- Bitcoin’s value restoration is linked to diminished sell-side strain from main stakeholders.

- Elevated ETF inflows and institutional demand are supporting Bitcoin’s present value stability.

Following a interval of great downturn, Bitcoin [BTC] now seems to have seen a noticeable rebound in value after reclaiming the $65,000 value mark earlier at this time.

At the moment BTC trades at $65,448, up 4.4% previously 24 hours. It’s price noting that the asset had earlier at this time traded as excessive as $66,059.

In line with insights from the on-chain data supplier Glassnode, this surge could be the results of a “near-term sell-side reduction,” suggesting a short lived easing in promoting pressures which have closely influenced Bitcoin’s value trajectory in latest weeks.

The reduction in sell-side strain seems linked primarily to the cessation of large-scale sell-offs by vital holders, together with the German authorities, which had been exerting downward strain on Bitcoin’s market worth.

This improvement suggests a pivotal shift available in the market, probably paving the way in which for extra secure or growing costs transferring ahead.

Bitcoin: Evaluation of latest market actions

Glassnode’s report highlights that the latest decline in Bitcoin’s value to round $53,000 was influenced by anticipated repayments from the defunct Japan-based crypto trade Mt. Gox and substantial Bitcoin gross sales by the German authorities.

These components contributed to an elevated quantity of Bitcoin hitting the market, intensifying sell-side strain.

Nevertheless, the majority of the German authorities’s sell-off occurred in a condensed interval from seventh July to tenth July, throughout which 39.8k BTC flowed out from official wallets, stabilizing shortly thereafter.

This stabilization coincided with Bitcoin costs not falling additional, suggesting that the market had already absorbed the shock of those gross sales.

Additional help for the value got here from a major inflow of funds into Bitcoin spot ETFs, marking the primary notable improve in curiosity since early June.

Over $1 billion flowed into these funds final week alone, aligning with Bitcoin’s value restoration and supporting the notion that the market might need reached a sell-side exhaustion level.

Along with the easing of sell-side pressures, there was a notable uptick in institutional demand which has helped counterbalance the sooner outflows.

This demand is mirrored within the substantial lower in Bitcoin trade flows, that are essential indicators of market liquidity and investor sentiment.

Alternate flows have considerably declined from their all-time highs in March, discovering a brand new baseline at roughly $1.5 billion every day.

The decline in trade flows typically signifies a discount in promoting strain, as fewer holders are transferring their Bitcoin to exchanges on the market. This, mixed with the renewed institutional curiosity, suggests a more healthy market outlook.

Upward transfer to be prolonged?

Whereas Glassnode has revealed that the present rally in BTC’s value is because of full exhaustion from sellers, it’s price BTC fundamentals to gauge the sustainability of this upward pattern.

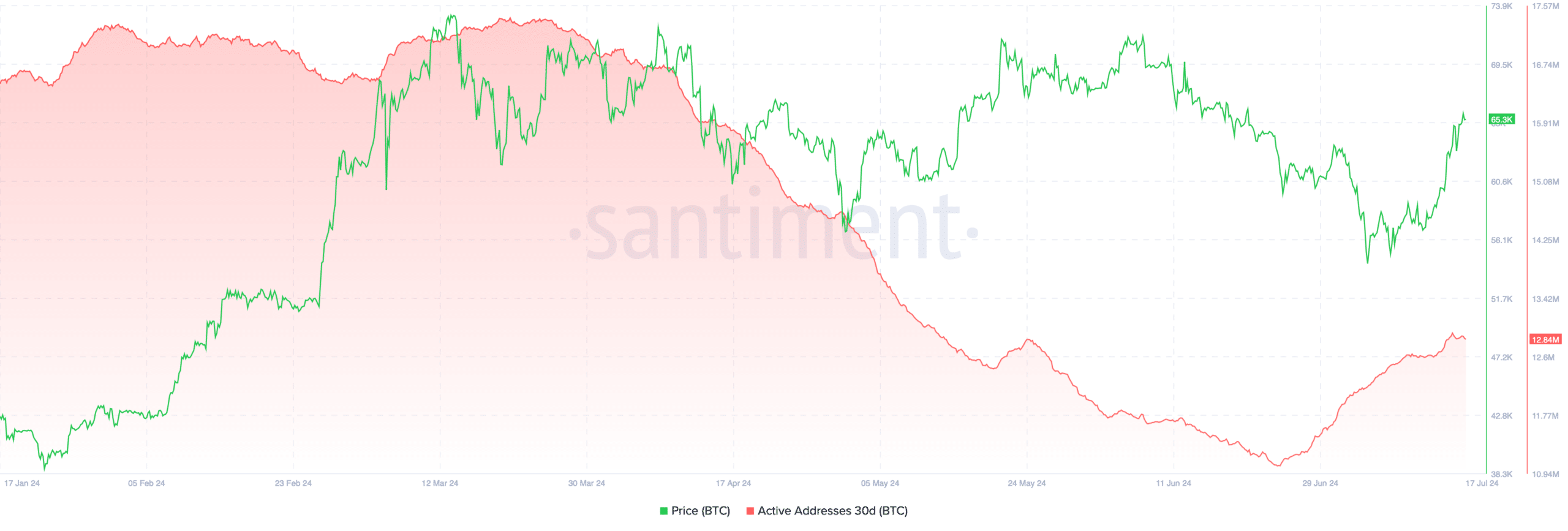

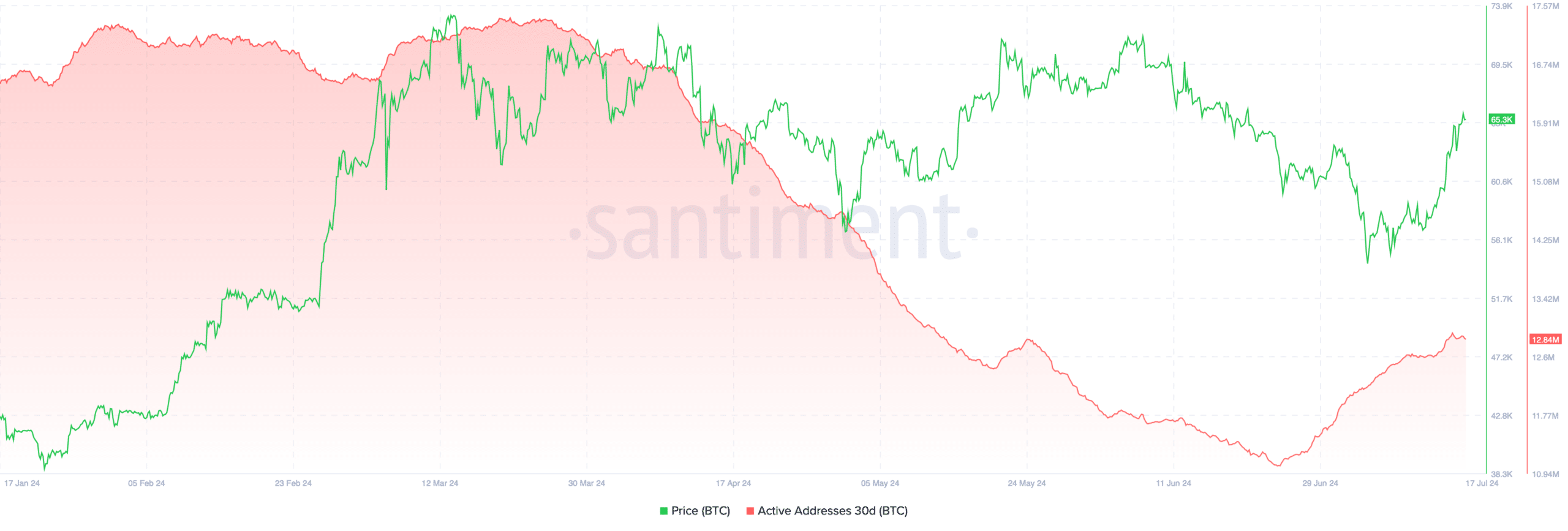

Santiment data signifies a restoration in Bitcoin’s lively addresses; from a drop to 11 million in late June from 17.35 million in March, the depend has risen to 12.84 million.

This rebound suggests rising retail curiosity which might probably help a continued rise in Bitcoin’s value.

Supply: Santiment

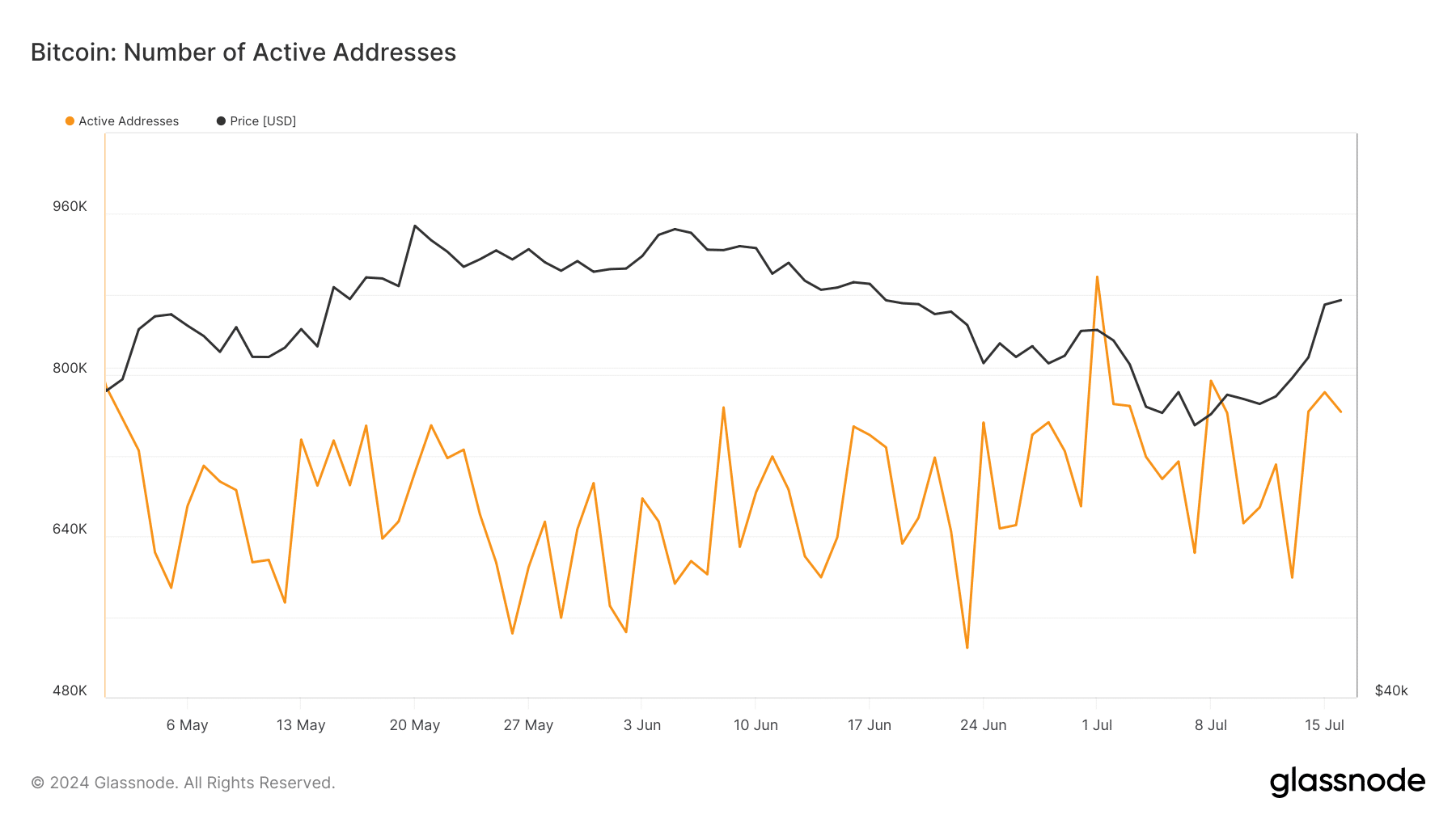

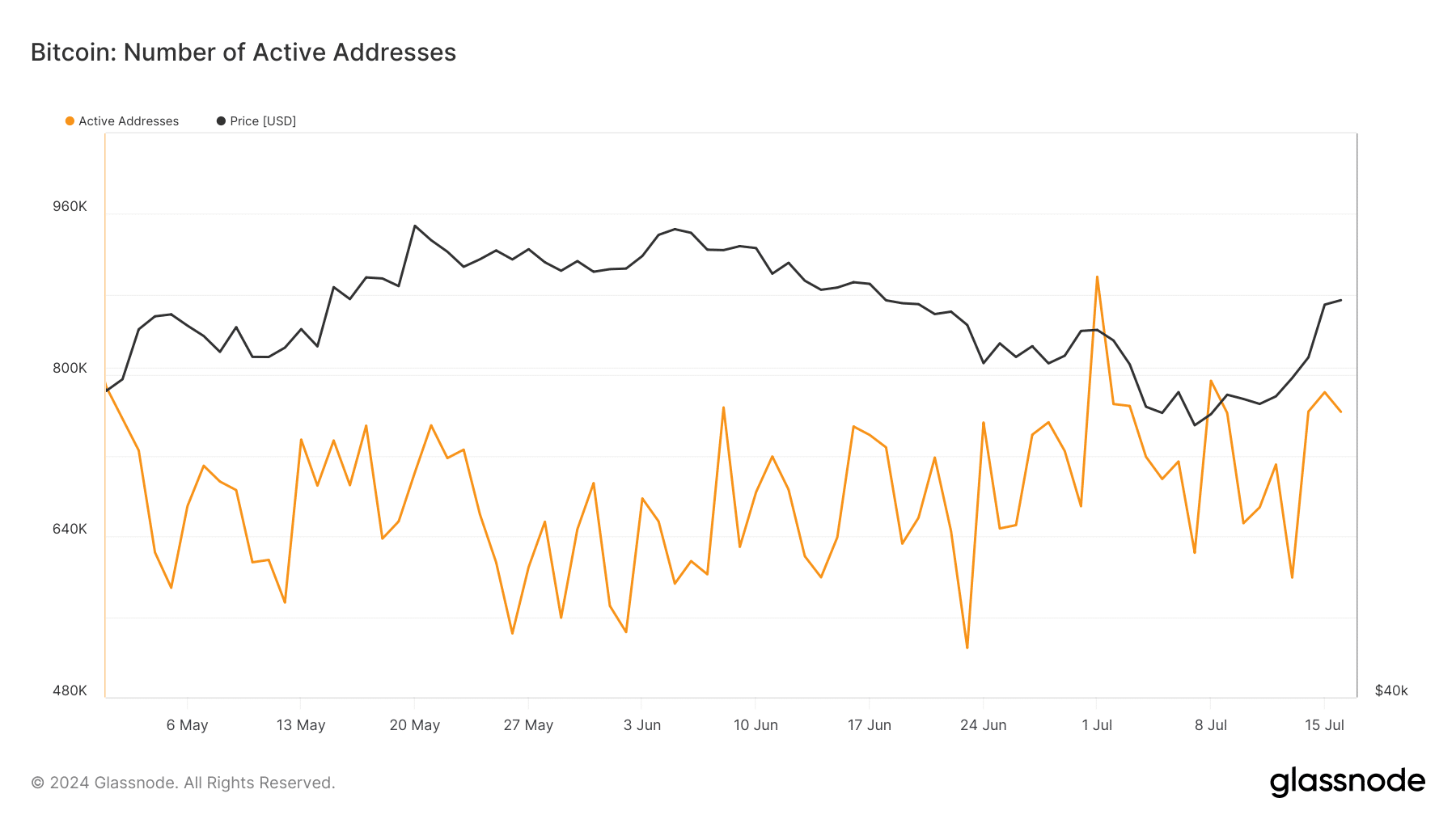

Moreover, Bitcoin’s new deal with creation from Glassnode, underscores this constructive sentiment. After dipping beneath 600,000 in late June, the variety of new addresses climbed to 897,000 on 1st July, earlier than settling at 763,000.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Regardless of this slight pullback, the constant improve in lively and new addresses might point out a strengthening market presence, possible setting the stage for additional value stabilization or good points.

Supply: Glassnode

Supporting this outlook, AMBCrypto just lately reported that Bitcoin’s skill to transform resistance ranges into help might sign an impending stabilization or an upward value trajectory if it stays above key thresholds.