Devin Walsh, Govt Director of the Uniswap Basis, a non-profit group supporting the expansion and decentralization of the Uniswap decentralized change (DEX), believes that Uniswap is decentralizing. Walsh even compares the present state of the DEX to that of Ethereum. The manager additionally acknowledged that the DEX’s present stage of success is because of the lively participation and contribution of the developer group.

Uniswap Turning into Extra Decentralized?

The Govt Director responded to a thread on X the place Antonio Juliano, the founding father of dYxX, a layer-2 DEX on Ethereum, insinuated that Uniswap is now centralized. Nonetheless, it began on a decentralized path.

With centralization, Juliano added, the protocol can iterate rapidly, primarily to spice up income. However, by being extra decentralized, dapps permit customers to benefit from the full benefits of decentralized finance (DeFi).

Decentralization of protocols launching on public ledgers, like Ethereum or Cardano, is essential. Often, the group will gauge how effectively a dapp is decentralized by taking a look at, amongst different components, how choices are made and which celebration spearheads growth.

Within the case of Ethereum, Walsh identified that the group has taken over from the place Vitalik Buterin, the co-founder; and Consensys, a know-how firm creating options for Ethereum, left. Since then, a number of builders have been refining the community and making certain it’s safe and strong to anchor dapps.

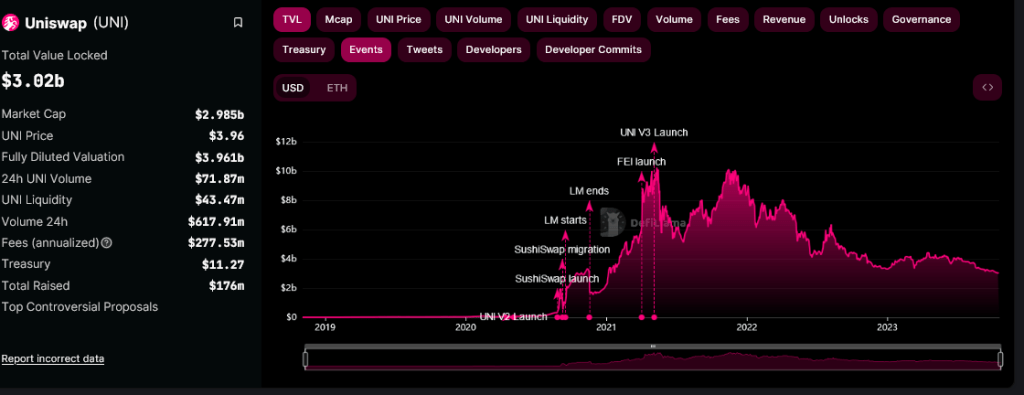

Uniswap is likely one of the hottest DEXes on Ethereum, taking a look at complete worth locked (TVL). DeFiLlama knowledge shows that the change manages over $3 billion of property and is primarily lively on Ethereum. Nonetheless, the change allows trustless swapping on layer-2 platforms like OP Mainnet, and public ledgers just like the BNB Chain.

Getting ready For Hooks And KYC?

Presently, Uniswap Labs leads the event of Uniswap. Nonetheless, Walsh stated extra builders are actually constructing and contributing options. This, the Uniswap Basis govt additional noticed, is very contemplating the scheduled launch of Hooks in v4.

There isn’t any particular timeline for when Uniswap will deploy the most recent iteration, however the launch of the Cancun improve on Ethereum will play a job. The protocol will likely be extra customizable with Hooks because the characteristic acts extra like a plugin.

Even so, there have been considerations that Hooks, although being developed by group builders, would be the foundation for Uniswap to censor liquidity suppliers (LP) or merchants who don’t confirm by adhering to know-your-customer guidelines (KYC). UNI costs stay below stress at spot charges and will break decrease, registering new 2023 lows.

Characteristic picture from Canva, chart from TradingView