Some market commentators have expressed concern concerning the US authorities’s plans to promote Bitcoin seized from the Silk Highway saga. However $130 million is a penny in comparison with outflows from the Grayscale Bitcoin Belief (GBTC) exchange-traded fund (ETF).

Yesterday, the US authorities stated it might promote round $130 million value of BTC from sentenced Silk Highway drug traffickers. Fears of huge promote stress ensued from Bitcoin buyers.

Why Some Gross sales Received’t Impression Value

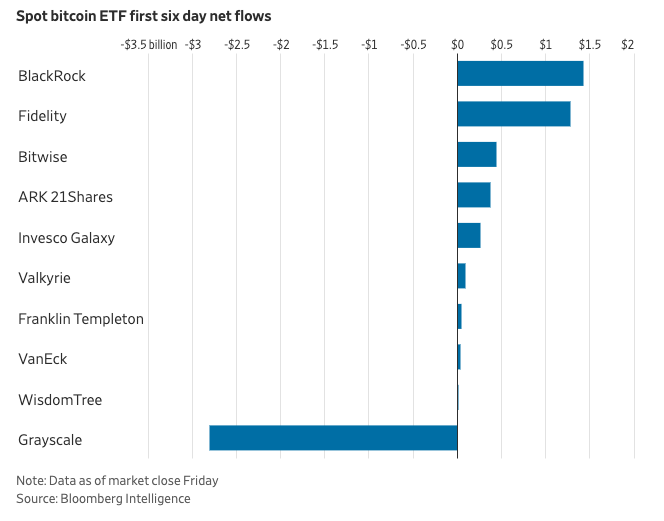

Nonetheless, Bitcoin maximalist Steven Lubka stated a Silk Highway dump is ‘peanuts’ in comparison with the $2.8 billion going out from exchange-traded funds (ETFs). Two days in the past, the value of Bitcoin was down 20% beneath $40,000, putting many pre-ETF buyers underwater. Over half of buyers who purchased Bitcoin at pre-ETF ranges of between $34,034.76 and $46,110.74 are underwater, in response to knowledge from IntoTheBlock.

Learn extra: Ross Ulbricht: The Actual Story Behind the Silk Highway Founder

Subsequently, gross sales of seized Silk Road BTC may very well be negligible. Critics have blamed massive GBTC outflows on Grayscale’s charges.

Latest studies recommend a big share of GBTC gross sales got here from FTX, an alternate that collapsed in 2022. Prior to now week, FTX reportedly bought roughly $1 billion value of GBTC holdings.

Bloomberg ETF analyst James Seyffart suspects the most important holder of GBTC, the Digital Foreign money Group (DCG), may also be selling. In accordance with latest monetary studies, DCG owns about $1.3 billion value of GBTC shares.

“The biggest “identified” holder of GBTC is definitely DCG itself. I’d truthfully be stunned if DCG hasn’t been a part of this GBTC promoting.”

The corporate might have bought GBTC to cowl authorized prices. Such gross sales needn’t be disclosed by legislation since DCG is a personal firm. It might select to report this info voluntarily.

However, a public firm should embody such transactions through earnings studies and filings with regulators. Will probably be clearer which corporations bought shares of GBTC at future earnings calls.

Why Mt Gox Received’t Impression Value

A tangential occasion that might influence the value of Bitcoin is repayments from the Mt. Gox chapter. The property will begin BTC and Bitcoin Money (BCH) repayments to collectors this week. Prospects misplaced 850,000 BTC when the alternate failed in 2014.

Collectors may revenue from an 80x enhance for the reason that collapse. This gross sales quantity might trigger extra stress earlier than Bitcoin’s halving.

In accordance with crypto funding agency CoinShares, daily volatility of 1-5% is not abnormal. The Mt. Gox influence may very well be minimal if collectors stagger gross sales.

Learn extra: Bitcoin Value Prediction 2024/2025/2030

April’s Bitcoin halving may mitigate the long-term results of huge gross sales within the medium to long run. The baked-in provide discount happens roughly each 4 years.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.