Staci Warden, the CEO of Algorand, believes tokenization might be certain that crypto survives. For this to turn into a actuality, banks and counterparties should transfer harmoniously, at the same time as firms like Chainlink attempt to lead the cost for cross-chain interoperability.

Talking on the Monetary Occasions Crypto and Digital Property Summit, Warden stated it’s good for banks to undertake blockchains. Nonetheless, the know-how received’t remodel monetary plumbing until all gamers transfer on the identical time.

How Tokenization Creates New Markets

People who find themselves not accredited traders or excessive net-worth people can not take part in sure elements of the economic system. This ineligibility is a distinct segment the place tokenization can create new markets that commerce fractions of high-value belongings, including further liquidity to the house.

Learn extra: What’s The Influence of Actual World Asset (RWA) Tokenization?

Some alternatives reap the benefits of back-office inefficiencies. An airline in Argentina referred to as FlyBondi is working to tokenize tickets.

The blockchain permits the airline to tokenize a ticket. The unique purchaser can promote this tokenized asset on a secondary market in the event that they now not want it, Warden stated.

“You’re making a secondary market in one thing that’s fairly illiquid, on this case not out there to you in any respect. And that’s the place I believe one of many areas may be very thrilling for the tokenization of belongings.”

She stated that the tokenization course of is trivial in comparison with whether or not one can take into account a stablecoin crypto, for instance, as a legitimate bearer of worth. Whether or not stablecoins could possibly be thought to be money for on-chain settlements is a topic of regulatory complexity in Europe. She added that stablecoins in the event that they characterize fiat cash, name into query the necessity for central financial institution digital currencies.

Learn extra: What’s Tokenization on Blockchain?

Tokenization Wants Blockchain Requirements

For banks and different establishments to undertake blockchains at scale, they want a means for various networks to speak. In any other case, they won’t benefit from the many efficiencies of blockchain settlements.

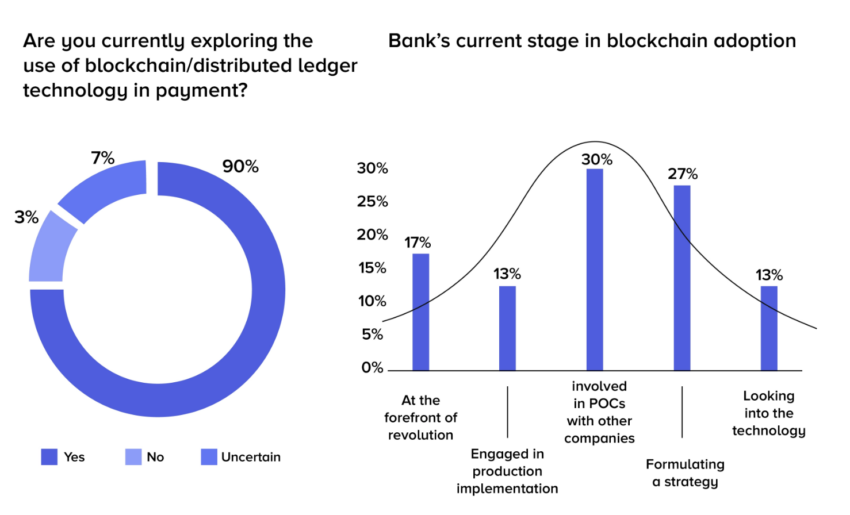

The place Banks Are With Blockchain Adoption | Supply: AppInventiv

The Society for Worldwide Interbank Monetary Telecommunication (SWIFT) is an instance of a system that permits banks to alternate messages securely and shortly. It permits banks to speak in response to a world commonplace, however banks nonetheless have to hold out the required clearing and settlements for transfers. These capabilities introduce inefficiencies.

Equally, for blockchains to turn into efficient means to switch belongings, they need to have the ability to talk with one another in response to a globally accepted commonplace. Solely then will establishments notice the complete advantages of settlement effectivity.

Chainlink, an organization that develops channels for blockchains to obtain knowledge from the true world, just lately went dwell with a brand new Cross-chain Interoperability Protocol (CCIP). The protocol launched on the Chainlink mainnet, Ethereum, Avalanche, Optimism, and Polygon.

The purpose of the protocol is to permit seamless knowledge alternate between blockchains. It has an Energetic Threat Administration (ARM) Community and lively charge limits as safety measures.

These measures negate dangers of so-called bridges that hyperlink blockchains that had been topic to multi-million greenback hacks prior to now. However for the CCIP to turn into as extensively accepted as SWIFT, customers should reply some advanced regulatory questions. The Financial institution of Italy is operating a pilot that might reply a number of the regulatory questions on the problem of the money worth of tokenized belongings, Warden stated.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.