- Bitcoin may surge above its 4-month-long worth vary in September.

- There was rising $100K per BTC calls by December 2024, per QCP Capital.

Bitcoin’s [BTC] worth motion has been resilient this week and remained above $60K regardless of large losses in U.S. equities.

Moreover, tailwinds are starting to align within the second half of 2024 and will tip BTC to a brand new all-time excessive. BTC has been caught throughout the $60K—$71K vary since March, however the sideways motion may quickly be over.

Is BTC able to surge above the 4-month vary?

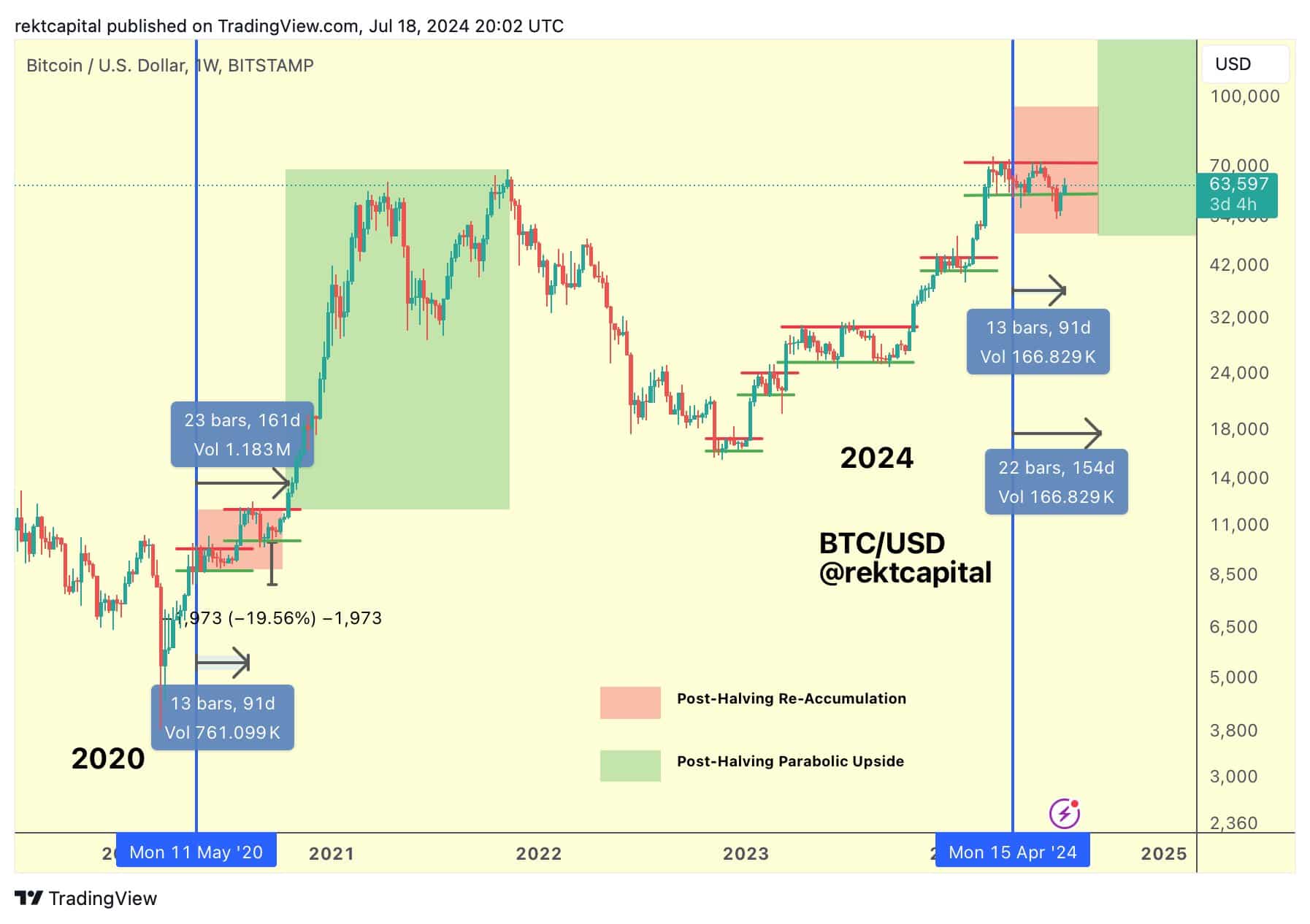

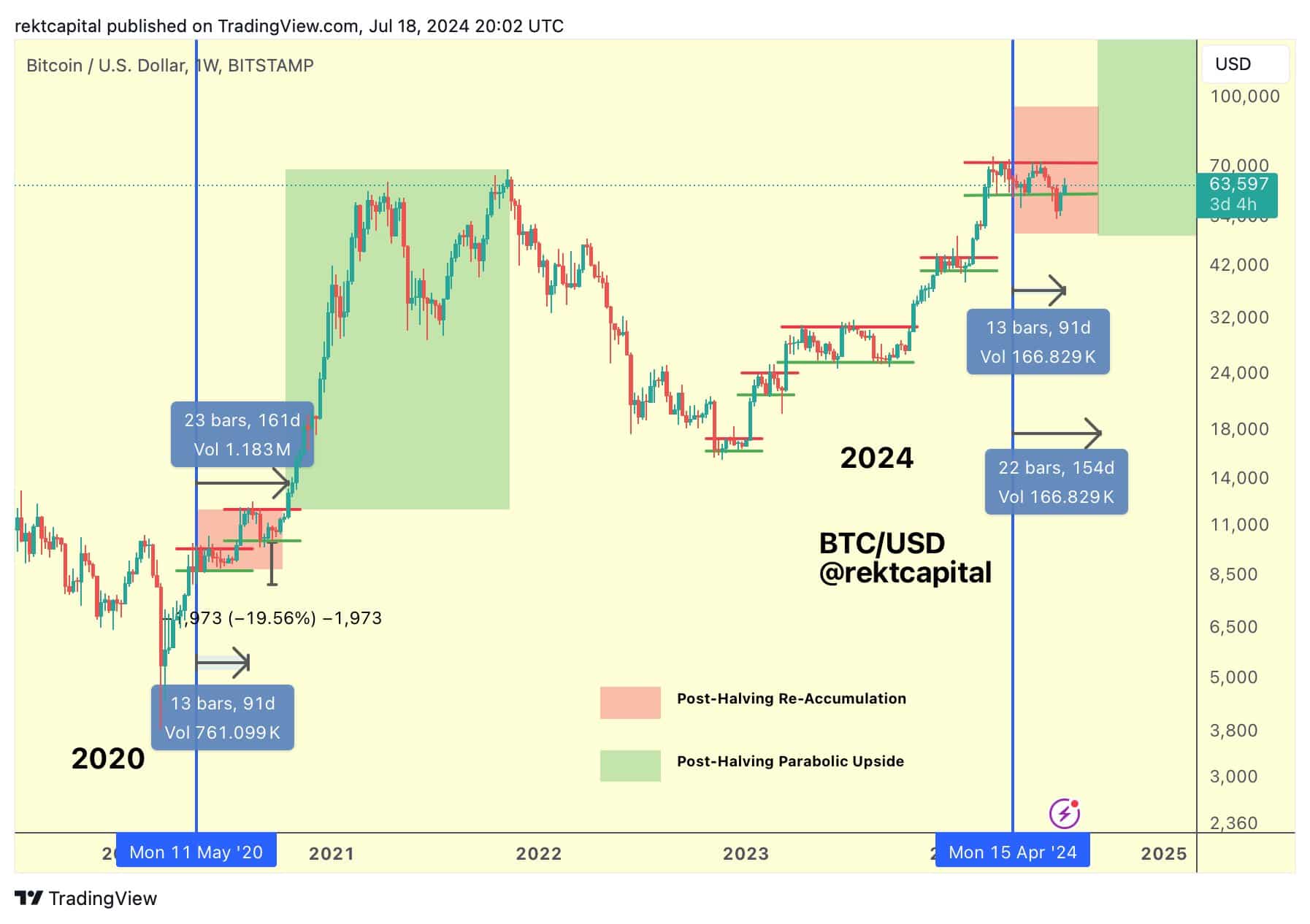

In response to market analyst Rekt Capital, based mostly on historic knowledge, a possible breakout from the $60K—$71K vary in September was possible.

“If historical past repeats, a Bitcoin breakout from the Re-Accumulation Vary would happen in September 2024.”

Supply: Rekt Capital

The projection was based mostly on the sideways motion that happens after the halving occasion. If the historic pattern repeats, this consolidation interval may finish in September.

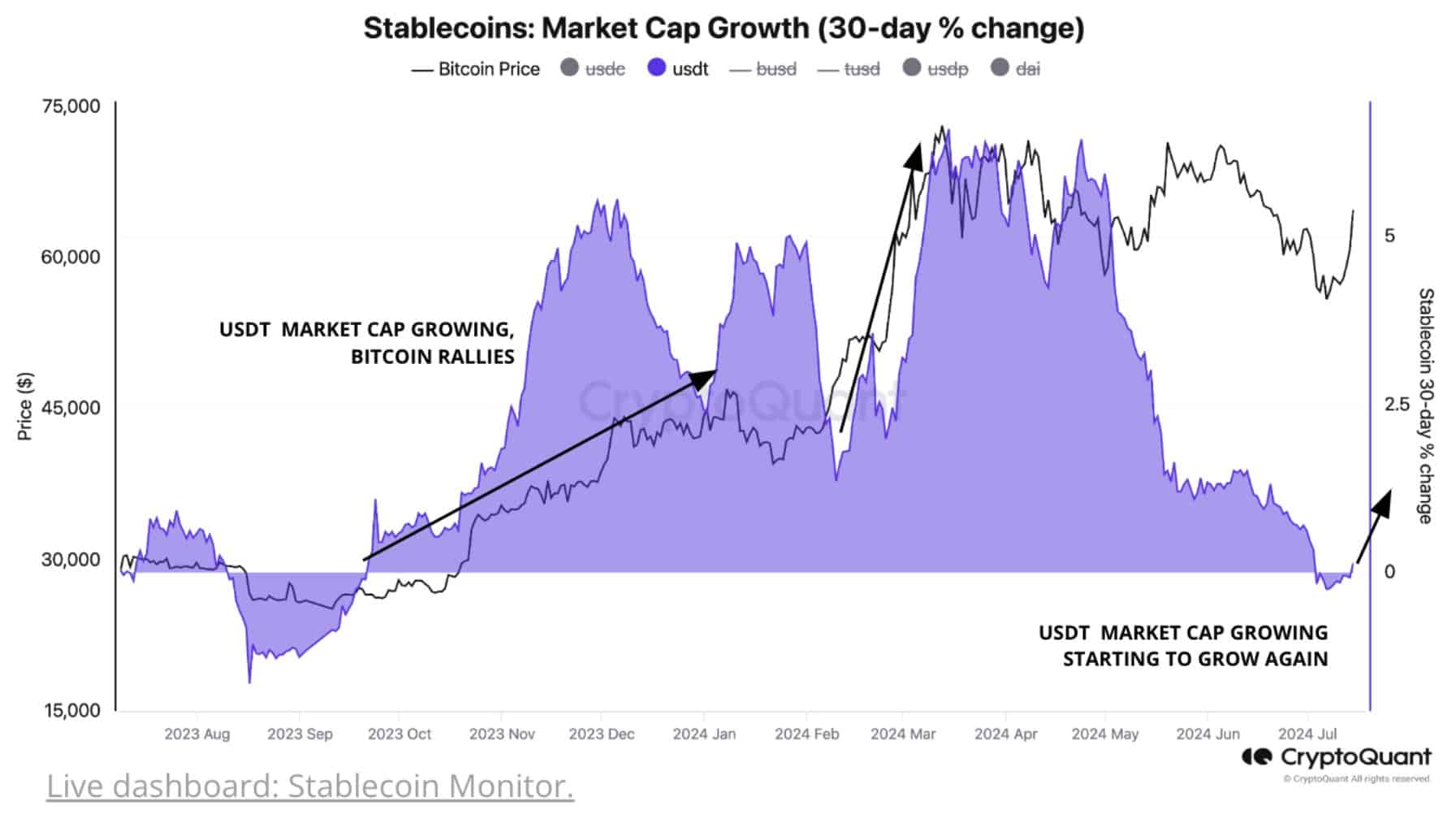

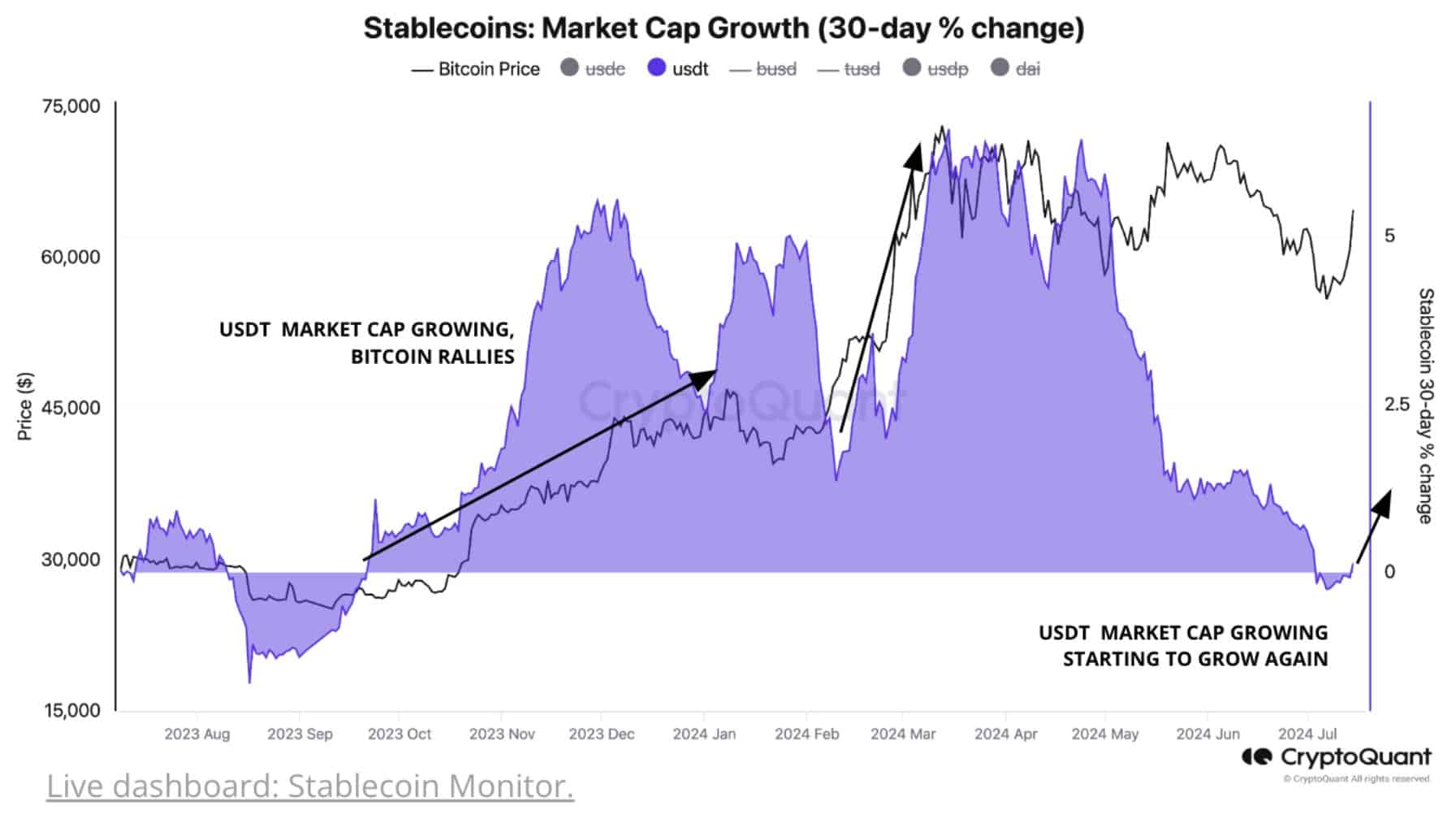

An uptick in stablecoins development, which dropped considerably in H1 2024, supported the above break-out prospect for bulls.

“Stablecoin inflows into the #crypto markets are constructive once more! It is a very bullish growth, traditionally aligning with #Bitcoin rallies.”

Supply: CryptoQuant

The stablecoin development meant market gamers may place themselves for bids as market sentiment improved.

All eyes are set on September for a possible Fed price minimize. Over 90% rate of interest merchants count on the Fed to maintain the speed unchanged through the subsequent Fed choice on the finish of July. In September, odds of price cuts stood at 93%.

The speed cuts may gasoline BTC. Additional BTC rallies could be potential if Donald Trump, a pro-crypto candidate, wins the US presidential elections in November.

Nonetheless, a September price minimize was not that apparent.

In response to a Bloomberg report, Trump had warned Fed chair Jerome Powell to not minimize charges earlier than November to keep away from giving Biden an higher hand.

“The Fed ought to abstain from chopping charges earlier than the November election and giving the financial system, and Biden, a lift.”

It stays to be seen whether or not Powell will take the warning severely and dent market expectations.

In the meantime, regardless of the resilient worth motion, the market remained bullish, with $100K per BTC worth targets by the tip of the 12 months, according to QCP Capital analysts.

“Even with decrease spot in a single day, we continued to see sizeable institutional curiosity in Dec $100k Calls. This indicators an excellent stronger conviction of a year-end rally as the percentages of a Trump victory will increase.”