Presently, conventional belongings are regularly debased attributable to overproduction and inflation. Bitcoin emerges as a beacon of stability with its immutable shortage and superior financial properties.

As the following Bitcoin halving approaches, specialists and market analysts highlight BTC as the last word software for long-term financial savings.

In response to a brand new report, Bitcoin’s distinctive attributes place it forward of conventional financial savings devices. Joe Burnett, researcher at Unchained, defined that the upcoming Bitcoin halving, which is able to cut back the block reward from 6.25 BTC to three.125 BTC, is ready to cement Bitcoin’s position as a primary financial savings medium.

Burnett described the trendy financial atmosphere as an “innovation entice.” Right here, speedy technological developments and market competitors result in an oversupply of products and companies, in the end inflicting asset values to plummet.

He argued that in such a state of affairs, storing vital wealth outdoors of Bitcoin can be “more and more troublesome” as a result of debasement of conventional belongings.

“Bitcoin stands out as the asset class that more and more captures a big share of whole world wealth, all at a time when world wealth is quickly rising as a result of relentless acceleration of innovation. In a world of abundance, hyper-productivity, and intensely aggressive markets, storing vital wealth outdoors of Bitcoin can be more and more troublesome,” Burnett mentioned.

The researcher additionally highlighted that conventional belongings, together with fiat currencies, shares, and actual property, are inclined to worth erosion over time. For example, the US greenback has depreciated considerably, down 92.8% during the last 5 years when measured towards fundamental client items.

Learn extra: How you can Shield Your self From Inflation Utilizing Cryptocurrency

This pattern is mirrored in different asset courses, with the 20-year Treasury Bond dropping greater than 94.8% in the identical interval.

Even treasured metals like gold and silver should not immune. Regardless of their historic popularity as steady storeholds of worth, the elevated effectivity in mining and manufacturing applied sciences has led to a surge in provide, which, in flip, diminishes their worth.

“There’s virtually infinite gold within the universe, and there’s even an estimated ~$771 trillion price of gold simply in Earth’s oceans (~70x the present circulating provide). The potential circulating provide of gold has no severe restrict, and gold holders can have their financial savings endlessly devalued as humanity turns into extra productive at mining and extracting gold,” Burnett defined.

These findings underscore the diminishing returns of conventional investments and spotlight the rising relevance of Bitcoin. Burnett argued that Bitcoin’s “immutable absolute shortage” uniquely fits it as a financial savings software, particularly in a hyper-competitive, innovation-driven financial system.

The Results of the Halving on BTC

Because the halving approaches, lowering Bitcoin’s provide inflation by 50%, Burnett identified this may lower promote stress and doubtlessly result in vital value appreciation.

Likewise, Matthew Howells-Barby, VP of Development at Kraken, famous that the Bitcoin halving has traditionally catalyzed substantial value will increase. New all-time highs are sometimes reached inside a yr following previous halving occasions.

“The Bitcoin halving has traditionally served as a launching level for brand new value discovery in BTC. New all-time highs have been reached inside the yr following every of the previous three halving occasions, dwarfing any of the positive aspects made within the yr earlier than the halving,” Howells-Barby advised BeInCrypto.

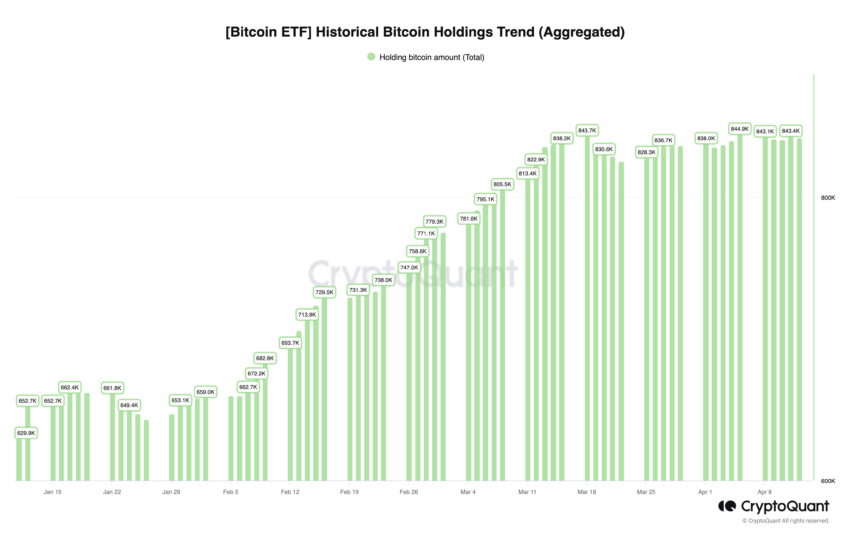

He additional elaborated that the inflow from the spot Bitcoin exchange-traded funds (ETFs) has probably accelerated BTC’s appreciation greater than anticipated. Due to this fact, it’s setting the stage for one more bullish cycle post-halving.

Value predictions place Bitcoin between $100,000 and $120,000 within the present bull market. Much more optimistic long-term forecasts by analysts like Cathie Wooden predict BTC may attain $1.48 million by 2030. Because of this, the case for Bitcoin as a superior financial savings software is compelling.

“Probably the most vital variations on this cycle when in comparison with earlier ones is the investor combine. The spot Bitcoin ETsF have introduced in a considerably larger quantity of institutional capital, which ought to, in principle, cut back the volatility of BTC costs over an extended time period. I nonetheless imagine we’ll expertise future bear market situations, however the upside potential is even larger,” Howells-Barby concluded.

Learn extra: What Occurred on the Final Bitcoin Halving? Predictions for 2024

The argument for Bitcoin’s superiority lies in its efficiency and foundational expertise. It ensures no extra Bitcoin might be created past its 21 million cap. This side of Bitcoin is especially pertinent because the halving nears, highlighting its resilience towards inflation and its functionality to safeguard towards financial uncertainty.

Disclaimer

Following the Belief Mission tips, this characteristic article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.