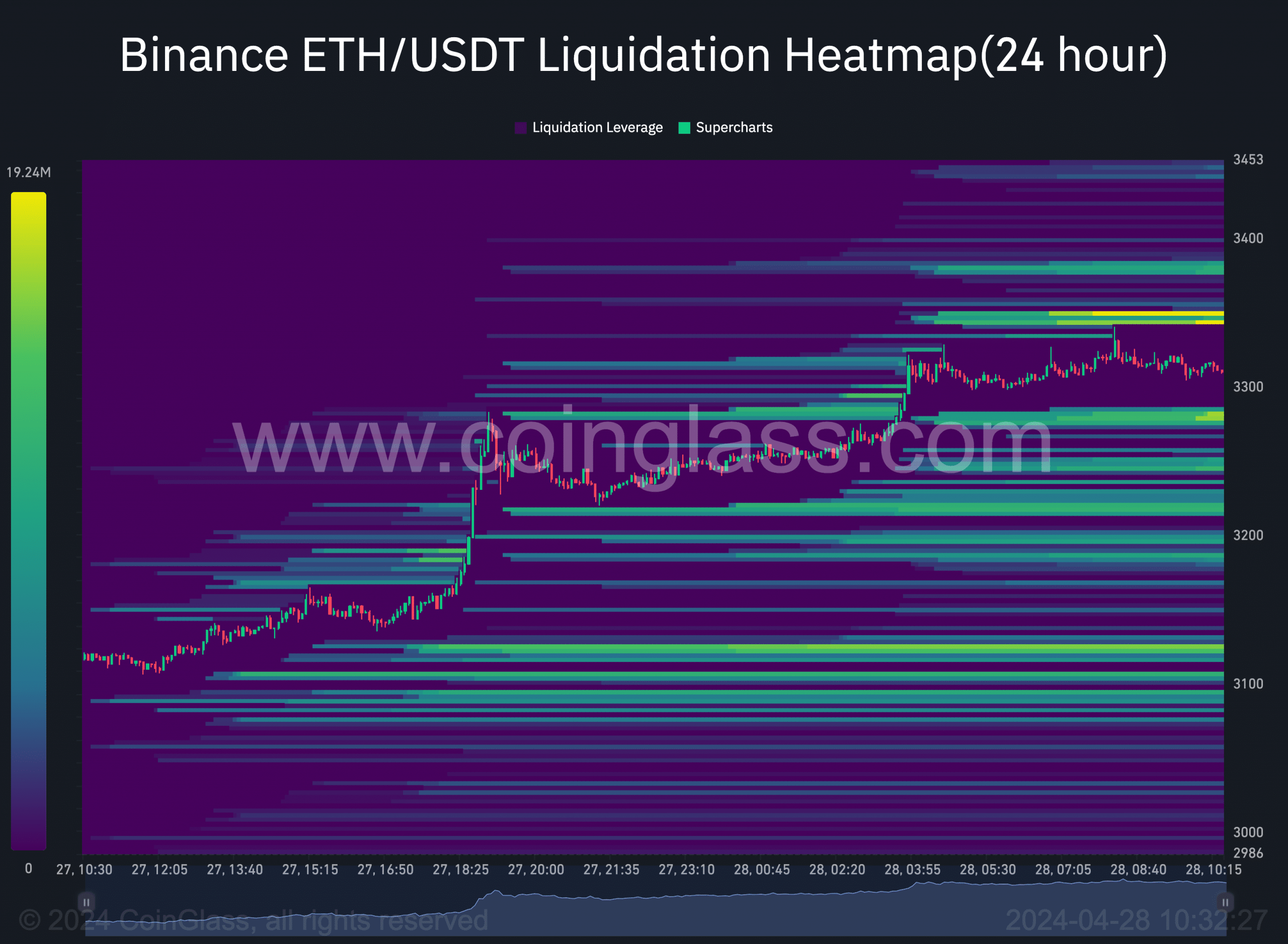

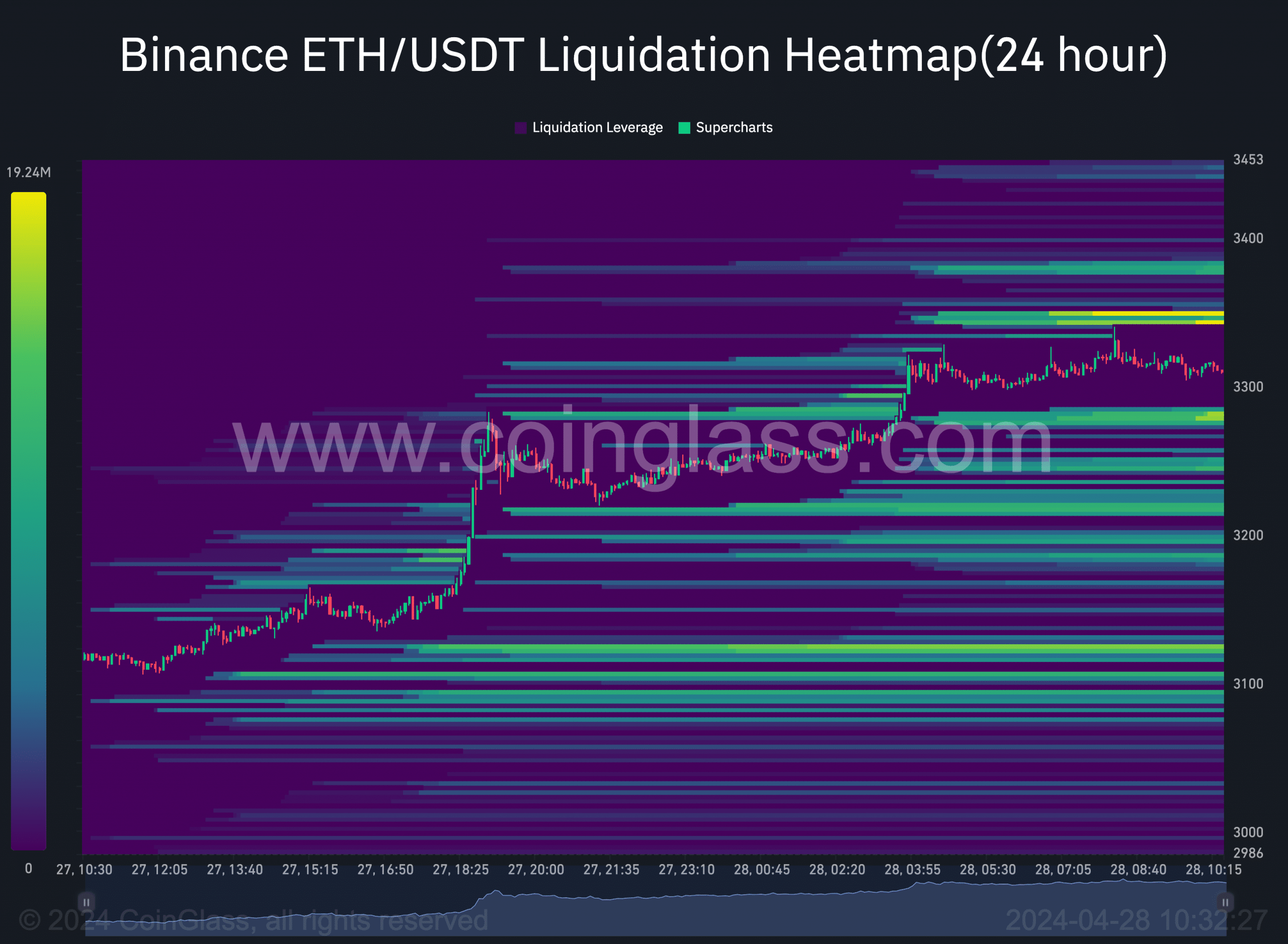

One indicator we gauged was the liquidation heatmap. For most individuals, the liquidation heatmap helps to trace excessive liquidity within the order e-book.

Supply: Coinglass

Nonetheless, the identical indicator may be instrumental in figuring out help and resistance zones. From the information above, there was a focus of liquidity at $3,353.

In areas like this, giant trades may be executed at comparatively good costs. However as quickly as orders enter this liquidity, the value would possibly reverse. As such, the $3,353 area could possibly be a resistance level for ETH.

$4K will not be shut

Transferring on, the worth of the cryptocurrency would possibly drop as soon as it hits the value talked about above. Nonetheless, help lied at $3,276, indicating that ETH may not slip under the extent.

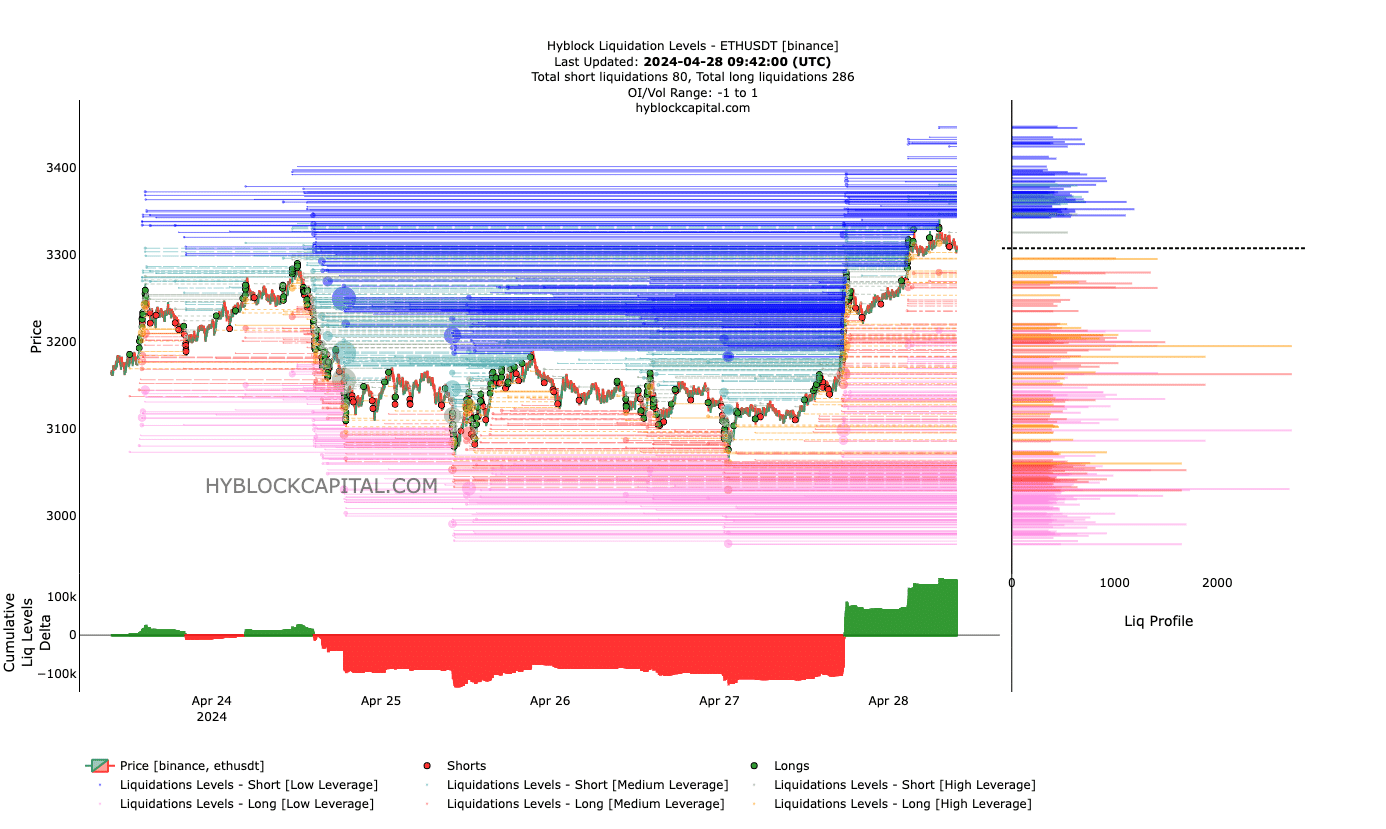

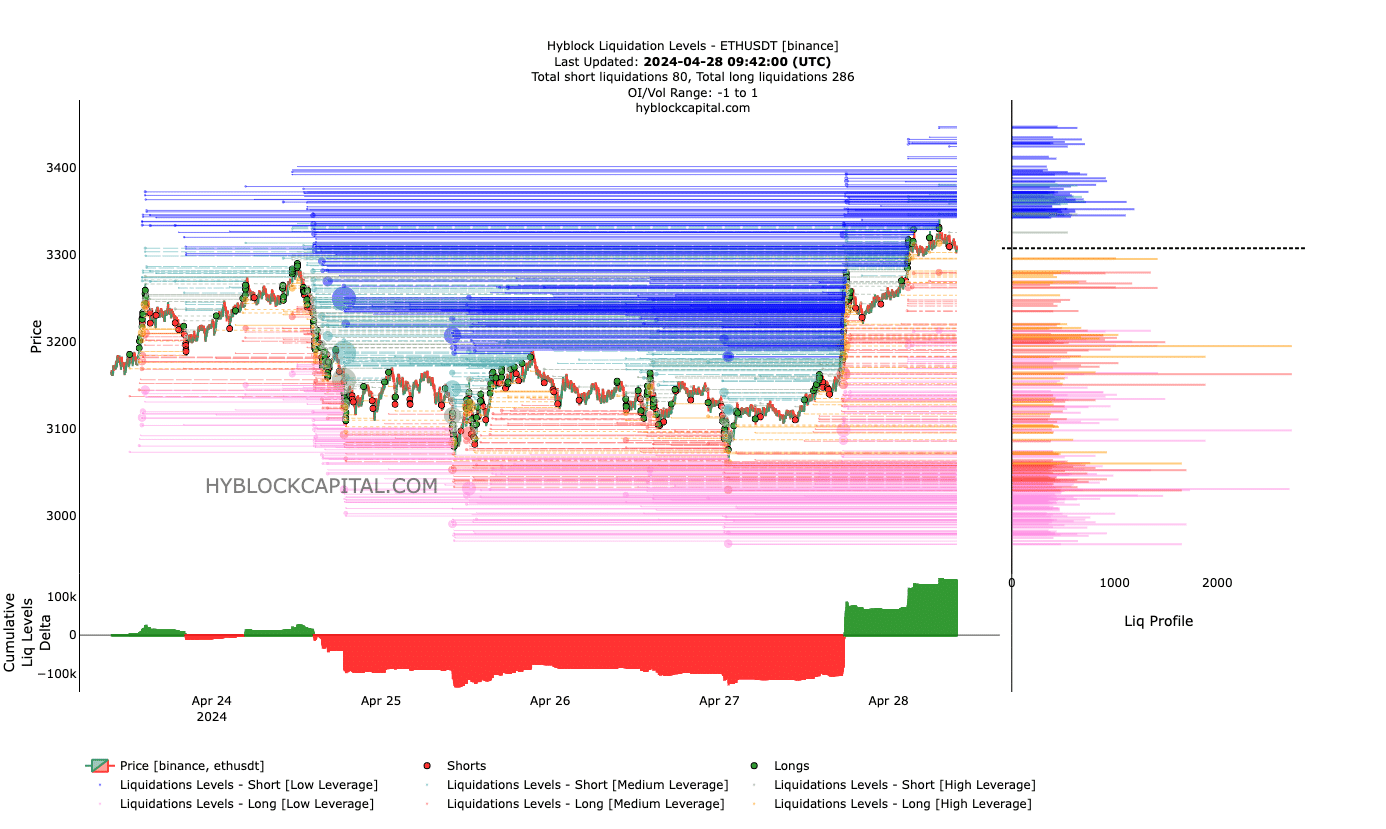

The subsequent half we thought-about was the Cumulative Liquidation Ranges Delta (CLLD). If optimistic, the CLLD signifies that there are extra lengthy liquidations.

Alternatively, a unfavourable CLLD means that quick liquidations had been greater than longs. As of this writing, the CLLD was optimistic. However this indicator additionally has a say on the value.

With the press time place, the CLLD indicated that ETH might bear a full retrace. Ought to this be the case, the value of the cryptocurrency would possibly drop to $3,120.

Supply: Hyblock

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Within the meantime, the value of the cryptocurrency would possibly maintain its head above $3,300 for a while. Nonetheless, anticipating this enhance to drive ETH to $4,000 may be a stretch.

Our evaluation confirmed that the market lacked sufficient firepower to drive such a hike. As well as, anticipating the altcoin to surpass its all-time excessive may not be an choice anytime quickly.