- Bitcoin sentiment spikes with ETF inflows, however analysts warn of a bearish head and shoulders sample.

- Market corrections observe Bitcoin’s bullish sentiment, with the MVRV ratio displaying balanced market situations.

Bitcoin [BTC] has skilled a market correction following a interval of elevated bullish sentiment.

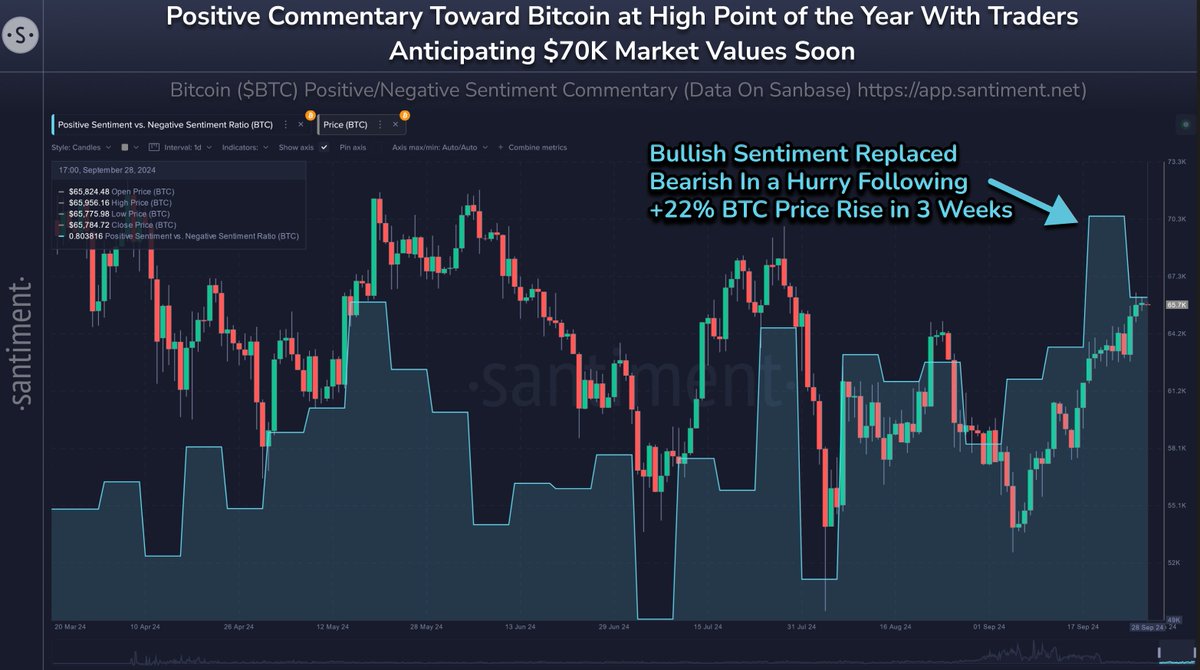

In line with market intelligence platform Santiment, the group’s optimism towards Bitcoin has been steadily rising, with sentiment information displaying a notable shift.

This optimistic outlook, nevertheless, has raised considerations of a possible market prime, which regularly results in worth corrections within the cryptocurrency house.

Bitcoin’s worth retraced from $65,664 to $63,243 on Monday, triggered by some panic promoting.

Santiment warns that if the present concern of lacking out (FOMO) turns into concern, uncertainty, and doubt (FUD), Bitcoin’s market might expertise heightened volatility.

Santiment famous that the market has traditionally moved towards crowd expectations, signaling a possible continuation of this correction.

Rising sentiment and ETF inflows

Santiment’s evaluation from final Friday indicated rising confidence amongst Bitcoin merchants, following a 22% worth surge over the previous three weeks.

The sentiment ratio, which tracks the steadiness between bullish and bearish posts about Bitcoin, revealed a major rise in optimism, with 1.8 bullish posts for each bearish submit.

Whereas this means optimistic sentiment, Santiment factors out that extreme confidence typically precedes market downturns, as merchants could also be overly optimistic.

Supply: Santiment

On the similar time, Bitcoin exchange-traded funds (ETFs) have seen large inflows. On the thirtieth of September, Lookonchain reported that $BTC ETFs witnessed 7,111 BTC in internet inflows.

This equated to roughly $453.42 million.

A considerable portion of this, round 3,085 BTC ($196.71 million), got here from ARK21Shares, elevating its cumulative holdings to almost 50,684 BTC.

These institutional inflows come as market members await the U.S. Securities and Alternate Fee’s (SEC) resolution on pending functions for spot Bitcoin ETFs.

The anticipation of potential ETF approvals has possible contributed to the rising curiosity from establishments.

Moderation out there

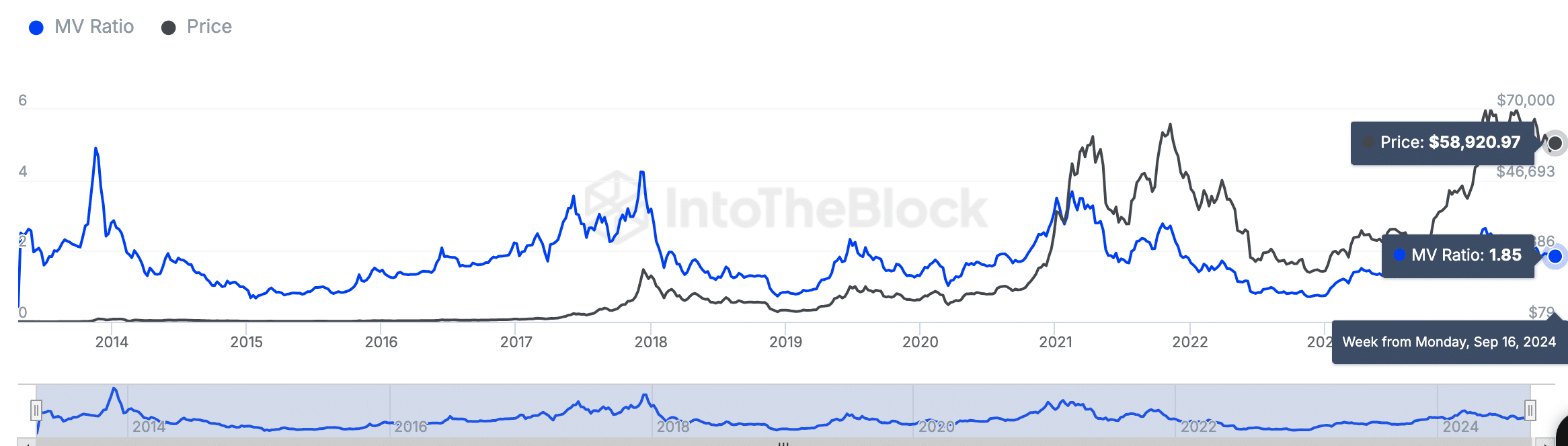

The MVRV ratio, which compares Bitcoin’s market worth to its realized worth, presently stands at 1.85. This means that Bitcoin is buying and selling above its realized worth, however isn’t in an overheated or undervalued state.

Traditionally, peaks within the MVRV ratio, sometimes above 3.5, have marked Bitcoin worth tops, similar to throughout the bull markets of 2013, 2017, and 2021. These durations have been adopted by sharp corrections and bear market phases.

Supply: IntoTheBlock

When the MVRV ratio falls under 1, it signifies that Bitcoin is buying and selling under its realized worth, typically presenting shopping for alternatives.

The press time ratio of 1.85, nevertheless, instructed the market was in a balanced state, with potential for both continued correction or restoration, relying on future sentiment shifts.

Bearish technical sample provides to uncertainty

Including to the uncertainty, a current report from AMBCrypto highlighted considerations raised by a crypto analyst often called Ash Crypto.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The analyst identified a multi-year bearish head and shoulders sample on Bitcoin’s chart that has been creating since 2021.

The coin’s worth is nearing the neckline assist of this sample, and failure to carry this assist might lead to a considerable worth drop.