- The Delta Gradient revealed that Bitcoin’s potential decline might final one to 2 months.

- The autumn in energetic addresses raises considerations about demand for BTC.

If Bitcoin’s [BTC] worth motion rhymes with historic patterns, then it’s about to go decrease than it has in the previous few days. In brief, this projected decline might final a month or two.

Nonetheless, AMBCrypto didn’t make this conclusion with out the required information On this article, we are going to break it down. One of many prime metrics that aligns with this prediction is the Delta Gradient.

South is the best way

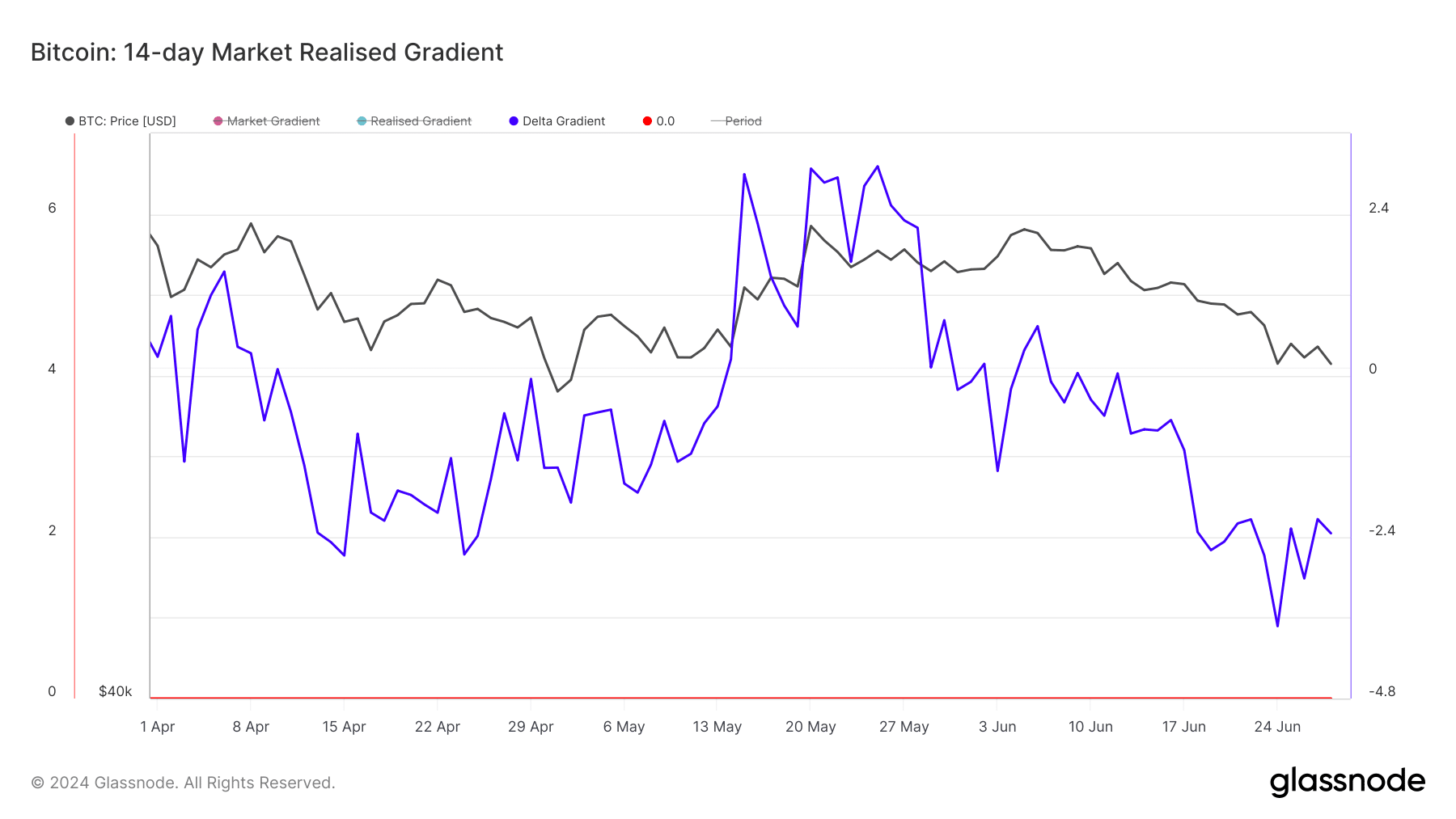

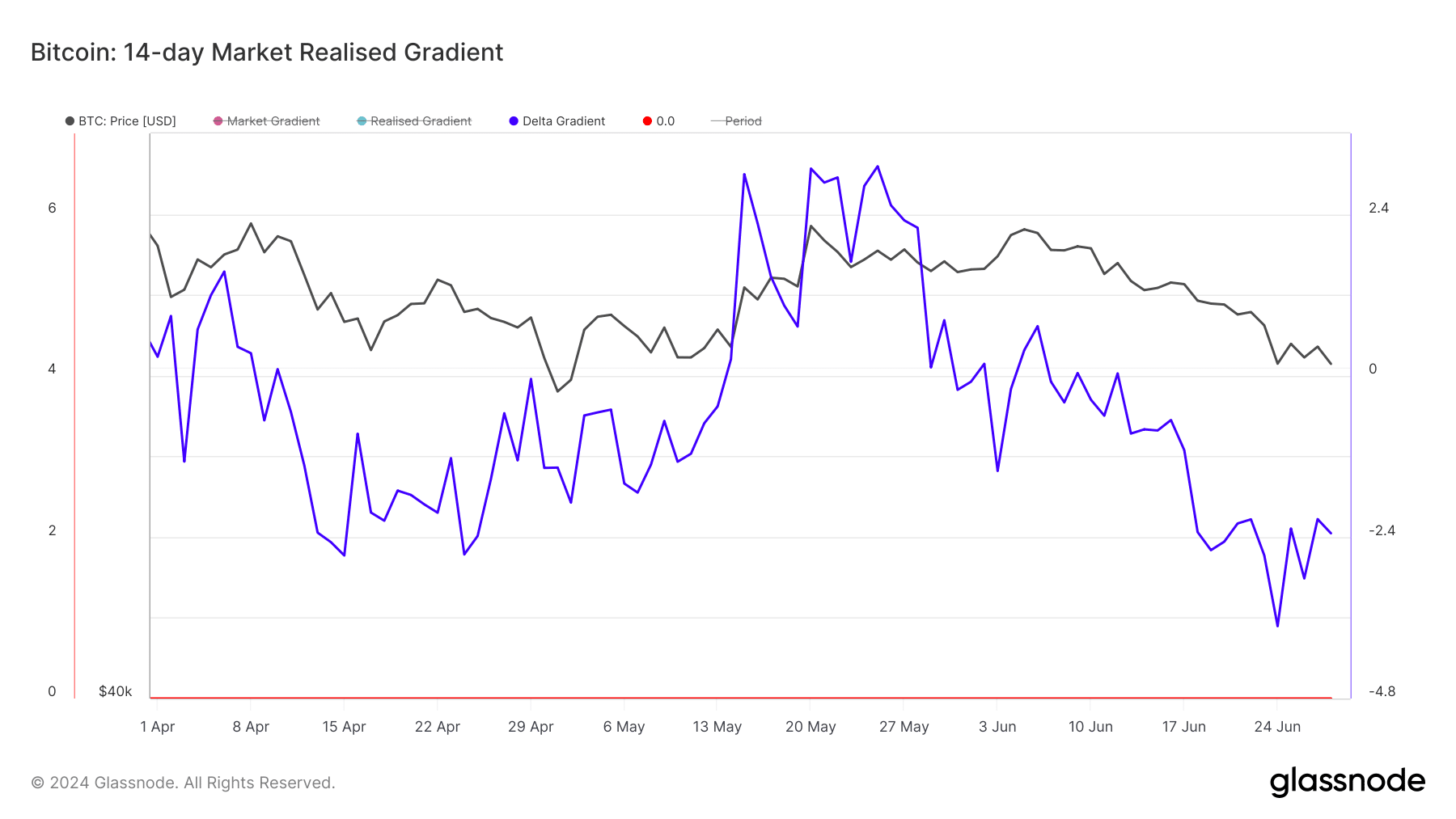

For these unfamiliar, the Delta Gradient measures the relative change in momentum towards the true natural capital of a cryptocurrency.

When the gradient is optimistic, an uptrend seems. Most occasions, this uptrend lasts 28 to 60 days.

At press time, Bitcoin’s downtrend was -2.34. This negative reading implies that the worth would possibly proceed to endure a downtrend. Additionally, this projected downtrend might final an identical period.

Supply: Glassnode

As of this writing, BTC modified fingers at $61,062. This was a 4.96% lower within the final seven days. Ought to the Delta Gradient proceed to drop, then Bitcoin’s worth would possibly fall under $60,000 prefer it did some days again.

This was additionally in tune with Bitcoin’s response to the interval the Realized Value rose above the spot worth. Moreover, we examined the Community Realized Revenue/Loss.

Combined alerts seem on the charts

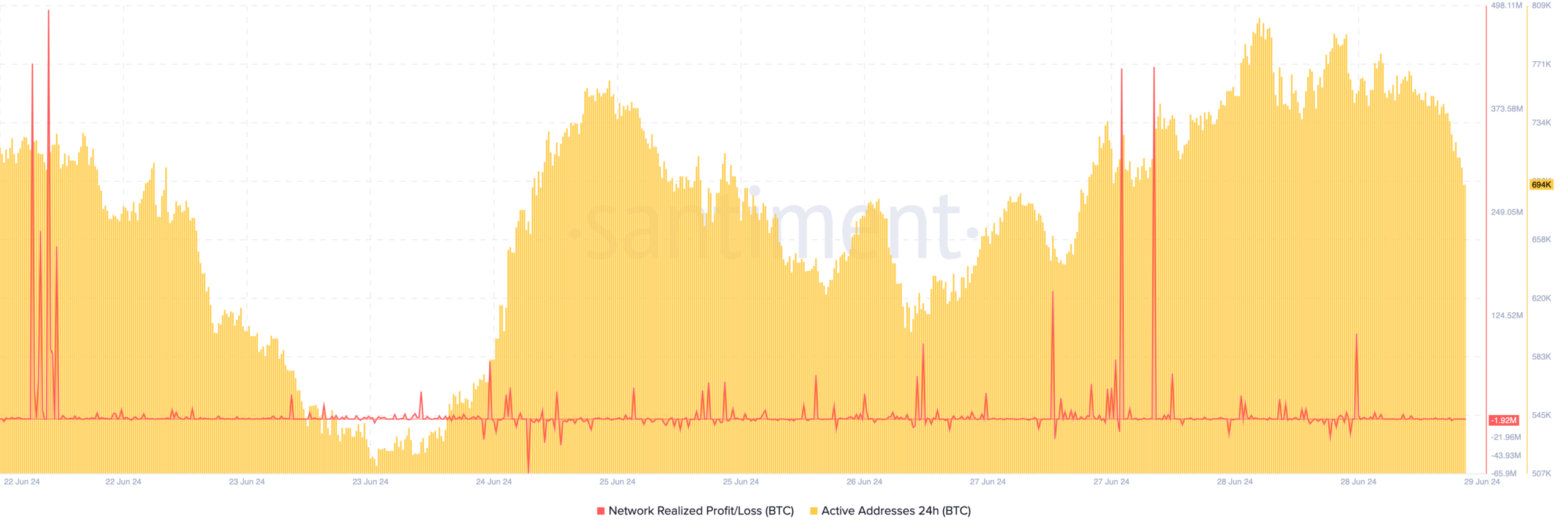

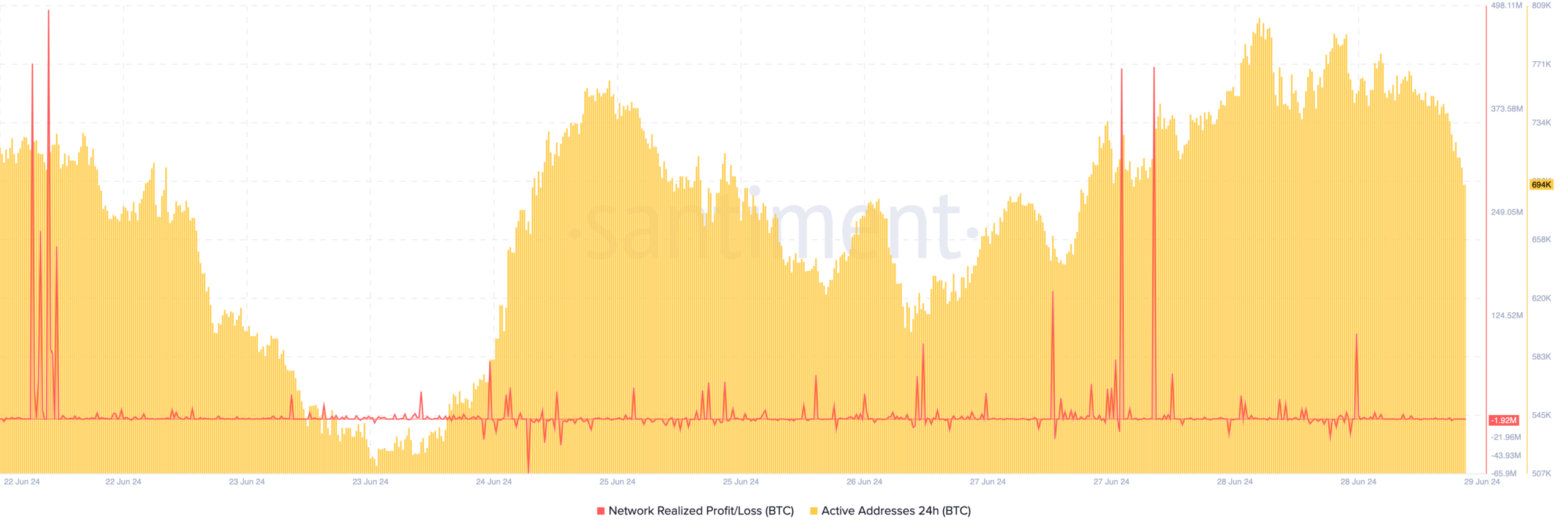

This metric exhibits the worth of transactions which have realized a revenue or loss in latest time. A optimistic studying of the metric implies that profit-taking is excessive. As such, this might trigger costs to fall.

Nonetheless, if the metric is destructive, it implies that there was a surge in realized losses. Whether it is intense, worth might start to climb. Based on Santiment, Bitcoin’s Community Realized Revenue/Loss was -1.92 million.

This implied {that a} chunk of the transactions on-chain ended in losses.

Usually, this decline is predicted to foreshadow a worth improve. However that may not be the case because of the dwindling exercise on Bitcoin’s community.

At press time, the 24-hour Lively Addresses was right down to 694,000. Just a few days in the past, it was virtually a million. Lively addresses is a measure of consumer exercise.

Supply: Santiment

Thus, when it decreases because it has performed in latest occasions, it implies that market contributors usually are not interacting with BTC at a excessive stage. Consequently, this might result in a notable decline in demand for the coin

Reasonable or not, right here’s BTC’s market cap in ETH phrases

Ought to demand proceed to lower, so will the worth. Nonetheless, analyst Michael van de Poppe opined that BTC’s correction would possibly quickly be over.

Based on him, the not too long ago concluded week was good for the coin. He mentioned,

“A fairly first rate weekly candle for Bitcoin is approaching right here. I’d anticipate the correction to be comparatively over. We didn’t get the obvious deep corrections in earlier cycles both.”