- Miners might need been promoting BTC due to their lowered income.

- Nevertheless, long-term traders have been assured in BTC.

Bitcoin [BTC] has managed to push its value within the final 24 hours, but it surely has nonetheless been struggling beneath the $60k mark. The latest value uptick couldn’t assist change the sentiment of Bitcoin miners as they continued to promote their holdings.

Will miners’ newest sell-off push BTC down in direction of $54k once more?

Bitcoin miners are promoting BTC

The bulls took management within the final 24 hours as they pushed BTC’s value up by over 3%. On the time of writing, BTC was buying and selling at $56,675.42 with a market capitalization of over $1.11 trillion.

Nevertheless, the miners nonetheless selected to promote BTC whereas its value gained bullish momentum.

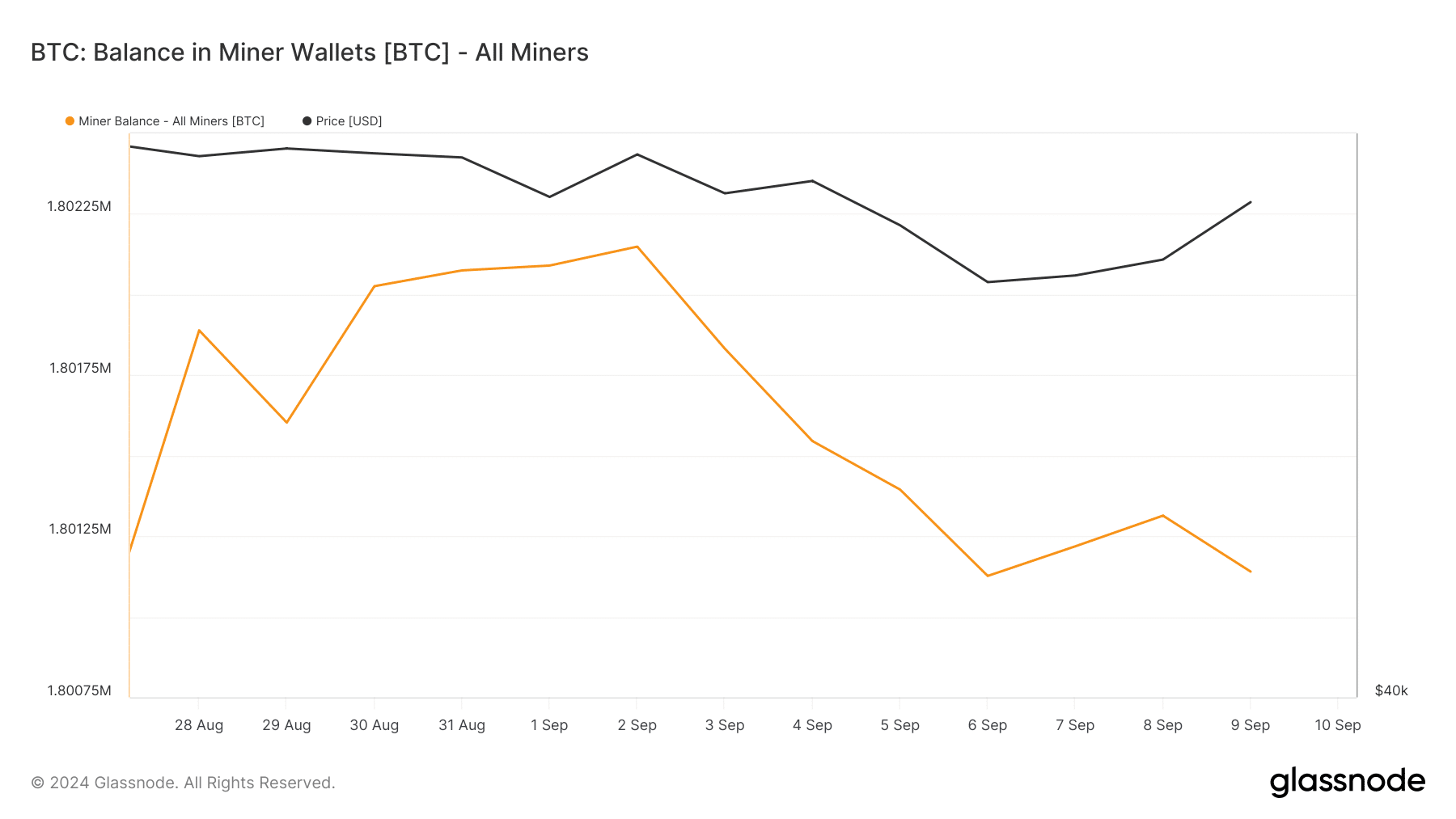

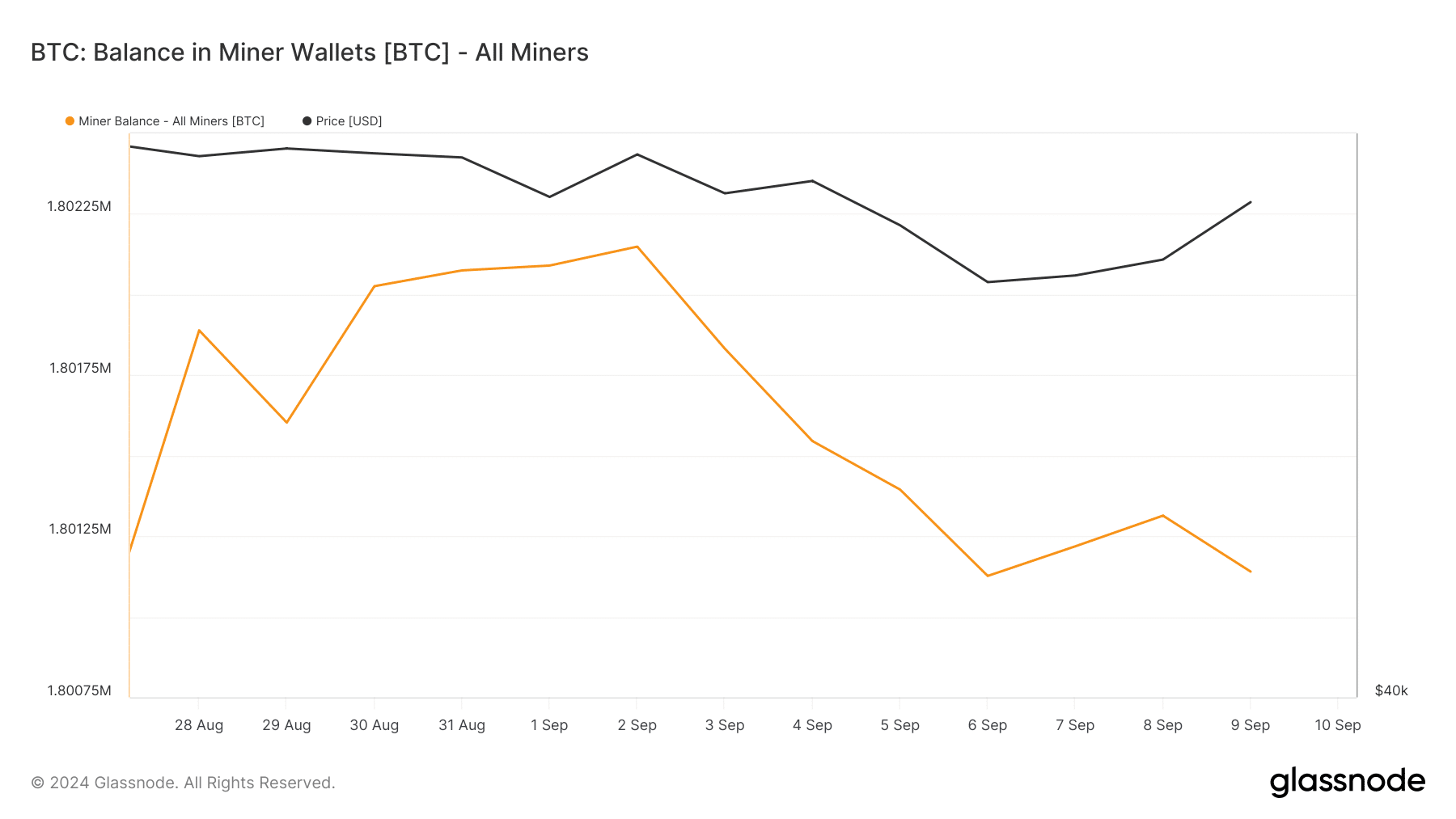

As per AMBCrypto’s have a look at Glassnode’s information, stability in miner wallets fell to 1.8 million BTC. This recommended that miners weren’t anticipating the king coin’s value to rise additional.

Supply: Glassnode

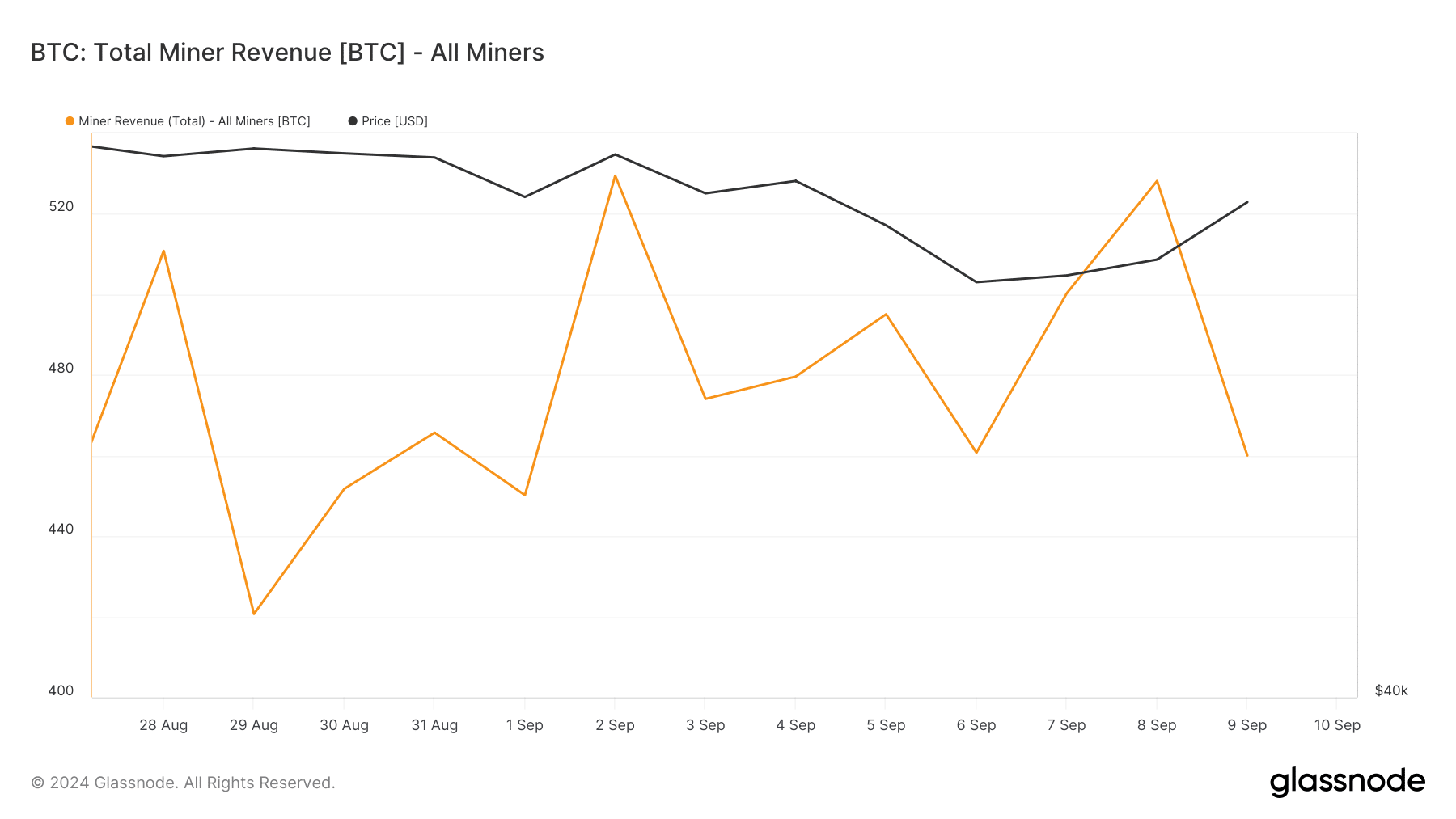

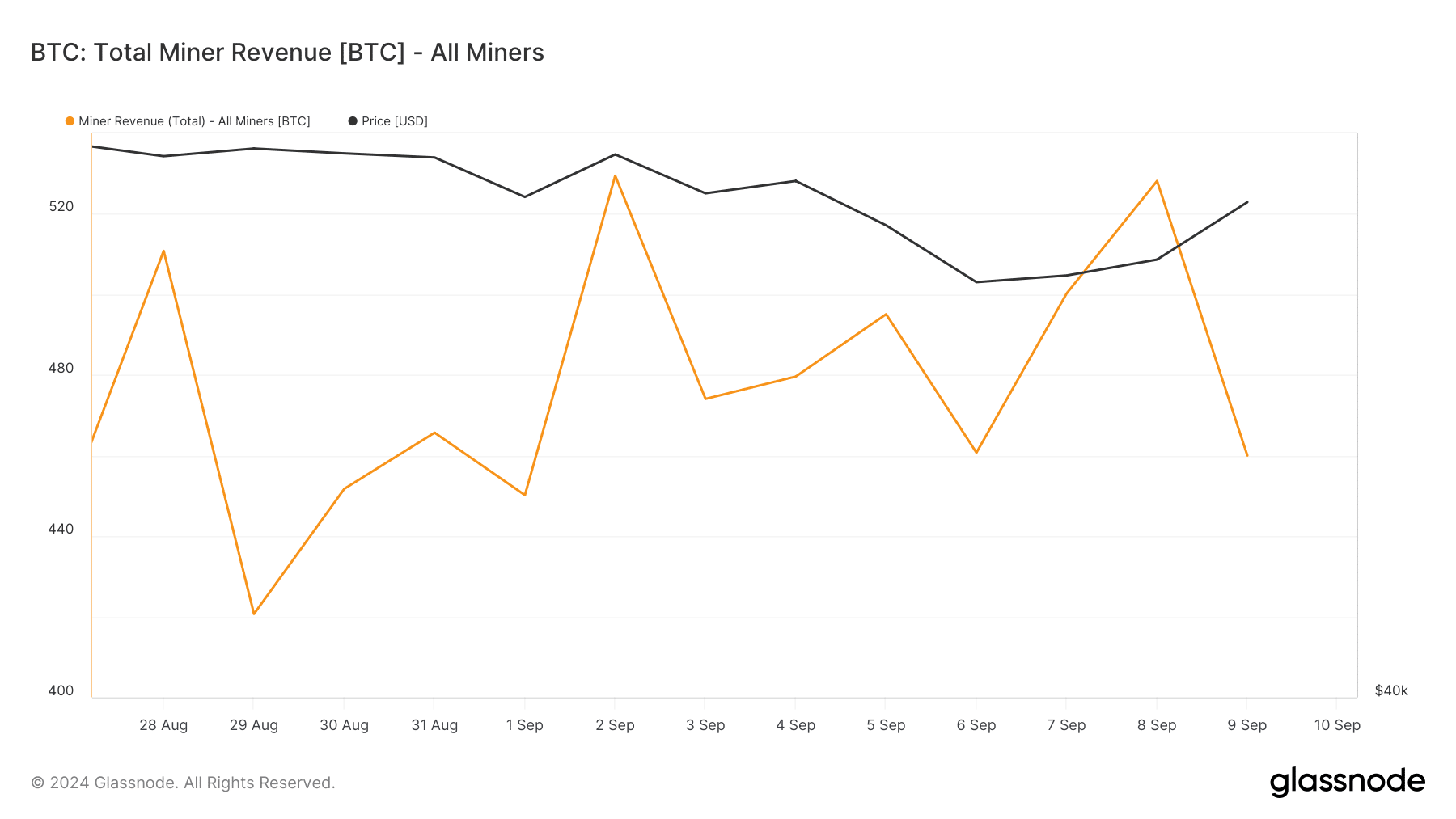

We then checked miners’ income to seek out out what motivated them to promote. Curiously, their income additionally registered a decline within the latest previous.

Supply: Glassnode

The drop in miners stability and income additionally affected the blockchain’s hashrate. As per Coinwarz’s data, BTC’s hashrate dropped in the previous couple of days. At press time, the quantity stood at 712.57 EH/s.

Will BTC’s value be affected?

There’s a likelihood that this habits of miners will have an effect on BTC’s value as promote stress usually ends in value corrections.

In reality, Ali, a well-liked crypto analyst, just lately posted a tweet revealing that if BTC drops to $54.2k, then it’ll face a liquidation value $24 million.

Therefore, AMBCrypto checked extra information units to seek out different purple flags.

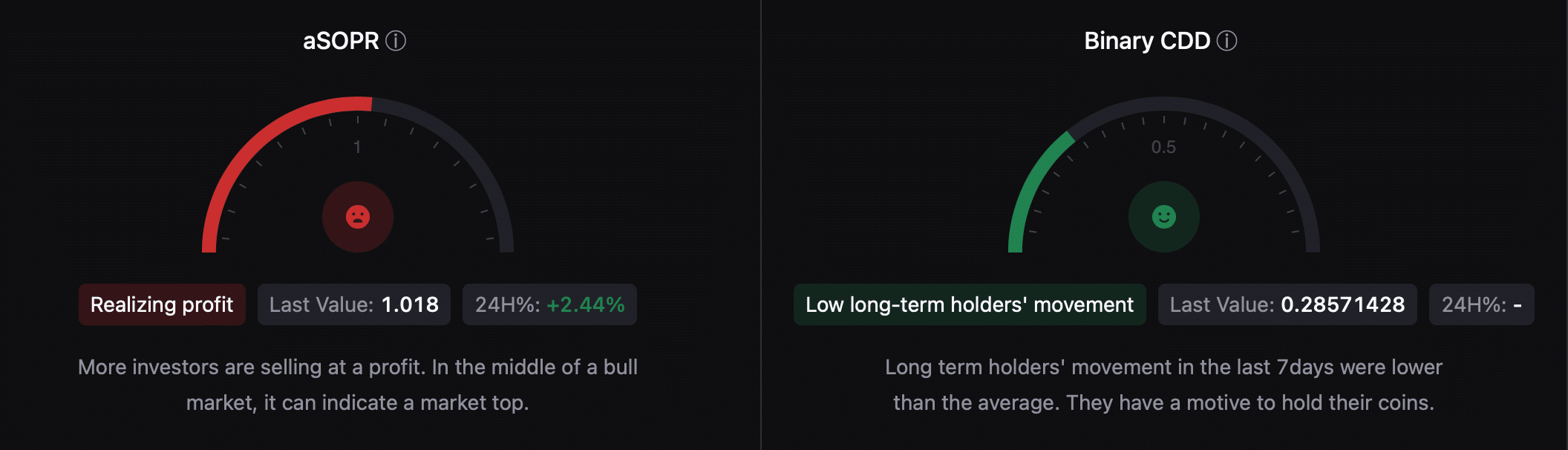

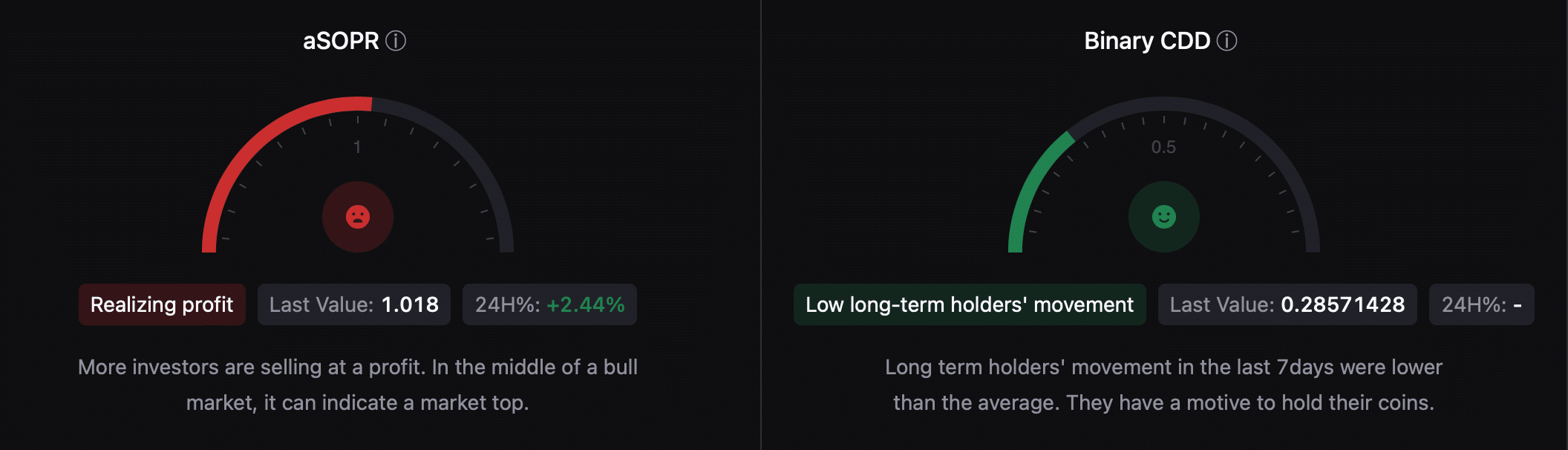

As per our evaluation of CryptoQuant’s data, BTS’s aSORP was purple, which means that extra traders have been promoting at a revenue. In the course of a bull market, it will possibly point out a market high.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nevertheless, the remainder of the metrics appeared bullish. As an illustration, Bitcoin’s Binary CDD revealed that long-term holders’ motion within the final seven days was decrease than the common. They’ve a motive to carry their cash.

Supply: CryptoQuant

Aside from that, issues within the derivatives market additionally appeared fairly optimistic, because the coin’s taker’s purchase/promote ratio was inexperienced. This indicated that purchasing sentiment was dominant amongst futures traders.